Press release

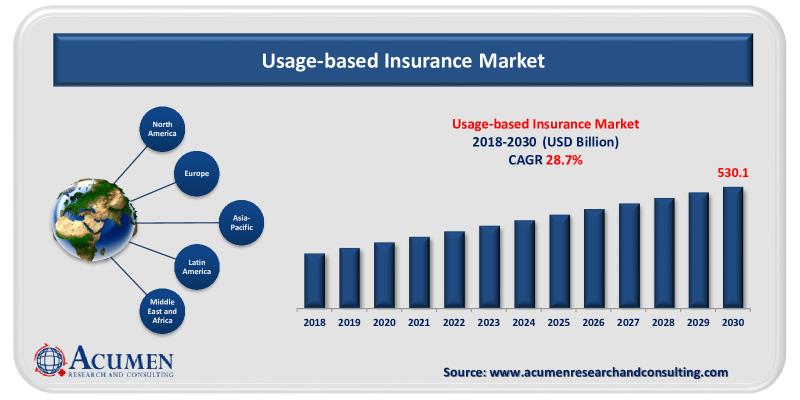

Usage-based Insurance Market value is set to grow by USD 530.1 Billion from 2022 to 2030

The most recent study offered by Acumen Research and Consulting focuses Usage-based Insurance Market size, share, growth rate, and market trends, as well as the parameters and factors influencing it in both the long term and short term. The report investigates the Usage-based Insurance Market trends in order to assess its current and future potential. Our Usage-based Insurance Market analysis also provides market participants and new entrants with a comprehensive view of the market landscape. This report provides an analytical examination of the major challenges that may emerge in the market in terms of Usage-based Insurance Market revenue, sales, export, or import.Key Highlights of the Report

• Usage-based Insurance Market achieved a value of USD 530.1 Billion by 2030 with a more than 28.7% CAGR.

• North America region accounted for a significant market share, whereas Asia-Pacific region is anticipated to register a considerable CAGR

• Usage-based Insurance Market is driven by factors such as product/service innovation, key players mergers and acquisitions, and favorable regulatory support

• Qualitative insights on Usage-based Insurance Market such as Value Chain Analysis, Porter's Five Forces Analysis, Regulatory Compliance Details, and Manufacturing Footprint Analysis

• Overview of key players and strategies adopted in order to get a competitive edge

The report is a valuable resource for investors, shareholders, industry planners, and established and existing Usage-based Insurance Market players looking to expand their reach in the current Usage-based Insurance Market landscape. The report thoughtfully considers the global Usage-based Insurance Market analysis, even as it targets leading firms and their corporate strategies, market presence, operational segments, aggressive panorama, geographical expansion, and pricing and value structures.

Download Sample Report Copy From Here: https://www.acumenresearchandconsulting.com/request-sample/1369

Our comprehensive Usage-based Insurance Market analysis contains both qualitative and quantitative market information, making it an essential document to obtain. It enables clients all over the world to gain knowledge about the rapidly expanding Usage-based Insurance Market growth, including all of the ups and downs detailed in the report. In addition, our analysts have included a chapter on the Covid-19 crisis, which has had a significant impact on market growth. Furthermore, we provide a meta-analysis and systematic data review of the market based on global manufacturers and regions in the report. Furthermore, our analysts classify market hidden opportunities with a global rising CAGR for Usage-based Insurance Market forecast until 2030.

Reasons to Acquire Our Detailed Market Report

• Analyze numerous Usage-based Insurance Market outlook using Porter's five forces analysis

• Usage-based Insurance Market growth rate and shares of various product types and applications/end-users

• Usage-based Insurance Market analysis by region

• Covid-19 Impact Analysis using a thorough research approach

• Recognize the most recent developments, Usage-based Insurance Market shares, and key market players' policies.

• In-depth valuation of the market's top players' market strategies, geographic footprints, and Usage-based Insurance Market business segments

• Estimate the key issues, product developments, and solutions that will have an impact on the progress threat

Customization Request: https://www.acumenresearchandconsulting.com/request-customization/1369

Research Methodology

The Usage-based Insurance Market outlook has been assessed using both primary as well as secondary research techniques. This report is based on in-depth qualitative and quantitative analyses that help us validate the exact Usage-based Insurance Market value. The qualitative analysis involves primary interviews, surveys, and vendor briefings. The report also offers the size of Usage-based Insurance Market forecast from 2022 to 2030 which is identified through secondary research and their revenues have also been discussed in the following report. The data is then validated and verified through the primary sources.

This report contains concise and accurate data on the Usage-based Insurance Market size, which is updated as global markets change. The markets have changed dramatically over time, making it a difficult task to assess the market scope and situation. As a result, our analysts at Acumen Research and Consulting have evaluated the current market situation and provided a detailed account of it to help you comprehend the competition and scope of the Usage-based Insurance Market value in a considerably effective manner.

Usage-based Insurance Market Regional Analysis and Countries Level Analysis

Usage-based Insurance Market regional analysis is a highly comprehensive part of the research presented in the report. This section sheds light on the sales growth of different regional and country-level Usage-based Insurance Market shares. It provides in-depth and precise country-wise Usage-based Insurance Market growth rate, value/volume analysis, and region-wise market size information of the global market.

Usage-based Insurance Market Players mentioned in this report

The report details an overall study on the Usage-based Insurance Market companies and also enlightens those players' yearly revenue, SWOT analysis, product/service specifications, market positioning, company shares, recent developments, and business strategies. Additionally, the report details the mergers and acquisitions currently in place in the Usage-based Insurance Market. The report illustrates an elaborative account of the competitive landscape of the global market. These factors are essential in decision making and hence will assist the client in making a well-informed decision.

Usage-based Insurance Market Players as below:

Progressive, AllState Insurance Company, AXA, AA, Allianz, Uniqa, Generali, MAIF, Groupama, Aviva, Uniposai, Insure the Box, State Farm and Liberty Mutual are key players in the global UBI market.

The major market segments of Usage-based Insurance Market are as below:

Global Usage-based Insurance Market, By Policy Type

• MHYD

• PAYD

• PHYD

Global Usage-based Insurance Market, By Device Type

• OBD Dongle

• Black Box

• Smartphone

• Others

Global Usage-based Insurance Market, By Vehicle Type

• Commercial

• Passenger

Usage-based Insurance Market By Geography

North America

• U.S.

• Canada

Europe

• U.K.

• Germany

• France

• Spain

• Rest of Europe

Latin America

• Mexico

• Brazil

• Rest of Latin America

Asia-Pacific

• India

• Japan

• China

• Australia

• South Korea

• Rest of Asia-Pacific

The Middle East & Africa (MEA)

• Gulf Cooperation Council (GCC)

• South Africa

• Rest of the Middle East & Africa

Customization of the Report

The report can be well customized for all types of approaches to ensure the flexibility of workflow without interfering with your preferred work approach. The client can contact our sales team who will ensure that the report meets your specifications and needs.

Some Key Questions Answered in this Report are

• What is the size of the Usage-based Insurance Market in 2021, and how much will it be worth by 2030?

• What is the current global market scenario for Usage-based Insurance Market?

• What are the best business strategies for maximizing growth potential?

• What are the recent Usage-based Insurance Market trends?

• What is the market share in terms of Usage-based Insurance Market revenue, sales, and size in specific geographical regions?

• Who are the key industry players in the Usage-based Insurance Market?

• Which Usage-based Insurance Market segment is in high demand?

Ask Query Here: richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

Table Of Contents@ https://www.acumenresearchandconsulting.com/table-of-content/usage-based-insurance-market

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/1369

Browse Our More Press Releases: https://www.acumenresearchandconsulting.com/press-releases

Browse Our Press-Release:-

Usage-based Insurance Market https://www.globenewswire.com/news-release/2019/05/16/1826253/0/en/Usage-based-Insurance-Market-Size-to-Hit-US-190-Bn-by-2026.html

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Usage-based Insurance Market value is set to grow by USD 530.1 Billion from 2022 to 2030 here

News-ID: 2800222 • Views: …

More Releases from Acumen Research and Consulting

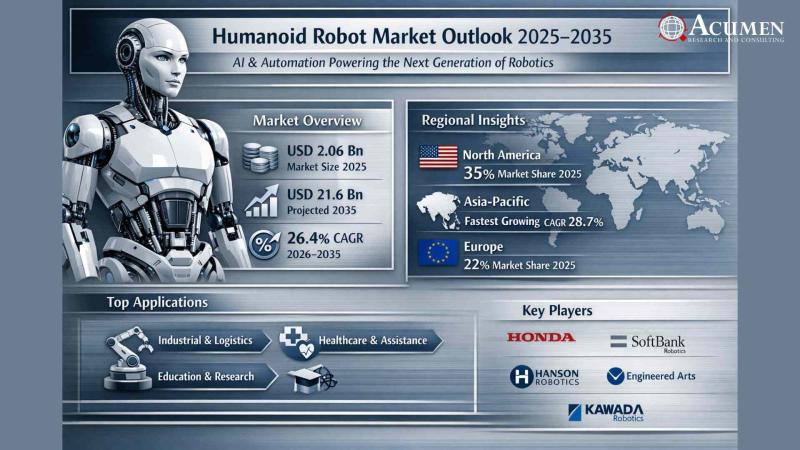

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

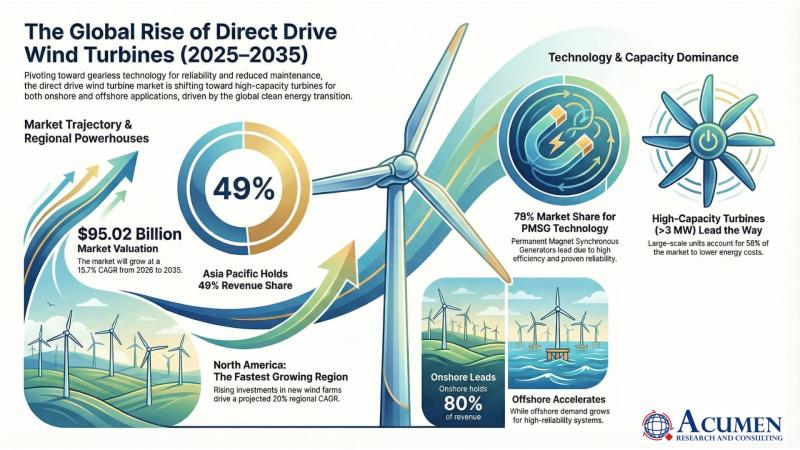

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…