Press release

Travel Insurance Market Impact of Industry Size, Shares, and Impact Y-o-Y

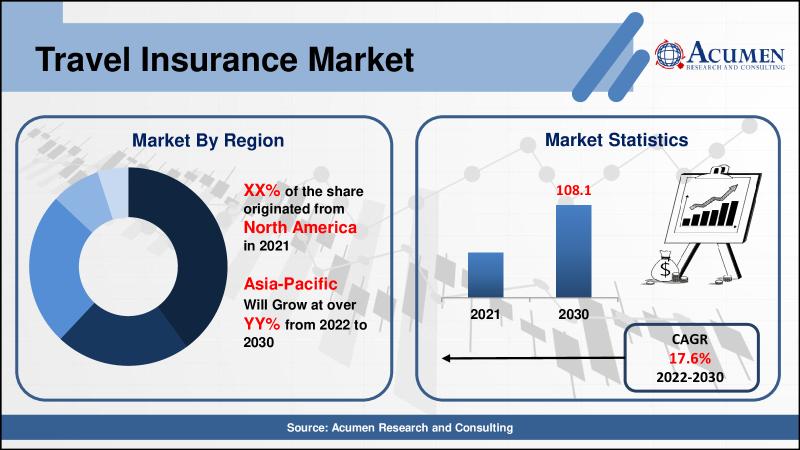

The Global Travel Insurance Market is expected to grow at a CAGR of around 17.6% from 2022 to 2030 and reach the market value of over US$ 108.1 Billion by 2030.The global travel insurance market is projected to experience significant double-digit growth during the forecast period from 2022 to 2030. The increasing number of travelers is the primary factor supporting the demand for travel insurance in the global market. The travel insurance market is also gaining growth due to companies that are selling travel packages along with travel insurance.

The global travel insurance market is segmented on the basis of insurance cover, application, end-user, and geography. On the basis of insurance cover, the market is bifurcated across single-trip travel insurance, annual multi-trip travel insurance, and long-stay travel insurance. Additionally, travel insurance has applications across domestic travel and outbound travel. The end-user of travel insurance includes senior citizens, education travelers, business travelers, family travelers, and adventure travel.

DOWNLOAD SAMPLE PAGES OF THIS REPORT@ https://www.acumenresearchandconsulting.com/request-sample/2513

Based on insurance cover, single-trip travel insurance is having a dominating share in the global travel insurance market. The cheaper cost of single-trip travel insurance is a major factor contributing to its dominance in the market. The preference of users on single trip travel insurance over multi or long-stay travel insurance is additionally maximizing its market value.

North America had a potential share (%) in terms of revenue in the travel insurance market. The presence of a large number of people investing in travel and tourism is supporting the regional market value. The major economy of the region US is contributing to the major revenue in the region. A 2016-2018 travel protection market study conducted by the US Travel Insurance Association shows, in 2018 Americans spent nearly $3.8 billion on all types of travel protection.

VIEW TABLE OF CONTENT OF THIS REPORT@ https://www.acumenresearchandconsulting.com/travel-insurance-market

Asia Pacific is anticipated to experience the fastest growth over the forecast period from 2020 to 2027. The increasing discretionary income which is supporting the increased spending power of people on traveling is driving the market value. The emerging tourism industry of the developing economies of the region is further prolife rating the market value.

Some of the leading competitors in the global travel insurance market include Allianz Group, American International Group Inc., Assicurazioni Generali S.P.A, AXA S.A., Insure & Go Insurance Services Limited, Seven Corners Inc., Travel Insured International, TravelSafe Insurance, USI Insurance Services, and Zurich Insurance Co. Limited. The major players are continuously making efforts to spread awareness about getting travel insurance across their existence. Additionally, they are making strategic development plans for the expansion of their share and market potential.

Browse Upcoming Market Research Reports@ https://www.acumenresearchandconsulting.com/forthcoming-reports

Some of the key observations regarding the travel insurance industry include:

• Arch Insurance has introduced a new program in 2021 that allows its brokers to quickly price and purchase business travel account policies for U.S. companies with up to 250 business travelers. The new program is called Arch BTAExpress, it utilizes an underwriting and technology experience that lets its users get access to the simple design, pricing, and binding of BTA policies, and quotes usually delivered almost instantly.

• The uncertainty associated with the post-Covid-19 travel plans is advised to take travel insurance by considering the likely setbacks in the travel industry as happened earlier. UK has experienced a 109% surge in spending on holiday after the announcement of roadmap out of lockdown by the UK Prime Minister Boris Johnson. Bookings have aroused by 102% at travel agencies and 122% at airlines, according to the card data from Lloyds Bank. Buying travel insurance is essential as it will protect the cost of canceling a holiday. Moreover, many of the insurance providers are offering protection against corona virus-related cancellations, which will be a worthy investment if taking a staycation.

• Manulife Financial Corp. is offering COVID-19-related travel insurance from 2020 for Canadians who take international and domestic trips. The policy covers the emergency medical coverage that includes the corona virus and related conditions. It also covers the losses associated with the trip interruptions or cancellations in the event of quarantine. Moreover, the Manulife plan also includes emergency medical coverage up to $200,000 for COVID-19 and associated conditions after a positive test result, as well as emergency air transport to return home.

INQUIRY BEFORE BUYING@ https://www.acumenresearchandconsulting.com/inquiry-before-buying/2513

BUY THIS PREMIUM RESEARCH REPORT - https://www.acumenresearchandconsulting.com/buy-now/0/2513

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market Impact of Industry Size, Shares, and Impact Y-o-Y here

News-ID: 2851068 • Views: …

More Releases from Acumen Research and Consulting

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

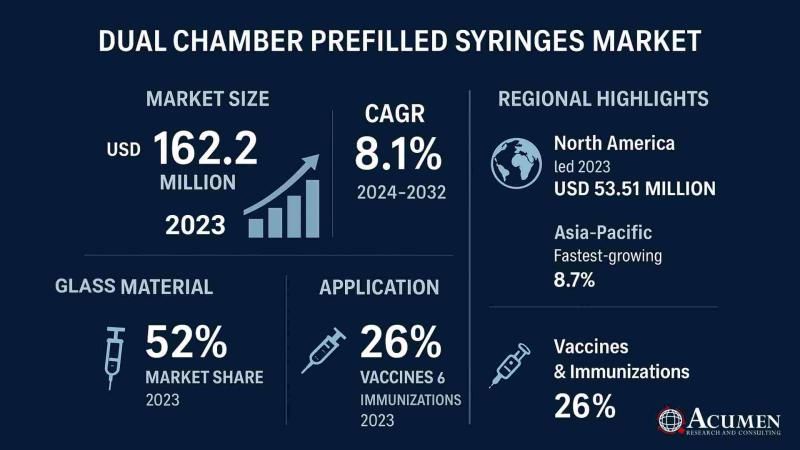

Global Dual Chamber Prefilled Syringes Market to Reach USD 323.7 Million by 2032 …

According to the latest report by Acumen Research and Consulting, the global Dual Chamber Prefilled Syringes Market is witnessing rapid expansion, driven by rising adoption of advanced drug delivery systems, increasing demand for biologics, and the growing emphasis on patient safety and convenience.

The Dual Chamber Prefilled Syringes Market Size was valued at USD 162.2 million in 2023 and is projected to reach USD 323.7 million by 2032, growing at a…

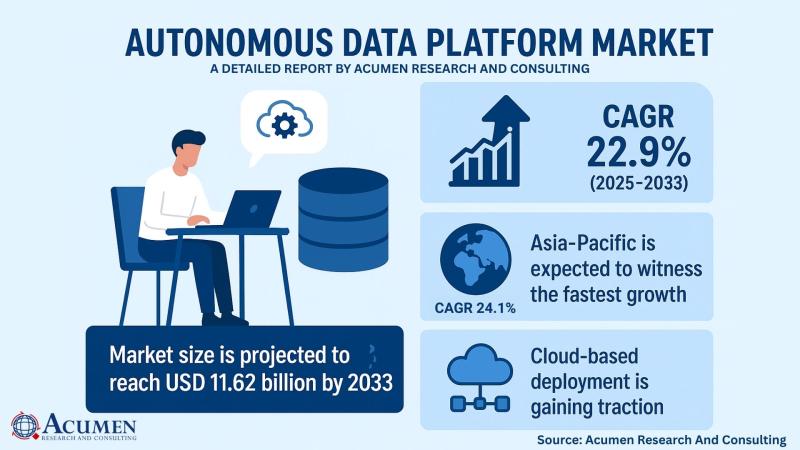

Autonomous Data Platform Market to Reach USD 11.62 Billion by 2033, Growing at a …

The global Autonomous Data Platform Market is experiencing significant growth, driven by the increasing demand for AI-driven data management and real-time analytics across various industries. According to a comprehensive market analysis by Acumen Research and Consulting, the market was valued at USD 1.85 billion in 2024 and is projected to reach USD 11.62 billion by 2033, expanding at a robust compound annual growth rate (CAGR) of 22.9% during the forecast…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…