Press release

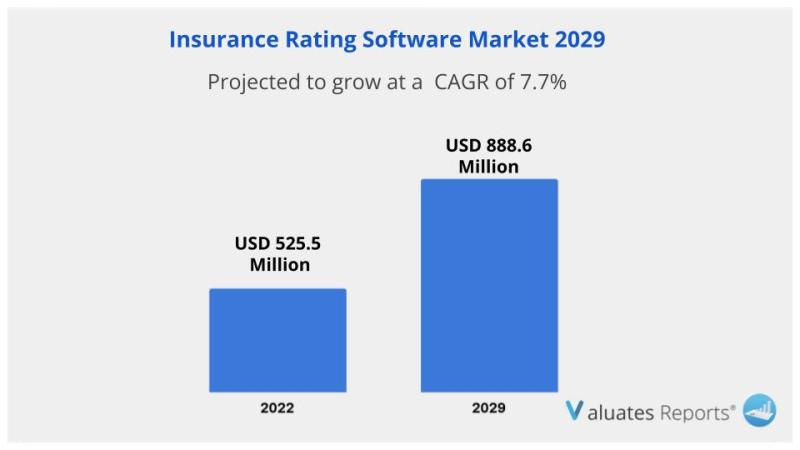

Insurance Rating Software market size is estimated to be worth US$ 525.5 million in 2022 and is forecast to a readjusted size of US$ 888.6 million by 2029 with a CAGR of 7.7% - Valuates Reports

Due to the COVID-19 pandemic, the global Insurance Rating Software market size is estimated to be worth US$ 525.5 million in 2022 and is forecast to a readjusted size of US$ 888.6 million by 2029 with a CAGR of 7.7% during the forecast period 2023-2029.Get Sample Report - https://reports.valuates.com/request/sample/QYRE-Auto-8B9454/Global_Insurance_Rating_Software_Market_Insights_and_Forecast_to_2028

Fully considering the economic change by this health crisis, Cloud-Based accounting for % of the Insurance Rating Software global market in 2022, is projected to value US$ million by 2029, growing at a revised % CAGR from 2023 to 2029.

While Automobile segment is altered to an % CAGR throughout this forecast period.

Insurance Rating Software Market Insights

This report studies the insurance rating software (also called insurance quoting software) market, the software is a type of application software as comparative rater used for insurance process. The users can be insurance agency, individual, insurance companies, etc.

The data in the report is mainly based on the substantive insurance rating software.

Vertafore, Applied Systems, EZLynx, ACS, ITC, HawkSoft, QQ Solutions, Sapiens/Maximum Processing, Agency Matrix, Buckhill, InsuredHQ and Zhilian Software are the key suppliers in the global Insurance Rating Software market. Top 10 took up about 48% of the global market.

Insurance Rating Software Market Scope and Market Size

The global Insurance Rating Software market is segmented by company, region (country), by Type and by Application. Players, stakeholders, and other participants in the global Insurance Rating Software market will be able to gain the upper hand as they use the report as a powerful resource. The segmental analysis focuses on sales, revenue and forecast by region (country), by Type and by Application for the period 2018-2029.

Insurance Rating Software Segment by Type

-Cloud-Based

-On-Premise

Insurance Rating Software Segment by Application

-Automobile

-Home

-Motorcycle

-Others

Get Detailed Report - https://reports.valuates.com/market-reports/QYRE-Auto-8B9454/global-insurance-rating-software

Similar Reports

Insurance Analytics Market - https://reports.valuates.com/market-reports/ALLI-Manu-4N44/insurance-analytics

Cryptocurrency Hardware Wallet Market - https://reports.valuates.com/reports/QYRE-Auto-E301/global-cryptocurrency-hardware-wallet

Edge Computing Market - https://reports.valuates.com/market-reports/QYRE-Auto-35M1599/global-edge-computing

Tokenization Market - https://reports.valuates.com/market-reports/QYRE-Auto-26Y3935/global-tokenization

Valuates Reports

sales@valuates.com

For U.S. Toll Free Call +1-(315)-215-3225

For IST Call +91-8040957137

WhatsApp : +91-9945648335

Website: https://reports.valuates.com

Twitter - https://twitter.com/valuatesreports

Linkedin - https://in.linkedin.com/company/valuatesreports

Facebook - https://www.facebook.com/valuatesreports/

Sitemap:

https://reports.valuates.com/sitemap/html/reports/912

https://reports.valuates.com/sitemap/html/reports/913

https://reports.valuates.com/sitemap/html/reports/914

Valuates offers in-depth market insights into various industries. Our extensive report repository is constantly updated to meet your changing industry analysis needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Rating Software market size is estimated to be worth US$ 525.5 million in 2022 and is forecast to a readjusted size of US$ 888.6 million by 2029 with a CAGR of 7.7% - Valuates Reports here

News-ID: 2883725 • Views: …

More Releases from Valuates Reports

High Content Screening Market Set to Surge - Key Insights You Must Know

High Content Screening Market Size

The global market for High Content Screening was valued at US$ 661 million in the year 2024 and is projected to reach a revised size of US$ 1149 million by 2031, growing at a CAGR of 8.3% during the forecast period.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-17L6152/Global_High_Content_Screening_Market_Insights_Forecast_to_2028

High-content screening (HCS) or high-content analysis (HCA) (also known as cellomics), is a set of analytical techniques that is applied in genetic research…

Hospital Supplies Market Expands Globally as Infection Control, Surgical Innovat …

Hospital Supplies Market Size

The global market for Hospital Supplies was valued at US$ 33680 million in the year 2024 and is projected to reach a revised size of US$ 62780 million by 2031, growing at a CAGR of 9.4% during the forecast period.

Major Trends

• Disposable supplies strengthen infection prevention

• Surgical innovation drives operating room upgrades

• Sterilization systems enhance compliance standards

• Vaccination programs sustain syringe demand

• Asia-Pacific expands hospital infrastructure

• Outpatient care increases clinic procurement

• Regulatory standards elevate…

Power Battery Blue Film Market Share Expands with EV Growth and Advanced Battery …

Power Battery Blue Film Market Size

The global market for Power Battery Blue Film was valued at US$ 214 million in the year 2024 and is projected to reach a revised size of US$ 475 million by 2031, growing at a CAGR of 5.8% during the forecast period.

View sample report

https://reports.valuates.com/request/sample/QYRE-Auto-12R19714/Global_Power_Battery_Blue_Film_Market_Research_Report_2025

The Power Battery Blue Film Market is witnessing rapid market growth driven by accelerating electric vehicle (EV) adoption, expansion of lithium-ion battery…

Aspirating Aerator Market Share Expands with Rising Wastewater Treatment Investm …

Aspirating Aerator Market

The global market for Aspirating Aerator was valued at US$ million in the year 2024 and is projected to reach a revised size of US$ million by 2031, growing at a CAGR of %during the forecast period.

View sample report

https://reports.valuates.com/request/sample/QYRE-Auto-39E16118/Global_Aspirating_Aerator_Market_Research_Report_2023

The Aspirating Aerator Market is experiencing steady market growth driven by increasing investments in wastewater treatment infrastructure and stricter environmental regulations worldwide. Aspirating aerators are widely used to enhance oxygen…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…