Press release

Life Insurance Policy Administration Systems Market Business Opportunities and Global Forecast to 2026

According to a recent market report published by Persistence Market research titled, "Life insurance policy administration system Market-Global Industry Analysis and Forecast by 2026. The life insurance policy administration system market is expected to register a CAGR of 12.0% to 2026. The need to remain up-to-date and its feature to maximize the ability to respond to changes in the business are among the major factors driving the life insurance policy administration system market.A life insurance policy administration system is a system that provides end-to-end lifecycle management of individual, group life and pension products. Thus, it is a software that helps insurers manage life and annuity insurance policies. With the help of a life insurance policy administration system, organizations can maintain a record of the policies issued by them to clients, calculate policy costs, as well as design new policies. A life insurance policy administration system can improve the flexibility and administration of different insurance policies. Moreover, it can be implemented as a part of an integrated insurance suite or as a standalone solution.

Get a Sample Copy of Report @ https://www.persistencemarketresearch.com/samples/14137

The life insurance policy administration system market is categorized on the basis of deployment type, component, policy administration category, end-user, module, and region. On the basis of deployment type, the life insurance policy administration system market is segmented into SaaS and on-premise. The revenue contribution from the SaaS segment in the life insurance policy administration system market is expected to expand at a CAGR of 13.0% during the forecast period.

Based on component, the life insurance policy administration system market is segmented into software and services. The services segment is further divided into professional services and managed services. The services segment in the life insurance policy administration system market is estimated to register a CAGR of 13.2% during the forecast period.

On the basis of policy administration, the life insurance policy administration system market is segmented into policy lifecycle, underwriting, contract changes, claim settlement, user experience, and others. The revenue contribution from the user experience segment in life the insurance policy administration system market is expected to expand at a CAGR of 13.7% during the forecast period.

On the basis of end-user, the global life insurance policy administration system market is segmented into insurance companies, banks, and others. The insurance companies segment is expected to dominate the life insurance policy administration system market and enjoy a market share of 70.3% in 2026.

On the basis of module, the global life insurance policy administration system market is segmented into customer relationship management, product development, training & development, business intelligence, and others. The business intelligence segment in the life insurance policy administration system market is expected to grow f US$ 1,579.7 Mn in 2026 owing to the high CAGR associated with it.

Ask for Customization @ https://www.persistencemarketresearch.com/request-customization/14137

This report also covers the trends driving each segment and offers analysis and insights regarding the potential of the life insurance policy administration system market in regions such as North America, Latin America, Europe, China, Japan, South East Asia, and the Middle East & Africa. Among these regions, Europe is projected to exhibit relatively high growth in the global life insurance policy administration system market, registering a CAGR of 15.5% over the forecast period.

Revenue from the life insurance policy administration system market in North America and Europe is expected to collectively account for over 46.7% of the global life insurance policy administration system market revenue in 2018. Life insurance policy administration system market providers can focus on expanding across several countries in the China and SEA & other of APAC regions.

Key competitors in the life insurance policy administration system market are Oracle Corporation, Plc, InsPro Technologies LLC, Concentrix Corporation, DXC Technology Company, Infosys Limited, SAP SE, Capgemini SE, Mphasis Wyde, EXL Service Holdings, Inc., Sapiens International Corporation, Majesco and others.

Key Segments Covered

Deployment type

SaaS

On-premise

Component type

Software

Services

Managed services

Professional services

Policy Administration Category

Policy Lifecycle

Underwriting

Contract changes

Claim Settlement

User experience

Others

End-user

Insurance companies

Banks

Others

Module

CRM

Product Development

Training & Development

Business Intelligence

Others

Key Regions Covered

North America

U.S.

Canada

Latin America

Brazil

Mexico

Rest of Latin America

Europe

Germany

UK

France

Italy

Spain

Russia

BENELUX

Rest of Europe

SEA and Other Asia Pacific

India

Australia & New Zealand

ASEAN

Rest of SEA & other APAC

China

Japan

Middle East & Africa

North Africa

South Africa

GCC

Turkey

Rest of Middle East & Africa

Buy Report Now @ https://www.persistencemarketresearch.com/checkout/14137

Contact Us:

Persistence Market Research

Address - 305 Broadway, 7th Floor, New York City, NY 10007 United States

U.S. Ph. - +1-646-568-7751

USA-Canada Toll-free - +1 800-961-0353

Sales - sales@persistencemarketresearch.com

Website - https://www.persistencemarketresearch.com

Persistence Market Research is here to provide companies a one-stop solution with regards to bettering customer experience. It does engage in gathering appropriate feedback after getting through personalized customer interactions for adding value to customers' experience by acting as the "missing" link between "customer relationships" and "business outcomes'. The best possible returns are assured therein.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Insurance Policy Administration Systems Market Business Opportunities and Global Forecast to 2026 here

News-ID: 2793949 • Views: …

More Releases from Persistence Market Research

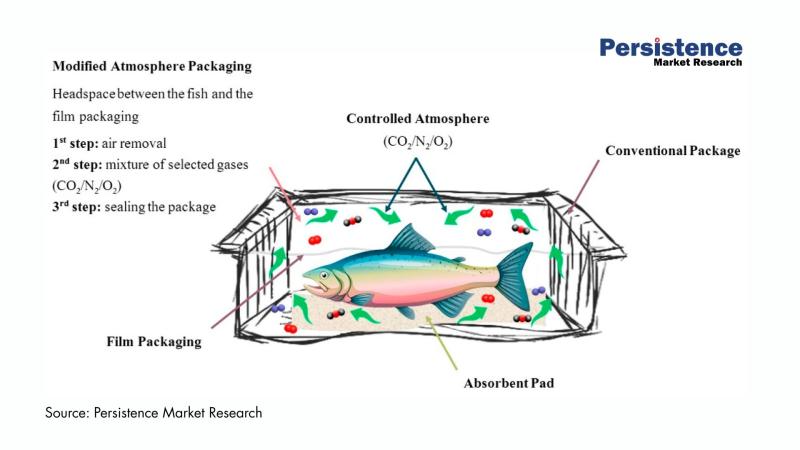

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…