Press release

Logistics Insurance Market Scenario and Growth Prospects 2022

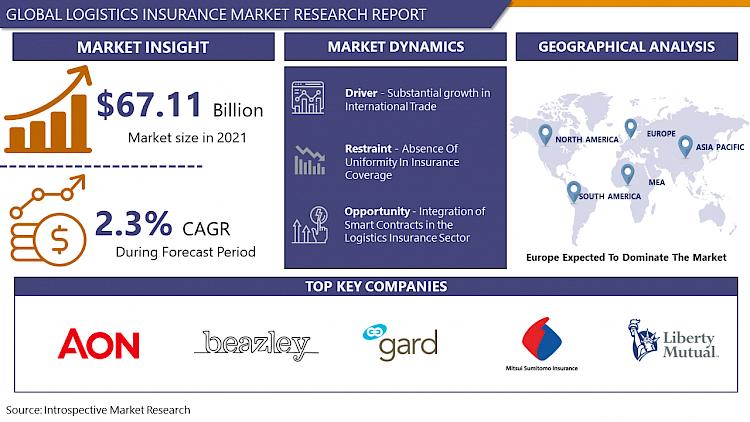

Market Overview:The Global Logistics Insurance market size was valued at USD 67.11 Billion in 2021 and is projected to reach USD 78.69 Billion by 2028, growing at a CAGR of 2.3% from 2022 to 2028.

Logistics Insurance is a type of insurance policy that is specifically designed to cover commodities in any mode of transportation, including air, sea, land, and train. It protects cargo against a wide range of physical losses or damage to freight caused by external causes while in transit. The goods are transported around the world by land, sea, train, or air. The likelihood of hauled items and products being lost or destroyed during the journey is extremely high. In these cases, cargo insurance can help by covering the loss.

Read Full Research Report: -

https://introspectivemarketresearch.com/reports/logistics-insurance-market/

Market Dynamics:

Driver:

The expansion of import-export operations among nations is the result of increased trade contacts among various nations. Physical damage to items as a result of mishaps caused by outside sources such as bad weather, rotten goods, technical flaws, and others. To avoid such occurrences, business owners obtain logistics insurance to protect themselves against such damaged goods, which are of high value because they are exported from multiple countries. Global trade is expected to grow by 23% from 2020 to approximately USD 28 trillion in 2021, according to the United Nations Conference on Trade and Development.

Opportunities:

Blockchain has the potential to improve global trade efficiency by significantly reducing bureaucracy and paperwork. A multi-stakeholder process with a lengthy paper trail, for example, could be replaced with an automated process that stores information in a tamper-evident digital format. Insurance, legal, brokerage, and settlement services are examples of automation services that currently require an intermediary. Blockchain technology could be used to track a product's lifecycle and ownership transfer from manufacturer to store shelf, even as it passes through the hands of the manufacturer, logistics service provider, wholesaler, retailer, and consumer.

Acquire PDF Sample Report + All Related thorough TOC, Graphs and Tables of Global Logistics Insurance Market Now:

https://introspectivemarketresearch.com/request/16338

Market Segmentation

By Type, the Marine Cargo Insurance segment dominates the Logistics Insurance Market. The foundation of international trade and the world economy is maritime transit. More than 80% of products traded internationally are transported by sea, and this proportion is significantly higher for the majority of developing nations. A marine cargo insurance policy offers comprehensive coverage against all the potential marine-related perils that the goods are exposed to while they are in transit.

By Coverage Type, Cargo Insurance dominates the Logistics Insurance Market. The most common kind of insurance used to protect shipments from physical harm or theft is cargo insurance. The value of the objects is guaranteed against damage that occurs during transport due to a well-protected cargo insurance policy. Because there is never an assurance that the goods won't be damaged, cargo insurance is crucial.

By End User, the Enterprise segment dominates the Logistics Insurance Market. Generally, special insurance coverage is made on the bulk cargos which are made by large enterprises for the long-haul transportation for an end to end coverage of their goods. Due to the high volume of goods, the risk of losses is greater and companies and trading enterprises are highly unlikely to neglect such risk. Therefore, logistics insurance has a large clientele that deals with bulk cargo and high volume intercity and cross-border trade.

By Type

• Land Cargo Insurance

• Marine Cargo Insurance

• Air Transport Insurance

By Coverage Type

• Cargo Insurance

• Freight Forwarder Liability Insurance

• Marine services liability

• Energy logistics

• Other

By End User

• Individual,

• Enterprises

For More Information or Query or, Customization before Buying Visit:

https://introspectivemarketresearch.com/inquiry/16338

Regional Analysis Of Logistics Insurance Market

The European region dominates the Logistics Insurance Market. The presence of a solid logistics infrastructure and the growing use of digital insurance are the main elements supporting this region's dominance. Automating compliance with regulations in the area is also likely to promote regional growth. The pricing of policies is significantly influenced by government regulatory actions, which are anticipated to have a substantial impact on the sector as a strong driver. Also, Europe is the major hub for global cargo transportation due to the existence of major ports. In 2021, Rotterdam's overall cargo throughput increased 7.3% to 468.7 million tonnes. Because more commodities were purchased during the epidemic, the number of containers grew by 6.6% to 15.3 million TEU in 2020.

By Region

• North America (U.S., Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

• Asia-Pacific (China, India, Japan, Southeast Asia, Rest of APAC)

• Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

• South America (Brazil, Argentina, Rest of South America)

Major Key Players Considered in the Market

• Aon PLC

• Atrium Corporation

• Beazley Group

• Gard AS

• Liberty Mutual Insurance

• Mitsui Sumitomo Insurance Company Limited

• Peoples Insurance Agency

• Samsung Fire & Marine Insurance Co. Ltd.

• Sompo Japan Nipponkoa Insurance Inc.

• Swiss Re Ltd

• Tokio Marine Holdings Inc

Up-To Avail 20% Discount on various license types on immediate purchase (Use corporate email ID). Get Higher Priority-

https://introspectivemarketresearch.com/discount/16338

Key Industry Development In The Logistics Insurance Market

In March 2020, To provide customers with protection against physical loss or damage to their products, Maersk has partnered with Zurich Insurance Plc (Zurich). This product is called Maersk Cargo Insurance.

In July 2022, A new co-innovation solution was unveiled by NTT DATA and SAP Asia Pacific and Japan (APJ) to enhance supply chain insurance management. The solution, dubbed Connected Product, was created in collaboration with SAP SE and NTT DATA, a pioneer in global digital business and IT services. This partnership furthers the strategic alliance established between NTT and SAP SE's parent company in 2020.

Objectives of the global Logistics Insurance market

1. To identify the main subsegments of the Logistics Insurance market to comprehend its structure.

2. Identifies describes, and analyses the sales volume, value, market share, competitive market landscape, opportunities and threats, and strategic initiatives for the main worldwide Logistics

Insurance manufacturers for the next few years.

3. To examine the Logistics Insurance in terms of specific expected growth, career outlook, and market share contribution.

4. Analyse commercial developments in the market, such as market expansions, partnerships, new product development, and mergers.

5. To develop a strategic analysis of the main players and a thorough analysis of their strategic planning.

Buy the Latest Version of this Report @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=16338

Read Related Report: -

https://introspectivemarketresearch.com/reports/vaccine-logistics-market/

https://introspectivemarketresearch.com/reports/supply-chain-and-logistics-for-b2b-market/

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email : sales@introspectivemarketresearch.com

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Logistics Insurance Market Scenario and Growth Prospects 2022 here

News-ID: 2784315 • Views: …

More Releases from Introspective Market Research

Absorbed Glass Mat (AGM) Separator Batteries Market To Reach USD 38.55 Billion b …

Absorbed Glass Mat (AGM) Separator Batteries Market was valued at USD 23.81 Billion in 2023 and is expected to reach USD 38.55 Billion by the year 2032.

Absorbed Glass Mat (AGM) batteries are advanced lead-acid batteries designed for higher electrical output, making them ideal for start-stop vehicle systems and increasingly popular in electric vehicles. Unlike conventional batteries, AGM batteries are sealed, maintenance-free, non-spillable, and highly resistant to vibrations, with improved…

Automotive Fuel Injection Systems Market: Business Research Analysis By 2032

Automotive Fuel Injection Systems are crucial for optimizing engine performance, fuel efficiency, and reducing emissions in modern vehicles. These systems, which include fuel injectors, a fuel pump, a pressure regulator, and an ECU, precisely control fuel delivery either through Direct Fuel Injection or Port Fuel Injection. With growing demand for fuel-efficient, environmentally-friendly vehicles, advanced technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI) are driving market growth…

North America Coal to Liquid Market to Reach 3.02 Mn at CAGR 8.1% | DKRW Energy, …

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through…

India Green Hydrogen Market Next Big Thing | Adani Green Energy, JSW Energy, NTP …

IMR posted new studies guide on India Green Hydrogen Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the India Green Hydrogen marketplace became specifically driven with the aid of the growing R&D spending internationally.

India Green Hydrogen Market Size Was Valued at USD 2.51 Billion in 2023, and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…