Press release

Credit Management Software Market is Booming Worldwide | DebtPack, Credica, Innovation Software, Finastra

The latest study released on the Global Credit Management Software Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Management Software market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.Key Players in This Report Include:

Rimilia Holdings Ltd (United Kingdom), Emagia Corporation (United States), Innovation Software Limited (United Kingdom), Oracle (United States), Credica Limited (United Kingdom), Cforia Software Inc. (United States), HighRadius Corporation (United States), Finastra (United Kingdom), SOPLEX Consult GmbH (United States), DebtPack (South Africa)

Download Free Sample Report PDF (Including Full TOC, Table & Figures) @ https://www.advancemarketanalytics.com/sample-report/20291-global-credit-management-software-market#utm_source=OpenPRVinay

Definition:

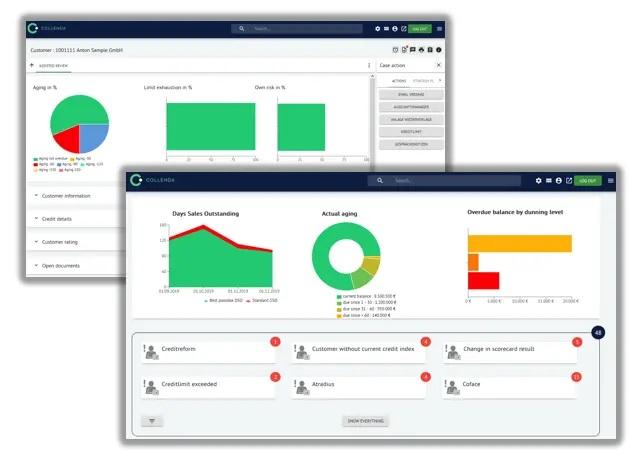

Credit management software is software that allows to record and track payment arrangements. It is designed to help streamline credit processing and management. It reduces manual work that saves time and cost with user-friendlier workflows and smarter automated processes. Credit management software helps to control the entire customer onboarding and credit monitoring experience. The factors such as Increasing Applications of Credit Management Software as well as High Benefits such as Improved Customer Communication and Customer Service and Satisfaction are driving the global credit management software market.

Market Trend:

• Increased Adoption of Cloud-based Solutions

Market Drivers:

• Increasing Applications of Credit Management Software

• Improved Customer Communication and Customer Service and Satisfaction

Market Opportunities:

• Increasing Demand from End-users

• Increasing Need for Credit Management Software in Numerous Industries

The Global Credit Management Software Market segments and Market Data Break Down are illuminated below:

by End-users (BFSI, Healthcare, IT and Telecommunication, Government, Others), Enterprise (Small and Medium Enterprises, Large Enterprises), Deployment (On-Premises, On-Cloud), Features (Customer Scorecards, Portfolio Alerts, Portfolio Monitoring, Portfolio Benchmarking, Portfolio Consolidation, Credit Workflow, Credit Documentation, Others), Subscription (Annual Subscription, Monthly Subscription, Others)

Global Credit Management Software market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to help the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Have a query? Market an enquiry before purchase @ https://www.advancemarketanalytics.com/enquiry-before-buy/20291-global-credit-management-software-market#utm_source=OpenPRVinay

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• -To carefully analyze and forecast the size of the Credit Management Software market by value and volume.

• -To estimate the market shares of major segments of the Credit Management Software

• -To showcase the development of the Credit Management Software market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Credit Management Software market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Credit Management Software

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Credit Management Software market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Buy Complete Assessment of Credit Management Software market Now @ https://www.advancemarketanalytics.com/buy-now?format=1&report=20291#utm_source=OpenPRVinay

Major highlights from Table of Contents:

Credit Management Software Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Credit Management Software market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Credit Management Software Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Credit Management Software Market Production by Region Credit Management Software Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

• Key Points Covered in Credit Management Software Market Report:

• Credit Management Software Overview, Definition and Classification Market drivers and barriers

• Credit Management Software Market Competition by Manufacturers

• Impact Analysis of COVID-19 on Credit Management Software Market

• Credit Management Software Capacity, Production, Revenue (Value) by Region (2021-2027)

• Credit Management Software Supply (Production), Consumption, Export, Import by Region (2021-2027)

• Credit Management Software Production, Revenue (Value), Price Trend by Type {Payment Gateway, Merchant Account, Subscription Management,}

• Credit Management Software Manufacturers Profiles/Analysis Credit Management Software Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Browse Complete Summary and Table of Content @ https://www.advancemarketanalytics.com/reports/20291-global-credit-management-software-market#utm_source=OpenPRVinay

Key questions answered

• How feasible is Credit Management Software market for long-term investment?

• What are influencing factors driving the demand for Credit Management Software near future?

• What is the impact analysis of various factors in the Global Credit Management Software market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Contact Us:

Craig Francis (PR & Marketing Manager)

AMA Research & Media LLP

Unit No. 429, Parsonage Road Edison, NJ

New Jersey USA - 08837

Phone: +1(201) 7937323, +1(201) 7937193

sales@advancemarketanalytics.com

About Author:

Advance Market Analytics is Global leaders of Market Research Industry provides the quantified B2B research to Fortune 500 companies on high growth emerging opportunities which will impact more than 80% of worldwide companies' revenues.

Our Analyst is tracking high growth study with detailed statistical and in-depth analysis of market trends & dynamics that provide a complete overview of the industry. We follow an extensive research methodology coupled with critical insights related industry factors and market forces to generate the best value for our clients. We Provides reliable primary and secondary data sources, our analysts and consultants derive informative and usable data suited for our clients business needs. The research study enables clients to meet varied market objectives a from global footprint expansion to supply chain optimization and from competitor profiling to M&As.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Management Software Market is Booming Worldwide | DebtPack, Credica, Innovation Software, Finastra here

News-ID: 2890818 • Views: …

More Releases from AMA Research & Media LLP

Property Insurance in the Oil and Gas Sector Market Detailed Strategies, Competi …

Advance Market Analytics published a new research publication on "Property Insurance in the Oil and Gas Sector Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Property Insurance in the Oil and Gas Sector market was mainly driven by the…

Textile Reinforced Concrete Market Charting Growth Trajectories: Analysis and Fo …

Advance Market Analytics published a new research publication on "Textile Reinforced Concrete Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Textile Reinforced Concrete market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample…

Online TV Streaming Service Market Detailed Strategies, Competitive Landscaping …

Advance Market Analytics published a new research publication on "Online TV Streaming Service Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Online TV Streaming Service market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive…

Potato Vodka Market Unidentified Segments - The Biggest Opportunity Of 2025

Advance Market Analytics published a new research publication on "Potato Vodka Market Insights, to 2033" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Potato Vodka market was mainly driven by the increasing R&D spending across the world.

Get Free Exclusive PDF Sample Copy of…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…