Press release

Doorstep Banking Software Market Growth Revenue, Trends Analysis, Size, Demand, Region And Forecasts Report 2029| Microsoft Corporation, Tata Consultancy Services (TCS)Limited, Capital Banking solutions

Doorstep banking is a facility provided to client so that they don't have to visit bank branch for your routine banking activities like cash deposit, cash withdrawal, cheque deposit or making a demand draft.Los Angeles, United State: QY Research recently published a research report titled, "Global Doorstep Banking Software Research Report Market 2023". The research study presented in this report offers complete and intelligent analysis of the competition, segmentation, dynamics, and geographical advancement of the global Doorstep Banking Software market. It takes into account the CAGR, value, volume, revenue, production, consumption, sales, manufacturing cost, prices, and other key factors related to the global Doorstep Banking Software market. The authors of the report have segmented the global Doorstep Banking Software market as per product, application, and region. Segments of the global Doorstep Banking Software market are analyzed on the basis of market share, production, consumption, revenue, CAGR, market size, and more factors. The analysts have profiled leading players of the global Doorstep Banking Software market, keeping in view their recent developments, market share, sales, revenue, areas covered, product portfolios, and other aspects.

Competitive Landscape Analysis

Competitive landscape is a critical aspect every key player needs to be familiar with. The report throws light on the competitive scenario of the global Doorstep Banking Software market to know the competition at both the domestic and global levels. Market experts have also offered the outline of every leading player of the global Doorstep Banking Software market, considering the key aspects such as areas of operation, production, and product portfolio. Additionally, companies in the Doorstep Banking Software report are studied based on the key factors such as company size, market share, market growth, revenue, production volume, and profits.

Click Here To Get a Sample Copy of Doorstep Banking Software Market Report: https://www.qyresearch.com/sample-form/form/5476336/Global-Doorstep-Banking-Software-Market-Research-Report-2023

Key Players Mentioned in the Global Doorstep Banking Software Market Research Report:

Microsoft Corporation

Tata Consultancy Services (TCS)Limited

Capital Banking solutions

Fiserv Inc.

COR Financial Solutions Limited

EdgeVerve Systems Limited

AClWorldwide

CGl lnc.

Temenos Headquarters SA

Market Segmentation

Each segment of the global Doorstep Banking Software market is extensively evaluated in the research study. The segmental analysis offered in the report pinpoints key opportunities available in the global Doorstep Banking Software market through leading segments. The regional study of the global Doorstep Banking Software market included in the report helps readers to gain sound understanding of the development of different geographical markets in recent years and also going forth. We have provided a detailed study on critical dynamics of the global Doorstep Banking Software market, which include market influence and market effect factors, drivers, challenges, restraints, trends, and prospects. The research study also includes other types of analysis such as qualitative and quantitative.

Global Doorstep Banking Software Market Segment by Type:

On-premise

Cloud

Global Doorstep Banking Software Market Segment by Application:

Central Bank

Commercial Bank

Cooperative Banks

Regional Rural Banks

This research study can be used by all participants of the global Doorstep Banking Software market as it covers every major and minor aspect of the current and future market competition. Even for stakeholders, it can prove highly beneficial, considering the range of studies offered along with detailed analysis of growth strategies that players are expected to adopt in the coming years. New entrants or players looking to make a foray into the global Doorstep Banking Software market can gather useful information and effective advice from the report. On the other hand, established companies can use the Doorstep Banking Software report to stay updated about current and future market scenarios and plan out their future business moves.

Doorstep Banking Software Market Segment by Region:

North America (USA and Canada)

Europe (Germany, the U.K., France, Russia, Italy, Rest of Europe)

Asia-Pacific (China, Japan, South Korea, India, Southeast Asia, Rest of Asia-Pacific)

South America (Mexico, Brazil, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Egypt, South Africa, Rest of MEA)

What To Expect IN Our Report?

(1) A complete section of the Doorstep Banking Software market report is dedicated for market dynamics, which include influence factors, market drivers, challenges, opportunities, and trends.

(2) Another broad section of the research study is reserved for regional analysis of the global Doorstep Banking Software market where important regions and countries are assessed for their growth potential, consumption, market share, and other vital factors indicating their market growth.

(3) Players can use the competitive analysis provided in the report to build new strategies or fine-tune their existing ones to rise above market challenges and increase their share of the global Doorstep Banking Software market.

(4) The report also discusses competitive situation and trends and sheds light on company expansions and merger and acquisition taking place in the global Doorstep Banking Software market. Moreover, it brings to light the market concentration rate and market shares of top three and five players.

(5) Readers are provided with findings and conclusion of the research study provided in the Doorstep Banking Software Market report.

Enquire for customization in Report Doorstep Banking Software:https://www.qyresearch.com/customize-request/form/5476336/Global-Doorstep-Banking-Software-Market-Research-Report-2023

Important Section of Table of Contents

Market Overview: The report begins with this section where product overview and highlights of product and application segments of the global Doorstep Banking Software market are provided. Highlights of the segmentation study include price, revenue, sales, sales growth rate, and market share by product.

Competition by Company: Here, the competition in the global Doorstep Banking Software market is analyzed, taking into consideration price, revenue, sales, and market share by company, market concentration rate, competitive situations and trends, expansion, merger and acquisition, and market shares of top 5 and 10 companies.

Company Profiles and Sales Data: As the name suggests, this section gives the sales data of key players of the global Doorstep Banking Software market as well as some useful information on their business. It talks about the gross margin, price, revenue, products and their specifications, applications, competitors, manufacturing base, and the main business of players operating in the global Doorstep Banking Software market.

Market Status and Outlook by Region: In this section, the report discusses about gross margin, sales, revenue, production, market share, CAGR, and market size by region. Here, the global Doorstep Banking Software market is deeply analyzed on the basis of regions and countries such as North America, Europe, China, India, Japan, and the MEA.

Application or End User: This part of the research study shows how different application segments contribute to the global Doorstep Banking Software market.

Market Forecast: Here, the report offers complete forecast of the global Doorstep Banking Software market by product, application, and region. It also offers global sales and revenue forecast for all years of the forecast period.

Upstream Raw Materials: The report provides analysis of key raw materials used in the global Doorstep Banking Software market, manufacturing cost structure, and the industrial chain.

Marketing Strategy Analysis and Distributors: This section offers analysis of marketing channel development trends, indirect marketing, and direct marketing followed by a broad discussion on distributors and downstream customers in the global Doorstep Banking Software market.

Research Findings and Conclusion: This is one of the last sections of the report where the findings of the analysts and the conclusion of the research study are provided.

Appendix: Here, we have provided a disclaimer, our data sources, data triangulation, market breakdown, research programs and design, and our research approach.

Table of Contents

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Doorstep Banking Software Market Size Growth Rate by Type: 2018 VS 2022 VS 2029

1.2.2 On-premise

1.2.3 Cloud

1.3 Market by Application

1.3.1 Global Doorstep Banking Software Market Growth by Application: 2018 VS 2022 VS 2029

1.3.2 Central Bank

1.3.3 Commercial Bank

1.3.4 Cooperative Banks

1.3.5 Regional Rural Banks

1.4 Study Objectives

1.5 Years Considered

1.6 Years Considered

2 Global Growth Trends

2.1 Global Doorstep Banking Software Market Perspective (2018-2029)

2.2 Doorstep Banking Software Growth Trends by Region

2.2.1 Global Doorstep Banking Software Market Size by Region: 2018 VS 2022 VS 2029

2.2.2 Doorstep Banking Software Historic Market Size by Region (2018-2023)

2.2.3 Doorstep Banking Software Forecasted Market Size by Region (2024-2029)

2.3 Doorstep Banking Software Market Dynamics

2.3.1 Doorstep Banking Software Industry Trends

2.3.2 Doorstep Banking Software Market Drivers

2.3.3 Doorstep Banking Software Market Challenges

2.3.4 Doorstep Banking Software Market Restraints

3 Competition Landscape by Key Players

3.1 Global Top Doorstep Banking Software Players by Revenue

3.1.1 Global Top Doorstep Banking Software Players by Revenue (2018-2023)

3.1.2 Global Doorstep Banking Software Revenue Market Share by Players (2018-2023)

3.2 Global Doorstep Banking Software Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Players Covered: Ranking by Doorstep Banking Software Revenue

3.4 Global Doorstep Banking Software Market Concentration Ratio

3.4.1 Global Doorstep Banking Software Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Doorstep Banking Software Revenue in 2022

3.5 Doorstep Banking Software Key Players Head office and Area Served

3.6 Key Players Doorstep Banking Software Product Solution and Service

3.7 Date of Enter into Doorstep Banking Software Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Doorstep Banking Software Breakdown Data by Type

4.1 Global Doorstep Banking Software Historic Market Size by Type (2018-2023)

4.2 Global Doorstep Banking Software Forecasted Market Size by Type (2024-2029)

5 Doorstep Banking Software Breakdown Data by Application

5.1 Global Doorstep Banking Software Historic Market Size by Application (2018-2023)

5.2 Global Doorstep Banking Software Forecasted Market Size by Application (2024-2029)

6 North America

6.1 North America Doorstep Banking Software Market Size (2018-2029)

6.2 North America Doorstep Banking Software Market Growth Rate by Country: 2018 VS 2022 VS 2029

6.3 North America Doorstep Banking Software Market Size by Country (2018-2023)

6.4 North America Doorstep Banking Software Market Size by Country (2024-2029)

6.5 United States

6.6 Canada

7 Europe

7.1 Europe Doorstep Banking Software Market Size (2018-2029)

7.2 Europe Doorstep Banking Software Market Growth Rate by Country: 2018 VS 2022 VS 2029

7.3 Europe Doorstep Banking Software Market Size by Country (2018-2023)

7.4 Europe Doorstep Banking Software Market Size by Country (2024-2029)

7.5 Germany

7.6 France

7.7 U.K.

7.8 Italy

7.9 Russia

7.10 Nordic Countries

8 Asia-Pacific

8.1 Asia-Pacific Doorstep Banking Software Market Size (2018-2029)

8.2 Asia-Pacific Doorstep Banking Software Market Growth Rate by Region: 2018 VS 2022 VS 2029

8.3 Asia-Pacific Doorstep Banking Software Market Size by Region (2018-2023)

8.4 Asia-Pacific Doorstep Banking Software Market Size by Region (2024-2029)

8.5 China

8.6 Japan

8.7 South Korea

8.8 Southeast Asia

8.9 India

8.10 Australia

9 Latin America

9.1 Latin America Doorstep Banking Software Market Size (2018-2029)

9.2 Latin America Doorstep Banking Software Market Growth Rate by Country: 2018 VS 2022 VS 2029

9.3 Latin America Doorstep Banking Software Market Size by Country (2018-2023)

9.4 Latin America Doorstep Banking Software Market Size by Country (2024-2029)

9.5 Mexico

9.6 Brazil

10 Middle East & Africa

10.1 Middle East & Africa Doorstep Banking Software Market Size (2018-2029)

10.2 Middle East & Africa Doorstep Banking Software Market Growth Rate by Country: 2018 VS 2022 VS 2029

10.3 Middle East & Africa Doorstep Banking Software Market Size by Country (2018-2023)

10.4 Middle East & Africa Doorstep Banking Software Market Size by Country (2024-2029)

10.5 Turkey

10.6 Saudi Arabia

10.7 UAE

11 Key Players Profiles

11.1 Microsoft Corporation

11.1.1 Microsoft Corporation Company Detail

11.1.2 Microsoft Corporation Business Overview

11.1.3 Microsoft Corporation Doorstep Banking Software Introduction

11.1.4 Microsoft Corporation Revenue in Doorstep Banking Software Business (2018-2023)

11.1.5 Microsoft Corporation Recent Development

11.2 Tata Consultancy Services (TCS)Limited

11.2.1 Tata Consultancy Services (TCS)Limited Company Detail

11.2.2 Tata Consultancy Services (TCS)Limited Business Overview

11.2.3 Tata Consultancy Services (TCS)Limited Doorstep Banking Software Introduction

11.2.4 Tata Consultancy Services (TCS)Limited Revenue in Doorstep Banking Software Business (2018-2023)

11.2.5 Tata Consultancy Services (TCS)Limited Recent Development

11.3 Capital Banking solutions

11.3.1 Capital Banking solutions Company Detail

11.3.2 Capital Banking solutions Business Overview

11.3.3 Capital Banking solutions Doorstep Banking Software Introduction

11.3.4 Capital Banking solutions Revenue in Doorstep Banking Software Business (2018-2023)

11.3.5 Capital Banking solutions Recent Development

11.4 Fiserv Inc.

11.4.1 Fiserv Inc. Company Detail

11.4.2 Fiserv Inc. Business Overview

11.4.3 Fiserv Inc. Doorstep Banking Software Introduction

11.4.4 Fiserv Inc. Revenue in Doorstep Banking Software Business (2018-2023)

11.4.5 Fiserv Inc. Recent Development

11.5 COR Financial Solutions Limited

11.5.1 COR Financial Solutions Limited Company Detail

11.5.2 COR Financial Solutions Limited Business Overview

11.5.3 COR Financial Solutions Limited Doorstep Banking Software Introduction

11.5.4 COR Financial Solutions Limited Revenue in Doorstep Banking Software Business (2018-2023)

11.5.5 COR Financial Solutions Limited Recent Development

11.6 EdgeVerve Systems Limited

11.6.1 EdgeVerve Systems Limited Company Detail

11.6.2 EdgeVerve Systems Limited Business Overview

11.6.3 EdgeVerve Systems Limited Doorstep Banking Software Introduction

11.6.4 EdgeVerve Systems Limited Revenue in Doorstep Banking Software Business (2018-2023)

11.6.5 EdgeVerve Systems Limited Recent Development

11.7 AClWorldwide

11.7.1 AClWorldwide Company Detail

11.7.2 AClWorldwide Business Overview

11.7.3 AClWorldwide Doorstep Banking Software Introduction

11.7.4 AClWorldwide Revenue in Doorstep Banking Software Business (2018-2023)

11.7.5 AClWorldwide Recent Development

11.8 CGl lnc.

11.8.1 CGl lnc. Company Detail

11.8.2 CGl lnc. Business Overview

11.8.3 CGl lnc. Doorstep Banking Software Introduction

11.8.4 CGl lnc. Revenue in Doorstep Banking Software Business (2018-2023)

11.8.5 CGl lnc. Recent Development

11.9 Temenos Headquarters SA

11.9.1 Temenos Headquarters SA Company Detail

11.9.2 Temenos Headquarters SA Business Overview

11.9.3 Temenos Headquarters SA Doorstep Banking Software Introduction

11.9.4 Temenos Headquarters SA Revenue in Doorstep Banking Software Business (2018-2023)

11.9.5 Temenos Headquarters SA Recent Development

12 Analyst's Viewpoints/Conclusions

13 Appendix

13.1 Research Methodology

13.1.1 Methodology/Research Approach

13.1.2 Data Source

13.2 Disclaimer

13.3 Author Details

Contact US

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

ankit@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Doorstep Banking Software Market Growth Revenue, Trends Analysis, Size, Demand, Region And Forecasts Report 2029| Microsoft Corporation, Tata Consultancy Services (TCS)Limited, Capital Banking solutions here

News-ID: 2887844 • Views: …

More Releases from QY Research, Inc.

Global Semiconductor Silicon Wafer Market to Reach US$ 29.08 Billion by 2032, Dr …

Market Summary -

The global Semiconductor Silicon Wafer market was valued at US$ 17,020 million in 2025 and is projected to reach US$ 29,080 million by 2032, growing at a CAGR of 8.1% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Semiconductor Silicon Wafer Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" delivers a comprehensive, data-driven assessment of the global silicon wafer…

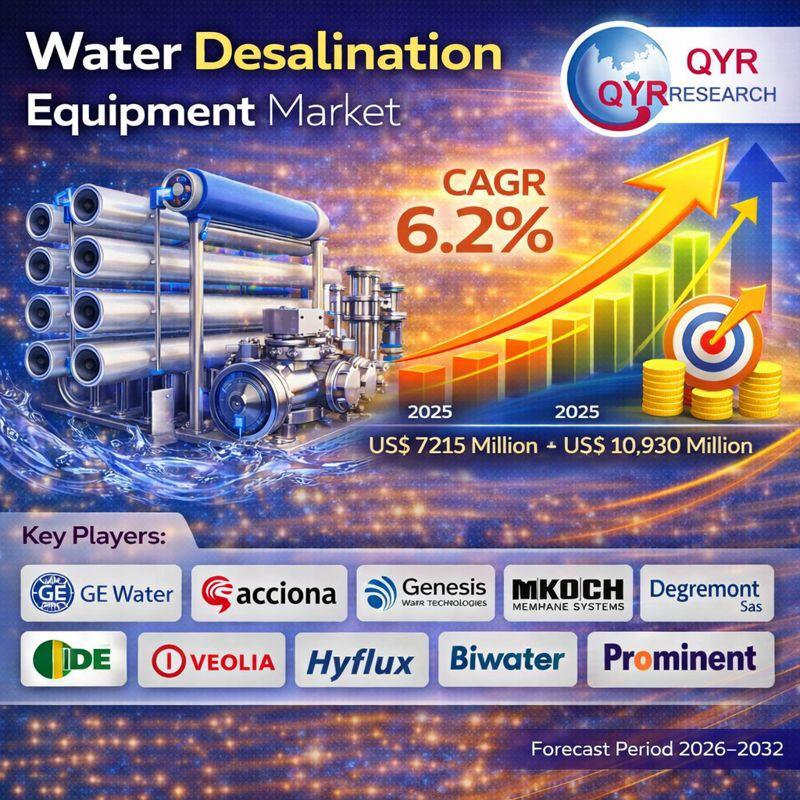

Global Water Desalination Equipment Market to Reach US$ 10.93 Billion by 2032, D …

Market Summary -

The global Water Desalination Equipment market was valued at US$ 7,215 million in 2025 and is projected to reach US$ 10,930 million by 2032, growing at a CAGR of 6.2% during the forecast period 2026-2032.

According to QY Research, the newly published report titled "Global Water Desalination Equipment Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global desalination equipment…

Global Syndiotactic Polystyrene Market to Reach US$ 162 Million by 2032, Driven …

Market Summary -

The global Syndiotactic Polystyrene (SPS) market was valued at US$ 111 million in 2025 and is projected to reach US$ 162 million by 2032, expanding at a CAGR of 5.6% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Syndiotactic Polystyrene Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven assessment of the global SPS market. The…

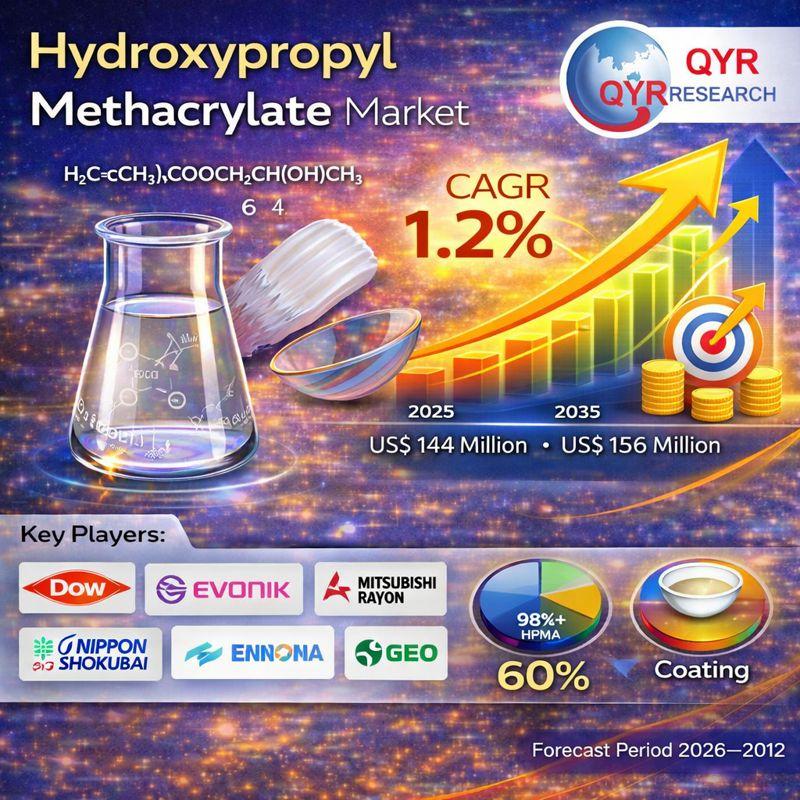

Global Hydroxypropyl Methacrylate Market to Reach US$ 156 Million by 2032, Suppo …

Market Summary -

The global Hydroxypropyl Methacrylate (HPMA) market was valued at US$ 144 million in 2025 and is projected to reach US$ 156 million by 2032, expanding at a CAGR of 1.2% during the forecast period 2026-2032.

According to QY Research, the newly released report titled "Global Hydroxypropyl Methacrylate Market Insights - Industry Share, Sales Projections, and Demand Outlook 2026-2032" provides a comprehensive, data-driven evaluation of the global HPMA market.…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…