Press release

At 9.50% CAGR, Global Health Insurance Market Size to Surpass USD 3.619 trillion by 2028 - Industry Trends, Share, Growth, Analysis & Forecast Report by Facts & Factors

The worldwide health insurance market was valued at USD 2.10 trillion in 2021 and is projected to reach USD 3.619 trillion by 2028, with a CAGR of almost 9.50% during the forecast period, according to Facts and Factors. The analysis examines the market's drivers, constraints, and challenges as well as how they will affect the demand during the forecast period. The paper also looks at new potential in the market for health insurance.Health insurance will pay for any medical expenses paid for the treatment of a disease, injury, or another physical or mental incapacity. A monthly, semi-annual, or yearly premium or payroll tax is exchanged for the provision of healthcare benefits. Up to the coverage and term of the insurance, the insurer is obligated to cover the policyholder's medical expenses. The range, which may include sicknesses, age groups, governmental regulations, etc., may change depending on the insurance. The characteristics and advantages of health insurance plans are numerous. It offers the policyholder financial protection against specific medical procedures. Reimbursement, pre- and post-hospitalization coverage, cashless hospitalization, and a number of add-ons are among the perks of health insurance.

𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭@https://www.fnfresearch.com/sample/health-insurance-market

Anyone having health insurance is shielded from any monetary losses brought on by a medical emergency. It pays for costs associated with receiving medical care, including ambulance fees, doctor visits, hospital stays, medications, and childcare procedures.

The rising cost of healthcare services, along with the increased prevalence of diabetes, cancer, stroke, and renal failure, is one of the main factors boosting the need for health insurance globally. Additionally, businesses are now mandated to provide health insurance to their employees by regulatory organizations in many different countries. Additionally, these agencies are enforcing laws requiring foreign health insurance for tourists. Also pushing people to sign up for government health insurance plans or programs with affordable premiums is the expanding older population. The improvement of the healthcare infrastructure and an increase in health consciousness are further factors promoting market expansion.

𝐑𝐞𝐚𝐝 𝐃𝐞𝐭𝐚𝐢𝐥 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧@https://www.fnfresearch.com/health-insurance-market

𝐃𝐢𝐯𝐢𝐬𝐢𝐨𝐧𝐚𝐥 𝐎𝐯𝐞𝐫𝐯𝐢𝐞𝐰

Based on insurance type, coverage, end-user type, age group, distribution channel, and geography, the worldwide health insurance market is segmented. Depending on the type of insurance, the market is split into illness and medical insurance. Medical insurance was one of these, and it had a significant increase in 2021.

Preferred provider organizations (PPOs), point of services (POS), health maintenance organizations (HMOs), and exclusive provider organizations are the market segments that are categorized based on coverage (EPOS). Preferred provider organizations (PPOs) held the top spot in the market in 2021 and are anticipated to keep it throughout the projected period.

The market is divided into groups and individuals based on end-user type. In 2021, niche market segments will rule the market. Seniors, adults, and children are the three categories into which the age group market is divided. The adult market segment will rule the industry in 2021. Based on the service provider, the market is divided into private and public suppliers. In 2021, the private sector will rule the market. The market is divided into direct sales, brokers/agents, banks, and others based on the distribution route. In 2021, direct sales will rule the industry.

𝐑𝐞𝐚𝐝 𝐛𝐮𝐲𝐧𝐨𝐰 𝐑𝐞𝐩𝐨𝐫𝐭 𝐟𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧@https://www.fnfresearch.com/buynow/su/health-insurance-market

𝐂𝐨𝐦𝐩𝐞𝐭𝐢𝐭𝐢𝐯𝐞 𝐋𝐚𝐧𝐝𝐬𝐜𝐚𝐩𝐞

The report contains qualitative and quantitative research on the global health insurance market, as well as detailed insights and development strategies employed by the leading competitors. The report also provides an in-depth analysis of the market's main competitors, as well as information on their competitiveness. The research also identifies and analyses important business strategies used by these main market players, such as mergers and acquisitions (M&A), affiliations, collaborations, and contracts.

𝐊𝐞𝐲 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐢𝐧 𝐭𝐡𝐞 𝐠𝐥𝐨𝐛𝐚𝐥 𝐡𝐞𝐚𝐥𝐭𝐡 𝐢𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐦𝐚𝐫𝐤𝐞𝐭 𝐢𝐧𝐜𝐥𝐮𝐝𝐞 Aetna Inc., Aia Group Limited, Allianz, Assicurazioni Generali S.P.A., Aviva, Axa, Cigna, Ping An Insurance (Group) Company Of China, Ltd., Unitedhealth Group, Zurich.

𝐑𝐞𝐜𝐞𝐧𝐭 𝐃𝐞𝐯𝐞𝐥𝐨𝐩𝐦𝐞𝐧𝐭:

August 2020: To assist businesses in planning and researching secure overseas travel, Foreign Medical Group, Inc. (IMG) has increased its range of products. The new support programs offered by the business were developed to help customers make plans for 2020 and beyond.

Global Health Insurance Market is segmented as follows:

𝐁𝐲 𝐈𝐧𝐬𝐮𝐫𝐚𝐧𝐜𝐞 𝐓𝐲𝐩𝐞

Disease Insurance

Medical Insurance

𝐁𝐲 𝐂𝐨𝐯𝐞𝐫𝐚𝐠𝐞

Preferred Provider Organizations (PPOs)

Point Of Service (POS)

Health Maintenance Organizations (HMOS)

Exclusive Provider Organizations (EPOS)

𝐁𝐲 𝐄𝐧𝐝-𝐮𝐬𝐞𝐫 𝐓𝐲𝐩𝐞

Group

Individuals

𝐁𝐲 𝐀𝐠𝐞 𝐆𝐫𝐨𝐮𝐩

Senior Citizens

Adult

Minors

𝐁𝐲 𝐒𝐞𝐫𝐯𝐢𝐜𝐞 𝐏𝐫𝐨𝐯𝐢𝐝𝐞𝐫

Public

Private

𝐁𝐲 𝐃𝐢𝐬𝐭𝐫𝐢𝐛𝐮𝐭𝐢𝐨𝐧 𝐂𝐡𝐚𝐧𝐧𝐞𝐥

Direct Sales

Brokers/Agents

Banks

Others

𝐍𝐞𝐞𝐝 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧? 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭@https://www.fnfresearch.com/customization/health-insurance-market

𝐁𝐲 𝐑𝐞𝐠𝐢𝐨𝐧

North America

The U.S.

Canada

Mexico

Europe

France

The UK

Spain

Germany

Italy

Nordic Countries

Denmark

Sweden

Norway

Benelux Union

Belgium

The Netherlands

Luxembourg

Rest of Europe

Asia Pacific

China

Japan

India

Australia

South Korea

Southeast Asia

Indonesia

Thailand

Malaysia

Singapore

Rest of Southeast Asia

Rest of Asia Pacific

The Middle East & Africa

Saudi Arabia

UAE

Egypt

South Africa

Rest of the Middle East & Africa

Latin America

Brazil

Argentina

Rest of Latin America

𝐓𝐡𝐞 𝐟𝐨𝐥𝐥𝐨𝐰𝐢𝐧𝐠 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐫𝐞𝐩𝐨𝐫𝐭'𝐬 𝐚𝐧𝐚𝐥𝐲𝐬𝐢𝐬 𝐨𝐛𝐣𝐞𝐜𝐭𝐢𝐯𝐞𝐬:

To estimate the size of each sub-section of the global health insurance market.

To estimate the size and future prospects of the international health insurance market based on important variables.

To take into account the key stakeholders and their long-term development plans.

To research the global health insurance market's growth trends, business possibilities, and general level of interest.

To calculate the size of the worldwide health insurance market (in volume and value terms) based on information collected from the company, key regions/nations, products, and applications.

Important data on market growth, SWOT analysis, and long-term improvement goals, as well as market share, company size, and industry segmentation overall.

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: sales@fnfresearch.com

Web: https://www.fnfresearch.com

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client's/customer's conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release At 9.50% CAGR, Global Health Insurance Market Size to Surpass USD 3.619 trillion by 2028 - Industry Trends, Share, Growth, Analysis & Forecast Report by Facts & Factors here

News-ID: 2787954 • Views: …

More Releases from Facts & Factors

Trending: Military Vehicle Electrification Market Size & Share To Exceed USD 9.5 …

The Military Vehicle Electrification Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation. The report titled Military Vehicle Electrification Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market.

Request Access Full Report is Available @ https://www.fnfresearch.com/military-vehicle-electrification-market

This covers market…

Global AIOps (Artificial Intelligence for IT Operations) Market - Size, Share, G …

The research report presents a strategic analysis of the AIOps (Artificial Intelligence for IT Operations) Market analysis through top players, size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis, new product launches, technological innovations, and growth contributors. Further, the market attractiveness index is provided based on a five-forces analysis.

View the Full Report with Table of Contents @ https://www.fnfresearch.com/artificial-intelligence-for-it-operations-market

This report mainly focuses on the top players and their…

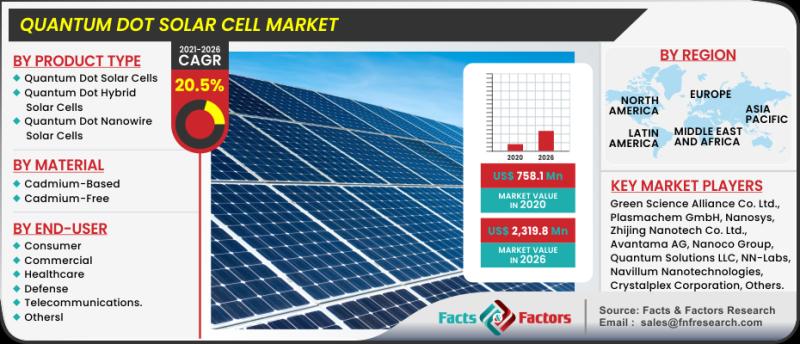

Exceptional Growth in Global Quantum Dot Solar Cell Market Size, Share to Gain U …

The Quantum Dot Solar Cell Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/quantum-dot-solar-cell-market

The report titled "Quantum Dot Solar Cell Market" is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This…

Global Energy Meter Market Size, Share, Growth, Business Strategies and Forecast …

The Energy Meter Market has developed swiftly in recent years and has made a significant contribution to the global financial situation in terms of growth rate, market share, and sales generation.

Request Access Full Report is Available @ https://www.fnfresearch.com/energy-meter-market

The report titled Energy Meter Market is an analytical study that presents a comprehensive explanation of the industry along with information on significant aspects of the market. This covers market demands, major…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…