Press release

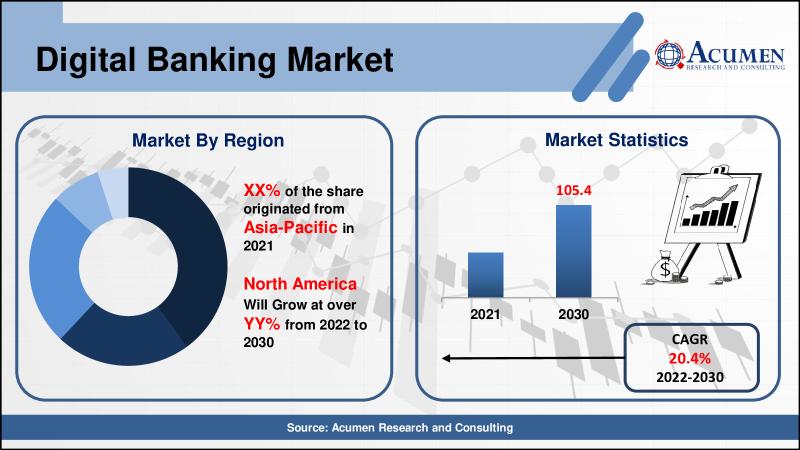

Digital Banking Market to reach USD 105.4 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario

The most recent study offered by Acumen Research and Consulting focuses Digital Banking Market size, share, growth rate, and market trends, as well as the parameters and factors influencing it in both the long term and short term. The report investigates the Digital Banking Market trends in order to assess its current and future potential. Our Digital Banking Market analysis also provides market participants and new entrants with a comprehensive view of the market landscape. This report provides an analytical examination of the major challenges that may emerge in the market in terms of Digital Banking Market revenue, sales, export, or import.Key Highlights of the Report

• Digital Banking Market achieved a value of USD 105.4 Billion by 2030 with a more than 20.4% CAGR.

• Asia-Pacific region accounted for a significant market share, whereas North America region is anticipated to register a considerable CAGR

• Digital Banking Market is driven by factors such as product/service innovation, key players mergers and acquisitions, and favorable regulatory support

• Qualitative insights on Digital Banking Market such as Value Chain Analysis, Porter's Five Forces Analysis, Regulatory Compliance Details, and Manufacturing Footprint Analysis

• Overview of key players and strategies adopted in order to get a competitive edge

The report is a valuable resource for investors, shareholders, industry planners, and established and existing Digital Banking Market players looking to expand their reach in the current Digital Banking Market landscape. The report thoughtfully considers the global Digital Banking Market analysis, even as it targets leading firms and their corporate strategies, market presence, operational segments, aggressive panorama, geographical expansion, and pricing and value structures.

Download Sample Report Copy From Here: https://www.acumenresearchandconsulting.com/request-sample/1086

Our comprehensive Digital Banking Market analysis contains both qualitative and quantitative market information, making it an essential document to obtain. It enables clients all over the world to gain knowledge about the rapidly expanding Digital Banking Market growth, including all of the ups and downs detailed in the report. In addition, our analysts have included a chapter on the Covid-19 crisis, which has had a significant impact on market growth. Furthermore, we provide a meta-analysis and systematic data review of the market based on global manufacturers and regions in the report. Furthermore, our analysts classify market hidden opportunities with a global rising CAGR for Digital Banking Market forecast until 2030.

Reasons to Acquire Our Detailed Market Report

• Analyze numerous Digital Banking Market outlook using Porter's five forces analysis

• Digital Banking Market growth rate and shares of various product types and applications/end-users

• Digital Banking Market analysis by region

• Covid-19 Impact Analysis using a thorough research approach

• Recognize the most recent developments, Digital Banking Market shares, and key market players' policies.

• In-depth valuation of the market's top players' market strategies, geographic footprints, and Digital Banking Market business segments

• Estimate the key issues, product developments, and solutions that will have an impact on the progress threat

Customization Request: https://www.acumenresearchandconsulting.com/request-customization/1086

Research Methodology

The Digital Banking Market outlook has been assessed using both primary as well as secondary research techniques. This report is based on in-depth qualitative and quantitative analyses that help us validate the exact Digital Banking Market value. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The report also offers the size of Digital Banking Market forecast from 2022 to 2030 which is identified through secondary research and their revenues have also been discussed in the following report. The data is then validated and verified through the primary sources.

This report contains concise and accurate data on the Digital Banking Market size, which is updated as global markets change. The markets have changed dramatically over time, making it a difficult task to assess the market scope and situation. As a result, our analysts at Acumen Research and Consulting have evaluated the current market situation and provided a detailed account of it to help you comprehend the competition and scope of the Digital Banking Market value in a considerably effective manner.

Digital Banking Market Regional Analysis and Countries Level Analysis

Digital Banking Market regional analysis is a highly comprehensive part of the research presented in the report. This section sheds light on the sales growth of different regional and country-level Digital Banking Market shares. It provides in-depth and precise country-wise Digital Banking Market growth rate, value/volume analysis, and region-wise market size information of the global market.

Digital Banking Market Players mentioned in this report

The report details an overall study on the Digital Banking Market companies and also enlightens those players' yearly revenue, SWOT analysis, product/service specifications, market positioning, company shares, recent developments, and business strategies. Additionally, the report details the mergers and acquisitions currently in place in the Digital Banking Market. The report illustrates an elaborative account of the competitive landscape of the global market. These factors are essential in decision making and hence will assist the client in making a well-informed decision.

Digital Banking Market Players as below:

Some of the key players include Backbase, BNY Mellon, Fiserv, Halcom, Appway, ebanklT, Crealogix, ETRONIKA, Fidor, Finastra, Intellect Design Arena, Oracle, IE Digital, Kony, NETinfo, EdgeVerve Systems, NF Innova, SAB, TCS, Temenos, Technisys, and Worldline.

The major market segments of Digital Banking Market are as below:

Digital Banking Market, By Type

• Retail Banking

• Corporate Banking

• Investment Banking

Digital Banking Market, By Service

• Transactional Services

• Non-Transactional Services

Digital Banking Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Latin America

• Mexico

• Brazil

• Rest of Latin America

Asia-Pacific

• India

• Japan

• China

• Australia

• South Korea

• Rest of Asia-Pacific

The Middle East & Africa (MEA)

• Gulf Cooperation Council (GCC)

• South Africa

• Rest of the Middle East & Africa

Customization of the Report

The report can be well customized for all types of approaches to ensure the flexibility of workflow without interfering with your preferred work approach. The client can contact our sales team who will ensure that the report meets your specifications and needs.

Some Key Questions Answered in this Report are

• What is the size of the Digital Banking Market in 2021, and how much will it be worth by 2030?

• What is the current global market scenario for Digital Banking Market?

• What are the best business strategies for maximizing growth potential?

• What are the recent Digital Banking Market trends?

• What is the market share in terms of Digital Banking Market revenue, sales, and size in specific geographical regions?

• Who are the key industry players in the Digital Banking Market?

• Which Digital Banking Market segment is in high demand?

Ask Query Here: richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

Table Of Contents@ https://www.acumenresearchandconsulting.com/table-of-content/digital-banking-market

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/1086

Browse Our More Press Releases: https://www.acumenresearchandconsulting.com/press-releases

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Market to reach USD 105.4 Billion - Risk-adjusted numbers with COVID-19 analysis change scenario here

News-ID: 2814741 • Views: …

More Releases from Acumen Research and Consulting

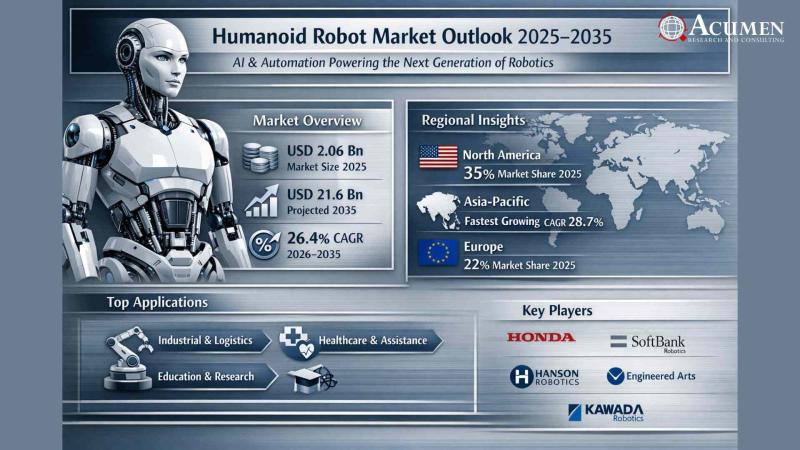

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

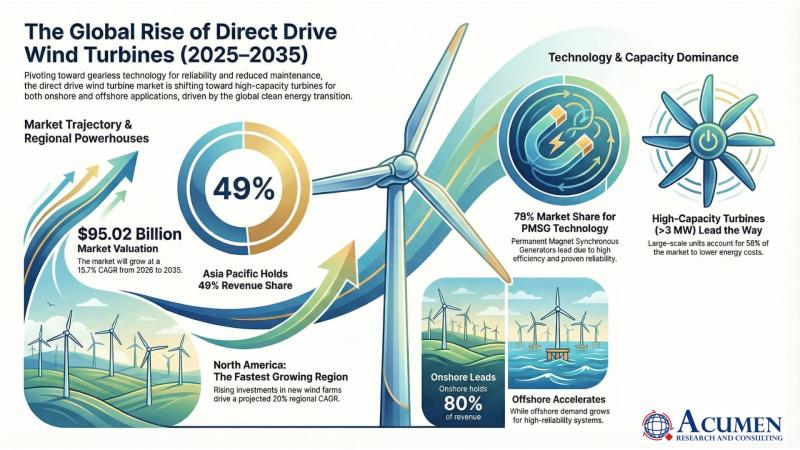

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…