Press release

Neo And Challenger Bank Market will Predicted to Grow at a 48.3% CAGR During Forecast Period

Neo And Challenger Bank Market Dynamics By Straits Research:Straits Research has recently added a new report to its vast depository titled Neo And Challenger Bank Market. The report studies vital factors about the Neo And Challenger Bank Market that are essential to be understood by existing as well as new market players. The report highlights the essential elements such as market share, profitability, production, sales, manufacturing, advertising, technological advancements, key market players, regional segmentation, and many more crucial aspects related to the Neo And Challenger Bank Market.

According to Straits Research, the Neo And Challenger Bank market size will grow at a CAGR of 48.3% During the forecast period.

Click here to Get Latest Research Data and Market Trends @ https://straitsresearch.com/report/neo-and-challenger-bank-market/request-sample

Important factors like strategic developments, government regulations, market analysis, end users, target audience, distribution network, branding, product portfolio, market share, threats and barriers, growth drivers, and the latest trends in the industry are also mentioned.

Competitive Players

Some of the key players operating in the Neo And Challenger Bank market are

Atom Bank plc, Fidor Solutions AG, Monzo Bank Limited, Movencorp, Inc., MYbank, Number26 GmbH, Simple Finance Technology Corporation, Tandem Bank, UBank limited, and WeBank.

The global Neo And Challenger Bank Market is highly fragmented and the major players are using various strategies such as product launches, agreements, expansions, joint ventures, acquisitions, partnerships, and others to increase their footprints in this market.

This research also provides a dashboard view of prominent Organization, highlighting their effective marketing tactics, market share and most recent advances in both historical and current settings.

Get the inside scoop on your industry with our comprehensive market research report!

Buy Now @ https://straitsresearch.com/buy-now/neo-and-challenger-bank-market

The report on Neo And Challenger Bank Market provides detailed segmentation by type, applications, and regions. Each segment provides information about production and manufacturing during the forecast period. The application segment highlights the applications and operational processes of the industry. Understanding these segments will help identify the importance of the various factors aiding the market growth.

Global Neo And Challenger Bank Market: Segmentation

By Service Type

Loans

Mobile Banking

Checking & saving accounts

Payment & money transfer

Others

By End User

Business

Personal

By Region

North America

Europe

Asia-Pacific

Key point summary of the Global Neo And Challenger Bank Market report:

- This report gives out a comprehensive prospect of several factors driving or restraining market growth.

- It presents an in-depth analysis of fluctuating competition dynamics and puts the reader ahead of competitors.

- It helps in making well-informed business decisions by creating a precise analysis of market segments and by having complete insights into the Global Neo And Challenger Bank market.

- This report helps users in comprehending the key product segments and their future developments

Other features of the report:

- Gives a thorough analysis of the key strategies with a focus on the corporate structure, R&D methods, localization strategies, production capabilities, sales, and performance in various companies.

- Provides valuable insights into the product portfolio, including product planning, development, and positioning.

- Analyses the role of key market players and their partnerships, mergers, and acquisitions.

Explore the comprehensive contents of our report through the table of content!

Read Full TOC @ https://straitsresearch.com/report/neo-and-challenger-bank-market/toc

Trending Report:

https://www.globenewswire.com/en/news-release/2022/07/07/2476203/0/en/Endoscopy-Devices-Market-Size-is-projected-to-reach-USD-10-55-Billion-by-2030-growing-at-a-CAGR-of-6-17-Straits-Research.html

https://www.globenewswire.com/en/news-release/2022/10/18/2536739/0/en/Halal-Cosmetics-Market-Size-is-projected-to-reach-USD-83-76-Billion-by-2030-growing-at-a-CAGR-of-12-Straits-Research.html

https://www.globenewswire.com/en/news-release/2022/08/09/2494863/0/en/Electrocardiograph-ECG-Market-Size-is-projected-to-reach-USD-10-79-Billion-by-2030-growing-at-a-CAGR-of-5-67-Straits-Research.html

Contact Us:

Email: sales@straitsresearch.com

Address: 825 3rd Avenue, New York, NY, USA, 10022

Tel: +1 6464807505, +44 203 318 2846

About Straits Research:

Straits Research is dedicated to providing businesses with the highest quality market research services. With a team of experienced researchers and analysts, we strive to deliver insightful and actionable data that helps our clients make informed decisions about their industry and market. Our customized approach allows us to tailor our research to each client's specific needs and goals, ensuring that they receive the most relevant and valuable insights.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo And Challenger Bank Market will Predicted to Grow at a 48.3% CAGR During Forecast Period here

News-ID: 2877386 • Views: …

More Releases from Straits Research

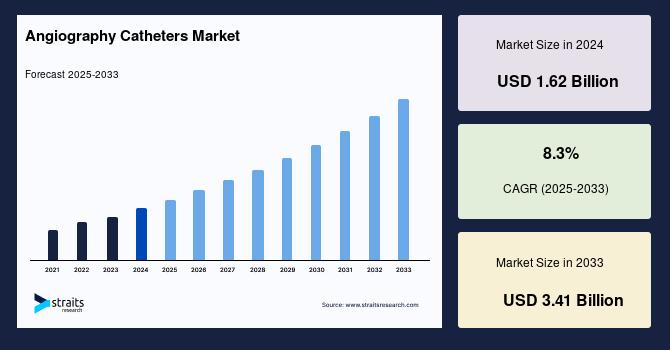

Angiography Catheters Market Size to Reach USD 3.41 Billion by 2033, Driven by R …

The global angiography catheters market is experiencing strong momentum, driven by the growing burden of cardiovascular diseases (CVDs), rising preference for minimally invasive diagnostic and interventional procedures, and ongoing innovations in catheter-based imaging technologies. Industry estimates indicate that the market is expected to expand from USD 1.8 billion in 2025 to USD 3.41 billion by 2033, progressing at a compound annual growth rate (CAGR) of 8.3% over the forecast period.

Angiography…

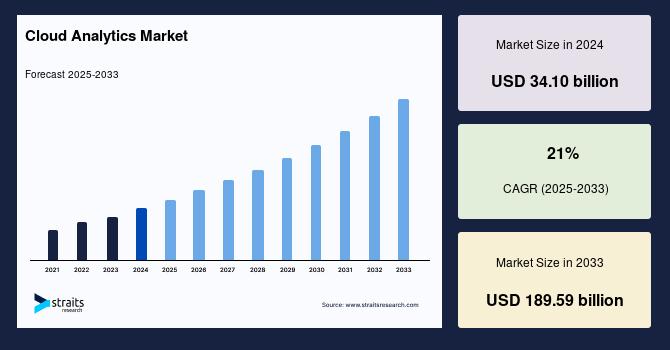

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

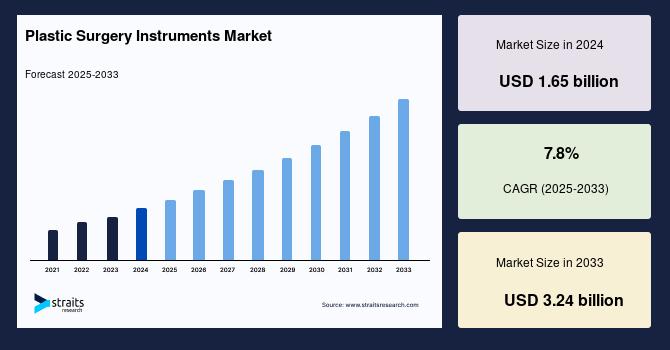

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

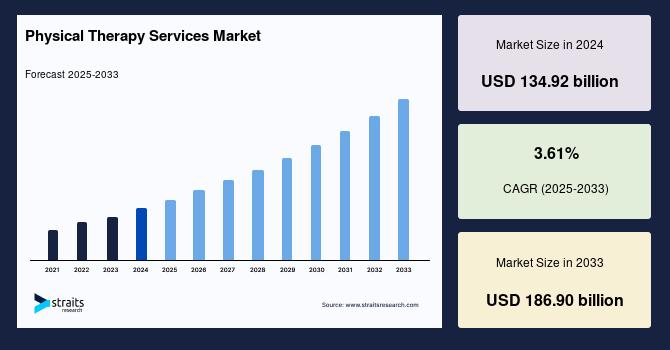

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…