Press release

Digital Insurance Platform Market Business Growth Analysis 2022 Future Trends, CAGR of 13.7%, Upcoming Demand, Opportunities and Challenges, Competitive Scenario and Share Forecast to 2029

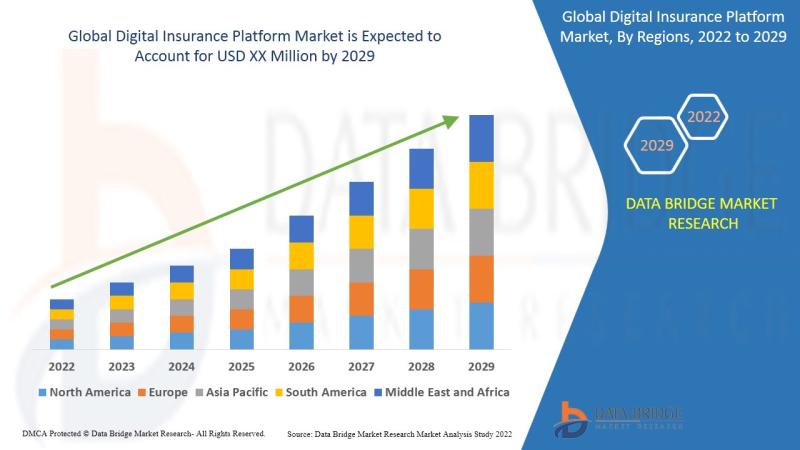

Data Bridge Market Research completed a qualitative study titled "Digital Insurance Platform Market" with 100+ market data tables, pie charts, graphs, and figures spread across Pages and an easy-to-grasp full analysis. This Digital Insurance Platform market report considers various factors that have a direct or indirect effect on the development of the business which includes historic data, present market trends, environment, technological innovation, upcoming technologies, and the technical progress in the Digital Insurance Platform industry. Important industry trends, market size, and market share are analyzed and discussed in detail in this Digital Insurance Platform market research report. By understanding the minds of target markets, attitudes, feelings, beliefs, and value systems, this market research report has been prepared. The report makes you visualize what the Digital Insurance Platform industry is doing which lends more credibility and trust.Data Bridge Market Research analyses that the digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

Get a Sample PDF of Digital Insurance Platform Market Research Report@ https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-insurance-platform-market

Digital Insurance Platform Market Analysis:

The digital insurance platform market is being driven by the rising adoption of IoT products. The upsurge in the adoption rate of underwater acoustic modems in naval defense is a major factor driving the market's growth. The changing insurer's focus from product-based to consumer-centric strategies is driving up demand for digital insurance platform equipment market. Other significant factors such as rising awareness amongst insurers towards digital channels, and technological advancement will cushion the growth rate of digital insurance platform market. Furthermore, upsurge in the adoption rate of cloud-based digital solutions by the insurers to obtain the high scalability will accelerate the growth rate of digital insurance platform market for the forecast period mentioned above.

Moreover, increasing awareness amongst insurers to access a broader segment of the market and emerging new markets will boost the beneficial opportunities for the digital insurance platform market growth.

However, difficulties involved in the integration of insurance platforms with legacy systems will act as major retrain and further impede the market's growth. The dearth of skilled workforce will challenge the growth of the digital insurance platform market.

List of the leading companies operating in the Digital Insurance Platform Market includes:

Appian Corporation

Cognizant Technology Solutions Corporation

Duck Creek Technologies

DXC Technology Company

EIS Group Inc.

IBM Corporation

Infosys Limited

Majesco

Microsoft Corporation

Mindtree Ltd.

Oracle Corporation

Pegasystems Inc.

Prima Solutions SA

SAP SE

Tata Consultancy Services Limited

Access Full Report@ https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

This Digital Insurance Platform Market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the Digital Insurance Platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

The report provides insights on the following pointers:

Market Penetration: Comprehensive information on the product portfolios of the top players in the Digital Insurance Platform market

Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the market

Competitive Assessment: In-depth assessment of the market strategies, and geographic and business segments of the leading players in the market

Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Digital Insurance Platform Market

Digital Insurance Platform Market Segmentation:

Component:

Tools

Services

End-User:

Insurance Companies

Third-Party Administrators and Brokers

Aggregators

Insurance Application:

Automotive and Transportation

Home and Commercial Buildings

Life and Health

Business and Enterprise

Consumer Electronics and Industrial Machines

Travel

Deployment Type:

On-Premises

Cloud

Organization Size:

Large Enterprises

Small and Medium-Sized Enterprises

Consider Data Bridge Market Research for this Report which would Help Impact Your Revenues Positively

This Digital Insurance Platform research offers the latest product news, trends, and updates from the industry's leading players who have leveraged their market position.

It also offers strategic plans and standards to arrive at informed business decisions adopted by the main players, thereby advocating your go to market strategies.

In addition, it offers insights into the dynamics of customer behaviour that can help the organization better curate market strategies

Usage of exclusive tailor-made tools along with primary research, secondary research and our in-house data model helps us in extracting the exact market numbers

Mapping the customer in 3P grid comprising of Purpose, Planning and Positioning, thereby delivering a solution by keeping the prospecting client at the sweet spot

The market research report includes all of the market's valuable elements, such as sales growth, product pricing & analysis, growth opportunities, and recommendations for addressing market challenges

The report covers all the primary mergers & acquisitions, alliances, and collaborations that have generated additional opportunities for market players or in some cases, challenges

To Gain More Insights into the Market Analysis, Browse Summary of the Digital Insurance Platform Market Report@ https://www.databridgemarketresearch.com/reports/global-digital-insurance-platform-market

Digital Insurance Platform Market Country Level Analysis

The countries covered in the Digital Insurance Platform market report are South Africa, Saudi Arabia, U.A.E., Egypt, Israel, the Rest of Middle East and Africa, U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Russia, Netherlands, Belgium, Switzerland, Turkey, Rest of Europe, China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific, Brazil, Argentina and Rest of South America. North America dominates globally due to rising demand for advanced technologies and software design and development.

North America dominates the digital insurance platform market and will continue to flourish its trend of dominance during the forecast period due to the high concentration of large insurance companies in this region. Asia-Pacific is expected to grow during the forecast period of 2022-2029 due to the rise in the level of commercial investment by various industries.

The country section of the report also provides individual market-impacting factors and market regulation changes that impact the market's current and future trends. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Make an Enquiry before Buying@ https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-digital-insurance-platform-market

Digital Insurance Platform Market Report Answers the Following Questions:

How much revenue will the Digital Insurance Platform market generate by the end of the forecast period?

Which market segment is expected to have the maximum market share?

What are the influencing factors and their impact on the Digital Insurance Platform market?

Which regions are currently contributing the maximum share of the overall Digital Insurance Platform market?

What indicators are likely to stimulate the Digital Insurance Platform market?

What are the main strategies of the major players in the Digital Insurance Platform market to expand their geographic presence?

What are the main advances in the Digital Insurance Platform market?

How do regulatory standards affect the Digital Insurance Platform market?

Table of Content: Global Digital Insurance Platform Market

1 Introduction

2 Market Segmentation

3 Executive Summary

4 Premium Insights

5 Market Overview

6 Global Digital Insurance Platform Market, Component

7 Global Digital Insurance Platform Market, End-User

8 Global Digital Insurance Platform Market, Insurance Application

9 Global Digital Insurance Platform Market, Deployment Type

10 Global Digital Insurance Platform Market Organization Size

10 Global Digital Insurance Platform Market, By Region

11 Global Digital Insurance Platform Market, Company Landscape

12 SWOT Analysis

13 Company Profile

14 Questionnaire

15 Related Reports

New Business Strategies, Challenges & Policies are mentioned in Table of Content, Request TOC@ https://www.databridgemarketresearch.com/toc/?dbmr=global-digital-insurance-platform-market

Browse Related Reports:

https://business1dotcom.wordpress.com/2022/10/25/bow-and-stern-thrusters-market-size-growth-8-20-industry-analysis-trends-major-players-and-forecast-2022-2029-lewmar-limited-zf-friedrichshafen-ag-dutch-thruster-group-bv/

https://business1dotcom.wordpress.com/2022/10/25/blu-ray-players-market-size-growth-15-10-industry-analysis-trends-major-players-and-forecast-2022-2029-mahindra-boston-scientific-corporation-vmoto-limited-jiangsu-xinri-electric-vehicle-co/

https://business1dotcom.wordpress.com/2022/10/25/autonomous-underwater-vehicle-auv-market-size-growth-19-80-industry-analysis-trends-major-players-and-forecast-2022-2029-kongsberg-maritime-teledyne-marine-bluebird-marine-systems-ltd/

https://business1dotcom.wordpress.com/2022/10/25/automotive-lighting-actuators-market-size-growth-8-00-industry-analysis-trends-major-players-and-forecast-2022-2029-johnson-electric-holdings-limited-mitsubishi-electric-corporation-borgwarner/

US: +1 888 387 2818

UK: +44 208 089 1725

Hong Kong: +852 8192 7475

Email - corporatesales@databridgemarketresearch.com

Data Bridge Market Research Pvt Ltd is a multinational management consulting firm with offices in India and Canada. As an innovative and neoteric market analysis and advisory company with unmatched durability level and advanced approaches. We are committed to uncover the best consumer prospects and to foster useful knowledge for your company to succeed in the market.

Data Bridge Market Research is a result of sheer wisdom and practice that was conceived and built-in Pune in the year 2015. The company came into existence from the healthcare department with far fewer employees intending to cover the whole market while providing the best class analysis. Later, the company widened its departments, as well as expands their reach by opening a new office in Gurugram location in the year 2018, where a team of highly qualified personnel joins hands for the growth of the company. "Even in the tough times of COVID-19 where the Virus slowed down everything around the world, the dedicated Team of Data Bridge Market Research worked round the clock to provide quality and support to our client base, which also tells about the excellence in our sleeve."

Data Bridge Market Research has over 500 analysts working in different industries. We have catered more than 40% of the fortune 500 companies globally and have a network of more than 5000+ clientele around the globe. Our coverage of industries includes

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Insurance Platform Market Business Growth Analysis 2022 Future Trends, CAGR of 13.7%, Upcoming Demand, Opportunities and Challenges, Competitive Scenario and Share Forecast to 2029 here

News-ID: 2818662 • Views: …

More Releases from Data Bridge Market Research

Fire Resistant Glass Market Advances with Intumescent Coatings, Hybrid Laminates …

Fire resistant glass market is growing at a high CAGR during the forecast period 2024-2031.

Fire Resistant Glass Market is positioned for robust growth, and shifting market dynamics reshaping the competitive landscape. DataM Intelligence's new report provides data-driven insights, SWOT analysis, and marketing-ready intelligence for businesses seeking to improve market penetration and campaign ROI.

Get your exclusive sample report today: (corporate email gets priority access): https://datamintelligence.com/download-sample/fire-resistant-glass-market?vs

Fire Resistant Glass Market Overview &…

Rising Demand for Advanced Treatments to Propel Obliterative Bronchiolitis Marke …

The Obliterative Bronchiolitis Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Obliterative Bronchiolitis market forward, including increasing market share, dynamic segmentation,…

Medical-Social Working Services Market Industry Trends and Forecast to 2030

This Medical-Social Working Services Market report has been prepared by considering several fragments of the present and upcoming market scenario. The market insights gained through this market research analysis report facilitates more clear understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. It consists of most-detailed market segmentation, thorough analysis of major market players, trends in consumer and…

Global Marine Insurance Market to Grow at 4.50% CAGR, Reaching USD 39.87 Billion …

The Marine Insurance Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Marine Insurance market forward, including increasing market share, dynamic segmentation,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…