Press release

Burial Insurance Market Growth, Trends, Size, Share, Demand And Top Growing Companies 2029

The global burial insurance market is expected to perform astoundingly well between the forecast years, predicts Fairfield Market Research. The market's growth will be determined by the changing political scenario, initiating fast-paced trade. As the pandemic ebbs, growing trade across the globe is expected to bode well for the global burial insurance market . Analysts anticipate the demand in global burial insurance market to pick up pace as the consumers look at spending money in a post pandemic world.The burial insurance market research report includes an executive summary that gives an overview of the dynamics that are shaping the market. It provides a brief account of key market players, their strategies, and the line of thought to take the market forward. The report includes a SWOT analysis and a Porter's Five Forces analysis, which allows the readers to build a clear impression of market's trajectory to make well-informed business decision.

Get Sample Copy/TOC to Clarified View of the Report Outline Before You Buy It: https://www.fairfieldmarketresearch.com/report/burial-insurance-market/request-toc/

Major Company Names Covered in Global Burial Insurance Market Report:

AARP, Gerber Life Insurance Company, Foresters Financial Services Inc., Mutual of Omaha Insurance Company, Globe Life and Accident Insurance Company, Colonial Penn, The American Automobile Association Inc., Fidelity Life Association, Royal Neighbors of America, Metlife, Inc.

Key Dynamics:

The insights into the top industry trends serve as the best investments markers, which further facilitate the decision-making process for the potential players. With all the vital information, the report intends to uncover the multiple growth opportunities that the readers can consider to capitalise on. Detailed examination of the key growth influencing factors like pricing structure, demand-supply scenario, production, profit margins, and value chain analysis further unfurl the insights into how the market growth will unfold over the next few years.

Regional Analysis and Competition:

The next part of the global burial insurance market report represents a regional assessment of the market that unlocks a spectrum of untapped opportunities in international, as well as regional and domestic marketplaces. The report further sheds light on the detailed competitive intelligence that facilitates the understanding of competition on the basis of their recent innovations, and developments. In-depth company profiling enables readers to understand the evaluation of key company shares, the scope of NPD in new markets, emerging product lines, possibilities of product innovation, and pricing strategies. The competitive analysis data presented in the global burial insurance market report enables the readers to realise their market entry potential. It aids in devising actionable, fruitful strategies that meet their business goals.

Do You Have Any Query or Specific Requirement? Request for Custom Research: https://www.fairfieldmarketresearch.com/report/burial-insurance-market/request-customization/

Regional Analysis Section in Global Burial Insurance Market Report Covers-

North America (US)

Europe (Germany, France, UK)

Asia Pacific (China, Japan, India)

Latin America (Brazil)

The Middle East & Africa

Key Questions Answered in Report:

What is the global burial insurance market size and what are the market projections estimated in the report?

What are the most prominent segments in burial insurance market?

What are the leading regions in global burial insurance market?

What are the key influencing trends for demand and supply that are likely to shape burial insurance market during the forecast period?

What are the key opportunities existing and likely to be emerging in global burial insurance market?

How has been the impact of global COVID-19 pandemic on the global burial insurance market and what does the projected recovery look like?

Research Methodology - Class-leading Results Backed by Award Winning Methodology

Fairfield Market Research uses a research methodology that has proven its worth through client satisfaction and years of honing. Our analysts have years of experience in diverse fields and use primary and secondary research techniques to an gain in-depth knowledge of the global burial insurance market. We keep close tabs on the competition and our researchers conduct interviews with industry leaders and C-suite executives to ensure we remain abreast of current trends in the market.

For More Information Visit: https://www.fairfieldmarketresearch.com/report/burial-insurance-market/

Contact

Fairfield Market Research

London, UK

UK +44 (0)20 30025888

USA +1 (844) 3829746 (Toll-free)

Email: sales@fairfieldmarketresearch.com

Web: https://www.fairfieldmarketresearch.com/

Follow Us: https://bit.ly/3voYIm9

About Us :-

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values and eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Burial Insurance Market Growth, Trends, Size, Share, Demand And Top Growing Companies 2029 here

News-ID: 2878668 • Views: …

More Releases from Fairfield Market Research

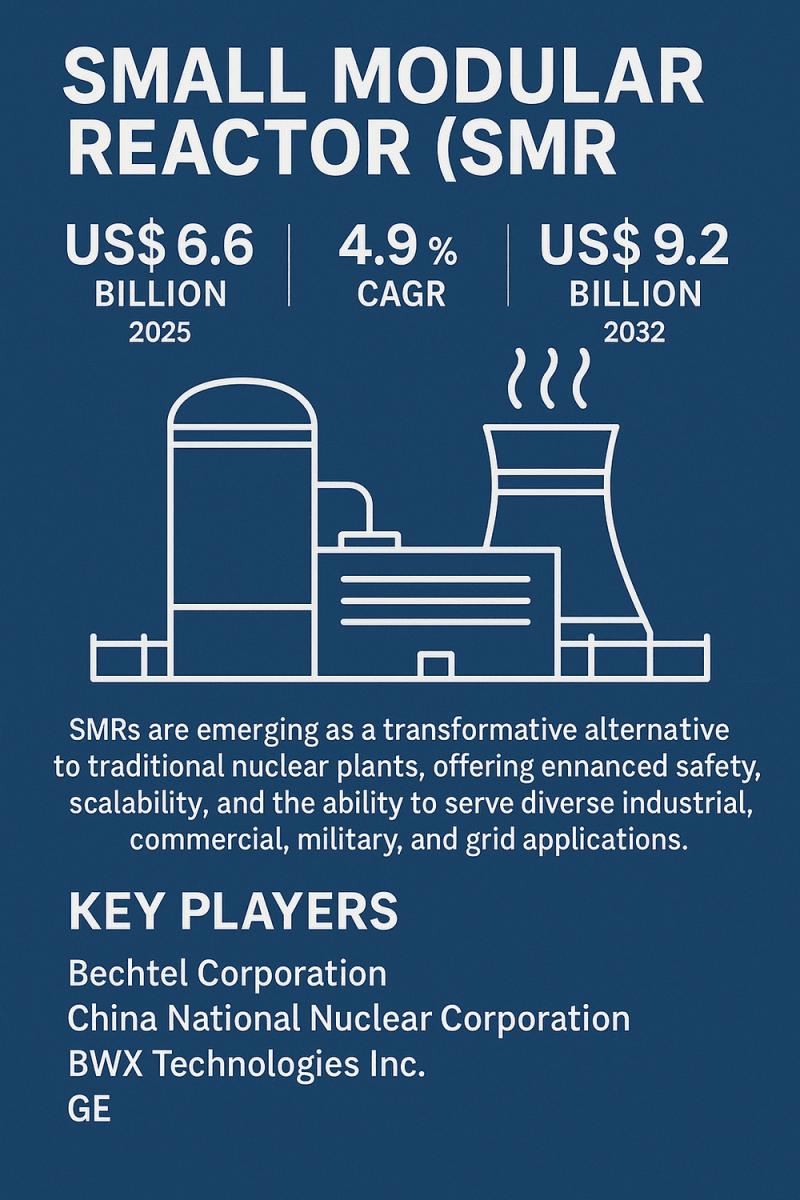

Small Modular Reactor (SMR) Market Set to Climb from $6.6 Bn in 2025 to $9.2 Bn …

The Small Modular Reactor (SMR) industry is entering a crucial phase of global development as nations accelerate the transition toward low-carbon energy systems and resilient power infrastructure. With the market estimated at US$ 6.6 billion in 2025 and projected to reach US$ 9.2 billion by 2032, the sector is expanding at a 4.9% CAGR during the forecast period. SMRs are emerging as a transformative alternative to traditional nuclear plants, offering…

Antimony-free Films Market Set for Sustainable Expansion Through 2032

The global Antimony-free Films Market is entering a defining phase of strategic expansion as sustainability, regulatory shifts, and consumer safety expectations reshape the packaging and materials landscape. With rising concerns surrounding antimony-based catalysts in polyester films, end-use industries are accelerating the transition toward safer, more compliant, and environmentally responsible alternatives. According to industry estimates, the market is valued at US$ 238.6 million in 2025 and is projected to reach US$…

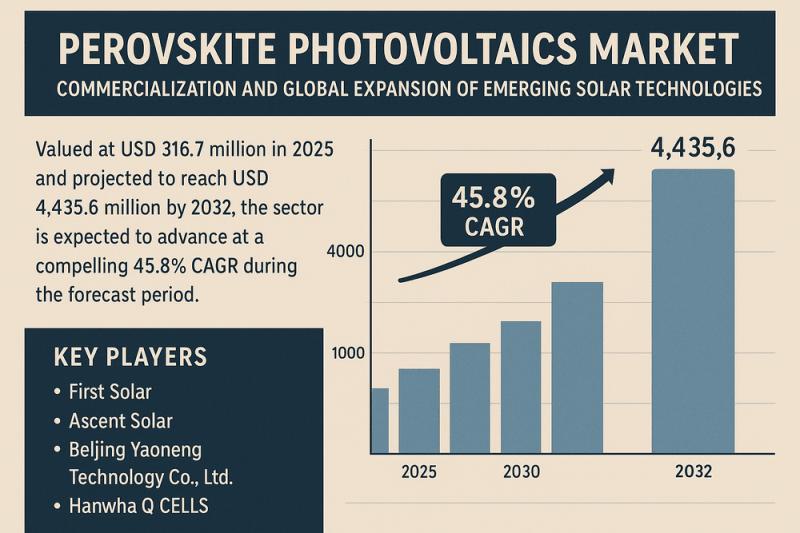

Perovskite Photovoltaics Market Set for Transformational Growth Through 2032

The Perovskite Photovoltaics Market is entering a pivotal phase of commercialization and global expansion as emerging solar technologies gain momentum across residential, commercial, and utility-scale applications. Valued at USD 316.7 million in 2025 and projected to reach USD 4,435.6 million by 2032, the sector is expected to advance at a compelling 45.8% CAGR during the forecast period. This remarkable growth trajectory reflects rising demand for low-cost, high-efficiency solar modules, continued…

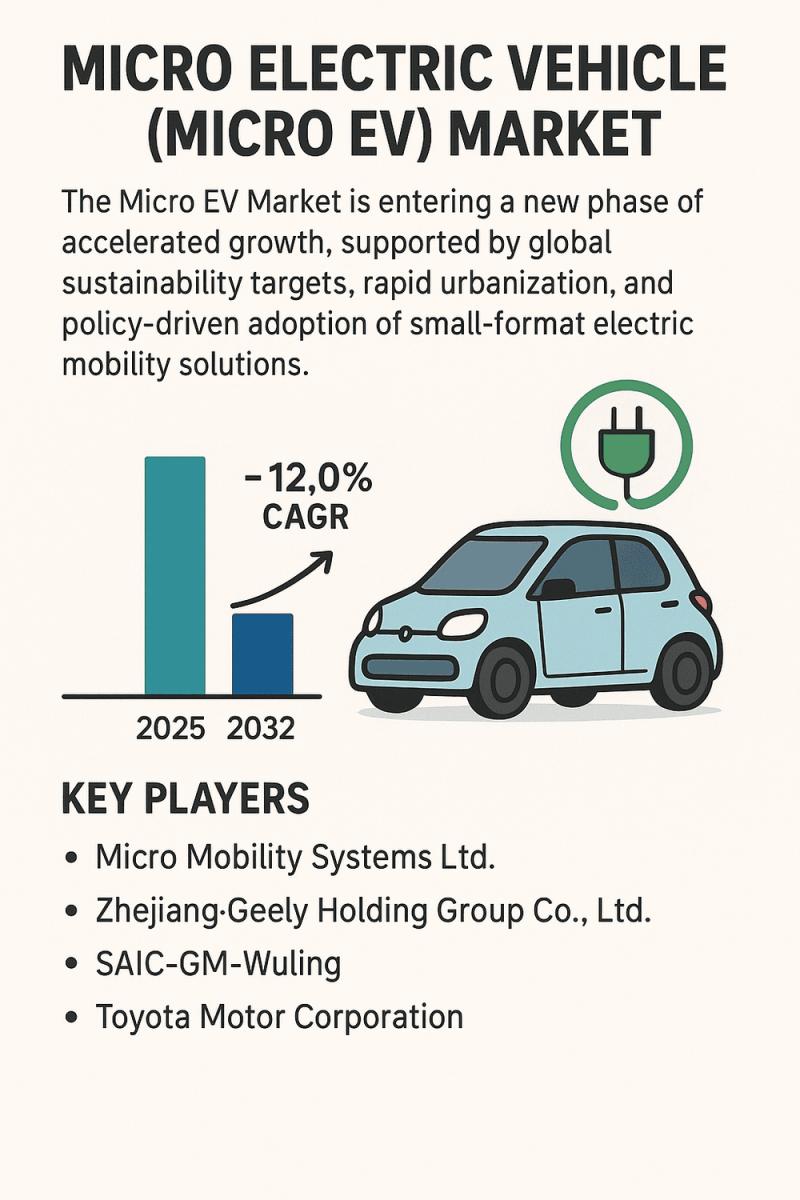

Micro EV Market Accelerates Toward a Sustainable Urban Mobility Future Through 2 …

The Micro Electric Vehicle (Micro EV) Market is entering a new phase of accelerated growth, supported by global sustainability targets, rapid urbanization, and policy-driven adoption of small-format electric mobility solutions. Valued at USD 12.1 billion in 2025 and projected to reach USD 26.8 billion by 2032, the industry expands at a 12.0% CAGR, reflecting strong market confidence in compact, zero-emission vehicles. These vehicles-ranging from two-seater microcars to lightweight quadricycles-are increasingly…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…