Press release

Malaysia Online Insurance Market Growth, Trends, Developments and Outlook to 2026F: Ken Research

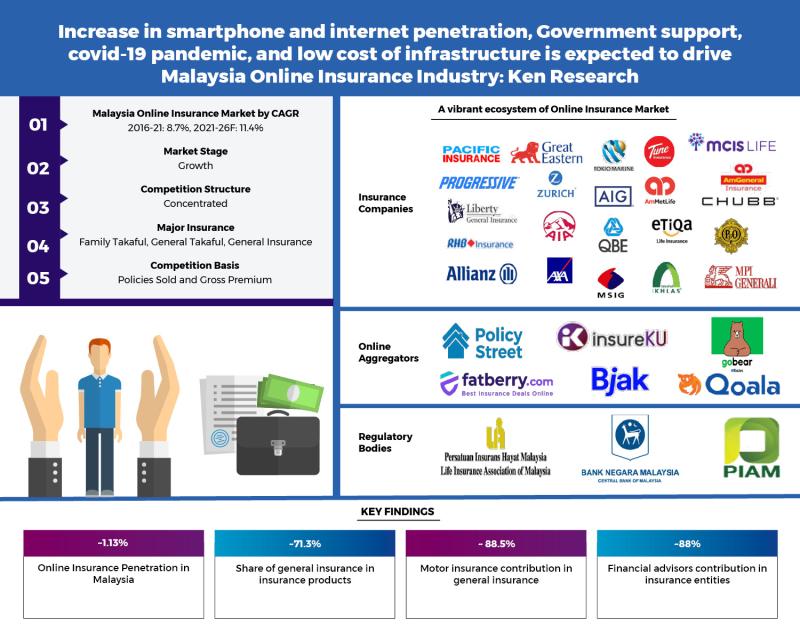

How Online insurance industry is positioned in Malaysia?Malaysia Online Insurance Market display a stable growth since 2016 growing at single digit CAGR ~%. Online Insurance market revenue stood at RM ~ Mn at 2018 and witnessed massive growth at a CAGR of ~% due to the impact of Covid-19 pandemic. Out of total insurance market, online has very insignificant share standing at ~X%. The online insurance industry is still in the nascent stage and insurance market in Malaysia is also still in the growth stage, growing at a CAGR of ~XX%. The online market players have been segmented into three segments, online insurance and online aggregator's insurance providers. The major regulatory bodies are PIHM, Bank Negara Malaysia, PIAM among others managing the insurance industry and also managing the online insurance market. The major segments in insurance industry are General Insurance, General Takaful, Life Insurance and Family Takaful.

The market for both online captive players and online aggregators is concentrated among very limited number of players. The top 4 players in the captive segment covers more than three fourth of the total market share in terms of gross direct premiums. While in case of online insurance aggregators, the top two players owing majority of the market. The government's policy of insuring the uninsured has progressively pushed insurance penetration in Malaysia and led to a proliferation of insurance schemes.

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ4

Malaysia Online Insurance Industry Segmentation Basis Gross Premium

Insurance market segmentation Product Type (Life Insurance, Family Takaful, General Takaful, General Insurance)

Online Insurance Industry in Malaysia can be segmented based on Product Type: Life Insurance, Family Takaful, General Takaful, and General Insurance where General Insurance accounting for highest share at XX% as compared to Life Insurance, Family Takaful and General Takaful on the basis of revenue generated in the year 2022. General insurance increased acceptance for online registrations, and expected to dominate the online insurance market in Malaysia owing to increased focus of companies on sales of motor, travel, personal accident, etc.

General Insurance segmentation by product type (Personal accident, Employers' liability, Motor Insurance, and Medical & Health)

General insurance industry in market can be segmented basis on product type: Personal accident, Employers' liability, Motor Insurance, and Medical & Health where Motor Insurance has the highest share-acquiring majority of the market share at ~XX% as compared to Personal accident, Medical & Health and employer's liability. Motor Insurance, constitutes majority of market due to increased registrations, awareness of online insurance, less dependency on agents system when compared to life insurance where an agent model is preferred.

By Gross direct premium (Aggregators, Company owned website, and financial advisors)

Online Insurance Industry in Malaysia can be segmented based on Premiums: Aggregators, Company owned website, and financial advisors where financial advisors accounting for majority share at XX% as compared to others on the basis of Gross direct premium in the year 2021.

Insurance market segmentation based regional split (Penang, Klang Valley & Selangor and Johor)

Online Insurance Industry in Malaysia can be segmented based on regions: Penang, Klang Valley & Selangor and Johor where Klang Valley & Selangor accounting for majority of the market share at XX% as compared to Penang and Johor on the basis of revenue generated in the year 2021. Klang Valley has the highest urban working population in Malaysia, which forms the majority of insurance buyers. Majority of the companies are headquartered in Kuala Lumpur leading to an increased accessibility.

Malaysia Online Insurance Industry Covid Impact

Malaysia online insurance industry has seen double digit growth at the CAGR of XX% since 2019. The pandemic experience has increased consumer awareness of the need for risk protection, in particular for healthcare. Recent trends reveal that people prioritize insurance post COVID-19 and that they prefer moving their purchase journey online. ReMark's survey showed that online sales have boomed in Malaysia with more than twice as many purchases via contactless channels in 2020 (26.9%) than in 2019 (12.5%), and it's unsurprisingly the youth who are leading the charge, given their interest in life and medical products and comfort in using automated technology have both increased.

While sales of health insurance picked up, travel insurance suffered due to various countries' imposition of travel bans and the public's general reluctance to engage in non-essential travel.

URUS was a holistic assistance package to assist vulnerable borrowers impacted by COVID-19 who continued to experience cash flow difficulties. It offered repayment assistance and development support, including personalized financial plans, financial education programs and avenues to supplement incomes and obtain other development support via referrals to AKPK's Social Synergy Network.

Comparative Landscape In Malaysia Online Insurance Market

Competition is observed to be concentrated in the Malaysia Online Insurance Market with majority of market being acquired by two or three largest players. The comparison has been built on multiple factors which includes monthly and daily active users, financial parameters, company information, different models among others.

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ4

Malaysia Online Insurance Market Future Outlook And Projections

Malaysia online insurance market is expected to expand with a double digit CAGR at XX% in between 2021 and 2026 on the basis of Gross Direct Premium. It is anticipated that Malaysia online insurance market will grow owing to factors such as increased government focus, technological developments, development of Aggregators and increased convenience. The market will pick up for both Motor and Non-Motor Insurance. After the pandemic, it is being forecasted that technology, in the form of automation and personalization, will dominate the insurance landscape, prompting Insurtech players to further diversify their products and services, and forcing incumbent Insurance Companies to adapt to technological advancements. General Insurance will dominate the Online Insurance Market in Malaysia owing to the increased focus of companies on sales of motor, travel, personal accident, etc. online. Companies are developing these categories at present.

Key Segments Covered in Malaysia Online Insurance Industry

Malaysia Online Insurance Market

By Product type of Insurance basis Gross Premium

Life Insurance

Family Takaful

General Takaful

General Insurance

By Product type of General Insurance basis Gross Premium

Motor Insuranc

Medical & Health

Employer's liability

Personal accident

By Type of Entity basis Gross Premium

Captive Players

Aggregator Players

Financial Advisors

By Region basis Gross Premium

Penang

Johar

Klang Valley & Selangor

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ4

Key Target Audience

Insurance players

Online Insurance Captive players

Online Insurance Aggregators players

Insurance Technology provider

Insurance users

New Entrant in Online Insurance space

Associated or affiliated Banks with Insurance entities

Regulatory Bodies for Insurance entities

Time Period Captured in the Report:

Historical Period: 2016-2021

Forecast Period: 2022-2026F

Companies Covered:

Online Insurane Aggregators

Policy Street

Bjak

Qoala

Online Insurance Captive Players

Liberty Insurance

Axa Affin Insurance

eTiQa Insurance

AIA Malaysia

Takaful Ikhlas

Tune Insurance

Zurich Insurance

Chubb Insurance

Allanz Malaysia Berhad

FWD Takaful

For more insights on the market intelligence, refer to the link below:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/malaysia-online-insurance-market-outlook-to-2026/596048-93.html

Related Reports By Ken Research:-

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/singapore-online-insurance-market-outlook-to-2026/596138-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-online-insurance-market-outlook-to-2027/596005-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/uae-online-insurance-industry-outlook-to-2024/335274-93.html

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

We currently cater to 300+ sectors with 150,000+ research repository across 196+ countries serving 1000+ clients and have partnered with almost 25+ content aggregators.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Malaysia Online Insurance Market Growth, Trends, Developments and Outlook to 2026F: Ken Research here

News-ID: 2822808 • Views: …

More Releases from Ken Research Pvt .Ltd

Indonesia Industrial Air Filtration Market Surpasses USD 1.1 Billion Milestone - …

Comprehensive market analysis maps compliance-led growth trajectory, industrial expansion hotspots, technology evolution, and strategic imperatives for stakeholders across Indonesia's rapidly industrializing manufacturing ecosystem.

Delhi, India - February 12, 2026 - Ken Research released its strategic market analysis titled "Indonesia Industrial Air Filtration Market Outlook to 2030," revealing that the current market size is valued at USD 1.1 billion, based on a five-year historical analysis. The detailed study outlines how the market…

Ken Research Stated Nigeria Solar Home Systems and Pay-Go Energy Market to Reach …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Nigeria's rapidly evolving off-grid energy ecosystem.

Delhi, India - October 2025 - Ken Research released its strategic market analysis titled "Nigeria Solar Home Systems and Pay-Go Energy Market," revealing that the current market size is valued at USD 1.1 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Ken Research Stated Philippines' Death Care Market to Reached USD 1.0 Billion

Comprehensive market analysis maps evolving consumer preferences, regulatory shifts, and expansion opportunities shaping the country's organized death care ecosystem.

Delhi, India - February 11, 2026 - Ken Research released its strategic market analysis titled "Philippines Death Care Market", revealing that the current market size is valued at USD 1.0 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven by rising urbanization,…

Philippines Curtain Wall Market Surpasses USD 1.3 billion Milestone - Latest Ins …

Comprehensive market analysis maps strong construction-led growth trajectory, competitive dynamics, and strategic imperatives for façade system manufacturers, developers, EPC firms, and investors across the country's evolving commercial and residential skyline.

Delhi, India - February 11, 2026 - Ken Research released its strategic market analysis titled "Philippines Curtain Wall Market Outlook to 2032," revealing that the current market size is valued at USD 1.3 billion, based on a five-year historical analysis. The…

More Releases for Insuranc

Burial Insurance Market Hits New High | Major Giants nited of Omaha, Fidelity Li …

HTF MI recently introduced Global Burial Insurance Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Gerber Life, Mutual of Omaha, Colonial Penn, Globe Life, AARP, Foresters Financial, MetLife,…

Empowering Growth: Kidnap for Ransom and Ransom Insuranc Market 2024 and Industr …

Kidnap for Ransom and Ransom Insuranc Market Overview

Kidnap for ransom and ransom insurance is evolving in response to the escalating threat of kidnapping and extortion in high-risk regions around the world. Kidnap for ransom insurance provides financial protection to individuals, families, and businesses against the financial consequences of ransom demands, extortion, and related expenses such as crisis management and legal fees. With geopolitical instability, organized crime, and terrorism posing significant…

Takaful Insurance Market : Top 10 Players are ABU DHABI NATIONAL TAKAFUL CO., AL …

Global Takaful Insurance Market Size, Share, and Industry Forecast, 2021-2030 . The global takaful insurance market study evaluates the market reach, revenue potential, and industry growth while keeping track of the current regional trends. All information in the takaful insurance market is gathered from trustworthy sources and is meticulously examined and validated by industry professionals. According to research report by Allied Market Research, the global takaful insurance market was valued…

Personal Accident and Health Insurance Market to See Huge Growth by 2025 | Allia …

A new research document is added in HTF MI database of 200 pages, titled as 'Global Personal Accident and Health Insurance Market Size study with COVID-19 impact, by Type (Personal Accident Insurance, Health Insurance), by Application (Direct Marketing, Bancassurance, Agencies, E-commerce, Brokers) and Regional Forecasts 2020-2026' with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, South America, Europe, Asia-Pacific…

Demographic Trends in Insurance Market Report- Detailed Analysis Report with Lea …

The research reports on Demographic Trends in Insurance Market report gives detailed overview of factors that affect global business scope. Demographic Trends in Insurance Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. Demographic Trends in Insurance Market report contains emerging players analyze data including competitive situations, sales, revenue and…

Accident Insurance Industry in US Forecast to 2019-2025 Profiling Allianz, AXA, …

The Global Accident Insurance Industry Research Report includes companies engaged in manufacturing, capacity, production, price, cost, revenue and contact information.

The report provides key statistics on the market status of the Accident Insurance manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

Get Free Sample Copy of Accident Insurance market 2019-25 at: https://www.inforgrowth.com/samplerequest/r/949749/global-accident-insurance-market-size-status-a

Complete report on Accident Insurance market spreads across 106 pages…