Press release

Fixed Income Assets Management market: High-growth Segments and their Share Forecasts | The Vanguard Group, Pimco Funds, Franklin Distributors Inc

"The global Fixed Income Assets Management Market is carefully researched in the report while largely concentrating on top players and their business tactics, geographical expansion, market segments, competitive landscape, manufacturing, and pricing and cost structures. Each section of the research study is specially prepared to explore key aspects of the global Fixed Income Assets Management Market. For instance, the market dynamics section digs deep into the drivers, restraints, trends, and opportunities of the global Fixed Income Assets Management Market. With qualitative and quantitative analysis, we help you with thorough and comprehensive research on the global Fixed Income Assets Management Market. We have also focused on SWOT, PESTLE, and Porter's Five Forces analyses of the global Fixed Income Assets Management Market.Leading players of the global Fixed Income Assets Management Market are analyzed taking into account their market share, recent developments, new product launches, partnerships, mergers or acquisitions, and markets served. We also provide an exhaustive analysis of their product portfolios to explore the products and applications they concentrate on when operating in the global Fixed Income Assets Management Market. Furthermore, the report offers two separate market forecasts - one for the production side and another for the consumption side of the global Fixed Income Assets Management Market. It also provides useful recommendations for new as well as established players of the global Fixed Income Assets Management Market.

Final Fixed Income Assets Management Report will add the analysis of the impact of COVID-19 on this Market.

Fixed Income Assets Management Market competition by top manufacturers/Key players Profiled:

The Vanguard Group

Pimco Funds

Franklin Distributors Inc

Fidelity Distributors Corp.

American Funds Investment Co.

Putnam Investments LLC

Oppenheimer Funds Inc

Scudder Investments

Evergreen Investments

Dreyfus Corp

Federated Investors Inc

T. Rowe Price Group

Request to Download PDF Sample Copy of Report: https://www.qyresearch.com/sample-form/form/5341037/Global-Fixed-Income-Assets-Management-Industry-Research-Report-Growth-Trends-and-Competitive-Analysis-2022-2028

Competitive Analysis:

Global Fixed Income Assets Management Market is highly fragmented and the major players have used various strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. The report includes market shares of Fixed Income Assets Management Market for Global, Europe, North America, Asia-Pacific, South America and Middle East & Africa.

Scope of the Report:

The all-encompassing research weighs up on various aspects including but not limited to important industry definition, product applications, and product types. The pro-active approach towards analysis of investment feasibility, significant return on investment, supply chain management, import and export status, consumption volume and end-use offers more value to the overall statistics on the Fixed Income Assets Management Market. All factors that help business owners identify the next leg for growth are presented through self-explanatory resources such as charts, tables, and graphic images.

The report offers in-depth assessment of the growth and other aspects of the Fixed Income Assets Management market in important countries (regions), including:

North America(United States, Canada and Mexico)

Europe (Germany, France, UK, Russia and Italy)

Asia-Pacific (China, Japan, Korea, India, Southeast Asia and Australia)

South America (Brazil, Argentina, Colombia)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Our industry professionals are working reluctantly to understand, assemble and timely deliver assessment on impact of COVID-19 disaster on many corporations and their clients to help them in taking excellent business decisions. We acknowledge everyone who is doing their part in this financial and healthcare crisis.

Share Your Questions Here For More Details On this Report or Customization's As Per Your Need: https://www.qyresearch.com/customize-request/form/5341037/Global-Fixed-Income-Assets-Management-Industry-Research-Report-Growth-Trends-and-Competitive-Analysis-2022-2028

Table of Contents

Report Overview: It includes major players of the global Fixed Income Assets Management Market covered in the research study, research scope, and Market segments by type, market segments by application, years considered for the research study, and objectives of the report.

Global Growth Trends: This section focuses on industry trends where market drivers and top market trends are shed light upon. It also provides growth rates of key producers operating in the global Fixed Income Assets Management Market. Furthermore, it offers production and capacity analysis where marketing pricing trends, capacity, production, and production value of the global Fixed Income Assets Management Market are discussed.

Market Share by Manufacturers: Here, the report provides details about revenue by manufacturers, production and capacity by manufacturers, price by manufacturers, expansion plans, mergers and acquisitions, and products, market entry dates, distribution, and market areas of key manufacturers.

Market Size by Type: This section concentrates on product type segments where production value market share, price, and production market share by product type are discussed.

Market Size by Application: Besides an overview of the global Fixed Income Assets Management Market by application, it gives a study on the consumption in the global Fixed Income Assets Management Market by application.

Production by Region: Here, the production value growth rate, production growth rate, import and export, and key players of each regional market are provided.

Consumption by Region: This section provides information on the consumption in each regional market studied in the report. The consumption is discussed on the basis of country, application, and product type.

Company Profiles: Almost all leading players of the global Fixed Income Assets Management Market are profiled in this section. The analysts have provided information about their recent developments in the global Fixed Income Assets Management Market, products, revenue, production, business, and company.

Market Forecast by Production: The production and production value forecasts included in this section are for the global Fixed Income Assets Management Market as well as for key regional markets.

Market Forecast by Consumption: The consumption and consumption value forecasts included in this section are for the global Fixed Income Assets Management Market as well as for key regional markets.

Value Chain and Sales Analysis: It deeply analyzes customers, distributors, sales channels, and value chain of the global Fixed Income Assets Management Market.

Key Findings: This section gives a quick look at important findings of the research study.

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc.

Table of Contents:

1 Report Overview

1.1 Study Scope

1.2 Market Analysis by Type

1.2.1 Global Fixed Income Assets Management Market Size Growth Rate by Type: 2017 VS 2021 VS 2028

1.2.2 Core Fixed Income

1.2.3 Alternative Credit

1.3 Market by Application

1.3.1 Global Fixed Income Assets Management Market Growth Rate by Application: 2017 VS 2021 VS 2028

1.3.2 Enterprises

1.3.3 Individuals

1.4 Study Objectives

1.5 Years Considered

2 Market Perspective

2.1 Global Fixed Income Assets Management Market Size (2017-2028)

2.2 Fixed Income Assets Management Market Size across Key Geographies Worldwide: 2017 VS 2021 VS 2028

2.3 Global Fixed Income Assets Management Market Size by Region (2017-2022)

2.4 Global Fixed Income Assets Management Market Size Forecast by Region (2023-2028)

2.5 Global Top Fixed Income Assets Management Countries Ranking by Market Size

3 Fixed Income Assets Management Competitive by Company

3.1 Global Fixed Income Assets Management Revenue by Players

3.1.1 Global Fixed Income Assets Management Revenue by Players (2017-2022)

3.1.2 Global Fixed Income Assets Management Market Share by Players (2017-2022)

3.2 Global Fixed Income Assets Management Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

3.3 Company Covered: Ranking by Fixed Income Assets Management Revenue

3.4 Global Fixed Income Assets Management Market Concentration Ratio

3.4.1 Global Fixed Income Assets Management Market Concentration Ratio (CR5 and HHI)

3.4.2 Global Top 10 and Top 5 Companies by Fixed Income Assets Management Revenue in 2021

3.5 Global Fixed Income Assets Management Key Players Head office and Area Served

3.6 Key Players Fixed Income Assets Management Product Solution and Service

3.7 Date of Enter into Fixed Income Assets Management Market

3.8 Mergers & Acquisitions, Expansion Plans

4 Global Fixed Income Assets Management Breakdown Data by Type

4.1 Global Fixed Income Assets Management Historic Revenue by Type (2017-2022)

4.2 Global Fixed Income Assets Management Forecasted Revenue by Type (2023-2028)

5 Global Fixed Income Assets Management Breakdown Data by Application

5.1 Global Fixed Income Assets Management Historic Market Size by Application (2017-2022)

5.2 Global Fixed Income Assets Management Forecasted Market Size by Application (2023-2028)

6 North America

6.1 North America Fixed Income Assets Management Revenue by Company (2020-2022)

6.2 North America Fixed Income Assets Management Revenue by Type (2017-2028)

6.3 North America Fixed Income Assets Management Revenue by Application (2017-2028)

6.4 North America Fixed Income Assets Management Revenue by Country (2017-2028)

6.4.1 United States

6.4.2 Canada

7 Europe

7.1 Europe Fixed Income Assets Management Revenue by Company (2020-2022)

7.2 Europe Fixed Income Assets Management Revenue by Type (2017-2028)

7.3 Europe Fixed Income Assets Management Revenue by Application (2017-2028)

7.4 Europe Fixed Income Assets Management Revenue by Country (2017-2028)

7.4.1 Germany

7.4.2 France

7.4.3 U.K.

7.4.4 Italy

7.4.5 Russia

8 Asia Pacific

8.1 Asia Pacific Fixed Income Assets Management Revenue by Company (2020-2022)

8.2 Asia Pacific Fixed Income Assets Management Revenue by Type (2017-2028)

8.3 Asia Pacific Fixed Income Assets Management Revenue by Application (2017-2028)

8.4 Asia Pacific Fixed Income Assets Management Revenue by Region (2017-2028)

8.4.1 China

8.4.2 Japan

8.4.3 South Korea

8.4.4 India

8.4.5 Australia

8.4.6 China Taiwan

8.4.7 Indonesia

8.4.8 Thailand

8.4.9 Malaysia

9 Latin America

9.1 Latin America Fixed Income Assets Management Revenue by Company (2020-2022)

9.2 Latin America Fixed Income Assets Management Revenue by Type (2017-2028)

9.3 Latin America Fixed Income Assets Management Revenue by Application (2017-2028)

9.4 Latin America Fixed Income Assets Management Revenue by Country (2017-2028)

9.4.1 Mexico

9.4.2 Brazil

9.4.3 Argentina

10 Middle East and Africa

10.1 Middle East and Africa Fixed Income Assets Management Revenue by Company (2020-2022)

10.2 Middle East and Africa Fixed Income Assets Management Revenue by Type (2017-2028)

10.3 Middle East and Africa Fixed Income Assets Management Revenue by Application (2017-2028)

10.4 Middle East and Africa Fixed Income Assets Management Revenue by Country (2017-2028)

10.4.1 Turkey

10.4.2 Saudi Arabia

10.4.3 UAE

11 Company Profiles

11.1 The Vanguard Group

11.1.1 The Vanguard Group Company Details

11.1.2 The Vanguard Group Business Overview

11.1.3 The Vanguard Group Fixed Income Assets Management Products and Services

11.1.4 The Vanguard Group Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.1.5 The Vanguard Group Fixed Income Assets Management SWOT Analysis

11.1.6 The Vanguard Group Recent Developments

11.2 Pimco Funds

11.2.1 Pimco Funds Company Details

11.2.2 Pimco Funds Business Overview

11.2.3 Pimco Funds Fixed Income Assets Management Products and Services

11.2.4 Pimco Funds Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.2.5 Pimco Funds Fixed Income Assets Management SWOT Analysis

11.2.6 Pimco Funds Recent Developments

11.3 Franklin Distributors Inc

11.3.1 Franklin Distributors Inc Company Details

11.3.2 Franklin Distributors Inc Business Overview

11.3.3 Franklin Distributors Inc Fixed Income Assets Management Products and Services

11.3.4 Franklin Distributors Inc Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.3.5 Franklin Distributors Inc Fixed Income Assets Management SWOT Analysis

11.3.6 Franklin Distributors Inc Recent Developments

11.4 Fidelity Distributors Corp.

11.4.1 Fidelity Distributors Corp. Company Details

11.4.2 Fidelity Distributors Corp. Business Overview

11.4.3 Fidelity Distributors Corp. Fixed Income Assets Management Products and Services

11.4.4 Fidelity Distributors Corp. Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.4.5 Fidelity Distributors Corp. Fixed Income Assets Management SWOT Analysis

11.4.6 Fidelity Distributors Corp. Recent Developments

11.5 American Funds Investment Co.

11.5.1 American Funds Investment Co. Company Details

11.5.2 American Funds Investment Co. Business Overview

11.5.3 American Funds Investment Co. Fixed Income Assets Management Products and Services

11.5.4 American Funds Investment Co. Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.5.5 American Funds Investment Co. Fixed Income Assets Management SWOT Analysis

11.5.6 American Funds Investment Co. Recent Developments

11.6 Putnam Investments LLC

11.6.1 Putnam Investments LLC Company Details

11.6.2 Putnam Investments LLC Business Overview

11.6.3 Putnam Investments LLC Fixed Income Assets Management Products and Services

11.6.4 Putnam Investments LLC Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.6.5 Putnam Investments LLC Fixed Income Assets Management SWOT Analysis

11.6.6 Putnam Investments LLC Recent Developments

11.7 Oppenheimer Funds Inc

11.7.1 Oppenheimer Funds Inc Company Details

11.7.2 Oppenheimer Funds Inc Business Overview

11.7.3 Oppenheimer Funds Inc Fixed Income Assets Management Products and Services

11.7.4 Oppenheimer Funds Inc Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.7.5 Oppenheimer Funds Inc Fixed Income Assets Management SWOT Analysis

11.7.6 Oppenheimer Funds Inc Recent Developments

11.8 Scudder Investments

11.8.1 Scudder Investments Company Details

11.8.2 Scudder Investments Business Overview

11.8.3 Scudder Investments Fixed Income Assets Management Products and Services

11.8.4 Scudder Investments Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.8.5 Scudder Investments Fixed Income Assets Management SWOT Analysis

11.8.6 Scudder Investments Recent Developments

11.9 Evergreen Investments

11.9.1 Evergreen Investments Company Details

11.9.2 Evergreen Investments Business Overview

11.9.3 Evergreen Investments Fixed Income Assets Management Products and Services

11.9.4 Evergreen Investments Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.9.5 Evergreen Investments Fixed Income Assets Management SWOT Analysis

11.9.6 Evergreen Investments Recent Developments

11.10 Dreyfus Corp

11.10.1 Dreyfus Corp Company Details

11.10.2 Dreyfus Corp Business Overview

11.10.3 Dreyfus Corp Fixed Income Assets Management Products and Services

11.10.4 Dreyfus Corp Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.10.5 Dreyfus Corp Fixed Income Assets Management SWOT Analysis

11.10.6 Dreyfus Corp Recent Developments

11.11 Federated Investors Inc

11.11.1 Federated Investors Inc Company Details

11.11.2 Federated Investors Inc Business Overview

11.11.3 Federated Investors Inc Fixed Income Assets Management Products and Services

11.11.4 Federated Investors Inc Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.11.5 Federated Investors Inc Recent Developments

11.12 T. Rowe Price Group

11.12.1 T. Rowe Price Group Company Details

11.12.2 T. Rowe Price Group Business Overview

11.12.3 T. Rowe Price Group Fixed Income Assets Management Products and Services

11.12.4 T. Rowe Price Group Fixed Income Assets Management Revenue in Fixed Income Assets Management Business (2017-2022)

11.12.5 T. Rowe Price Group Recent Developments

12 Fixed Income Assets Management Market Dynamics

12.1 Fixed Income Assets Management Market Trends

12.2 Fixed Income Assets Management Market Drivers

12.3 Fixed Income Assets Management Market Challenges

12.4 Fixed Income Assets Management Market Restraints

13 Research Findings and Conclusion

14 Appendix

14.1 Research Methodology

14.1.1 Methodology/Research Approach

14.1.2 Data Source

14.2 Author Details

QY RESEARCH, INC.

17890 CASTLETON STREET

SUITE 369, CITY OF INDUSTRY

CA - 91748, UNITED STATES OF AMERICA

+1 626 539 9760 / +91 8669986909

hitesh@qyresearch.com / enquiry@qyresearch.com

About Us:

QY Research established in 2007, focus on custom research, management consulting, IPO consulting, industry chain research, data base and seminar services. The company owned a large basic data base (such as National Bureau of statistics database, Customs import and export database, Industry Association Database etc), expert's resources (included energy automotive chemical medical ICT consumer goods etc."

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fixed Income Assets Management market: High-growth Segments and their Share Forecasts | The Vanguard Group, Pimco Funds, Franklin Distributors Inc here

News-ID: 2852447 • Views: …

More Releases from QYResearch, Inc.

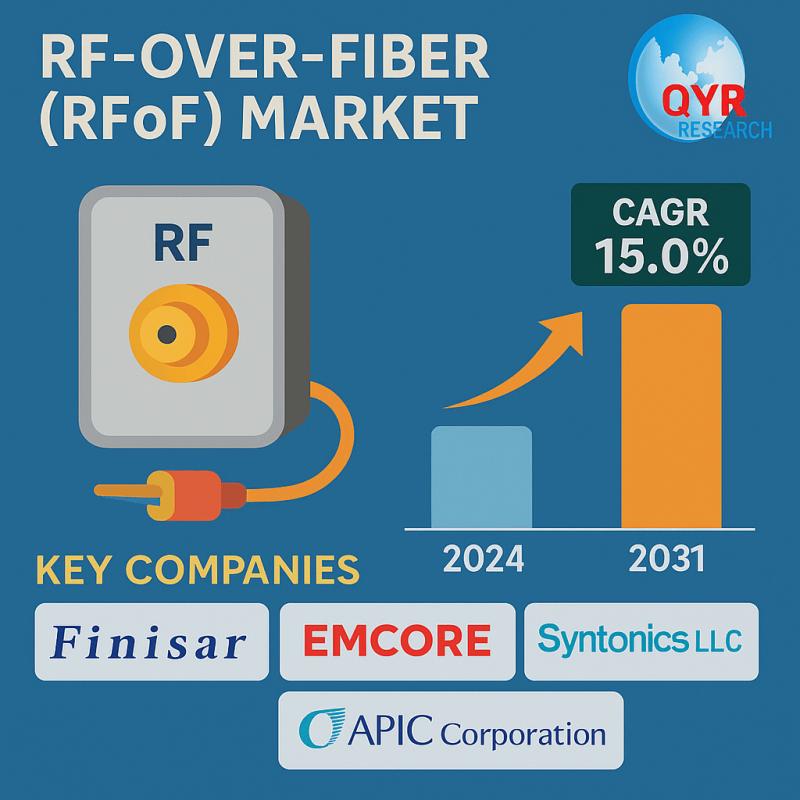

RF-over-Fiber (RFoF) Market Projected to Grow at a CAGR of 15.0% | Forecast 2025 …

Los Angeles, United State: The global RF-over-Fiber (RFoF) Market was valued at US$ 551 million in 2024 and is anticipated to reach US$ 1447 million by 2031, witnessing a CAGR of 15.0% during the forecast period 2025-2031. The research report targets specific customer segments to help companies effectively market their products and drive strong sales in the global RF-over-Fiber (RFoF) Market. It organizes valuable and relevant market insights to match…

Divinyl Sulfone Market 2024's Technological Tapestry: Advancements Shaping the M …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Balancing Acts: Gross Margins, Costs, and Revenue Predict …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

Divinyl Sulfone Market Bright Horizons: Positive Market Indicators Revealed | Bo …

"The thorough study and analysis report is a fantastic and essential tool for worldwide market players to obtain a competitive advantage over their rivals. It contains accurate and validated projections for the global Divinyl Sulfone industry's size, CAGR, production, consumption, and sales. Additionally, it offers projections for industry revenue and volume until 2026. The report's readers may quickly learn about the major prospects, difficulties, and development drivers of the worldwide…

More Releases for Fixed

Fixed Temperature Heat Detector Market

Fixed Temperature Heat Detector Market Overview

Fixed Temperature Thermal Detector works when the heat exceeds a pre-determined temperature, the bi-metal deflects and closes the contact, triggering the fire signal. Fixed Temperature Heat / Thermal Detectors can respond to: Fixed temperature limit. Rapid rate of change of the temperature in the protected area.

This report provides a deep insight into the global Fixed Temperature Heat Detector market covering all its essential aspects. This…

Wirewound Fixed Resistor Market

A wirewound fixed resistor is a tough resistor made by wrapping a high-resistance wire around a core. The global market for wirewound fixed resistors thrives due to their efficiency in high-power applications, reliability in renewable energy systems, stability in demanding environments, and crucial role in industrial automation. Despite facing competition, wirewound resistors remain indispensable for their precision, versatility, and ability to handle high power.

High-Power Applications

Wirewound fixed resistors are prominently favored…

Fixed Loop Ropeway Market

The global fixed loop ropeway market databook report is a comprehensive and important source of information that provides critical insights into many aspects of the fixed loop ropeway industry. It examines all key participants, including Leitner Poma , Nippon Cable , Kashiyama Industries , Doppelmayr Seilbahnen GmbH , MND Group , LEITNER Ropeways , Anzen Sakudo , Bartholet Maschinenbau , TATRALIFT , Tokyo Cableway, and places a strong emphasis on…

Commercial Fixed Wing Unmanned Aerial Vehicle Market: Exploring the Promising La …

Global Commercial Fixed Wing Unmanned Aerial Vehicle Market Overview:

The Commercial Fixed Wing Unmanned Aerial Vehicle market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Commercial Fixed Wing Unmanned Aerial Vehicle market has experienced significant growth, driven by factors such as…

Fixed Asset Management Software Market

Fixed asset management software is anticipated to have a global market value of USD 3.8 billion in 2021 and USD 4.2 billion in 2022. From 2022 to 2032, the market is projected to expand at a CAGR of 10.6%, reaching USD 11.4 billion.

Over the projected period, it is estimated that the market would be highly impacted by the quick adoption of IoT-based services across a variety of industries, including…

Network Automation and Orchestration Market Growth, Services Analysis - mobile, …

This Network automation and orchestration market report provides forecasts for communications service provider (CSP) spending on network automation and orchestration (NAO) software systems and related services for 2021–2026. The NAO market will grow by USD8.8 billion between 2020 and 2026, largely due to the continued adoption of network control and orchestration (NCO) solutions.

Get a Free Sample Copy of Global Network automation and orchestration Market Research Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=4833551

This forecast…