Press release

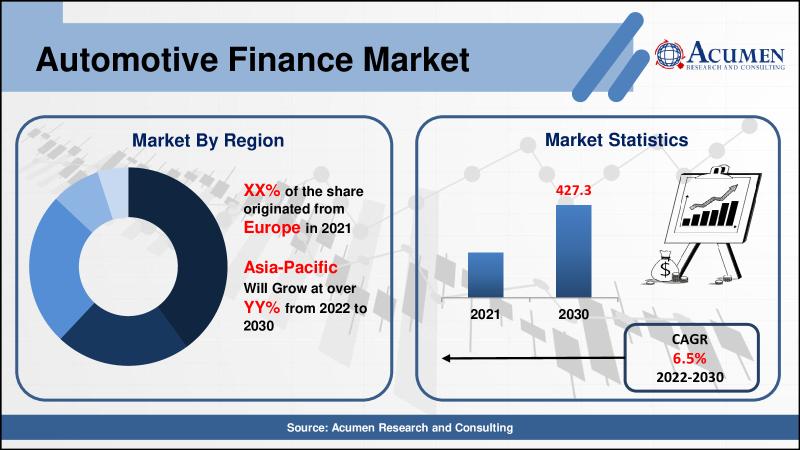

Automotive Finance Market Size is Estimated to Reach USD 427.3 Billion by 2030

The Global Automotive Finance Market is expected to grow at a CAGR of around 6.5% from 2022 to 2030 and reach the market value of over US$ 427.3 Billion by 2030.Europe dominates the automotive finance market; Asia Pacific register fastest growing CAGR of all times for automotive finance market

Europe currently holds the dominating share of the automotive finance market and is expected to maintain this dominance throughout the forecast period. This is because prominent players/OEMs service providers are present in this region. This is one of the most important factors influencing the growth of this regional market. According to European Commission statistics, the automotive industry is critical to Europe's prosperity. The automotive industry employs 13.8 million Europeans directly and indirectly, accounting for 6.1% of total EU employment. A population of approximately 2.6 million people works in direct manufacturing of motor vehicles, accounting for 8.5% of manufacturing employment in the EU. The EU is one of the world's largest producers of automobiles, and the automotive industry is the largest private investor in R&D. The European Commission supports global technological harmonisation and R&D funding to strengthen the competitiveness of the EU automotive industry and maintain its global technological leadership.

DOWNLOAD SAMPLE PAGES OF THIS REPORT@ https://www.acumenresearchandconsulting.com/request-sample/2668

Asia Pacific, on the other hand, is expected to have the fastest growing CAGR in the automotive finance market in the coming years. Government initiatives, particularly in India, China, and Japan, create lucrative growth opportunities for the regional market. This is accomplished by lowering the GST on EVs from the current rate of 12% to 5%. The Ministry of Finance has reduced the customs duty on EV components in order to encourage local manufacturing of these components. Furthermore, Asia Pacific's rapidly growing economies, where car financing is still a relatively new concept. Banks must become accustomed to structuring loan terms, and captives must cope with high entry costs and the need for extensive market education.

Segmental Outlook

The global automotive finance market is segmented based on provider type, finance type, purpose type, and vehicle type. By provider type, the market is segmented as banks, OEMs, and other financial institutions. By finance type, the market is classified into direct and indirect. By purpose type, the market is segregated as loan, leasing, and others. Further, vehicle type is bifurcated into commercial vehicles and passenger vehicles.

VIEW TABLE OF CONTENT OF THIS REPORT@ https://www.acumenresearchandconsulting.com/automotive-finance-market

The loan segment accounts for the largest market share in the global automotive finance market based on purpose type. According to Consumer Finance data, 2.3 million auto loans were originated in April 2019. Consumers applied for $52.8 Bn in new auto loans through April 2019, representing a 3.6% increase y-o-y when compared to August 2019, which was 2.1%.

In terms of finance, the direct segment dominates the automotive finance market, with reasonable revenue of around 55.9% during the forecast period. Consumers are concentrating their efforts on identifying the financing source that best meets their needs. Consumers apply for car loans directly at credit unions, banks, and other lending institutions. Furthermore, because no third-party salesperson or dealer is involved in the lending process, customers have complete control over it.

Competitive Landscape

Key companies profiled in this report involve Ally Financial, The Bank of America Corporation, Capital One Financial Corporation, Daimler Financial Services, Ford Motor Credit Company LLC, General Motors Financial Company, Inc., Hitachi Capital (PLC), and among others.

Browse Upcoming Market Research Reports@ https://www.acumenresearchandconsulting.com/forthcoming-reports

Some of the key observations regarding the automotive finance industry include:

• In May 2021, Diamler Truck Financials announced the launching of "Keep the World Moving" program for its freightliner and Western Star Trucks. The program allows a delay in the first payment by up to 120 days and also an allowance of up to US$5,000 based on the model. This imitative is expected to improve sales that were declined due to COVID-19 pandemic and would also improve the company's market share.

• In September 2021, Mitsubishi UFJ & Finance and Hitachi Capital, the leading leasing companies in Japan announced merging with Hitachi Capital PLC. The merging aims to expand its operations worldwide, in order to gain highest market share.

INQUIRY BEFORE BUYING@ https://www.acumenresearchandconsulting.com/inquiry-before-buying/2668

BUY THIS PREMIUM RESEARCH REPORT - https://www.acumenresearchandconsulting.com/buy-now/0/2668

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Finance Market Size is Estimated to Reach USD 427.3 Billion by 2030 here

News-ID: 2860140 • Views: …

More Releases from Acumen Research and Consulting

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

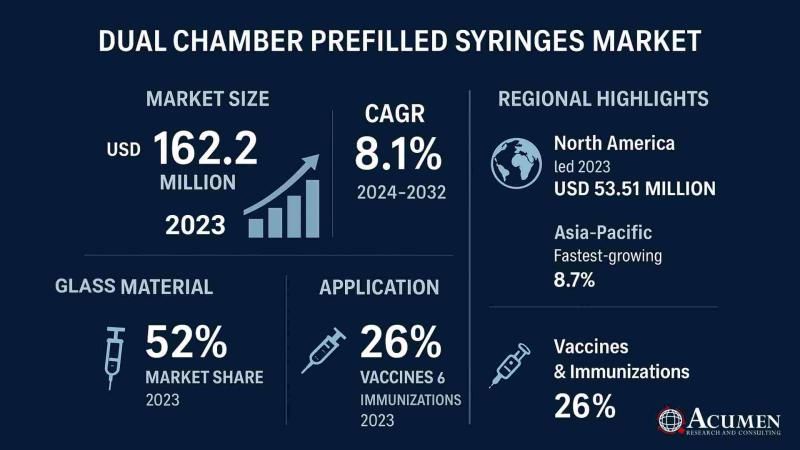

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

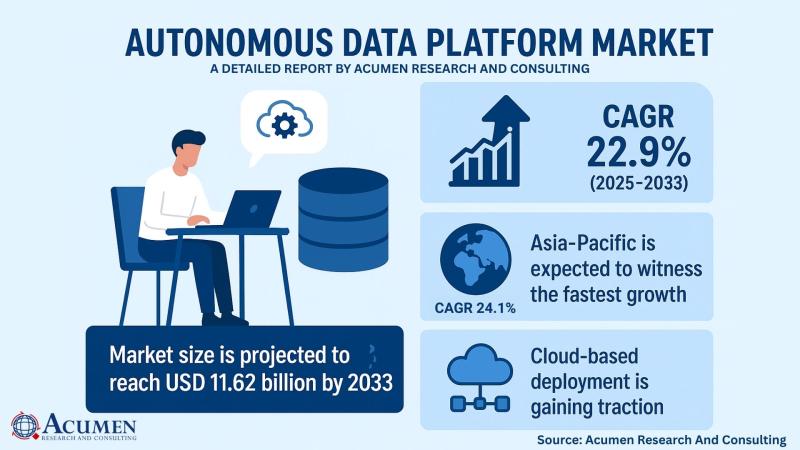

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

More Releases for Finance

Consumer Finance Market to Witness Revolutionary Growth by 2030 | Bajaj Capital, …

Global "Consumer Finance Market" Research report is an in-depth study of the market Analysis. Along with the most recent patterns and figures that uncovers a wide examination of the market offer. This report provides exhaustive coverage on geographical segmentation, latest demand scope, growth rate analysis with industry revenue and CAGR status. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of…

Big Boom in Environmental Finance Market 2020-2027 | Environmental Finance (Fult …

According to a report on Environmental Finance Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Environmental Finance Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study portrays an…

PLATINUM GLOBAL BRIDGING FINANCE - BRIDGING FINANCE, DEVELOPMENT FINANCE AND COM …

If your business is looking to finance bridging, development or commercial financing we have contacts with lenders and banks in over 25 countries around the world. Our specialist knowledge can help you get the ideal financing in place.

Platinum Global Bridging Finance is a specialist bridging loan lender. They deliver the loan financing that suits you and your clients desired financing. Their aim is to be crystal clear, so they offer…

Global Environmental Finance Market Leading Players are Environmental Finance (F …

Global Environmental Finance Market Insights, Size, Share, Forecast to 2025

This report studies the Environmental Finance Market size by players, regions, product types and end industries, history data 2013-2017 and forecast data 2019-2025; this report also studies the global market competition landscape, market drivers and trends, opportunities and challenges, risks and entry barriers, sales channels, distributors and Porter's Five Forces Analysis.

The main goal for the dissemination of this information is to…

Global Consumer Finance Services Market Forecast to 2025, Top Key Players- Bajaj …

The Consumer Finance Services Market Research Report is a valuable source of insightful data for business strategists. It provides the Consumer Finance Services overview with growth analysis and historical & futuristic cost, revenue, demand and supply data (as applicable). The research analysts provide an elaborate description of the value chain and its distributor analysis. This Consumer Finance Services market study provides comprehensive data which enhances the understanding, scope and application…

Why Consumer Finance Market is Growing Worldwide? Watch out by top key players B …

The split of retail banking that deals with lending money to consumers.

Consumer finance market is growing due to increasing per capita income, high economic growth, rapid urbanization and rise in consumer spending power. Rising consumer favorite towards the use of credit cards owing to the associated benefits related to it such as reward points and a host of promotional offers like movie tickets, discounts on flight bookings etc., is likely…