Press release

Mobile Banking Market Outlook, Key Players Analysis, Industry Demand by 2029

Global Mobile Banking Market OverviewIn its recent intelligence study, Fairfield Market Research reports that the global Mobile Banking market is projected for a steadfast growth. The report, titled Mobile Banking , provides a panoramic view of the global Mobile Banking market along with an extensive analysis of the historic, current, and futuristic market scenarios. Research analysts believe that the Mobile Banking market has been influenced by multiple uncertainties as well as multiple macro and microeconomic factors. Evolving Mobile Banking consumption patterns and advent of technology in end-use industries have been important in the market build-up. The report also sheds light on the economic turmoil and unprecedented disruptions caused to the Mobile Banking market due to the global COVID-19 pandemic. The executive summary gives a brief overview of the global Mobile Banking market that covers product definition and scope of the market. It also discusses the key market dynamics shaping the Mobile Banking market, including drivers, restraints, threats, opportunities, and trends.

Get Sample/TOC of this Global Mobile Banking Market: https://www.fairfieldmarketresearch.com/report/mobile-banking-market/request-toc

Global Mobile Banking Market: Segmentation

For thorough research to enable extraction of actionable insights into the futuristic growth prospects of the global Mobile Banking market, the report categorises the market into different segments on the basis of Mobile Banking . Segmentation of the Mobile Banking market allows the readers to understand the key aspects of the market such as product types, application areas, and end users. The chapters about different market segments intend to describe their development over the years and the course they are likely to take during the period of forecast. The progress of these segments is also further elaborated with an insightful data on some influential trends that are likely to shape them in the near future.

Global Mobile Banking Market: Competition Landscape

American Express Company, Bank of America Corporation, BNP Paribas, Citigroup Inc., Credit Agricole, HSBC Holdings plc, JPMorgan Chase & Co, Mitsubishi Ufj Financial Group, Inc., Societe Generale Group, and Wells Fargo & Company.

Global Mobile Banking Market: Regional Segmentation

To enable in-depth understanding of the Mobile Banking market and its progress at a global level, the report uncovers insightful information about the regional segmentation of the market. Taking into consideration all the key market dynamics associated with each of the geographies under assessment, these chapters in the report offer thorough evaluation of the uncertain political scenarios, demand-supply equations, socio-economic dynamics, regulatory structure, and demand and pricing patterns. This assessment allows readers to perform an accurate region-wise analysis of the global Mobile Banking market.

North America (the United States, Mexico, and Canada)

South America (Brazil etc.)

Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

The Middle East and Africa (GCC Countries and Egypt)

Global Mobile Banking Market: Research Methodology

The research methodology that has been followed by analysts while they worked on the the global Mobile Banking market intelligence has played a pivotal role in how the final publication has been collated. The use of individual primary and secondary research methodologies, and top-down and bottom-up approaches have aided in obtaining an accurate, precise, yet comprehensive analysis of the Mobile Banking market.

Global Mobile Banking Market: Competition Landscape

The report also includes a comprehensive chapter on the competitive rivalry in the global Mobile Banking market. A detailed analysis of the competition landscape provides insights on the key company profiles, their strong operating areas, potential growth regions, developmental strategies, financial positioning, and the existing and upcoming trends that they can viably invest in. Emphasizing the nature of the competition in the global Mobile Banking market, the report gives projections about how the competition will shape up in the near future.

Do You Have Any Query Or Specific Requirement? Request Customization of Report:

https://www.fairfieldmarketresearch.com/report/mobile-banking-market/request-customization

Strategic Points Covered in TOC

Chapter 1: Global Mobile Banking market introduction, product definition and scope, key driving forces, market risks, market overview, and market opportunities

Chapter 2: Detailed evaluation of the leading manufacturers operating in the global Mobile Banking market, covering their production volumes, revenue, sales, product prices, and shares

Chapter 3: Display of the competitive nature of key manufacturing players in the global Mobile Banking market along with their sales, revenue, and market shares

Chapter 4: Regional segmentation of the global Mobile Banking market, with projected sales, revenue, and global market shares

Chapter 5, 6, 7, 8, and 9: Market evaluation by segmentation on the basis of countries and manufacturers along with sales, revenue, and market shares in respective regions

Contact

Fairfield Market Research

London, UK

UK +44 (0)20 30025888

USA +1 (844) 3829746 (Toll-free)

Email: sales@fairfieldmarketresearch.com

Web: https://www.fairfieldmarketresearch.com/

Follow Us: https://bit.ly/3voYIm9

About Us

Fairfield Market Research is a UK-based market research provider. Fairfield offers a wide spectrum of services, ranging from customized reports to consulting solutions. With a strong European footprint, Fairfield operates globally and helps businesses navigate through business cycles, with quick responses and multi-pronged approaches. The company values an eye for insightful take on global matters, ably backed by a team of exceptionally experienced researchers. With a strong repository of syndicated market research reports that are continuously published & updated to ensure the ever-changing needs of customers are met with absolute promptness.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Banking Market Outlook, Key Players Analysis, Industry Demand by 2029 here

News-ID: 2842577 • Views: …

More Releases from Fairfield Market Research

Small Modular Reactor (SMR) Market Set to Climb from $6.6 Bn in 2025 to $9.2 Bn …

The Small Modular Reactor (SMR) industry is entering a crucial phase of global development as nations accelerate the transition toward low-carbon energy systems and resilient power infrastructure. With the market estimated at US$ 6.6 billion in 2025 and projected to reach US$ 9.2 billion by 2032, the sector is expanding at a 4.9% CAGR during the forecast period. SMRs are emerging as a transformative alternative to traditional nuclear plants, offering…

Antimony-free Films Market Set for Sustainable Expansion Through 2032

The global Antimony-free Films Market is entering a defining phase of strategic expansion as sustainability, regulatory shifts, and consumer safety expectations reshape the packaging and materials landscape. With rising concerns surrounding antimony-based catalysts in polyester films, end-use industries are accelerating the transition toward safer, more compliant, and environmentally responsible alternatives. According to industry estimates, the market is valued at US$ 238.6 million in 2025 and is projected to reach US$…

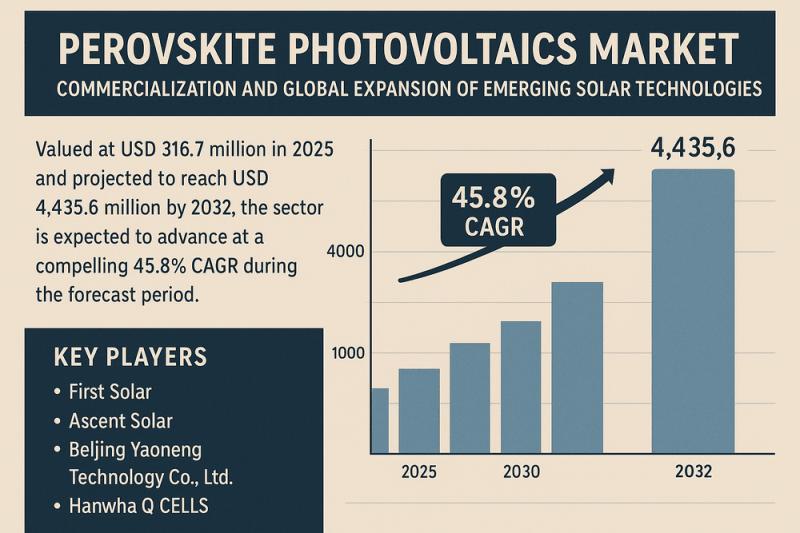

Perovskite Photovoltaics Market Set for Transformational Growth Through 2032

The Perovskite Photovoltaics Market is entering a pivotal phase of commercialization and global expansion as emerging solar technologies gain momentum across residential, commercial, and utility-scale applications. Valued at USD 316.7 million in 2025 and projected to reach USD 4,435.6 million by 2032, the sector is expected to advance at a compelling 45.8% CAGR during the forecast period. This remarkable growth trajectory reflects rising demand for low-cost, high-efficiency solar modules, continued…

Micro EV Market Accelerates Toward a Sustainable Urban Mobility Future Through 2 …

The Micro Electric Vehicle (Micro EV) Market is entering a new phase of accelerated growth, supported by global sustainability targets, rapid urbanization, and policy-driven adoption of small-format electric mobility solutions. Valued at USD 12.1 billion in 2025 and projected to reach USD 26.8 billion by 2032, the industry expands at a 12.0% CAGR, reflecting strong market confidence in compact, zero-emission vehicles. These vehicles-ranging from two-seater microcars to lightweight quadricycles-are increasingly…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…