Press release

Increasing awareness about litigation financing is anticipated to fuel the growth of the market as per the research done by RationalStat

The report titled "Global Litigation Funding Investment Market Analysis and Forecast, 2019-2028" assesses the global market based on type, enterprise size, end user, and region. A comprehensive report provides a detailed historical and future market size with a comprehensive market trend analysis. The market share analysis, service provided by top companies, an overview of the competition, strategic imperatives, key end users, potential growth areas, and competition analysis for the target players evaluated in the global litigation funding investment market study.Market Overview and Dynamics: Expansion of the legal service sector coupled with the increasing need for cost-effective litigation financing

The expansion of the legal services sector globally is positively influencing the litigation funding investment market growth. The growth of the legal services sector and the increasing number of complex legal cases being filed are driving the demand for litigation funding. Moreover, with the cost of litigating a case continuing to rise, many parties are looking for cost-effective financing options to support their legal endeavors, thus providing necessary thrust to market growth.

Additionally, the growing demand for alternative funding options available is also acting as a major factor for the litigation funding investment market growth in recent years. As traditional funding sources, such as banks and venture capital firms, become increasingly difficult to secure, many businesses and individuals are turning to litigation funding as a means of financing their lawsuits.

Further, the market is growing as a result of the claimants' increasing demand for litigation finance, which is driven by both people's and organizations' surge in legal fees, as well as the desire to use litigation investment as a means of generating money. Investors and companies alike are becoming more and more interested in litigation financing, which is also creating new investment opportunities, thus helping the market to grow significantly.

Segmental Analysis

• Based on enterprise size, the large enterprise segment accounted for holding a significant share of the global litigation funding investment market on the back of the rising number of litigation cases they have to fight owing to a huge service or product portfolio along with their global presence.

• On the basis of end user, the media & entertainment segment is estimated to grow at a considerable rate during the forecast period owing to rising cases of trademark and copyright infringements across the industry

• Based on the region, North America is expected to hold a significant share of the global litigation investment market over the forecast period. The market is expected to grow in the region over the next few years as a result of a growing portfolio of litigation funding or portfolio finance trends among investors and rising end-user demand for litigation funding investments, including those in the BFSI, media & entertainment, IT & telecommunication, and other sectors.

Competition Analysis

The global litigation funding investment market is characterized by the presence of various players operating in the market. These players adopt various strategies to reinforce their market share and gain a competitive edge over other competitors in the market. Mergers and acquisitions, product launches, partnerships, and collaborations are some of the strategies followed by industry players. Some of the key developments in the global litigation funding investment market include,

• In Jan 2022, Fintech start-up LegalPay launched an interim finance healthcare-focused fund for retail investors where they can participate by investing a minimum of INR 10,000 per opportunity in asset-backed legal and debt financing asset classes through fractional ownership. LegalPay targets mid-market companies, including MSMEs, undergoing insolvencies, requiring INR 1 Mn - INR 50 Mn.

• In July 2022, The London-based claimant law firm taking on mining giant BHP in a £5 Bn suit is set to receive an extra £100 Mn in funding from investment firm North Wall Capital. The move marks a significant expansion in the funding relationship between North Wall, a self-described 'special situations' investor, and PGMBM, which has brought group cases against a number of major corporations including Volkswagen, British Airways, and Bayer court.

Some of the prominent players that contribute significantly to the global litigation funding investment market include Parabellum Capital, Bentham Capital, Juridica Brickell Key, Burford Capital LLC, Woodford Litigation Funding Ltd, Apex Litigation Finance, Omni Bridgeway, Vannin, Augusta Ventures, Longford Capital Management LP, Calunius Capital, Harbour Litigation Funding Ltd, and Others.

RationalStat has segmented the global litigation funding investment market based on type, enterprise size, end user, and region.

• By Type

o Commercial Litigation

o International Arbitration

o Bankruptcy Claim

o Personal Injury

• By Enterprise Size

o Micro, Small, and Medium Enterprises (MSMEs)

o Large enterprises

• By End User

o Banking, Financial Services, and Insurance Sector (BFSI)

o Manufacturing

o IT & Telecommunication

o Media & Entertainment

o Healthcare

o Others (Travel & Hospitality)

• By Region

o North America

US

Canada

o Latin America

Brazil

Mexico

Rest of Latin America

o Western Europe

Germany

UK

France

Spain

Italy

Benelux

Nordic

Rest of Western Europe

o Eastern Europe

Russia

Poland

Rest of Eastern Europe

o Asia Pacific

China

Japan

India

South Korea

Australia

ASEAN (Indonesia, Vietnam, Malaysia, etc.)

Rest of Asia Pacific

o Middle East & Africa

GCC

South Africa

Turkey

Rest of the Middle East & Africa

For more information about this report https://store.rationalstat.com/store/global-litigation-funding-investment-market/

RationalStat LLC

Kimberly Shaw, Content and Press Manager

sales@rationalstat.com

Phone: +1 302 803 5429

RationalStat is an end-to-end US-based market intelligence and consulting company that provides comprehensive market research reports along with customized strategy and consulting studies. The company has sales offices in India, Mexico, and the US to support global and diversified businesses. The company has over 80 consultants and industry experts, developing more than 850 market research and industry reports for its report store annually.

RationalStat has strategic partnerships with leading data analytics and consumer research companies to cater to the client's needs. Additional services offered by the company include consumer research, country reports, risk reports, valuations and advisory, financial research, due diligence, procurement and supply chain research, data analytics, and analytical dashboards.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Increasing awareness about litigation financing is anticipated to fuel the growth of the market as per the research done by RationalStat here

News-ID: 2920341 • Views: …

More Releases from RationalStat LLC

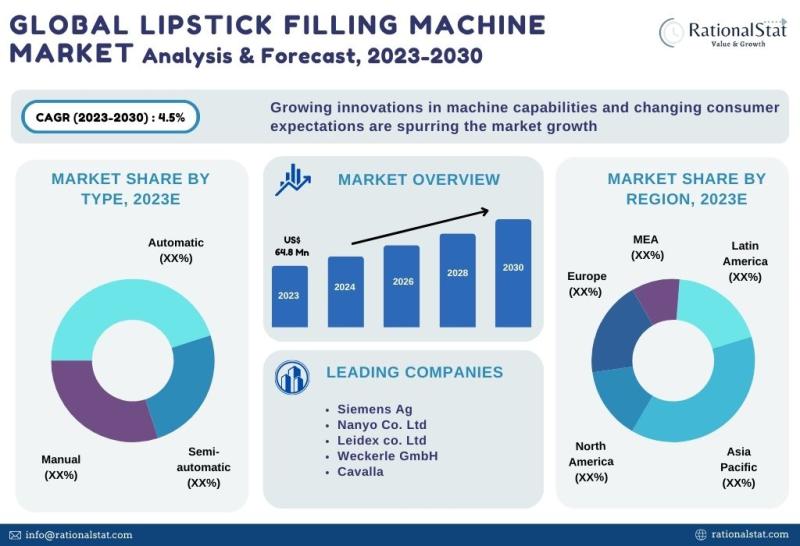

Latest Market Study | Global Lipstick Filling Machine Market Size, Share, & Fore …

The global lipstick filling machine market is expected to reach US$ 88.2 million by 2030, with an annual growth rate of more than 4.5%.

According to RationalStat's recent industry analysis, the Global Lipstick Filling Machine Market value is estimated at US$ 64.8 million in 2023 and is expected to rise at a strong CAGR of over 4.5% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

A lipstick…

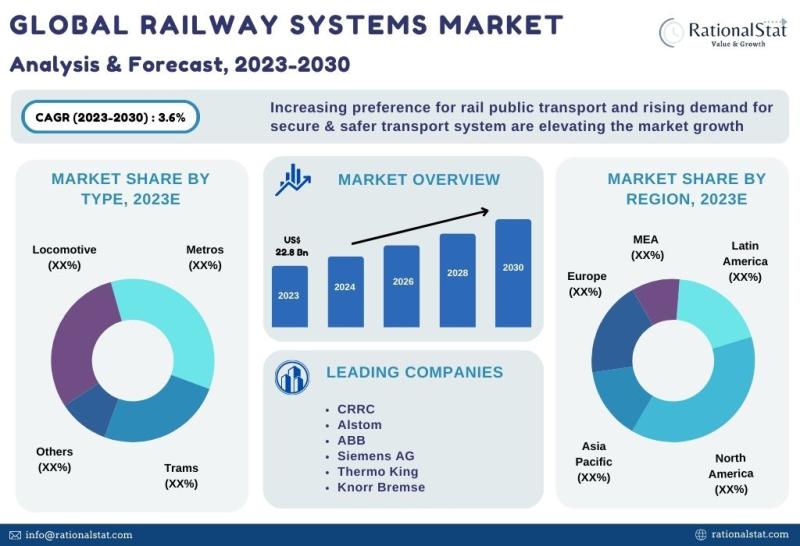

Published Market Report | Global Railway Systems Market Size, Share, & Forecast …

The global railway systems market is expected to reach US$ 29.2 billion by 2030, with an annual growth rate of more than 3.6%.

According to RationalStat's recent industry analysis, the Global Railway Systems Market value is estimated at US$ 22.8 billion in 2023 and is expected to rise at a strong CAGR of over 3.6% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Railway systems, also known…

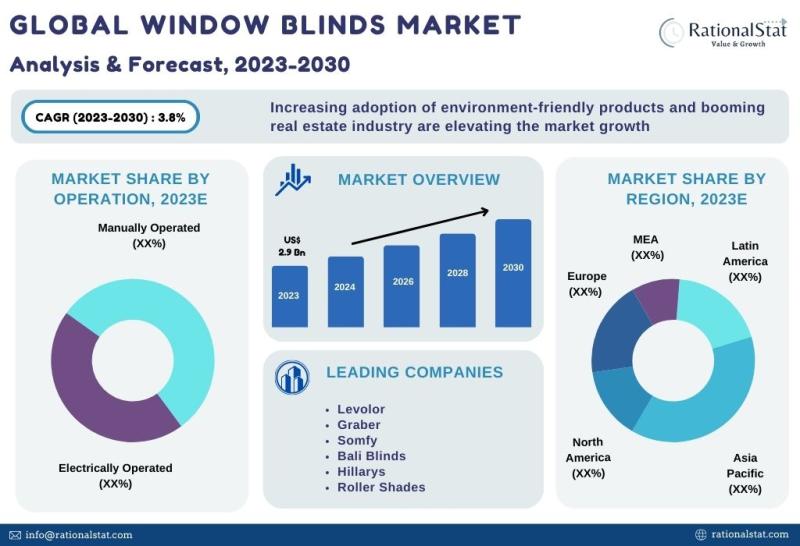

Published Market Report | Global Window Blinds Market Size, Share, & Forecast 20 …

The global window blinds market is expected to reach US$ 3.7 billion by 2030, with an annual growth rate of more than 3.8%.

According to RationalStat's most recent industry analysis, the Global Window Blinds Market value is estimated at US$ 2.9 billion in 2023 and is expected to rise at a strong CAGR of over 3.8% over the forecast period of 2023-2030.

Market Definition, Market Scope, and Report Overview

Window blinds are…

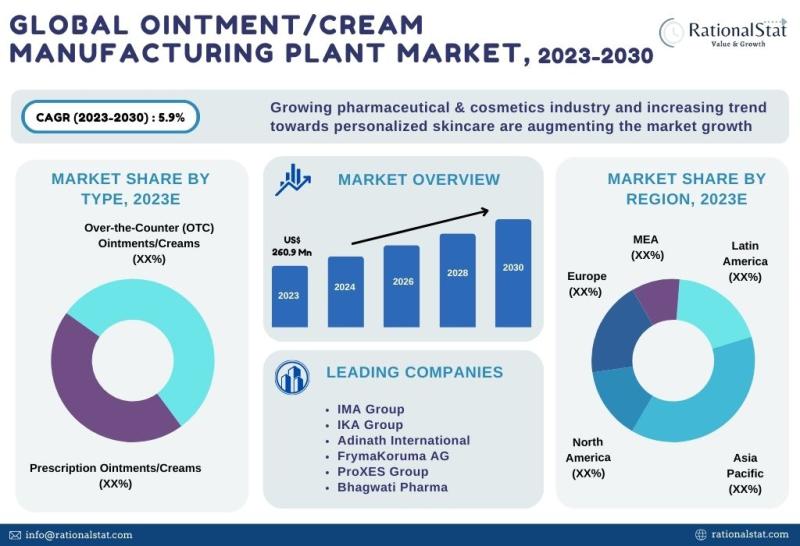

Ointment and Cream Manufacturing Plant Market Report 2023 | Ointment and Cream M …

The global ointment and cream manufacturing plant market is expected to approach US$ 388.7 million by 2030, with an annual growth rate of more than 5.9%

Global Ointment and Cream Manufacturing Plant Market is valued at US$ 260.9 million in 2023 and is expected to grow at a significant CAGR of over 5.9% over the forecast period of 2023-2030, according to the published market report by RationalStat

Market Definition, Market…

More Releases for Capital

Venture Capital Investment Market Is Booming Worldwide | Accel, Benchmark Cap …

Venture Capital Investment Market: The extensive research on Venture Capital Investment Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Venture Capital Investment Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the market, such as…

Venture Capital & Private Equity Firms Market is Going to Boom | TPG Capital, GG …

The latest independent research document on Venture Capital & Private Equity Firms examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Venture Capital & Private Equity Firms study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth,…

Venture Capital Investment Market 2021 Is Booming Worldwide | Accel, Benchmark C …

Venture Capital Investment Market describes an in-depth evaluation and Covid19 Outbreak study on the present and future state of the Venture Capital Investment market across the globe, including valuable facts and figures. Venture Capital Investment Market provides information regarding the emerging opportunities in the market & the market drivers, trends & upcoming technologies that will boost these growth trends. The report provides a comprehensive overview including Definitions, Scope, Application, Production…

Risk Capital Investment Market Business Development Strategies 2020-2026 by Majo …

Risk Capital Investment Market - Global Analysis is an expert compiled study which provides a holistic view of the market covering current trends and future scope with respect to product/service, the report also covers competitive analysis to understand the presence of key vendors in the companies by analyzing their product/services, key financial facts, details SWOT analysis and key development in last three years. Further chapter such as industry landscape and…

Global Venture Capital Investment Market, Top key players are Accel, Benchmark C …

Global Venture Capital Investment Market Report 2019 - History, Present and Future

The global market size of Venture Capital Investment is $XX million in 2018 with XX CAGR from 2014 to 2018, and it is expected to reach $XX million by the end of 2024 with a CAGR of XX% from 2019 to 2024.

Global Venture Capital Investment Market Report 2019 - Market Size, Share, Price, Trend and Forecast is a professional…

Venture Capital Investment Market 2019 Trending Technologies, Developments, Key …

Fintech solutions provide alternative finance firms with a platform for investors to directly come across companies and individuals looking for equity financing and debt. The technology has enabled new players to take faster decisions, engage with customers more precisely, and run operations at low cost-to-income ratios compared with traditional banks

This report studies the Venture Capital Investment market status and outlook of Global and major regions, from angles of players,…