Press release

Social Media Analytics Based Insurance Market New Pathways for Research and Innovation are Being Opened by Trends

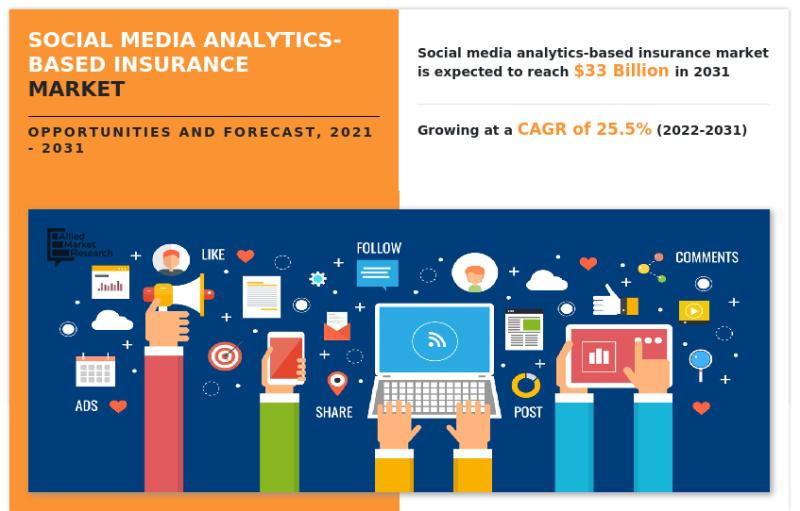

Allied Market Research published a report, "Social Media Analytics-Based Insurance Market by Component (Tools, Service), by Deployment Mode (On-Premise, Cloud), by Enterprise Size (Large Enterprise, Small and Medium-sized Enterprises (SMEs)), by Platforms (Facebook, LinkedIn, Twitter, Instagram, YouTube), by End User (Insurance Companies, Government Agencies, Third-party Administrators, Brokers and Consultancies): Global Opportunity Analysis and Industry Forecast, 2021-2031".As per the latest report, Over the next few years, the market will witness a major spike in CAGR. Technological innovations and increased disposable income would contribute significantly to market growth. The report offers a comprehensive study of major market players, key trends, and driving factors.

Grab Report Sample with Industry Insights@ https://www.alliedmarketresearch.com/request-sample/15129

The global Social Media Analytics Based Insurance Market market report includes detailed information regarding driving factors and opportunities that propel the market growth. Moreover, the report involves an analysis of challenges and restraining factors, which helps market entrants understand pitfalls in the industry. Technological advancements and a surge in demand are the prime reasons behind the market growth. The untapped potential in developing countries would open new opportunities in the coming years.

The market growth is analyzed using several strategic tools and methods. The SWOT analysis and Porter's Five analysis are offered in the report. These tools offer a detailed analysis of major determinants of market growth and are essential for leveraging lucrative opportunities in the market.

The Report will help the Leaders:

• Figure out the market dynamics altogether

• Inspect and scrutinize the competitive scenario and the future market landscape with the help of different strictures including Porter's five forces

• Understand the impact of different government regulations throughout the global health crisis and evaluate the global & Asia-Pacific radar market condition in the tough time

• Consider the portfolios of the protruding players functional in the market in consort with the thorough study of their products/services

• Have a compact idea of the highest revenue-generating segment

The global Social Media Analytics Based Insurance Market market report provides detailed segmentation of the market.

Key Segmentation

Component

• Tools

• Service

• Deployment Mode

• On-Premise

• Cloud

Enterprise Size

• Large Enterprise

• Small and Medium-sized Enterprises (SMEs)

Platforms

• YouTube

• End User

Insurance Companies

• Government Agencies

• Third-party Administrators, Brokers and

• Consultancies

By Region

• North America (U.S., Canada)

Europe (United Kingdom, Germany, France, Italy, Spain, Netherlands, Rest of Europe)

• Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of Asia-Pacific)

• LAMEA (Latin America, Middle East, Africa)

The report includes a comprehensive analysis of sales, revenue, growth rate, and market shares of every segment during the historic period and forecast period along with charts and tables.

Interested Stakeholders can Enquire about the Purchase of the Report @ https://www.alliedmarketresearch.com/purchase-enquiry/15129

The Covid-19 pandemic had a significant impact on the growth of the global Social Media Analytics Based Insurance Market market. The prolonged lockdown across several countries and restrictions on import-expert disrupted the supply chain. Moreover, the lack of workforce and increased prices of raw materials affected the market.

The global Social Media Analytics Based Insurance Market industry is analyzed based on the region along with the competitive landscape in each region. The regions included in the report are North America (United States, Canada, and Mexico), Europe (Germany, France, UK, Russia, and Italy), Asia-Pacific (China, Japan, Korea, India, and Southeast Asia), South America (Brazil, Argentina, Colombia), Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria, and South Africa). These insights aid to formulate business strategies and open lucrative opportunities.

The global Social Media Analytics Based Insurance Market market report includes a detailed analysis of the top 10 market players active in the global market. The study includes sales, production, and revenue analysis. The prime market players are Adobe, Brandwatch, Cision U.S. Inc., Clarabridge, Digimind, GoodData Corporation, Hootsuite Inc., International Business Machines Corporation, Meltwater, Netbase Quid, Inc., Oracle, Salesforce, Inc., SAS Institute Inc., Sprout Social, Inc., Talkwalker Inc., Kazee Indonesia, ViralStat.com. These market players have adopted several business strategies such as new product launches, mergers & acquisitions, partnerships, and collaborations to maintain their market presence in the market. The market report includes statistics, tables, and charts to offer a detailed study of the Social Media Analytics Based Insurance Market industry.

Get a detailed study of Covid-19 Impact Analysis on the Social Media Analytics Based Insurance Market Market@ https://www.alliedmarketresearch.com/request-for-customization/15129

Related Reports:

Online Retail Mobile Payment Transactions Market https://www.alliedmarketresearch.com/online-retail-mobile-payment-transactions-market-A17406

Entertainment Insurance Market https://www.alliedmarketresearch.com/entertainment-insurance-market-A17960

Musical Instrument Insurance Market https://www.alliedmarketresearch.com/musical-instrument-insurance-by-market-A14752

Internet of Things (IoT) in Banking Market https://www.alliedmarketresearch.com/internet-of-things-in-banking-market-A12751

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow us on LinkedIn and Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Social Media Analytics Based Insurance Market New Pathways for Research and Innovation are Being Opened by Trends here

News-ID: 2799690 • Views: …

More Releases from Allied Market Research

Warehouse Automation Market Expected to Reach $90,725.7 Million by 2034

According to a new report published by Allied Market Research, titled, "Warehouse Automation Market,by Solution (Automated Storage and Retrieval Systems, Conveyors and Sortation Systems, Robotics Systems, Picking and Packing Equipment, Palletizing and Depalletizing Systems, Sensors and Scanners, Others Hardware, Warehouse Management System, Warehouse Control System, Warehouse Execution System, Others Software's), by Application (Automotive, Food and beverage, E-Commerce, Pharmaceutical, Fashion and Apparel, Cosmetics, Others), by End User Industry (Retailers, Manufacturers and…

($243.26 million) U.S. Insurance Third-Party Administrator Market Poised for Exp …

According to the report published by Allied Market Research, the U.S. Insurance Third Party Administrator market generated $156.08 million in 2020, and is projected to reach $243.26 million by 2030, witnessing a CAGR of 4.6% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

Claim Your Research Report Sample & TOC: https://www.alliedmarketresearch.com/request-sample/14904

Third-party administrator acts…

Medical Professional Liability Insurance Market to Hit $33.7 Billion by 2031 at …

According to the report published by Allied Market Research, the global medical professional liability insurance market generated $12.5 billion in 2021, and is projected to reach $33.7 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

➡️Download Research Report Sample & TOC : https://www.alliedmarketresearch.com/request-sample/A30183

The adoption of medical liability insurance solutions or malpractice insurance has increased over the years to help organizations to cover liability of the doctors…

Crowdfunding Market on the Rise, Growing at 14.3% CAGR Through 2031

According to the report published by Allied Market Research, the global crowdfunding market generated $1.9 billion in 2021, and is estimated to reach $6.8 billion by 2031, witnessing a CAGR of 14.3% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…