Press release

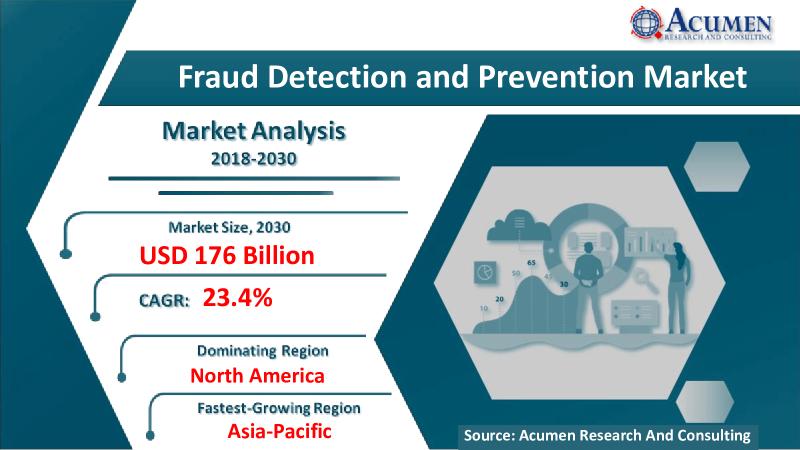

Fraud Detection and Prevention Market to reach USD 176 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario

The Global Fraud Detection and Prevention Market Size accounted for USD 27 Billion in 2021 and is projected to reach USD 176 Billion by 2030, with a significant CAGR of 23.4% from 2022 to 2030.Global Fraud Detection and Prevention Market Growth Aspects

The primary factor driving the industry is the growing number of fraud cases all over the world. For instance, according to recently published Federal Trade Commission (FTC) data, customers reported losing over $5.8 billion to fraud in 2021, a rise of over 70% from the previous year. In the same year, the Federal Trade Commission received fraud reports from over 2.8 million customers, with imposter fraud being the most frequently reported category again, followed by online shopping fraud.

In addition, the rising trend of online banking has augmented the rates of online fraud, which is anticipated to boost the fraud prevention and detection market revenue. According to a public study, in the first quarter of 2021, online banking accounted for 96% of all banking transactions and 93% of all fraud attempts. This leaves in-branch and telephone banking to account for the remaining 4%. Furthermore, telephone frauder increased their efforts, with the report indicating a 728% increase in telephone banking fraud.

Request For Free Sample Report @

https://www.acumenresearchandconsulting.com/request-sample/3048

While there was a rise in the number of fraudulent activities all over the world, the arrival of the COVID-19 pandemic acted as a catalyst for these illegal activities. According to the UK Finance Organization, unauthorized financial fraud losses from payment cards, remote banking, and paychecks totaled more than $950 million in 2020. Furthermore, UK Finance reported 149,946 cases of Authorized Push Payment (APP) fraud in 2020, totaling $581 million in gross losses. Our global fraud detection and prevention market forecast say that the implementation of advanced AI, ML, and blockchain would help business and consumers to save millions in the coming future.

Growing Cases of Identity Theft Propel the Fraud Detection and Prevention Market Value

Due to the increase in identity theft fraud, financial institutions are implementing voice recognition technologies all over their contact centers to reduce identity fraud attempts. Furthermore, the use of fraud authentication technologies like geolocation and device fingerprinting adds another layer of security to identity theft and improves customer verification. According to the Identity Theft Research Center (ITRC), there were a maximum number of data and information compromises in the United States in 2021, representing a 68% raise over 2020. In 2021, the Federal Trade Commission's (FTC) Consumer Sentinel Network received over 5.7 million reports, 49 percent of which were for fraud and 25 percent for identity theft.

Check the detailed table of contents of the report @

https://www.acumenresearchandconsulting.com/table-of-content/fraud-detection-and-prevention-market

Fraud Detection and Prevention Market Segmentation

The global market has been segmented based on component, fraud type, deployment mode, organization size, industry vertical, and region. Based on the component, the market is divided into solutions (authentication, fraud analytics, and government, risk and compliance (GRC)), and services (managed services and professional services). According to our fraud detection and prevention industry analysis, solutions dominated the market with the highest shares, whereas the services witnessed the fastest growth. Based on the fraud type, the market split into identity fraud, check fraud, internet/online fraud, payment fraud, insurance fraud, and other fraud types. Payment frauds were among the highest while identity theft is growing day by day.

Based on organization size, the market is categorized into large enterprises and SMEs. Large enterprises use most of the fraud detection and prevention solutions share, while SMEs are on the verge to support the industry significantly in the coming years. Based on the deployment model, the market is classified into cloud and on-premise. On-premise generated the maximum fraud detection and prevention market share in 2021. Furthermore, based on industry vertical, the market is segmented into IT & telecom, retail & e-commerce, BFSI, healthcare, industrial & manufacturing, government & defense, and others. BFSI is among the most affected industries that require fraud detection and prevention solutions. In the first half of 2021, the insurance industry was the most common target of computer virus attacks, accounting for nearly 25% of all these attacks on customers. According to consumer goods or services and telecommunications came in second and third place.

Fraud Detection and Prevention Market Players

Some key fraud detection and prevention companies covered in the industry include ACI Worldwide, Inc., BAE Systems, Experian plc, Fiserv, Inc., Equifax, Inc., IBM, Oracle, SAP SE, Software AG, SAS Institute, Inc., and Total System Services, Inc.

Fraud Detection and Prevention Market Regional Outlook

North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa are the regional classification of the global fraud detection and prevention market. North America commanded the leading market share and is expected to do so during the forecast timeframe. According to a survey, 47% of Americans witnessed financial identity theft in 2020. In addition, according to the FBI's Internet Crime Report 2021, the public reported a record 847,376 cyber-crime complaints to the FBI, a 7% increase from 2020. The Asia-Pacific region is expected to witness a growing number of fraud cases in the coming years. According to the Microsoft Global Tech Support fraudResearch 2021 report, consumers in India had a relatively high online fraud encounter rate of 69% in the previous year. Furthermore, 31 percent of Indians lost money as a result of a fraud, the highest rate in the world. In India, 48 percent of consumers were duped into pursuing the fraud, which is three times greater than the global.

Buy this premium research report -

https://www.acumenresearchandconsulting.com/buy-now/0/3048

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market to reach USD 176 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario here

News-ID: 2904559 • Views: …

More Releases from Acumen Research and Consulting

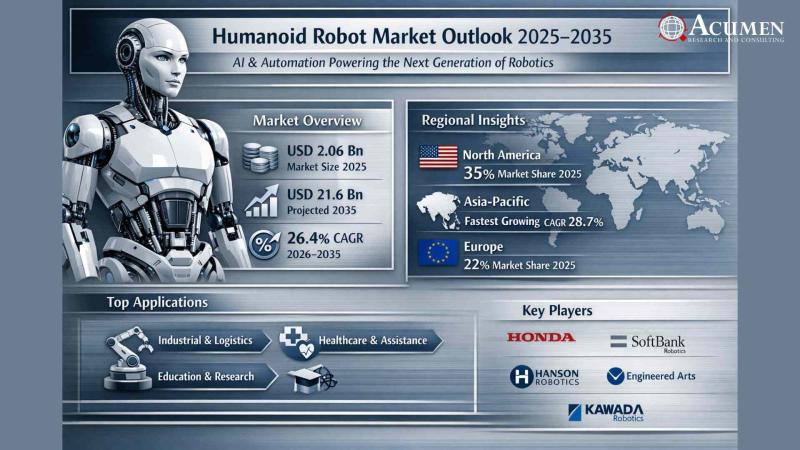

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

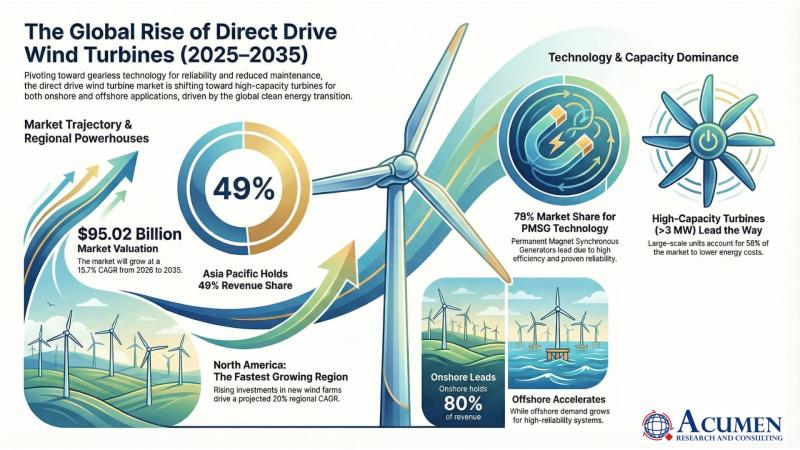

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…