Press release

Insurance Third Party Administrators market: Reliable Market Size and Share Forecasts up to 2028 | Sedgwick Claims Management Services Inc, UMR Inc, Crawford & Company

"The global Insurance Third Party Administrators Market is carefully researched in the report while largely concentrating on top players and their business tactics, geographical expansion, market segments, competitive landscape, manufacturing, and pricing and cost structures. Each section of the research study is specially prepared to explore key aspects of the global Insurance Third Party Administrators Market. For instance, the market dynamics section digs deep into the drivers, restraints, trends, and opportunities of the global Insurance Third Party Administrators Market. With qualitative and quantitative analysis, we help you with thorough and comprehensive research on the global Insurance Third Party Administrators Market. We have also focused on SWOT, PESTLE, and Porter's Five Forces analyses of the global Insurance Third Party Administrators Market.Leading players of the global Insurance Third Party Administrators Market are analyzed taking into account their market share, recent developments, new product launches, partnerships, mergers or acquisitions, and markets served. We also provide an exhaustive analysis of their product portfolios to explore the products and applications they concentrate on when operating in the global Insurance Third Party Administrators Market. Furthermore, the report offers two separate market forecasts - one for the production side and another for the consumption side of the global Insurance Third Party Administrators Market. It also provides useful recommendations for new as well as established players of the global Insurance Third Party Administrators Market.

Final Insurance Third Party Administrators Report will add the analysis of the impact of COVID-19 on this Market.

Insurance Third Party Administrators Market competition by top manufacturers/Key players Profiled:

Sedgwick Claims Management Services Inc

UMR Inc

Crawford & Company

Gallagher Bassett Services Inc

York Risk Services Group Inc

Maritain Health

Request to Download PDF Sample Copy of Report: https://www.qyresearch.com/sample-form/form/5341039/Global-Insurance-Third-Party-Administrators-Industry-Research-Report-Growth-Trends-and-Competitive-Analysis-2022-2028

Competitive Analysis:

Global Insurance Third Party Administrators Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Insurance Third Party Administrators Market for Global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Scope of the Report:

The all-encompassing research weighs up on various aspects including but not limited to important industry definition, product applications, and product types. The pro-active approach towards analysis of investment feasibility, significant return on investment, supply chain management, import and export status, consumption volume and end-use offers more value to the overall statistics on the Insurance Third Party Administrators Market. All factors that help business owners identify the next leg for growth are presented through self-explanatory resources such as charts, tables, and graphic images.

The report offers in-depth assessment of the growth and other aspects of the Insurance Third Party Administrators market in important countries (regions), including:

North America(United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Our industry professionals are working reluctantly to understand, assemble and timely deliver assessment on impact of COVID-19 disaster on many corporations and their clients to help them in taking excellent business decisions. We acknowledge everyone who is doing their part in this financial and healthcare crisis.

Share Your Questions Here For More Details On this Report or Customization's As Per Your Need: https://www.qyresearch.com/customize-request/form/5341039/Global-Insurance-Third-Party-Administrators-Industry-Research-Report-Growth-Trends-and-Competitive-Analysis-2022-2028

Table of Contents

Report Overview: It includes major players of the global Insurance Third Party Administrators Market covered in the research study, research scope, and Market segments by type, market segments by application, years considered for the research study, and objectives of the report.

Global Growth Trends: This section focuses on industry trends where market drivers and top market trends are shed light upon. It also provides growth rates of key producers operating in the global Insurance Third Party Administrators Market. Furthermore, it offers production and capacity analysis where marketing pricing trends, capacity, production, and production value of the global Insurance Third Party Administrators Market are discussed.

Market Share by Manufacturers: Here, the report provides details about revenue by manufacturers, production and capacity by manufacturers, price by manufacturers, expansion plans, mergers and acquisitions, and products, market entry dates, distribution, and market areas of key manufacturers.

Market Size by Type: This section concentrates on product type segments where production value market share, price, and production market share by product type are discussed.

Market Size by Application: Besides an overview of the global Insurance Third Party Administrators Market by application, it gives a study on the consumption in the global Insurance Third Party Administrators Market by application.

Production by Region: Here, the production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Consumption by Region: This section provides information on the consumption in each regional market studied in the report. The consumption is discussed on the basis of country, application, and product type.

Company Profiles: Almost all leading players of the global Insurance Third Party Administrators Market are profiled in this section. The analysts have provided information about their recent developments in the global Insurance Third Party Administrators Market, products, revenue, production, business, and company.

Market Forecast by Production: The production and production value forecasts included in this section are for the global Insurance Third Party Administrators Market as well as for key regional markets.

Market Forecast by Consumption: The consumption and consumption value forecasts included in this section are for the global Insurance Third Party Administrators Market as well as for key regional markets.

Value Chain and Sales Analysis: It deeply analyzes customers, distributors, sales channels, and value chain of the global Insurance Third Party Administrators Market.

Key Findings: This section gives a quick look at important findings of the research study.

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

Table of Contents:

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Insurance Third Party Administrators Market Size Growth Rate by Type: 2017 VS 2021 VS 2028

1.2.2 Healthcare Providers

1.2.3 Commercial General Liability

1.2.4 Others

1.3 Market by Application

1.3.1 Global Insurance Third Party Administrators Market Growth Rate by Application: 2017 VS 2021 VS 2028

1.3.2 Patient

1.3.3 Old man

1.3.4 Other

1.4 Study Objectives

1.5 Years Considered

2 Market Perspective

2.1 Global Insurance Third Party Administrators Market Size (2017-2028)

2.2 Insurance Third Party Administrators Market Size across Key Geographies Worldwide: 2017 VS 2021 VS 2028

2.3 Global Insurance Third Party Administrators Market Size by Region (2017-2022)

2.4 Global Insurance Third Party Administrators Market Size Forecast by Region (2023-2028)

2.5 Global Top Insurance Third Party Administrators Countries Ranking by Market Size

3 Insurance Third Party Administrators Competitive by Company

3.1 Global Insurance Third Party Administrators Revenue by Players

3.1.1 Global Insurance Third Party Administrators Revenue by Players (2017-2022)

3.1.2 Global Insurance Third Party Administrators Market Share by Players (2017-2022)

3.2 Global Insurance Third Party Administrators Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Company Covered: Ranking by Insurance Third Party Administrators Revenue

3.4 Global Insurance Third Party Administrators Market Concentration Ratio

3.4.1 Global Insurance Third Party Administrators Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Insurance Third Party Administrators Revenue in 2021

3.5 Global Insurance Third Party Administrators Key Players Head office and Area Served

3.6 Key Players Insurance Third Party Administrators Product Solution and Service

3.7 Date of Enter into Insurance Third Party Administrators Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Global Insurance Third Party Administrators Breakdown Data by Type

4.1 Global Insurance Third Party Administrators Historic Revenue by Type (2017-2022)

4.2 Global Insurance Third Party Administrators Forecasted Revenue by Type (2023-2028)

5 Global Insurance Third Party Administrators Breakdown Data by Application

5.1 Global Insurance Third Party Administrators Historic Market Size by Application (2017-2022)

5.2 Global Insurance Third Party Administrators Forecasted Market Size by Application (2023-2028)

6 North America

6.1 North America Insurance Third Party Administrators Revenue by Company (2020-2022)

6.2 North America Insurance Third Party Administrators Revenue by Type (2017-2028)

6.3 North America Insurance Third Party Administrators Revenue by Application (2017-2028)

6.4 North America Insurance Third Party Administrators Revenue by Country (2017-2028)

6.4.1 United States

6.4.2 Canada

7 Europe

7.1 Europe Insurance Third Party Administrators Revenue by Company (2020-2022)

7.2 Europe Insurance Third Party Administrators Revenue by Type (2017-2028)

7.3 Europe Insurance Third Party Administrators Revenue by Application (2017-2028)

7.4 Europe Insurance Third Party Administrators Revenue by Country (2017-2028)

7.4.1 Germany

7.4.2 France

7.4.3 U.K.

7.4.4 Italy

7.4.5 Russia

8 Asia Pacific

8.1 Asia Pacific Insurance Third Party Administrators Revenue by Company (2020-2022)

8.2 Asia Pacific Insurance Third Party Administrators Revenue by Type (2017-2028)

8.3 Asia Pacific Insurance Third Party Administrators Revenue by Application (2017-2028)

8.4 Asia Pacific Insurance Third Party Administrators Revenue by Region (2017-2028)

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 India

8.4.5 Australia

8.4.6 China Taiwan

8.4.7 Indonesia

8.4.8 Thailand

8.4.9 Malaysia

9 Latin America

9.1 Latin America Insurance Third Party Administrators Revenue by Company (2020-2022)

9.2 Latin America Insurance Third Party Administrators Revenue by Type (2017-2028)

9.3 Latin America Insurance Third Party Administrators Revenue by Application (2017-2028)

9.4 Latin America Insurance Third Party Administrators Revenue by Country (2017-2028)

9.4.1 Mexico

9.4.2 Brazil

9.4.3 Argentina

10 Middle East and Africa

10.1 Middle East and Africa Insurance Third Party Administrators Revenue by Company (2020-2022)

10.2 Middle East and Africa Insurance Third Party Administrators Revenue by Type (2017-2028)

10.3 Middle East and Africa Insurance Third Party Administrators Revenue by Application (2017-2028)

10.4 Middle East and Africa Insurance Third Party Administrators Revenue by Country (2017-2028)

10.4.1 Turkey

10.4.2 Saudi Arabia

10.4.3 UAE

11 Company Profiles

11.1 Sedgwick Claims Management Services Inc

11.1.1 Sedgwick Claims Management Services Inc Company Details

11.1.2 Sedgwick Claims Management Services Inc Business Overview

11.1.3 Sedgwick Claims Management Services Inc Insurance Third Party Administrators Products and Services

11.1.4 Sedgwick Claims Management Services Inc Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.1.5 Sedgwick Claims Management Services Inc Insurance Third Party Administrators SWOT Analysis

11.1.6 Sedgwick Claims Management Services Inc Recent Developments

11.2 UMR Inc

11.2.1 UMR Inc Company Details

11.2.2 UMR Inc Business Overview

11.2.3 UMR Inc Insurance Third Party Administrators Products and Services

11.2.4 UMR Inc Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.2.5 UMR Inc Insurance Third Party Administrators SWOT Analysis

11.2.6 UMR Inc Recent Developments

11.3 Crawford & Company

11.3.1 Crawford & Company Company Details

11.3.2 Crawford & Company Business Overview

11.3.3 Crawford & Company Insurance Third Party Administrators Products and Services

11.3.4 Crawford & Company Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.3.5 Crawford & Company Insurance Third Party Administrators SWOT Analysis

11.3.6 Crawford & Company Recent Developments

11.4 Gallagher Bassett Services Inc

11.4.1 Gallagher Bassett Services Inc Company Details

11.4.2 Gallagher Bassett Services Inc Business Overview

11.4.3 Gallagher Bassett Services Inc Insurance Third Party Administrators Products and Services

11.4.4 Gallagher Bassett Services Inc Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.4.5 Gallagher Bassett Services Inc Insurance Third Party Administrators SWOT Analysis

11.4.6 Gallagher Bassett Services Inc Recent Developments

11.5 York Risk Services Group Inc

11.5.1 York Risk Services Group Inc Company Details

11.5.2 York Risk Services Group Inc Business Overview

11.5.3 York Risk Services Group Inc Insurance Third Party Administrators Products and Services

11.5.4 York Risk Services Group Inc Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.5.5 York Risk Services Group Inc Insurance Third Party Administrators SWOT Analysis

11.5.6 York Risk Services Group Inc Recent Developments

11.6 Maritain Health

11.6.1 Maritain Health Company Details

11.6.2 Maritain Health Business Overview

11.6.3 Maritain Health Insurance Third Party Administrators Products and Services

11.6.4 Maritain Health Insurance Third Party Administrators Revenue in Insurance Third Party Administrators Business (2017-2022)

11.6.5 Maritain Health Insurance Third Party Administrators SWOT Analysis

11.6.6 Maritain Health Recent Developments

12 Insurance Third Party Administrators Market Dynamics

12.1 Insurance Third Party Administrators Market Trends

12.2 Insurance Third Party Administrators Market Drivers

12.3 Insurance Third Party Administrators Market Challenges

12.4 Insurance Third Party Administrators Market Restraints

13 Research Findings and Conclusion

14 Appendix

14.1 Research Methodology

14.1.1 Methodology/Research Approach

14.1.2 Data Source

14.2 Author Details

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

hitesh@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Third Party Administrators market: Reliable Market Size and Share Forecasts up to 2028 | Sedgwick Claims Management Services Inc, UMR Inc, Crawford & Company here

News-ID: 2852467 • Views: …

More Releases from QYResearch, Inc.

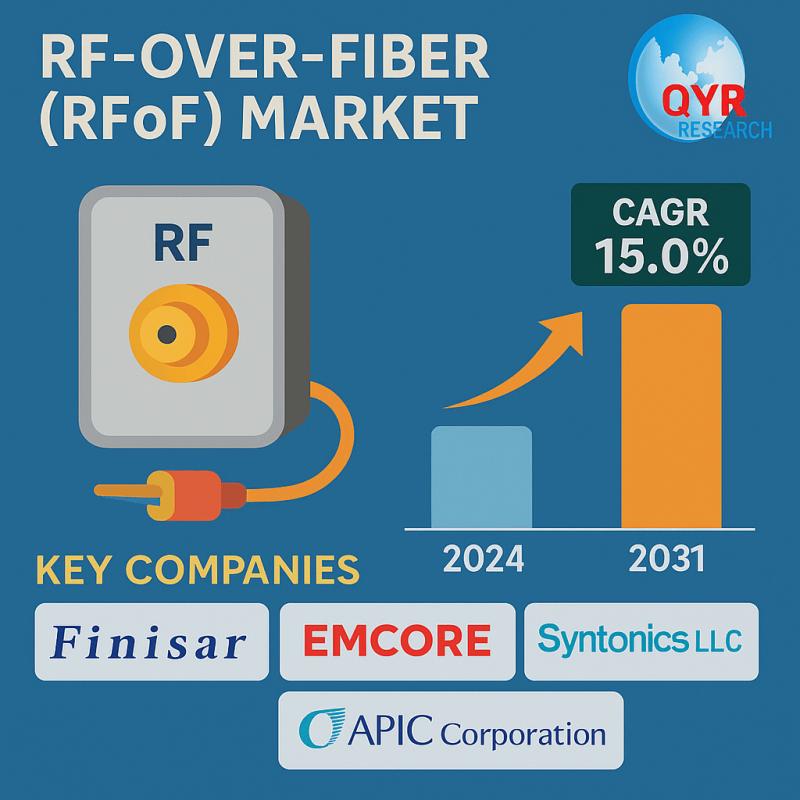

RF-over-Fiber (RFoF) Market Projected to Grow at a CAGR of 15.0% | Forecast 2025 …

Los Angeles, United State: The global RF-over-Fiber (RFoF) Market was valued at US$ 551 million in 2024 and is anticipated to reach US$ 1447 million by 2031, witnessing a CAGR of 15.0% during the forecast period 2025-2031. The research report targets specific customer segments to help companies effectively market their products and drive strong sales in the global RF-over-Fiber (RFoF) Market. It organizes valuable and relevant market insights to match…

Divinyl Sulfone Market 2024's Technological Tapestry: Advancements Shaping the M …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Balancing Acts: Gross Margins, Costs, and Revenue Predict …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Bright Horizons: Positive Market Indicators Revealed | Bo …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…