Press release

Likely consolidation in the UK altnet space

ThinkCX reveals how fibre operator mergers and buy-outs will change the UK broadband market in 2023ThinkCX's regional insights model the impact of altnet consolidation on UK broadband market share

January 20, 2023 - The latest data from ThinkCX market intelligence reveals how consolidation in the overcrowded fibre altnets market could play out in 2023, as investors and business leaders clamour for market share in specific areas of the UK.

Investment has been pouring into UK fibre rollouts over the last 5 years, leading to rapid growth in small, localised alternative providers. But recessionary shocks in the wider economy are leading analysts and market watchers to forecast a cooling off in 2023 - leading to a frenzy of mergers and acquisitions (M&A) among the altnet community.

"There's still a lot of investment available to fuel further fibre growth, but it's only around one-third the level of ask in the market at large and this is likely to trigger more consolidation among providers in the year ahead," said Guy Miller, CEO at MS3 Networks. "Understanding the market dynamics at a local and regional level will be incredibly important to building M&A investment cases, particularly for operators looking to build a concentrated subscriber base or branch out into underserved areas."

The ThinkCX market intelligence platform equips network professionals with a comprehensive, up-to-date view of broadband market share right down to each UK county and local authority area.

For example, in Herefordshire, the latest ThinkCX data shows the provider with the fastest growing market share is Zzoomm, which has added 0.87% total market share in the last 12 months alone (to 1.15% in total). This is comparable with the market share of Gigaclear (0.53%) and Zen (0.75%).

The picture is somewhat different in neighbouring Gloucestershire where Zzoomm does not figure at all and Gigaclear is the fastest growing provider (adding 0.77% total market share in the last year, to 4%). Among the many altnets operating in this county, Zen has only 0.39% market share and is falling.

Simply adding together some of these numbers accurately depicts how M&A between some of these providers would result in clear advantages," said Ron Smouter, VP Sales and Marketing at ThinkCX.

"As this example shows, market share for these altnets can be highly localised - providing niche business case opportunities for investors looking to expand penetration without committing to new digs. These market share numbers reflect actual service subscriptions, not simply homes passed, and are based on independent technical evidence rather than how customers, providers or vendors have responded to surveys or provided estimates. The result is a rich view into where the UK broadband market is going next - with millions of possible permutations in the data which covers every recognised broadband provider active in every corner of the UK market."

END

ThinkCX

#200, 8661 201 St, Langley, BC, Canada V2Y 0G9

Press contact: Gaia Paulucci Couldrick

gpauluccicouldrick@thinkcx.com

ThinkCX is a data science company focused on serving the communication service provider industry with actionable customer insights from the analysis of large quantities of digital consumer signals. We specialise in the accurate detection and granular measurement of service provider growth across mobility and broadband markets.

Our breakthrough approach enables us to detect market share without asking our clients to share sensitive data, directly contacting subscribers or using personal or private information, or leveraging unreliable small survey panels. Instead, we have developed a privacy compliant, technology-oriented approach that daily analyses billions of anonymous, digital signals that are licensed from thousands of mobile apps. The tactical application of our machine-learning technology assists our clients to not only acquire new subscribers, but also optimise the lifetime revenue of each existing subscriber. ThinkCX currently provides advanced data analytics for most of the top-tier telecom service providers in our domestic Canadian market and is expanding into new country markets such as the UK, Germany and Italy.

www.thinkcx.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Likely consolidation in the UK altnet space here

News-ID: 2895835 • Views: …

More Releases from ThinkCX

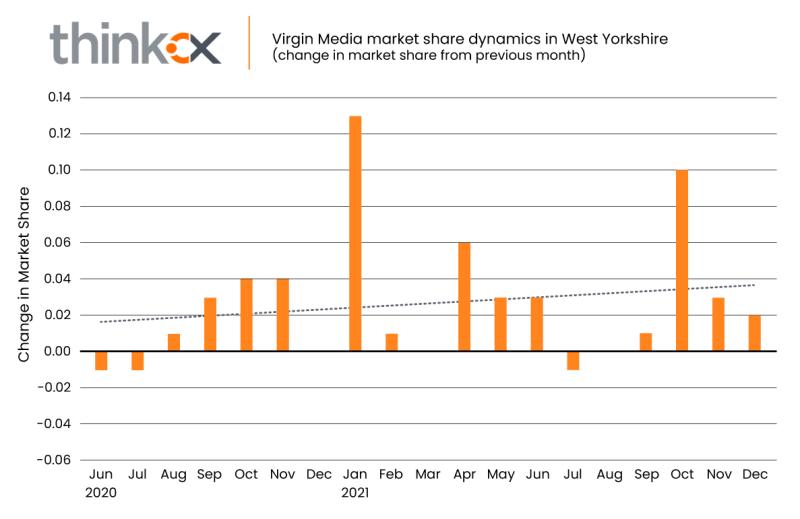

ThinkCX charts Virgin Media's market share turnaround in West Yorkshire

Deep market intelligence on UK broadband subscribers reveals extent to which Virgin Media's West Yorkshire 'Project Lightning' rollout arrested a decline in its local market share and led to net growth

March 20, 2023 - ThinkCX market intelligence today published its latest regional market share snapshot of a leading UK broadband provider, focusing on Virgin Media in West Yorkshire. The study, which uses data with a representation rate of over 90%…

More Releases for M&A

industrials m&a,m&a project management,corporate finance mergers and acquisition …

Mergers and acquisitions (M&A) in the industrial sector refer to the process of one company acquiring another company or assets in the manufacturing, construction, and engineering industries. The industrial sector is characterized by a diverse range of businesses, including heavy machinery, aerospace, and defense, chemicals, and engineering services.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The industrial sector is characterized by a high level of consolidation, with companies looking to acquire other companies to gain access…

m&a company,m&a integration,cross border merger,m&a due diligence,m&a strategy,m …

Mergers and acquisitions (M&A) are a common way for companies to grow and diversify their business operations. The process of merging or acquiring another company can be complex and time-consuming, but when executed successfully, it can bring significant benefits to the acquiring company, such as access to new markets, technologies, and customers.

https://upworkservice.com

China M&A advisory

E-mail:nolan@pandacuads.com

When it comes to successful M&A, the key is to ensure that the two companies are a…

private equity m&a,international mergers and acquisitions,technology m&a,m&a pro …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. One type of buyer that is becoming increasingly prevalent in the M&A landscape is private equity firms.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

Private equity firms are investment firms that raise capital from institutional investors and high net…

buy side m&a,global m&a,bank mergers and acquisitions,m&a advisory firms,success …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. In the M&A process, there are two main parties involved: the buyer and the seller. The term "buy side" refers to the party that is acquiring the target company. In contrast, the "sell side" refers to the party that is being acquired.

https://upworkservice.com/

China M&A advisory

E-mail:nolan@pandacuads.com

The buy side M&A process…

due diligence in mergers and acquisitions,recent m&a deals 2023,m&a management,m …

Due diligence is an investigation process that companies undertake prior to a merger or acquisition (M&A) in order to assess the target company's financial and operational condition. The goal of due diligence is to identify any potential risks or opportunities that may impact the value of the acquisition and to ensure that the deal is in the best interest of the acquiring company. Due diligence is a critical step in…

m&a valuation,corporate mergers,m&a business,merger integration,sell side m&a pr …

Mergers and acquisitions (M&A) are a common strategy for companies looking to expand their operations, enter new markets, or acquire new technologies. One crucial aspect of the M&A process is the valuation of the target company. Valuation is the process of determining the fair value of a company, and it is an essential step in the M&A process because it helps companies to determine the terms of the acquisition, such…