Press release

Cybersecurity Insurance Market New Business Opportunities and Investment Research Report by 2030

The cybersecurity insurance market crossed US$ 11.36 billion mark in 2022 and is expected to hit US$ 49.02 billion by 2030, recording a CAGR of 20.1% during the forecast period.Cyber security insurance is a contract that a person or a company can buy to assist mitigate the financial hazards of doing business online. The insurance policy transfers some of the risks to the insurer in exchange for a monthly or quarterly cost. Many businesses obtain cybersecurity insurance to cover any additional costs that may arise because of the physical destruction or theft of digital assets. The cost of notifying customers about a security breach, as well as the cost of regulatory compliance fines, are typical examples of such expenses.

The Report Cybersecurity Insurance Market study by "Business Market Insights" provides details about the market dynamics affecting the market, Market scope, Market segmentation and overlays shadow upon the leading market players highlighting the favorable competitive landscape and trends prevailing over the years.

Get Exclusive Sample Pages of Cybersecurity Insurance Market @: https://www.businessmarketinsights.com/sample/BMIRE00026888?utm_source=OpenPr&utm_medium=10640

Companies profiled

• BitSight Technologies.

• RedSeal, Inc.

• SecurityScorecard

• Cyber Indemnity Solutions Ltd

• Cisco Systems, Inc.

Governmental regulatory authorities and law enforcement organizations worldwide have taken several actions to tighten data security and protection. COVID-19 has made policyholders, brokers, insurers, and agents aware of the necessity for cybersecurity insurance coverage. For instance, the Californian Assembly proposed a law in February 2020 requiring all state contractors to have cybersecurity insurance to process regulated and protected personal information.

The expansion of data privacy regulations, including the US's Personally Identifiable Information (PII) and Health Insurance Portability and Accountability Act (HIPAA), the global Payment Card Industry Data Security Standard (PCI DSS), and the European Union's (EU) General Data Protection Regulation (GDPR), has caused insurance companies to concentrate on cybersecurity insurance measures. Rising digitization across the world has increased the count of cyberattacks. Hence, stringent government rules regarding data security are attributed to driving the cybersecurity insurance market during the forecast period.

In this report, the cybersecurity insurance market has been segmented on the basis of:

Component:

• Solution

• Services

Insurance Type

• Packaged

• Stand-alone

Enterprise size:

• SMEs

• Large Enterprises

End-User:

• Technology Provider

• Insurance Provider

Region

• North America

• Europe

• Asia Pacific (APAC)

• South & Central America

• Middle East & Africa

The report segments the Cybersecurity Insurance Market based on application, type, service, technology, and region. Each chapter under this segmentation allows readers to grasp the nitty-gritty of the market. A magnified look at the segment-based analysis is aimed at giving the readers a closer look at the opportunities and threats in the market. It also addresses political scenarios that are expected to impact the market in both small and big ways. The report on the Cybersecurity Insurance Market examines changing regulatory scenarios to make accurate projections about potential investments. It also evaluates the risk for new entrants and the intensity of the competitive rivalry.

Get Full Report: https://www.businessmarketinsights.com/reports/cybersecurity-insurance-market

Increasing adoption of cybersecurity insurance among large enterprises for improved security is one of the major factors accelerating the cybersecurity insurance market growth.

Organizations with more than 1,000 employees are considered large companies. The larger enterprises to boost their overall production and efficiency, businesses make significant investments in cutting-edge technology. Large businesses are frequently choosing cybersecurity insurance solutions and are anticipated to invest heavily in advanced solutions to deliver the highest level of security in their highly competitive industries.

Furthermore, large organizations have implemented cybersecurity insurance solutions due to their extensive usage of Internet of Things (IoT) and cloud-based applications, which are both very vulnerable to cyberattacks. In addition, the need for cybersecurity insurance solutions is fuelled by strict regulatory pressure. One of the strictest data privacy laws, for instance, is the CCPA in the US.

Recent strategic developments in Cybersecurity Insurance Market

The cybersecurity insurance market has undergone several significant developments, and a few of these have been mentioned below:

• In September 2021, to support the development and management of Microsoft's data-driven cybersecurity insurance products, At-Bay teamed with Microsoft.

• To provide a comprehensive perspective of business risk management, prevalent developed a connector marketplace with improved features that integrate new ESG and regulatory results in October 2021

The report provides the current market size for Cybersecurity Insurance, defines trends and presents growth forecasts for nine years from 2022 to 2030. 2020 is considered as the base year, and 2022 to 2030 is forecast year for the entire report. All the market numbers for revenue are provided in US dollars. The market is analyzed by the supply side, considering the market penetration of Cybersecurity Insurance Market for all the regions globally.

The scope of the Cybersecurity Insurance Market Report:

The research report focuses on the current market trends, opportunities, future potential of the market, and competition in the Cybersecurity Insurance. The study also provides market insights and analysis of the Cybersecurity Insurance, highlighting the technological market trends, adoption rate, industry dynamics, and competitive analysis of major players in the industry.

The global Cybersecurity Insurance Market is segmented based on deployment, component, solution, application, and geography. The segmentation in this research study has been finalized post in-depth secondary research and extensive primary research. In addition, the market is also segmented on the basis of products offered by the leading participants in the industry in order to understand widely used market specific terminologies. Thus, we have incorporated the segments of the research and have finalized the market segmentation.

Major highlights of the report:

• All-inclusive evaluation of the parent market

• Evolution of significant market aspects

• Industry-wide investigation of market segments

• Assessment of market value and volume in past, present, and forecast years

• Evaluation of market share

• Tactical approaches of market leaders

• Lucrative strategies to help companies strengthen their position in the market

Interested in purchasing this Report? Click here @ https://www.businessmarketinsights.com/buy/single/BMIRE00026888?utm_source=OpenPr&utm_medium=10640

Note - The Covid-19 (coronavirus) pandemic is impacting society and the overall economy across the world. The impact of this pandemic is growing day by day as well as affecting the supply chain. The COVID-19 crisis is creating uncertainty in the stock market, massive slowing of supply chain, falling business confidence, and increasing panic among the customer segments. The overall effect of the pandemic is impacting the production process of several industries. This report on 'Cybersecurity Insurance Market' provides the analysis on impact on Covid-19 on various business segments and country markets. The reports also showcase market trends and forecast to 2030, factoring the impact of Covid -19 Situation.

Reason to Buy

• Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global Cybersecurity Insurance Market.

• Highlights key business priorities in order to guide the companies to reform their business strategies and establish themselves in the wide geography.

• The key findings and recommendations highlight crucial progressive industry trends in the Cybersecurity Insurance Market, thereby allowing players to develop effective long-term strategies in order to garner their market revenue.

• Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

• Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those restraining the growth at a certain extent.

Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

Contact us:

If you have any questions about this report or would like further information, please contact us:

Contact person: Sameer Joshi

Email: sales@businessmarketinsights.com

Phone: +16467917070

Blog URL: https://bmiinsights.blogspot.com/

About Us:

Business Market Insights is a market research platform that provides subscription service for industry and company reports. Our research team has extensive professional expertise in domains such as Electronics & Semiconductor; Aerospace & Defense; Automotive & Transportation; Energy & Power; Healthcare; Manufacturing & Construction; Food & Beverages; Chemicals & Materials; and Technology, Media, & Telecommunications.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cybersecurity Insurance Market New Business Opportunities and Investment Research Report by 2030 here

News-ID: 2901627 • Views: …

More Releases from Business Market Insights

Laser Hair Removal Market Accelerates as Innovation, Consumer Awareness, and Aes …

The laser hair removal market is undergoing a transformative phase as evolving beauty standards, rapid technological innovation, and increasing preference for non-invasive aesthetic treatments continue to reshape the global personal care and dermatology landscape. Once considered a premium cosmetic procedure, laser hair removal is now becoming an integral part of modern grooming routines across diverse age groups and demographics.

Driven by continuous improvements in laser technology, treatment comfort, and customization capabilities,…

Veterinary Imaging Market Poised for Sustainable Growth Amid Rising Pet Humaniza …

The Global Veterinary Imaging Market continues its trajectory of steady, innovation-led expansion, fueled by rising adoption of advanced diagnostic solutions, deepening pet humanization trends, and escalating veterinary healthcare awareness worldwide. With significant developments reported in both technology adoption and service delivery, the veterinary imaging landscape is advancing to meet growing demand for higher diagnostic precision, faster clinical decision-making, and improved animal patient outcomes.

Veterinary imaging solutions - spanning X-ray, ultrasound,…

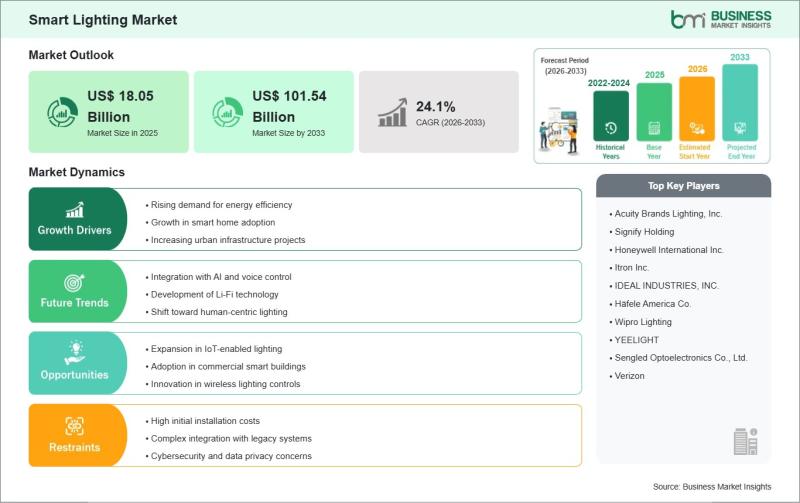

Smart Lighting Market to Skyrocket to US$101.54 Billion by 2033 from US$18.05 Bi …

The Smart Lighting Market is transforming everyday spaces into energy-efficient havens, powered by IoT, AI, and wireless controls that adapt to user needs and environments. Homeowners and businesses alike are discovering how connected bulbs and fixtures enhance ambiance while slashing energy use. The Smart Lighting Market size is expected to reach US$ 101.54 billion by 2033 from US$ 18.05 billion in 2025. The market is estimated to record a CAGR…

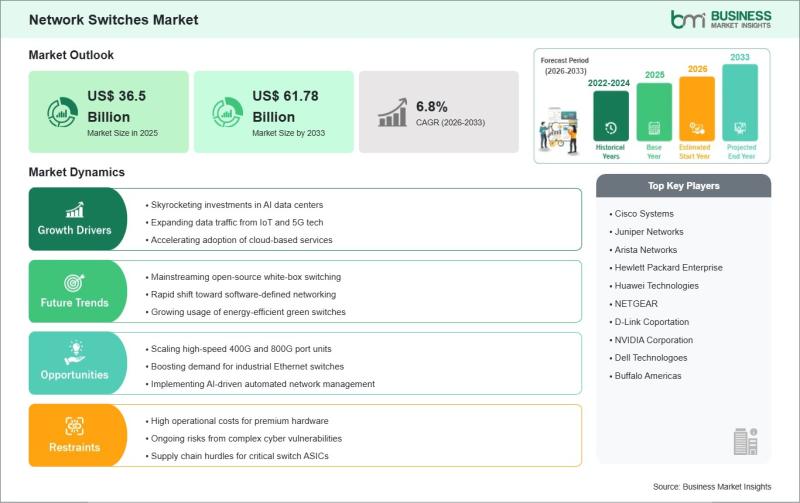

Network Switches Market Analysis: US$ 61.78 Billion Projection by 2033 at 6.8% G …

The Network Switches Market stands at the heart of digital transformation, powering seamless connectivity for enterprises embracing cloud computing, 5G, and IoT ecosystems. As businesses worldwide prioritize agile, secure networks, innovations in software-defined networking and high-speed Ethernet drive the evolution of this vital infrastructure.

Check valuable insights in the Network Switches Market report. You can easily get a sample PDF of the report - https://www.businessmarketinsights.com/sample/BMIPUB00032458?utm_source=OpenPr&utm_medium=10457

Executive Summary and Global Market Analysis:

Network…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…