Press release

Trade Finance Software Market to Garner US$ 2,920.4 million by 2027 - Top Key Players Are AWPL, BT Systems, CGI, China Systems, Comarch SA

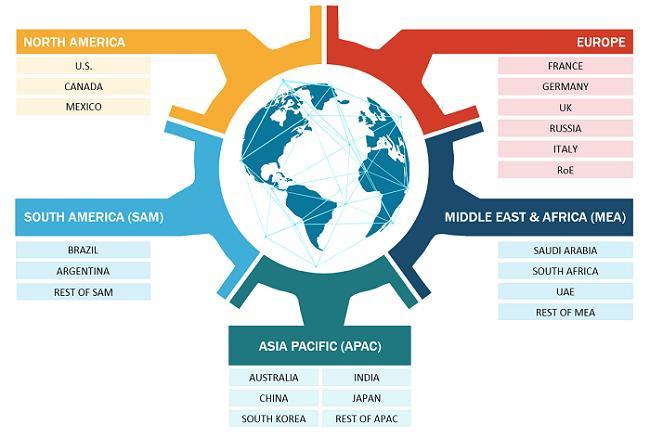

According to our latest market study on "Trade Finance Software Market to 2027 - COVID-19 Impact, and Global Analysis and Forecast - by Component (Solution and Services); Deployment (Cloud and On-Premise); Enterprise Size (Large Enterprises and SMEs); and End-Use (Banks, Traders, and Others)and Geography," the market was valued at US$ 1,573.8 million in 2021 and is projected to reach US$ 2920.4 million by 2027; it is expected to grow at a CAGR of 10.3% from 2020 to 2027. In 2019, APAC led the global trade finance software market with 36.81% revenue share, followed by Europe, and North America. APAC includes Australia, China, India, Japan, South Korea, and Rest of APAC. APAC is the world's largest continent and is well known for its technological innovations in the above mentioned countries. Rise in smartphone and internet penetration in the APAC countries is acting as a significant opportunity for the key players in the trade finance software market. Rapid technological advances, policy support, and economic digitization are among the factors that assist the transition of economies in this region from the growing stage to the developed stage. Also, the market in APAC is anticipated to grow at a fast pace during the forecast period due to increasing demand for trade finance software and services. Trade finance software allows SMEs and large enterprises to fine-tune their trade process. China, Australia, and Japan have emerged as unchallenged leaders in the trade finance software market.Get a Sample Copy of the report @ https://www.theinsightpartners.com/sample/TIPRE00011032/?utm_source=OpenPR&utm_medium=10212

Global Trade Finance Software Market Insight:

The market for trade finance software is segmented into component, deployment, enterprise size, end-use, and geography. Based on component, the market is segmented into solution and services. In 2020, the solution segment held the largest share of global trade finance software market. Based on deployment, the market is segmented into cloud and on-premise. In 2020, the cloud segment held the largest share of global trade finance software market. Based on enterprise size, the trade finance software market is divided into SMEs and large enterprises. SMEs segment is expected to be the fastest growing segment over the forecast period. On the basis of end-use, the market is segmented into banks, traders, and others. The banks segment contributed a substantial share in 2020. Geographically, the market is segmented into five major regions-North America, Europe, Asia Pacific (APAC), the Middle East and Africa (MEA), and South America (SAM).

The Key Players In The Global Market Are:

•AWPL

•BT Systems

•CGI

•China Systems

•Comarch SA

•Finastra

•IBSFINtech

•MITech

•Newgen Software

•Persistent Systems

•Surecomp

Impact of COVID-19 on Trade Finance Softwaremarket

The commencement of the COVID-19 epidemic has brought about momentous supply chain and logistics disruptions across the world.The COVID-19 pandemic is one of the largest disrupting forces, with the region's three countries continuing to combat outbreaks and significant community spread. The huge increase in the number of confirmed cases and rising reported deaths in the country has affected software providers to some extent due to the decrease in demand for their products. The business shutdowns as well as disruption in supply chain across the worldare impacting the adoption of the trade finance software market. The North America region is home to a large number of technology companies, and the impact of coronavirus outbreak is anticipated to be moderate in the year 2020 and likely in first quarter of 2021. The impact of COVID-19 is short-term; it is likely to decrease in the coming years.

Access Full Report At @ https://www.theinsightpartners.com/buy/TIPRE00011032/?utm_source=OpenPR&utm_medium=10212

In 2019, Europe stoodsecond in the trade finance softwaremarket with a decent market share and it is anticipated to witness a steady CAGR from 2020 to 2027.Over the past five years, capital invested in European technology has grown by 124%, rising by 39% between 2018 and 2019, to reach US$ 34.3 billion of capital investment in 2019. This compares to the cutbacks between 2018 and 2019 in capital investment in both the US and Asia. Europe's software development services are increasingly in demand. An increase in adoption of IT and telecommunication and digital transformation and automation are the key drivers of this growth. Moreover, European countries house a number of industries offering critical and important products. The medical sector in the region is advancing at a rapid rate. Likewise, numerous automakers have their establishments across countries, which are supported by innumerable component manufacturers. Other industries such as aerospace & defense, agriculture, consumer electronics, e-commerce, transportation & logistics are showcasing significant import-export activities with respect to their respective products, which, in turn has boosted trade finance market in the region. Further, in order to manage trade finance operations more efficiently various banks and traders are adopting trade finance solutions and services, thereby providing visibility to their clients.

The report segments the global Market as follows:

By Component (Solution and Services)

By Deployment (Cloud and On-Premise)

By Enterprise Size (Large Enterprises and SMEs), and End-Use (Banks, Traders, and Others)

Answers that the report acknowledges:

• Market size and growth rate during forecast period.

• Key factors driving the Market.

• Key market trends cracking up the growth of the Trade Finance Software Market

• Challenges to market growth.

• Key vendors of Trade Finance Software Market

• Detailed SWOT analysis.

• Opportunities and threats faces by the existing vendors in Global Trade Finance Software Market

• Trending factors influencing the market in the geographical regions.

• Strategic initiatives focusing the leading vendors.

• PEST analysis of the market in the five major region

Speak To Analyst @ https://www.theinsightpartners.com/speak-to-analyst/TIPRE00011032/?utm_source=OpenPR&utm_medium=10212

Contact Us:

If you have any queries pertaining to the report or would like further information, feel free to reach out to us at-

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

ABOUT US:

The Insight Partners is a one stop industry research provider of actionable solutions. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We are specialist in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Software Market to Garner US$ 2,920.4 million by 2027 - Top Key Players Are AWPL, BT Systems, CGI, China Systems, Comarch SA here

News-ID: 2835799 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Trade

Trade Intelligence for Global Trade: Benchmarking Competitors with Verified Trad …

In the modern supply chain battlefield, knowledge is not just power-it's leverage. Understanding how your competitors move in the global trade space can make the difference between a strategic win and a costly misstep. Yet, many companies still rely on fragmented or outdated information, missing out on key shifts that trade intelligence platforms can now uncover easily.

The Blind Spot in Traditional Competitive Research

Traditional competitor analysis typically relies on market reports,…

Decoding Chongqing's Cross-Border Trade through the Yumaotong Smart Trade Platfo …

Since its launch on May 13, the New Western International Land - Sea Corridor - Yumaotong Smart Trade Platform (hereinafter referred to as the 'Yumaotong Smart Trade Platform') has welcomed 420 enterprises, including over 100 foreign companies. At the 7th Western China International Fair held in Chongqing on May 22, Deng Ai, head of the platform, said that it offered global businesses a one-stop, full-chain, professional service from capturing trade…

Trade Show Displays: Maximizing Your Trade Show Booth Design

Trade shows are a critical aspect of any business that wants to showcase its products, services, and brand to potential customers, partners, and investors. Trade show displays are one of the most crucial elements in trade show marketing, and they play a significant role in determining the success of a company's presence at a trade show. In this article, we'll explore the different types of displays for trade shows and…

The future of international trade and worldwide network: Global Trade Plaza

The future of international trade and worldwide network: Global Trade Plaza

A radical change to support continuous growth in supply traffic.

Connecting all manufacturers, suppliers, traders, exporters, and importers.

Open the door to the future of safe international trade.

B2B marketplace Global Trade Plaza wants to redefine the supply chain. The growth due to digitalization has touched multiple fields, but couldn't do much for the intercountry supply. We are here with…

US-China trade war shifting cement seaborne trade flows

In 2018, the total number of active cement carriers surpassed 360 units, with the total dead weight tonnage topping 2.7 million, the highest figure recorded since 2010.

According to CW Research’s 2019 update of the World Cement, Clinker & Slag Sea-Based Trade Report, the upward trend was underpinned by a growing demand for cement carriers in key domestic trade markets.

Specialized cement carriers move about 25 million tons of cement per…

Suisse Trade – Holding Trade Seminar in Tokyo in December 2016

Suisse Trade is a full-fledged Forex trading firm that is renowned worldwide for rendering clients with the best assistance in commodity and Forex based trading. The company has been consistently successful in presenting clients with the most formidable instruments to trade in currency and commodities markets. The tasks undertaken by the company also involve spot and cash trades, limited risk options on futures as well as contracts. It has always…