Press release

Anti-Money Laundering (AML) Market Expected to Grow at 15% CAGR by 2030, Top Drivers and Opportunities Analysis - Nice Actimize, ACI Worldwide, FICO, SAS Institute, Oracle Corporation, Fiserv, FIS, Dixtior

Market InsightsIn terms of escalating financial crime concerns and the expanding scope of regulatory requirements, 2021 was a hard year for the financial industry. As a result, regulatory organizations focused on Anti-Money Laundering (AML) compliance and how to make it stricter to provide improved monitoring, detection, prevention, and eradication of money laundering and terrorism funding activities. This trend in compliance appears to be continuing in 2022, with more stringent regulatory updates to encompass as many new industries as possible that may be exposed to financial crimes, such as the cryptocurrency space. As a result, financial institutions must ensure that they are in compliance with the rapidly changing regulatory landscape and take safeguards ahead of time. This is pushing the need for the AML software markets.

The AML market is anticipated to grow with over a CAGR of 15% from 2022 to 2027. This growth can be majorly attributed to rising standards of regulations and compliances along with the increasing number of financial institutes, especially FinTechs. Further, the need for inhibiting cryptocurrency money laundering, and the rising demand and adoption of ai/ ml for AML are shaping long-term million dollars market opportunities for AML vendors.

Get a Sample Report (including Charts, Infographics, and Figures) @ https://nforming.com/publications/anti-money-laundering-aml-market/#tab-form

Anti-Money Laundering (AML) Market's Major Drivers

Higher Regulatory Compliances Pushing Demand for AML Software and Services from Banks

The amount of money laundered globally in a single year is estimated to be 2 - 5% of global GDP, or $800 billion - $2 trillion in current US dollars. To address this issue, governments and regulators all over the world have developed legislation and guidelines that have evolved. Regulators expect banks to have a unified view of their customers and their transactions across organizations and jurisdictions to identify odd transactions and behavior, as well as potential sanctions violations. Besides investing huge sums of money in systems and people, banks must adopt a broader and longer-term perspective. Due to this, banks and financial institutions (FIs) are struggling to meet multi-jurisdictional anti-money laundering (AML) compliance obligations, as well as an ever-increasing clients due to diligence requirements.

According to Kroll LLC, most of the all-major global banks have been sanctioned for AML or other financial crime failures in recent years. In addition, the number of money laundering fines issued rose to 55 in 2021 from 45 in 2020. This reflects the predominant emphasis that global regulators have placed on ensuring that AML measures are robustly functioning at the world's major financial services institutions. More, regulators are now focusing their enforcement efforts on other financial services companies, such as asset managers and cryptocurrency exchanges. Thus, the demand for AML software and services from banks and financial institutes (Fis) is surging sharply in the short term.

To Know More, Visit Our Blog @ https://nforming.com/blog/finance-and-banking/anti-money-laundering-aml-market-top-drivers-and-opportunities-by-2027/

Growing Number of FinTech to Increase the Demand for AML

Technological advancements in the financial industry have introduced new money laundering risks, particularly in relation to the growing use of mobile devices, increasing the rate and impact of money laundering crimes. With transactions taking place online via apps or the web, regulatory authorities across the countries are concerned about how new technology can be used by criminals for money laundering and other illegal conduct. Most fintech companies, like any other financial institution or business, are subject to AML regulations. Failure to report suspicious transactions is a criminal offense in most countries and can result in a jail sentence as well as penalties. This is harmful to fintech companies since it will reduce their market share and uptake, as well as lead to a negative profile. Thus, every fintech is expected to adopt the AML systems to adhere to strict legal regulations and compliances.

TO UNDERSTAND HOW COVID-19 IMPACT IS COVERED IN THIS REPORT, PLEASE VISIT@ https://nforming.com/publications/anti-money-laundering-aml-market/

Upcoming Opportunities in Anti-Money Laundering (AML) Market

Need for Inhibiting Cryptocurrency Money Laundering

Cybercriminals who trade in cryptocurrencies all have the aim to transfer their stolen monies to a site where they can be kept safe from authorities and eventually converted to cash. As a result, money laundering serves as the foundation for all other sorts of cryptocurrency-based criminality.

Further, cryptocurrencies, such as Bitcoin, can make it simpler for criminals to conceal the source of criminal gains and transport them across borders undetected. According to recent studies, the use of cryptocurrency for money laundering is fast gaining acceptability throughout the world.

Since 2017, cybercriminals have laundered nearly $33 billion in cryptocurrencies, with the majority of the total flowing through controlled exchanges. Money laundering accounted for around 0.05 percent of total cryptocurrency transaction volume in 2021. In 2021, cybercriminals laundered $8.6 billion in cryptocurrencies by sending it from unlawful addresses to addresses hosted by services.

More, money laundering activity is best seen at the deposit address level rather than at the service level. The reason for this is that many of the money laundering services used by cybercriminals are nested services, which means they employ addresses hosted by bigger services to access the liquidity and trading pairs of those larger services. OTC brokers, for example, frequently operate as nested services with addresses maintained by big exchanges.

Major Market Players Covered in The Anti-Money Laundering (AML) Market Are:

A few of the major competitors currently working in the global Anti-Money Laundering (AML) market are Nice Actimize, ACI Worldwide, FICO, SAS Institute, Oracle Corporation, Fiserv, FIS, Dixtior, and Other Companies.

Global Anti-Money Laundering (AML) Market Segments

By Offering

Solution

o Know Your Customer (KYC)/Due Diligence

o Transaction Screening and Monitoring

o Case Management

o Regulatory Reporting

Services

o Professional Services

o Managed Services

By Deployment Mode

o Cloud

o On-Premises

By Organization Size

o Small & Medium Sized Enterprises

o Large Enterprises

By End Users

o Banking & Financial Institutions

o Insurance Providers

o Others

Get More Publication Like This @ https://nforming.com/publications-cat/e-reports/

Based on regions, the Anti-Money Laundering (AML) Market is classified into North America, Europe, Asia- Pacific, Middle East & Africa, and Latin America

Middle East and Africa (GCC Countries and Egypt)

North America (United States, Mexico, and Canada)

South America (Brazil, Argentina, etc.)

Europe (Turkey, Germany, Russia UK, Italy, France, etc.)

Asia-Pacific (Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia)

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

Contact Us:

nForming Solutions.

India - +91-8080557298

US - +1-973-937-7675

Mail: nfo@nforming.com

Customization of the Report:

nForming Solutions also provides customization options to tailor the reports as per client requirements. This report can be personalized to cater to your research needs. Feel free to contact our sales team, who will ensure that you get a report per your needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering (AML) Market Expected to Grow at 15% CAGR by 2030, Top Drivers and Opportunities Analysis - Nice Actimize, ACI Worldwide, FICO, SAS Institute, Oracle Corporation, Fiserv, FIS, Dixtior here

News-ID: 2820656 • Views: …

More Releases from nforming Solutions

Mental Health Market to Grow $570B by 2030 From $415B in 2023

Mental Health Market Perspective

According to an opinion from key industry experts Mental Health Market revenue is expected to attain $ 570 billion at a high CAGR of 4.11% from 2023 to 2030. In 2022, the Mental Health Market was estimated at $ 415 billion.

Personalized mental health care (PMC) is a relatively new field, but it is growing rapidly. Patients are increasingly demanding personalized care, and this is driving the growth…

Payment as a Service Market will Grow to US$ 52.54 Billion by 2030| Easy-To-Use …

Industry Perspective:

The global payment as a service market size was worth USD 10.06 billion in 2022 and is estimated to grow to USD 52.54 billion by 2030, with a compound annual growth rate (CAGR) of approximately 22.95% over the forecast period. The report analyzes the payment as a service market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in…

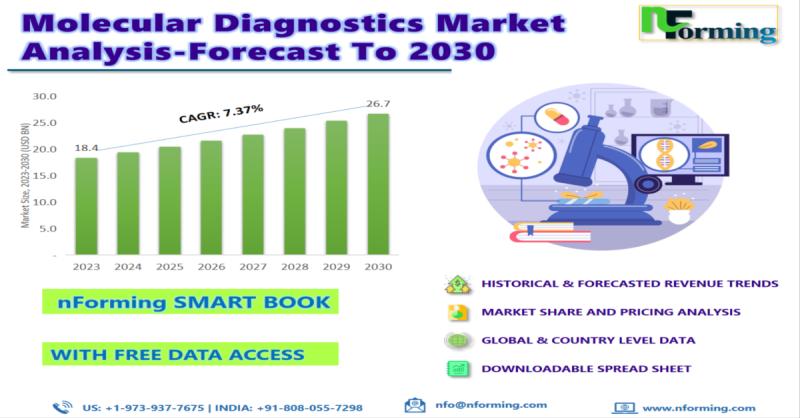

Molecular Diagnostics Market Expected to Reach $39.42 Billion Globally by 2030 w …

Molecular Diagnostics Market Industry Perspective:

The global molecular diagnostics market was worth USD 22.32 billion in 2022 and is estimated to grow to USD 39.42 billion by 2030, with a compound annual growth rate (CAGR) of approximately 7.37% over the forecast period. The report analyzes the molecular diagnostics market's drivers, restraints, and challenges and the effect they have on the demands during the projection period. In addition, the report explores emerging…

Global Healthcare Distribution Market Expected to Attain 1525.5 billion by 2030

Healthcare Distribution Market Definition

Global healthcare distribution market sales are expected to be worth $950 billion by 2023. This revenue will further grow at a CAGR of 7.0% from 2023 to reach $1,525.5 billion in 2030.

The healthcare distribution industry encompasses the economic sector that assumes responsibility for the efficient distribution of healthcare products and services. The investment in healthcare is being driven by various factors such as the growing demand for…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…