Press release

Real Estate Investment Trust (REIT) Market Demand, Share, Trend, Overview, Growth Rate, and Leading Players - Omega Healthcare Investors, Iron Mountain, Federal Realty Investment Trust, STAG Industrial Inc., W.P.Carey

Real Estate Investment Trust (REIT) Market research report offers an in-depth analysis of the global Real Estate Investment Trust (REIT) Market by presenting details about the latest product launches and recent innovations in the market. It also provides data about the impact on market growth due to covid-19. The competitive landscape has also been incorporated in the market so as to understand the market's current scenarios and trends. Moreover, the report also highlights collaborations, company mergers, and upcoming collaborations to strive in the market successfully.Click Here For a Free Sample + Related Graphs of the Report at: https://www.reportsnreports.com/contacts/requestsample.aspx?name=6516412

Descriptive company profiles of the major global players, including Omega Healthcare Investors, Iron Mountain, Federal Realty Investment Trust, STAG Industrial Inc., W.P.Carey, RioCan, H&R REIT, Automotive Properties REIT and Northwest Healthcare, etc.

This latest report researches the industry structure, revenue and gross margin. Major players headquarters, market shares, industry ranking and profiles are presented. The primary and secondary research is done in order to access up-to-date government regulations, market information and industry data. Data were collected from the Real Estate Investment Trust (REIT) companies, distributors, end users, industry associations, governments' industry bureaus, industry publications, industry experts, third party database, and our in-house databases.

This report also includes a discussion of the major players across each regional Real Estate Investment Trust (REIT) market. Further, it explains the major drivers and regional dynamics of the global Real Estate Investment Trust (REIT) market and current trends within the industry.

Key Companies Covered

In this section of the report, the researchers have done a comprehensive analysis of the prominent players operating and the strategies they are focusing on to combat the intense competition. Company profiles and market share analysis of the prominent players are also provided in this section. Additionally, the specialists have done an all-encompassing analysis of each player. They have also provided reliable revenue, market share and rank data of the companies for the period 2017-2022. With the assistance of this report, key players, stakeholders, and other participants will be able to stay abreast of the recent and upcoming developments in the business, further enabling them to make efficient choices.

Mentioned below are the prime players taken into account in this research report:

- Omega Healthcare Investors

- Iron Mountain

- Federal Realty Investment Trust

- STAG Industrial Inc.

- W.P.Carey

- RioCan

- H&R REIT

- Automotive Properties REIT

- Northwest Healthcare

- FIBRA Prologis

- Vonovia SE

- Deutsche Wohnen

- Segro REIT Plc

- Gecina REIT SA

- Aroundtown SA

- Leg Immobilien N AG

- Swiss Prime Site AG

- Covivio SA

- Klepierre Reit SA

- Link REIT

- Goodman Group

- Scentre Group

- Dexus

- Nippon Building Fund

- Mirvac

- Japan RE Investment Corporation

- GPT

- Stockland

- Capital Land Mall Trust

- Ascendas REIT

Market Segments

This report has explored the key segments: by Type and by Application. The lucrativeness and growth potential have been looked into by the industry experts in this report. This report also provides revenue forecast data by type and by application segments based on value for the period 2017-2028.

Real Estate Investment Trust (REIT) Segment by Type

- Equity REITs

- Mortagage REITs

- Hybrid REITs

Real Estate Investment Trust (REIT) Segment by Application

- Office

- Retail

- Residential

- Industrial

- Others

Key Regions & Countries

This section of the report provides key insights regarding various regions and the key players operating in each region. Economic, social, environmental, technological, and political factors have been taken into consideration while assessing the growth of the particular region/country. The readers will also get their hands on the value data of each region and country for the period 2017-2028.

- North America

- - United States

- - Canada

- Europe

- - Germany

- - France

- - UK

- - Italy

- - Russia

- - Nordic Countries

- - Rest of Europe

- Asia-Pacific

- - China

- - Japan

- - South Korea

- - Southeast Asia

- - India

- - Australia

- - Rest of Asia

- Latin America

- - Mexico

- - Brazil

- - Rest of Latin America

- Middle East & Africa

- - Turkey

- - Saudi Arabia

- - UAE

- - Rest of MEA

Key Drivers & Barriers

High-impact rendering factors and drivers have been studied in this report to aid the readers to understand the general development. Moreover, the report includes restraints and challenges that may act as stumbling blocks on the way of the players. This will assist the users to be attentive and make informed decisions related to business. Specialists have also laid their focus on the upcoming business prospects.

COVID-19 and Russia-Ukraine War Influence Analysis

The readers in the section will understand how the Real Estate Investment Trust (REIT) market scenario changed across the globe during the pandemic, post-pandemic and Russia-Ukraine War. The study is done keeping in view the changes in aspects such as demand, consumption, transportation, consumer behavior, supply chain management, export and import, and production. The industry experts have also highlighted the key factors that will help create opportunities for players and stabilize the overall industry in the years to come.

Report Includes:

This report presents an overview of global market for Real Estate Investment Trust (REIT) market size. Analyses of the global market trends, with historic market revenue data for 2017 - 2021, estimates for 2022, and projections of CAGR through 2028.

This report researches the key producers of Real Estate Investment Trust (REIT), also provides the revenue of main regions and countries. Highlights of the upcoming market potential for Real Estate Investment Trust (REIT), and key regions/countries of focus to forecast this market into various segments and sub-segments. Country specific data and market value analysis for the U.S., Canada, Mexico, Brazil, China, Japan, South Korea, Southeast Asia, India, Germany, the U.K., Italy, Middle East, Africa, and Other Countries.

This report focuses on the Real Estate Investment Trust (REIT) revenue, market share and industry ranking of main companies, data from 2017 to 2022. Identification of the major stakeholders in the global Real Estate Investment Trust (REIT) market, and analysis of their competitive landscape and market positioning based on recent developments and segmental revenues. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

This report analyzes the segments data by type and by application, revenue, and growth rate, from 2017 to 2028. Evaluation and forecast the market size for Real Estate Investment Trust (REIT) revenue, projected growth trends, production technology, application and end-user industry.

Direct Purchase of the Research Report (FLAT 25% Discount) at: https://www.reportsnreports.com/purchase.aspx?name=6516412

Contact Us:

Corporate Headquarters

Tower B5, office 101,

Magarpatta SEZ,

Hadapsar, Pune-411013, India

+ 1 888 391 5441

sales@reportsandreports.com

About Us:

ReportsnReports.com is your single source for all market research needs. Our database includes 500,000+ market research reports from over 95 leading global publishers & in-depth market research studies of over 5000 micro markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real Estate Investment Trust (REIT) Market Demand, Share, Trend, Overview, Growth Rate, and Leading Players - Omega Healthcare Investors, Iron Mountain, Federal Realty Investment Trust, STAG Industrial Inc., W.P.Carey here

News-ID: 2858718 • Views: …

More Releases from ReportsnReports

DeviceCon Series 2024 - UK Edition | MarketsandMarkets

Future Forward: Redefining Healthcare with Cutting-Edge Devices

Welcome to DeviceCon Series 2024 - Where Innovation Meets Impact!

Join us on March 21-22 at Millennium Gloucester Hotel, 4-18 Harrington Gardens, London SW7 4LH for a groundbreaking convergence of knowledge, ideas, and technology. MarketsandMarkets proudly presents the DeviceCon Series, an extraordinary blend of four conferences that promise to redefine the landscape of innovation in medical and diagnostic devices.

Register Now @ https://events.marketsandmarkets.com/devicecon-series-uk-edition-2024/register

MarketsandMarkets presents…

5th Annual MarketsandMarkets Infectious Disease and Molecular Diagnostics Confer …

London, March 7, 2024 - MarketsandMarkets is thrilled to announce the eagerly awaited 5th Annual Infectious Disease and Molecular Diagnostics Conference, scheduled to take place on March 21st - 22nd, 2024, at the prestigious Millennium Gloucester Hotel, located at 4-18 Harrington Gardens, London SW7 4LH.

This conference promises to be a groundbreaking event, showcasing the latest trends and insights in diagnosis, as well as unveiling cutting-edge technologies that are revolutionizing the…

Infection Control, Sterilization & Decontamination Conference |21st - 22nd March …

MarketsandMarkets is pleased to announce its 8th Annual Infection Control, Sterilisation, and Decontamination in Healthcare Conference, which will take place March 21-22, 2024, in London, UK. With the increased risk of infection due to improper sterilisation and decontamination practices, the safety of patients and healthcare workers is of paramount importance nowadays.

Enquire Now @ https://events.marketsandmarkets.com/infection-control-sterilization-and-decontamination-conference/

This conference aims to bring together all the stakeholders to discuss the obstacles in achieving…

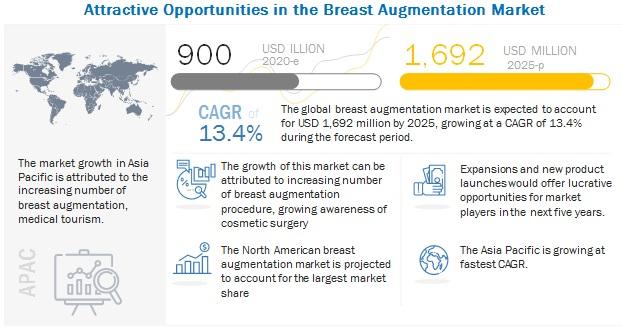

Breast Augmentation Market Key Players, Demands, Cost, Size, Procedure, Shape, S …

The global Breast Augmentation Market in terms of revenue was estimated to be worth $900 million in 2020 and is poised to reach $1,692 million by 2025, growing at a CAGR of 13.4% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying…

More Releases for REIT

North America REIT Market Valuation Expected to Hit USD 344.2 billion by Key Pla …

USA, New Jersey: According to Verified Market Research analysis, the North America REIT Market size was valued at USD 282.5 Billion in 2024 and is projected to reach USD 344.2 Billion by 2032, growing at a CAGR of 2.50% from 2026 to 2032.

How AI and Machine Learning Are Redefining the future of North America REIT Market?

AI-driven asset analytics are improving property valuation accuracy by integrating market data, tenant behavior, lease…

Real Estate Investment Trust (REIT) Market Size in 2023 To 2029 | Omega Healthca …

The research study serves as a comprehensive guide, providing readers with a thorough evaluation of the current industry trends and breakdown. The report encompasses global Real Estate Investment Trust (REIT) market research data from various companies, including their benefits, gross margins, calculated market decisions, and more, presented through tables, charts, and infographics. Furthermore, the report delves into other significant aspects such as demand and supply dynamics, import and export scenarios,…

Real Estate Investment Trust (REIT) Market Insights, Forecast to 2028 | Valuates …

Market Analysis and Insights: Global Real Estate Investment Trust (REIT) Market

The global Real Estate Investment Trust (REIT) market size is projected to reach US$ million by 2028, from US$ million in 2021, at a CAGR of % during 2022-2028.

Download Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4Y6957/Global_Real_Estate_Investment_Trust_REIT_Market_Insights_Forecast_to_2028

Fully considering the economic change by this health crisis, Equity REITs accounting for % of the Real Estate Investment Trust (REIT) global market in 2021, is projected to value…

Real Estate Investment Trust (REIT) Market Future Outlook 2023-2028, Industry De …

The Real Estate Investment Trust (REIT) Market research report incorporates the scope and objective of the study. Moreover, the report highlights key market segments and players covered. It also covers industry trends, focusing on market use cases and top market size by region, market trends, and Global market size. Moreover, the Real Estate Investment Trust (REIT) Market research report covers market growth rate and market share by region. Real Estate…

Asia Pacific REIT Industry Market Growing Technology Trends and Business Opportu …

Asia Pacific REIT Industry Market by Component, Application, Services, and Region- Forecast to 2025

The Global Asia Pacific REIT Industry Market Research Report 2021-2025 published by Market Insights Reports is a significant source of keen information for business specialists. It furnishes the Asia Pacific REIT Industry business outline with development investigation and historical and futuristic cost analysis, income, demand, and supply information (upcoming identifiers). The research analysts give a detailed depiction…

Jump in earnings for Fair Value REIT-AG in 2015

• EBIT more than doubled to EUR 12.3 million in 2015

• Group net profit of EUR 6.6 million (previous year: group net loss of EUR 47 thousand)

• Funds from operations (EPRA result) increased by 45% to EUR 6.4 million (previous year: EUR 4.4 million)

• Proposed dividend for 2014 of EUR 0.25 per share (55% of FFO)

• REIT equity ratio increased to 59.6% (previous year: 49.2%)

Munich, 23 March 2016 – Fair Value REIT-AG…