Press release

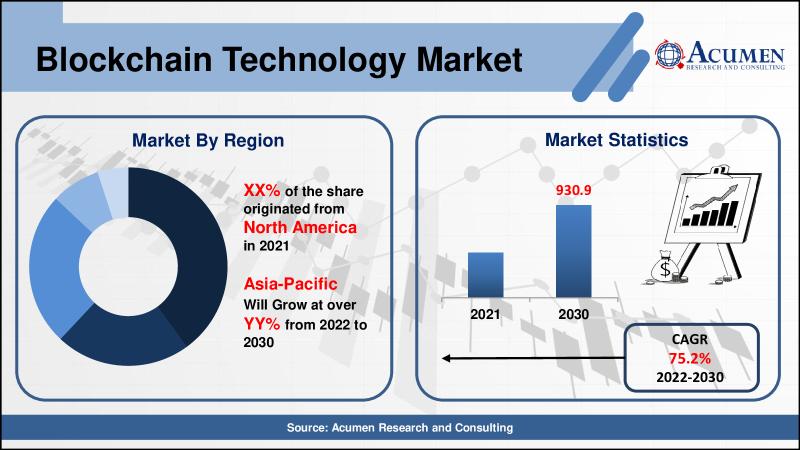

Blockchain Technology Market to reach USD 930.9 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario

The Global Blockchain Technology Market is anticipated to grow at a CAGR of around 75.2% during the forecast period 2022 to 2030 and to reach around US$ 930.9 Billion by 2030.Increasing adoption of blockchain from various end use industries across the globe is expected to drive the growth of the global blockchain technology market.

The market in North America is expected to account for a major revenue share in the global blockchain technology market due to the increasing adoption of blockchain from various industry verticals. Government spending on development of healthcare sector is increasing. Their approach towards integration of blockchain to improve the interoperability standards while maintaining the privacy and confidentiality of patient records is gaining importance. Major players are enhancing their business capabilities through introduction on innovative service this is expected to impact the growth of blockchain technology market.

DOWNLOAD SAMPLE PAGES OF THIS REPORT@ https://www.acumenresearchandconsulting.com/request-sample/2585

In 2020, Microsoft a global IT company integrated Lition blockchain into Azure. This integration is expected to help Microsoft Azure's enterprise clients can develop, test, and deploy Lition side chains and applications with ease on its platform.

In 2018, the company collaborated with Interswitch Group. The collaboration was focused on launch of a blockchain-based supply chain financing service in order to ensure fast and seamless trade financing in the entire supply chain system.

In 2020, IBM a global IT service company partnered with Nestle with the focus to use the IBM Food Trust enterprise blockchain solution in order to trace its Zoégas coffee brand. This solution would help the consumer to track the origin of the coffee beans used in their coffee.

The market in Asia Pacific is expected to witness faster growth in the target market due to high government spending on development of present IT infrastructure. In 2019, Institute for Development and Research in Banking Technology (IDRBT) division of Reserve Bank of India (RBI) came out with a blueprint of blockchain platform for the banking sector. Interestingly, a consortium of 11 of India's largest banks including ICICI Bank, Kotak Mahindra Bank, Standard Chartered Bank and Axis Bank, have launched the first ever blockchain-linked loan system in the nation.

VIEW TABLE OF CONTENT OF THIS REPORT@ https://www.acumenresearchandconsulting.com/blockchain-technology-market

Increasing awareness among consumers related to blockchain and rising demand for secure, and transparent payment systems from financial firms are major factors expected to drive the growth of global blockchain technology market. In addition, high adoption from retail enterprises is expected to support the growth of target market. Introduction of innovative solutions by major players in order to attract new customers is expected to boost the blockchain technology market growth.

In 2018, IBM a global IT enterprise launched a new Sterling Supply Chain Suite. The product will aid distributors, manufacturers, and retailers to integrate their data and networks with suppliers into a Hyperledger-based blockchain to track and trace products and parts. Factors such as uncertainty in regulatory regulations related to blockchain and lack of skilled labor are factors expected to hamper the growth of the global blockchain technology market. In addition, rising security and privacy concern is expected to challenge the growth of target market. However, changing government regulations and high spending on infrastructure development for easy adoption are factors expected to create new opportunities for players operating in blockchain technology market over the forecast period. In addition, increasing demand from retail and real estate sector is expected to support the revenue transaction of the target market.

Browse Upcoming Market Research Reports@ https://www.acumenresearchandconsulting.com/forthcoming-reports

The global blockchain technology market is segmented into type, component, application, enterprise size and industry vertical. The type segment is bifurcated into public, private, and hybrid. Among type the hybrid segment is expected to witness faster growth in the blockchain technology market. The enterprise size segment is divided into large enterprises and small & medium enterprises. Among enterprise size the large enterprise segment is expected to account for major revenue share in the global market.

Players operating in the global blockchain technology market are IBM Corporation, Microsoft Corporation, Linux Foundation, BTL Group Ltd., Chain, Inc., Circle Internet Financial Limited, Deloitte Touche Tohmatsu Limited, Digital Asset Holdings, LLC, Global Arena Holding, Inc. (GAHI), and Monax. The market is highly competitive due to presence of large number of players operating on global level.

INQUIRY BEFORE BUYING@ https://www.acumenresearchandconsulting.com/inquiry-before-buying/2585

BUY THIS PREMIUM RESEARCH REPORT - https://www.acumenresearchandconsulting.com/buy-now/0/2585

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Blockchain Technology Market to reach USD 930.9 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario here

News-ID: 2855253 • Views: …

More Releases from Acumen Research and Consulting

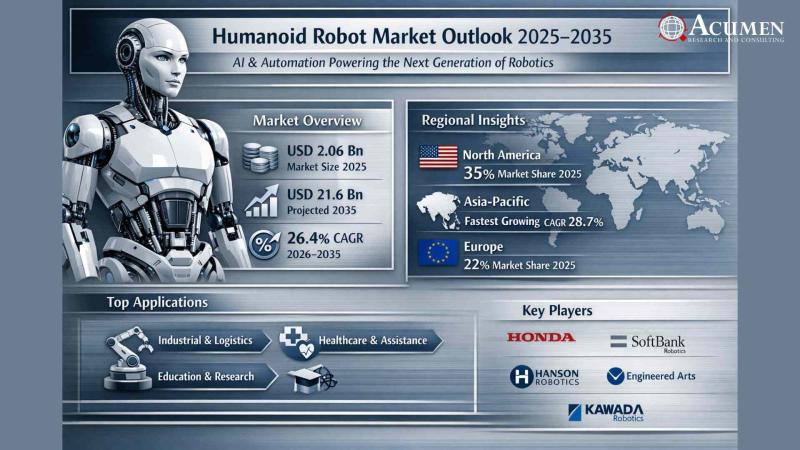

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

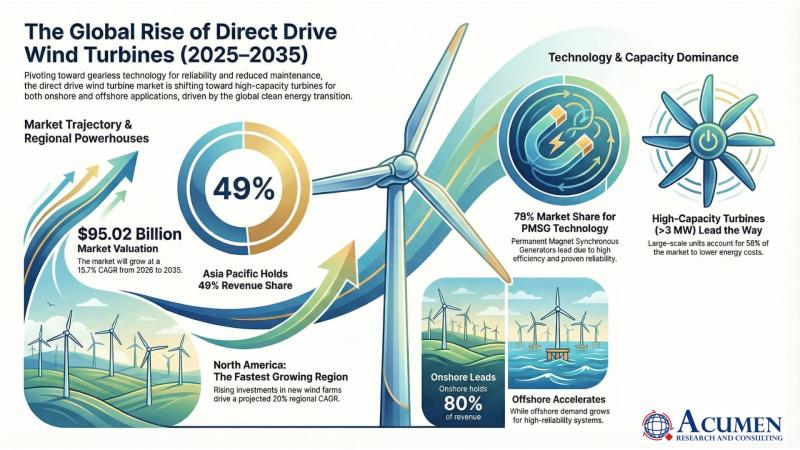

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…