Press release

Opportunities for the Global Takaful Insurance Market to reach Blatant Growth in Coming years by 2030 Abu Dhabi National Takaful Co., Allianz, AMAN Insurance.

According to the report published by Allied Market Research, the global takaful insurance market garnered $24.85 billion in 2020, and is expected to generate $97.17 billion by 2030, witnessing a CAGR of 14.6% from 2021 to 2030. The report offers an extensive analysis of changing market trends, value chain, top segments, top investment pockets, regional scenarios, and competitive landscape.Adoption of takaful insurance in non-Muslim countries and additional benefits of takaful insurance in comparison to conventional insurance drive the growth of the global takaful insurance market. However, limited consumer awareness and fewer market players hinder the market growth. On the other hand, advancements in technologies in the insurance sector and supportive government regulations provide new opportunities for the market in the next few years.

Download Free Sample Report (Get Detailed Analysis in PDF - 290+ Pages): https://www.alliedmarketresearch.com/request-sample/12200

Covid-19 Scenario:

Owing to economic uncertainty occurred across the world, participants have been postponing donations of large sums of money. However, the collections would increase as participants recover from the financial losses incurred during the Covid-19 pandemic.

Rise in awareness regarding various takaful insurance types such as health, family, and others resulted in increased demand, which in turn, accelerated the growth of the market.

The report offers detailed segmentation of the global takaful insurance market based on distribution channel, type, application, and region.

Based on distribution channel, the agents & brokers segment contributed to the largest market share in 2020, holding nearly three-fifths of the total share, and is estimated to continue its lead position during the forecast period. However, the direct response segment is expected to witness the largest CAGR of 18.8% from 2021 to 2030.

Get detailed COVID-19 impact analysis on the Takaful Insurance Market: https://www.alliedmarketresearch.com/request-for-customization/12200?reqfor=covid

Based on type, the general takaful segment accounted for the highest share in 2020, holding nearly three-fourths of the global takaful insurance market, and is estimated to maintain its leadership status during the forecast period. However, the family takaful segment is projected to manifest the highest CAGR of 16.3% from 2021 to 2030.

Based on region, GCC held the highest share in 2020, contributing to more than two-fifths of the total market share, and is expected to maintain its dominant share in terms of revenue by 2030. However, Asia is estimated to portray the fastest CAGR of 17.5% during the forecast period.

Interested to Procure the Data? Inquire here @ https://www.alliedmarketresearch.com/purchase-enquiry/12200

Leading players of the global takaful insurance market analyzed in the research include Abu Dhabi National Takaful Co., AMAN Insurance, Allianz, Prudential BSN Takaful Berhad, Islamic Insurance, SALAMA Islamic Arab Insurance Company, Qatar Islamic Insurance, Takaful International, Syarikat Takaful Brunei Darussalam, and Zurich Malaysia.

Key Benefits for Stakeholders

The study provides in-depth analysis of the takaful insurance market share along with current & future trends to illustrate the imminent investment pockets.

Information about key drivers, restrains, & opportunities and their impact analysis on the takaful insurance market size is provided in the report.

Porter's five forces analysis illustrates the potency of buyers and suppliers operating in the takaful insurance market.

An extensive analysis of the key segments of the industry helps to understand the takaful insurance market trends.

The quantitative analysis of the global takaful insurance market forecast from 2021 to 2030 is provided to determine the market potential.

Key Market Segments

By Distribution Channel

Agents & Brokers

Banks

Direct Response

Others

By Type

Family Takaful

General Takaful

Motor Takaful

Personal

Third Party Liability Coverage

Comprehensive & Optional Coverage

Commercial

Property & Fire

Medical & Health Takaful

Marine, Aviation & Transport

Others

By Application

Personal

Commercial

By Region

GCC

Saudi Arabia

UAE

Bahrain

Kuwait

Qatar

Oman

Asia

Malaysia

Pakistan

Indonesia

Brunei

Rest of Asia

MEA

Iran

Jordan

Sudan

Egypt

Nigeria

Rest of MEA

Rest of the World

Key Market players

Abu Dhabi National Takaful Co.

Allianz

AMAN Insurance

Islamic Insurance

Prudential BSN Takaful Berhad

Qatar Islamic Insurance

SALAMA Islamic Arab Insurance Company

Syarikat Takaful Brunei Darussalam

Takaful International

Zurich Malaysia

Some of the Major Points of TOC cover:

CHAPTER 3:MARKET OVERVIEW

3.1.Market definition and scope

3.2.Key forces shaping global takaful insurance market

3.3.Takaful insurance model

3.4.Impact of government regulations on the global takaful insurance market

3.5.Market dynamics

3.5.1.Drivers

3.5.1.1.Growth in demand of takaful insurance across Muslim majority countries

3.5.1.2.Distribution of Investment profits among both participants

3.5.1.3.Numerous benefits such as premium amount refund driving the growth

3.5.2.Restraints

3.5.2.1.Lack of standardization in takaful insurance due to regional differences

3.5.2.2.Lower consumer awareness

3.5.3.Opportunity

3.5.3.1.Untapped market potential for takaful insurance

3.6.COVID-19 impact analysis on takaful insurance market

3.6.1.Impact on takaful insurance market size

3.6.2.Change in consumer trends, preferences, and budget impact, owing to COVID-19

3.6.3.Framework for market challenges faced by takaful insurance providers

3.6.4.Economic impact on takaful insurance providers

3.6.5.Key player strategies to tackle negative impact on the industry

3.6.6.Opportunity analysis for takaful insurance providers

Related Links:

Gadget Insurance Market: https://www.alliedmarketresearch.com/gadget-insurance-market-A11629

Reinsurance Market:https://www.alliedmarketresearch.com/reinsurance-market-A06288

Commercial Auto Insurance Market: https://www.alliedmarketresearch.com/commercial-auto-insurance-market-A14156

AI in Insurance Market: https://www.alliedmarketresearch.com/ai-in-insurance-market-A11615

Usage-Based Insurance Market: https://www.alliedmarketresearch.com/usage-based-insurance-market

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Follow Us on | Facebook | LinkedIn | YouTube |

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Opportunities for the Global Takaful Insurance Market to reach Blatant Growth in Coming years by 2030 Abu Dhabi National Takaful Co., Allianz, AMAN Insurance. here

News-ID: 2919134 • Views: …

More Releases from Allied Market Research

Faucet Market Forecast 2035: Reaching USD 118.4 billion by 2035

According to a new report published by Allied Market Research, titled, "Faucet Market," The faucet market size was valued at $48.9 billion in 2023, and is estimated to reach $118.4 billion by 2035, growing at a CAGR of 7.6% from 2023 to 2035.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/2448

Faucet is a plumbing fixture used to control the flow of water in various settings such as kitchens,…

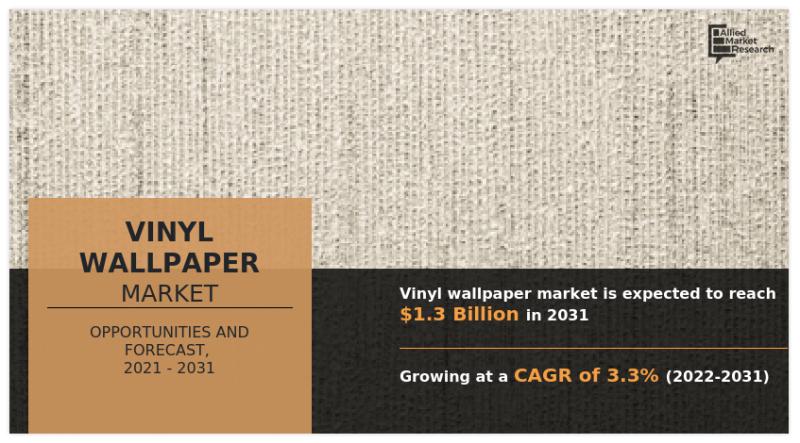

Vinyl Wallpaper Market Size Forecasted to Grow at 3.3% CAGR, Reaching USD 1.3 bi …

The Vinyl Wallpaper Market Size was valued at $943.30 million in 2021, and is estimated to reach $1.3 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16970

Vinyl wallpaper consists of a carrier layer (recycled paper or non-woven wallpaper base) and a decorative layer made of polyvinyl chloride. A synthetic foam layer provides three-dimensional structures to…

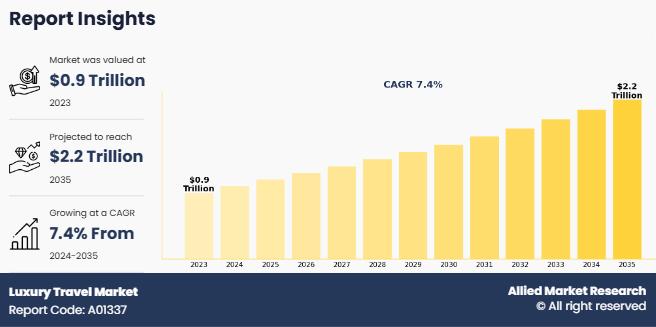

Luxury Travel Market Set to Achieve a Valuation of US$ 2149.7 billion, Riding on …

According to a new report published by Allied Market Research, titled, "Luxury Travel Market," The luxury travel market size was valued at $890.8 billion in 2023, and is estimated to reach $2149.7 billion by 2035, growing at a CAGR of 7.4% from 2024 to 2035.

Get Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/1662

Luxury travel refers to travel experiences that offer exceptional comfort, exclusivity, and personalized services, typically catering to…

Men Personal Care Market to Grow at a CAGR of 8.6% and will Reach USD 276.9 bill …

According to a new report published by Allied Market Research, titled, "Men Personal Care Market by Type, Age Group, Price Point, and Distribution Channel: Global Opportunity Analysis and Industry Forecast, 2021-2030," the men personal care market size is expected to reach $276.9 billion by 2030 at a CAGR of 8.6% from 2021 to 2030.

Request The Sample PDF of This Report: @ https://www.alliedmarketresearch.com/request-sample/1701

Men personal care products are non-medicinal…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…