Press release

Japan Usage based Insurance Market Is Expected to Grasp the Size, Shares, Demand, Global Trends, Growth and Revenue Outlook by 2032 | UnipolSai Assicurazioni S.p.A, Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Automobile

Japan Usage based Insurance Market Report from QMI highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans and make informed decisions to improved profitability. In addition, the study helps venture or private players in understanding the companies in more detail to make better informed decisions.Japan Usage based Insurance Market Research Report is spread wide in terms of pages and provides exclusive data, information, vital statistics with tables and figures, trends and competitive landscape details in this niche sector.

Get a Sample PDF of the report @ https://www.quincemarketinsights.com/request-sample-104308?OPPC

What is New Additions in 2023?

Detailed industry outlook

Additional information on company players

Customized report and analyst support on request

Recent market developments and it's futuristic growth opportunities

Customized regional/country reports as per request

The list of Key Players Profiled in the study includes:- UnipolSai Assicurazioni S.p.A, Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Automobile Mutual Insurance Company and Liberty Mutual Insurance Company.

Report overview:

The Japan Usage based Insurance report analyzes regional growth trends and future opportunities.

A detailed analysis of each segment provides relevant information.

The data gathered in the Japan Usage based Insurance Report has been researched and verified by our analysts.

This report provides actionable information on supply, demand and future forecasts.

Purchase the Complete Market Report @ https://www.quincemarketinsights.com/insight/buy-now/japan-usage-based-insurance-market/single_user_license?OPPC

⏩ Segmentation Analysis of the Market:

Japan Usage based Insurance Market forecast report provides a holistic evaluation of the market. The report offers a comprehensive analysis of key segments, trends, drivers, restraints, competitive landscape, and factors that are playing a substantial role in the market. Japan Usage based Insurance Market segments and Market Data Break Down are illuminated by Package (PAYD, PHYD, MHYD), Technology (OBD-II, Black box, Smartphone, Embedded), Vehicle Age (New, Old), Device Offering (BYOD, Company Provided)

⏩ Regional Coverage:

The countries covered in the usage-based insurance market report are the Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC).

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Highlights of the Japan Usage based Insurance Market report:

→ This analysis provides market size (US$ Million) and compound annual growth rate (CAGR%) for the forecast period (2023-2032), using 2021 as the base year. It also covers the Japan Usage based Insurance Market in-depth.

→ It offers enticing investment proposition matrices for this sector and explains the likely future growth of key revenue streams.

→ Additionally, this study offers crucial insights into market forces, limitations, opportunities, new product introductions or approvals, market trends, regional perspective, and competitive tactics used by top rivals.

→ Based on the following factors: company highlights, product portfolio, significant highlights, financial performance, and strategies, it covers key players in the Japan Usage based Insurance Market.

→ Marketers and company leaders will be able to make wise decisions about next product launches, type updates, market expansion, and marketing strategies thanks to the insights from this research.

→ A wide spectrum of industry stakeholders are covered by the Japan Usage based Insurance Market research, including investors, vendors, product producers, distributors, new entrants, and financial analysts.

→ The many strategy matrices used in researching the Japan Usage based Insurance Market will aid stakeholders in making decisions.

The research was developed through the synthesis, analysis and interpretation of data gathered from multiple sources on the parent market. Additionally, analysis has been done of the economic circumstances and other economic indicators and factors to evaluate their respective impact on the Japan Usage based Insurance Market, along with the present impact, so as to develop strategic and informed projections about the scenarios in the market. This is mostly due to the developing countries' unmet potential in terms of product pricing and revenue collection.

Report summary:

o The report is a clear pointer to the Japan Usage based Insurance market landscape in the current scenario.

o This report provides an accurate analysis of Japan Usage based Insurance industry activities in terms of market share and size.

o A SWOT analysis provides a concise explanation of the determinants of the Japan Usage based Insurance market amid numerous clusters of information.

o The report offers valuable insights into the industry trends, growth drivers and investment landscape of the Japan Usage based Insurance market.

If you have any query related to this market report, you can ask to our experts @ https://www.quincemarketinsights.com/enquiry-before-buying/enquiry-before-buying-104308?OPPC

ABOUT US:

QMI has the most comprehensive collection of market research products and services available on the web. We deliver reports from virtually all major publications and refresh our list regularly to provide you with immediate online access to the world's most extensive and up-to-date archive of professional insights into global markets, companies, goods, and patterns.

Contact us:

Quince Market Insights

Phone: APAC +91 706 672 4343 / US +1 208 405 2835 / UK +44 1444 39 0986

Email: sales@quincemarketinsights.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Japan Usage based Insurance Market Is Expected to Grasp the Size, Shares, Demand, Global Trends, Growth and Revenue Outlook by 2032 | UnipolSai Assicurazioni S.p.A, Progressive Casualty Insurance Company, Allstate Insurance Company, State Farm Automobile here

News-ID: 2877525 • Views: …

More Releases from Quince Market Insights

Premium Bicycles Market Demand, Future Trends, Size, Share and Outlook till 2032 …

Premium Bicycles Market Size & Industry Trends Shaping 2032

A more concise understanding of the Premium Bicycles Market dynamics is provided by QMI. A detailed analysis of market statistics covering both present and emerging trends. The report includes Porter's Five Forces to analyze the prominence of various features such as the understanding of both the suppliers and customers, risks posed by various agents, the strength of competition, and promising emerging businesspersons…

Smart Bicycle Market Detail Analysis focusing on Application, Types and Regional …

Smart Bicycle Market Size & Industry Trends Shaping 2032

A more concise understanding of the Smart Bicycle Market dynamics is provided by QMI. A detailed analysis of market statistics covering both present and emerging trends. The report includes Porter's Five Forces to analyze the prominence of various features such as the understanding of both the suppliers and customers, risks posed by various agents, the strength of competition, and promising emerging businesspersons…

Battery Technology Market: Drivers, Revenue, Application Industry Demand Analysi …

Battery Technology Market Size & Industry Trends Shaping 2032

A more concise understanding of the battery technology market dynamics is provided by QMI. A detailed analysis of market statistics covering both present and emerging trends. The report includes Porter's Five Forces to analyze the prominence of various features such as the understanding of both the suppliers and customers, risks posed by various agents, the strength of competition, and promising emerging businesspersons…

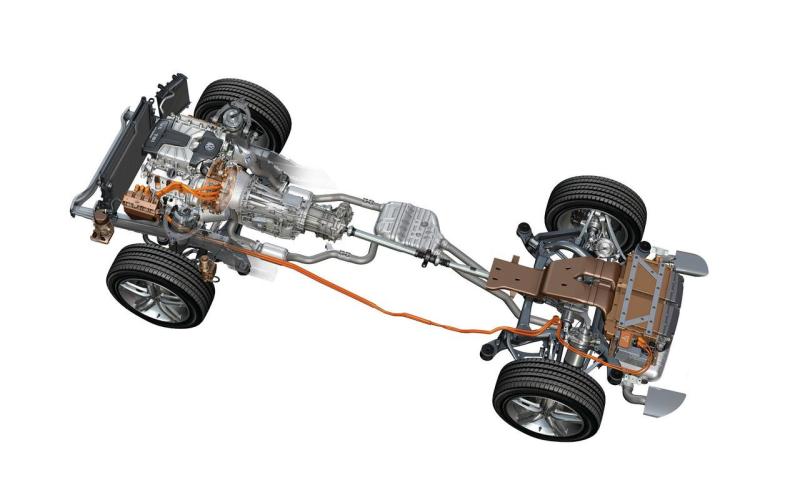

Global Automotive Powertrain Market Size, Share, Industry Forecast 2032 | Toyota …

The most recent report published by QMI indicates that the "Automotive Powertrain Market" is likely to accelerate significantly in the next few years. The Automotive Powertrain Market report gives a purposeful depiction of the area by the practice for research, amalgamation, market size, overview, and review of data taken from various sources. The Automotive Powertrain Market study includes information on market factors such as the market dynamics, drivers, restraints, challenges,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…