Press release

Usage-Based Insurance Market Size Worth US$ 123.4 Billion By 2027 | Industry CAGR of 24.47%

IMARC Group has recently released a new research study titled "Usage-Based Insurance Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2022-2027", The global usage-based insurance market reached a value of US$ 33.0 Billion in 2021. Looking forward, IMARC Group expects the market to reach US$ 123.4 Billion by 2027, exhibiting a CAGR of 24.47% during 2022-2027.Usage-based insurance (UBI), also known as telematics insurance, is a specialized automobile insurance policy that evaluates the premium based on the usage of the vehicle and the driving behavior of the consumer. It comprises a wireless device installed in the vehicle, which transmits data to the insurer each time the premium is due. It is commonly available in pay-how-you-drive (PHYD), pay-per-mile formats (PPM), and manage-how-you-drive (MHYD) variants. It assists in promoting good driving practices, minimizing the instances of road accidents, and offering enhanced satisfaction to the policyholder. As a result, UBI is gaining traction in the automotive industry across the globe.

Impact of COVID-19:

We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

Download a free sample report to get a detailed overview of the market: https://www.imarcgroup.com/usage-based-insurance-market/requestsample

Usage-Based Insurance Market Trends and Drivers:

The increasing sales of vehicles on account of the rising global population, rapid urbanization, and inflating income levels of individuals represent one of the major factors driving the demand for UBI around the world. The growing demand for hybrid and electric vehicles (H/EVs) is also influencing the market positively. Moreover, there is an increase in the adoption of remote diagnostics that connects to a wireless network for monitoring the health of the vehicle and provides the status of the automobile in real-time to prevent future crashes and failures. Along with this, the rising focus on driver and passenger safety on account of the expanding number of fatal road accidents among the masses is favoring the growth of the market. In addition, key players are incorporating advanced telematics-based platforms in light-duty vehicles (LDV) to minimize the requirement of installing an additional black box in the vehicles to record vehicular data, which is contributing to the market growth.

Besides this, governing agencies of numerous countries are mandating businesses to purchase a UBI policy for their heavy-duty vehicles, which is providing a thrust to the market growth. Furthermore, the increasing utilization of commercial vehicles for inter-city passenger tours and travel and heavy-duty vehicles for bulk transportation of goods is providing a thrust to the market growth. Apart from this, insurers are introducing online insurance solutions with hassle-free and fully digital insurance comparing, buying, and renewing platforms on account of considerable reliance on smartphones and rising penetration of high-speed internet connectivity. This is offering lucrative growth opportunities to market players operating in the industry. Additionally, the integration of the internet of things (IoT) and vehicle telematics solutions in vehicles allow users to interact with the connected vehicle eco-systems to offer an improved driving experience, which is strengthening the growth of the market.

Explore full report with table of contents: https://www.imarcgroup.com/usage-based-insurance-market

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Type:

Pay-As-You-Drive (PAYD)

Pay-How-You-Drive (PHYD)

Manage-How-You-Drive (MHYD)

Others

Breakup by Technology:

OBD II

Black box

Smartphones

Others

Breakup by Vehicle Type:

Light-duty Vehicle (LDV)

Heavy-duty Vehicle (HDV)

Breakup by Vehicle Age:

New Vehicles

Used Vehicles

Market Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Competitive Landscape with Key Player:

Aioi Nissay Dowa Insurance UK Ltd

Allianz SE

Allstate Insurance Company

American International Group Inc.

Assicurazioni Generali SpA

AXA

Liberty Mutual Insurance Company

Mapfre SA

Progressive Casualty Insurance Company

State Farm Automobile Mutual Insurance Company

TomTom International BV.

UnipolSai Assicurazioni SpA (Unipol Gruppo SpA).

Key Highlights of the Report:

Market Performance (2016-2021)

Market Outlook (2022-2027)

Market Trends

Market Drivers and Success Factors

Impact of COVID-19

Value Chain Analysis

Comprehensive mapping of the competitive landscape

Ask Analyst for 10% Free Customized Report: https://www.imarcgroup.com/request?type=report&id=3840&flag=C

Note: We are updating our reports, if you want the report with the latest primary and secondary data (2023-2028) including industry trends, market size and competitive landscape, etc. click request free sample report, published report will be delivered to you in PDF format via email within 24 to 48 hours.

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Related Reports By IMARC Group

Europe Bancassurance Market: https://www.imarcgroup.com/europe-bancassurance-market

United States Bancassurance Market: https://www.imarcgroup.com/united-states-bancassurance-market

India Health Insurance Market: https://www.imarcgroup.com/india-health-insurance-market

Cyber Insurance Market: https://www.imarcgroup.com/cyber-insurance-market

Self-Service Bi Market: https://www.imarcgroup.com/self-service-bi-market

Occupancy Sensor Market: https://www.imarcgroup.com/occupancy-sensor-market

Infrared Imaging Market: https://www.imarcgroup.com/infrared-imaging-market

Virtual Reality Headset Market: https://www.imarcgroup.com/virtual-reality-headset-market

Contact Us:

IMARC Services Private Limited

30 N Gould St Ste R

Sheridan, WY 82801 USA - Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic, and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-Based Insurance Market Size Worth US$ 123.4 Billion By 2027 | Industry CAGR of 24.47% here

News-ID: 2841908 • Views: …

More Releases from IMARC Group

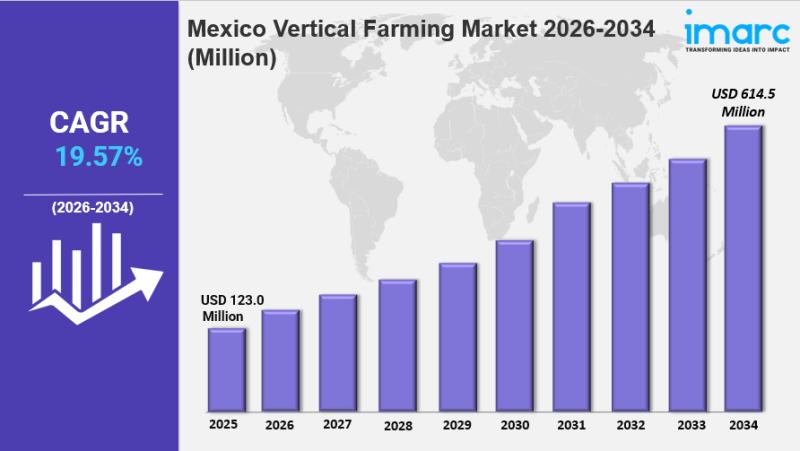

Mexico Vertical Farming Market Size, Share, Industry Overview, Trends and Foreca …

IMARC Group has recently released a new research study titled "Mexico Vertical Farming Market Size, Share, Trends and Forecast by Component, Structure, Growth Mechanism, Application and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Vertical Farming Market Overview

The Mexico vertical farming market size reached USD 123.0 Million in 2025. Looking forward, IMARC Group…

Indonesia Logistics Market Expected to Reach USD 132.2 Billion by 2034, Industry …

IMARC Group's latest research publication "Indonesia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034" the Indonesia logistics market size reached USD 72.4 Billion in 2025. The market is expected to reach USD 132.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.91% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/indonesia-logistics-market/requestsample

What is Logistics?

Logistics refers to the comprehensive process of planning, implementing, and controlling…

South East Asia Medical Tourism Market Expected to Reach USD 35.5 Billion by 203 …

IMARC Group's latest research publication "South East Asia Medical Tourism Market Size, Share, Trends and Forecast by Treatment Type, Service Provider, and Country, 2026-2034" the South East Asia medical tourism market size reached USD 6.1 Billion in 2025. The market is expected to reach USD 35.5 Billion by 2034, exhibiting a growth rate (CAGR) of 21.68% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/south-east-asia-medical-tourism-market/requestsample

What is Medical Tourism?

Medical tourism refers to the practice…

Bamboo Plywood Manufacturing Plant Cost 2026: Detailed Project Report & Profit A …

Setting up a Bamboo Plywood Manufacturing Plant positions investors in a growing and sustainable segment of the engineered wood and construction materials industry, backed by sustained global demand driven by eco-conscious construction, renewable material adoption, and increasing requirements for sustainable furniture and interior solutions. As urbanization accelerates and demand for environmentally friendly building products rises, bamboo plywood offers dual benefits: reducing reliance on traditional hardwoods while providing a strong, durable,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…