Press release

Digital Banking Platforms Market Size, Share, Opportunities, Business Strategy and Growth Factors till 2026

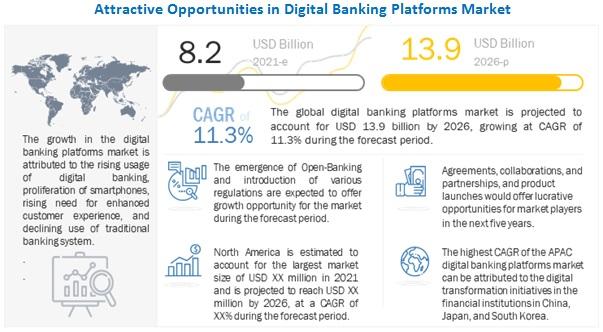

According to a research report "Digital Banking Platforms Market by Component (Platforms and Services), Banking Type (Retail Banking, Corporate Banking, and Investment Banking), Banking Mode (Online Banking and Mobile Banking), Deployment Type, and Region - Global Forecast to 2026" published by MarketsandMarkets, the global Digital Banking Platforms market size is expected to grow USD 8.2 billion in 2021 to USD 13.9 billion by 2026, at a Compound Annual Growth Rate (CAGR) of 11.3% during the forecast period. The digital banking platforms market is gaining traction due to the increasing adoption of smartphones is contributing to the growth of the digital banking platforms market. Countries such as India, Indonesia, South Africa, and China have seen high growth in smartphone sales in the last few years. According to the GSM Association (GSMA) Mobile Economy 2020 report, there will be 7.1 billion smartphone connections by 2025 from 5.2 billion in 2019. The adoption rate would increase from 65% to 80% by 2025.Get Sample of Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=90744083

acquisitions and consolidations to unlock market potential

Financial institutions are modifying their operational procedures to offer customers premium services and enhance account management due to the proliferation of digital channels and intense competition in the market. Many organizations provide integrated digital banking solutions to incorporate online or mobile banking platforms. Temenos (US), Finastra (England), Oracle (US), EdgeVerve (India), and TCS (India) are among the key players in the digital banking platforms market. Other startup companies include Backbase (Netherlands), ebankIT (England), and Apiture (US).

The collaboration between banks and FinTech firms involves an interchange for consumer targeting. This engagement provides access to one another's customer base, allowing them to expand their target markets by tapping into previously unexplored consumer groups. Third-party developers can develop products and solutions for bank customers using banking-as-a-platform (BAAP). They can now enhance platform capabilities while the system controls authentication and data sharing. This also allows banks to expand their contacts network and attract new clients. Consequently, banks can access a sizable market due to their recognizable brand value and extensive "Know Your Customer" research.

acquisitions and THEIR IMPACT ON digital banking

In September 2022, Newtek, an internally managed business development company (BDC), selected the Apiture Digital Banking Platform to support the digital capabilities of Newtek Bank. With this strategy, Newtek plans to leverage Apiture's business banking and account opening solutions in combination with Newtek's existing suite of business and finance solutions and the Newtek advantage to deliver a suite of financial and business solutions and services to independent business owners.

In May 2022, HCL Technologies UK Limited, a wholly-owned subsidiary of HCL Technologies (HCL), signed a definitive agreement to acquire Confinale AG, a digital banking and wealth management consulting specialist and Avaloq Premium Implementation Partner. With this acquisition, HCL's digital wealth and asset management capabilities have significantly strengthened, along with its presence in the global investment banking industry.

In February 2022, Fiserv, Inc., a leading global provider of payments and financial services technology, signed a definitive agreement to acquire Finxact, Inc., developer of the cloud-native banking solution that is powering digital transformation throughout the financial services sector. Through this acquisition, Fiserv will create a streamlined path for clients to offer digital solutions to their customers. In addition, Finxact will also enhance its ability to support a growing number of financial institutions and business clients.

Get More Info @ https://www.marketsandmarkets.com/Market-Reports/digital-banking-platforms-market-90744083.html

Resultingly, many banks and financial organizations have created new business lines and strategies to promote the expansion of digital channels. They have adopted different approaches to accelerate digital banking transformation for clients. FinTech firms also aim to partner with incumbents to increase scale and customer reach.

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market Size, Share, Opportunities, Business Strategy and Growth Factors till 2026 here

News-ID: 2786043 • Views: …

More Releases from Markets and Markets

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

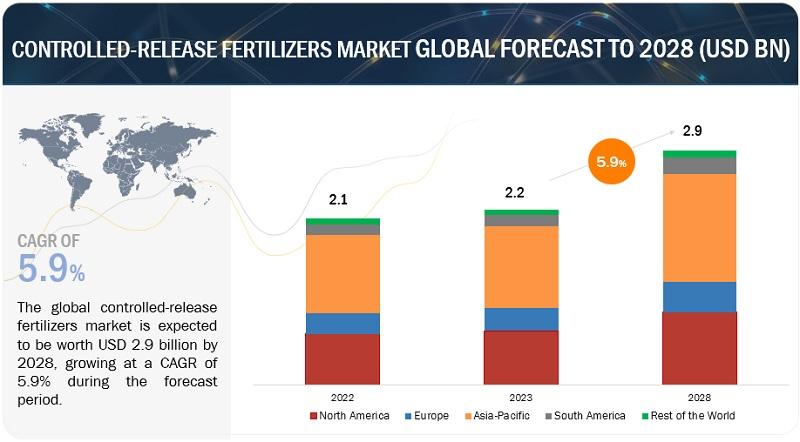

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

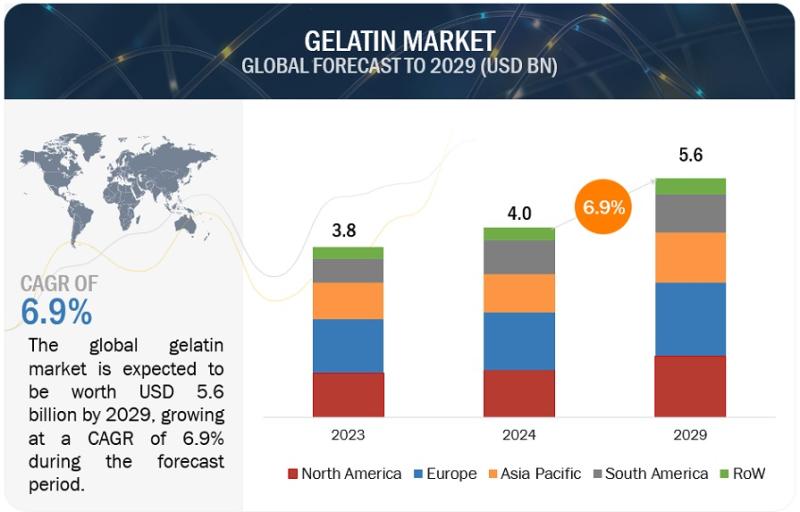

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

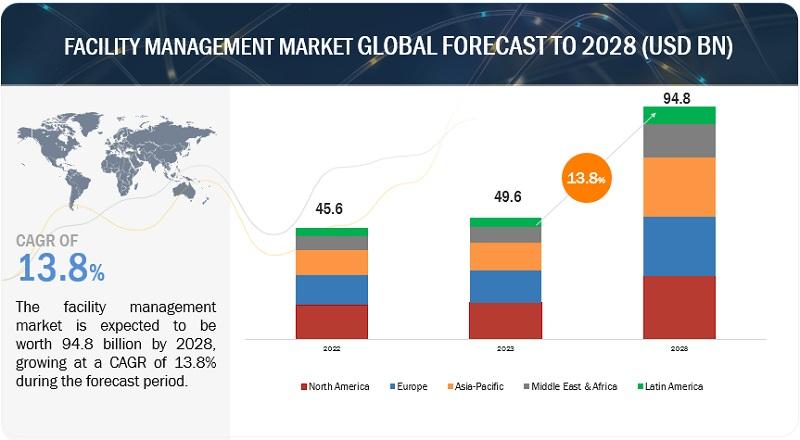

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…