Press release

Insurance Fraud Detection Global Market Size, Share, By Component, By Type, By Application, By Technology, By Deployment, By Industry And Regional Forecast 2022-2031

The global insurance fraud detection market report by the business research company identifies the increase in cyberattacks is expected to propel the growth of the insurance fraud detection market. A cyberattack is a dangerous and intentional attempt by an individual or organization to gain access to another person's or organization's data. Insurance companies are an excellent target for cyber-attacks since they have access to a large amount of personal policyholder data. Compared to other industries, which hold mainly sensitive financial data, insurers typically also collect a large amount of protected personal sensitive information. For instance, the FBI's Internet Crime Complaint Centre (IC3), a website that provides users with a standardized process and interfaces for reporting suspected cybercrime or other illicit online activities in the US, saw a 69% increase in the number of cybercrimes reported received in 2020 compared to 2019 in the US. On average, in 2020, the FBI received 2,000 cybercrime reports per day. Therefore, an increase in cyberattacks is driving the growth of the insurance fraud detection market.The global insurance fraud detection market size is expected to grow from $4.24 billion in 2021 to $5.19 billion in 2022 at a compound annual growth rate (CAGR) of 22.6%. The insurance fraud market size is expected to grow to $12.01 billion in 2026 at a CAGR of 23.3%.

Purchase The Insurance Fraud Detection Market Report Here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6399

North America was the largest region in the insurance fraud detection market in 2021. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the insurance fraud market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, and Africa.

Major players in the insurance fraud detection market are ACI Worldwide Inc., BAE Systems, BRIDGEi2i Analytics Solutions Pvt. Ltd., Datawalk Inc., DXC Technology Co., Experian PLC, Fair Isaac Corp., Fiserv Inc., FRISS, IBM Corp., Iovation Inc., Kount Inc., LexisNexis, Oracle Corp., Scorto Inc., TransUnion LLC, Wipro Ltd., CI Worldwide Inc., Equifax Inc, and Perceptiviti.

The global insurance fraud detection market is segmented -

1) By Deployment Type: On-Premises, Cloud

2) By Component: Solution, Services

3) By Organization Size: Small and Medium-Sized Enterprises (SMEs), Large Enterprises

4) By Application: Claims Fraud, Identity Theft, Payment and Billing Fraud, Money Laundering

5) By End-User: Insurance Companies, Agents and Brokers, Insurance Intermediaries, Others

Request A Sample Of The Insurance Fraud Detection Market Report Here:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6399&type=smp

The Insurance Fraud Detection Market Report Contents Include

1. Executive Summary

2. Insurance Fraud Detection Market Characteristics

3. Insurance Fraud Detection Market Trends And Strategies

4. Impact Of COVID-19 On Insurance Fraud Detection

5. Insurance Fraud Detection Market Size And Growth

.....

26. Africa Insurance Fraud Detection Market

27. Insurance Fraud Detection Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Insurance Fraud Detection Market

29. Insurance Fraud Detection Market Future Outlook and Potential Analysis

30. Appendix

This report covers the trends and market dynamics of the insurance fraud detection market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our:

TBRC Blog: http://blog.tbrc.info/

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Healthcare Blog: https://healthcareresearchreports.com/

About Us:

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. It has published over 3000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Insurance Fraud Detection Global Market Size, Share, By Component, By Type, By Application, By Technology, By Deployment, By Industry And Regional Forecast 2022-2031 here

News-ID: 2776535 • Views: …

More Releases from The Business research company

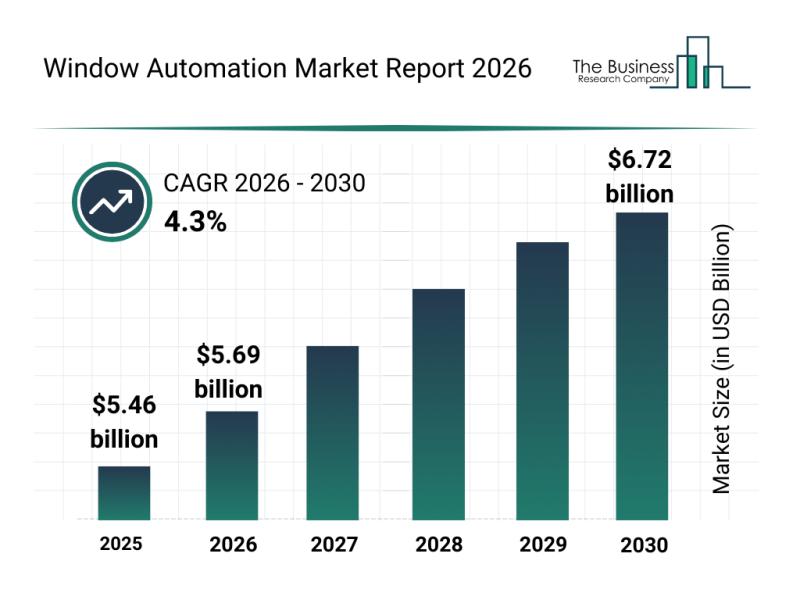

Worldwide Trends Overview: The Rapid Evolution of the Window Automation Market

The window automation sector is on track for consistent growth as technology advances and smart building solutions become increasingly popular. Rising interest in energy-saving ventilation, IoT integration, and AI-driven automation is shaping the future of this market. Below, we explore the market's valuation outlook, key players, emerging trends, and segmentation details that define this evolving industry.

Window Automation Market Size and Growth Expectations by 2030

The window automation market is projected…

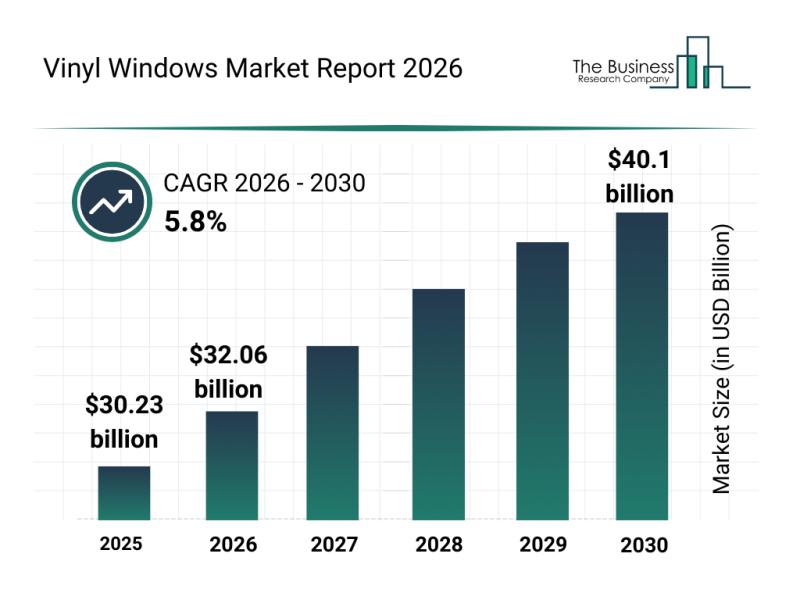

Leading Companies Reinforce Their Presence in the Vinyl Windows Market

The vinyl windows market is positioned for substantial expansion in the coming years, driven by a combination of technological advances and shifting consumer preferences. As demand grows for sustainable materials and smart home integrations, this sector is set to evolve rapidly, offering a variety of innovative solutions that meet modern architectural and environmental needs.

Projected Growth and Size of the Vinyl Windows Market by 2030

The vinyl windows market is anticipated…

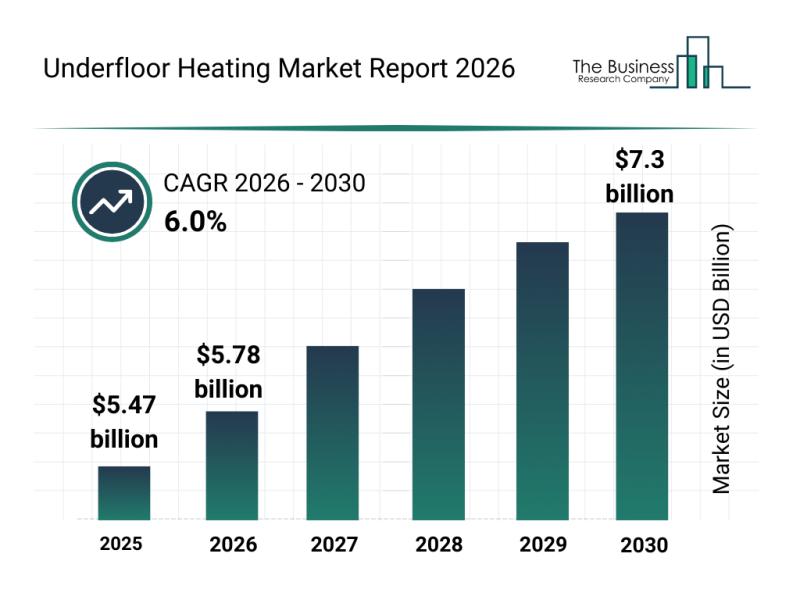

Future Perspectives: Key Trends Shaping the Underfloor Heating Market Until 2030

The underfloor heating market is on the verge of significant growth as demand for energy-efficient and smart heating solutions rises worldwide. Innovations in technology and increased focus on sustainable building practices are expected to drive this market forward through the end of the decade. Let's explore the market size, key players, emerging trends, and important segments shaping this industry.

Projected Expansion and Market Size of the Underfloor Heating Industry

The underfloor…

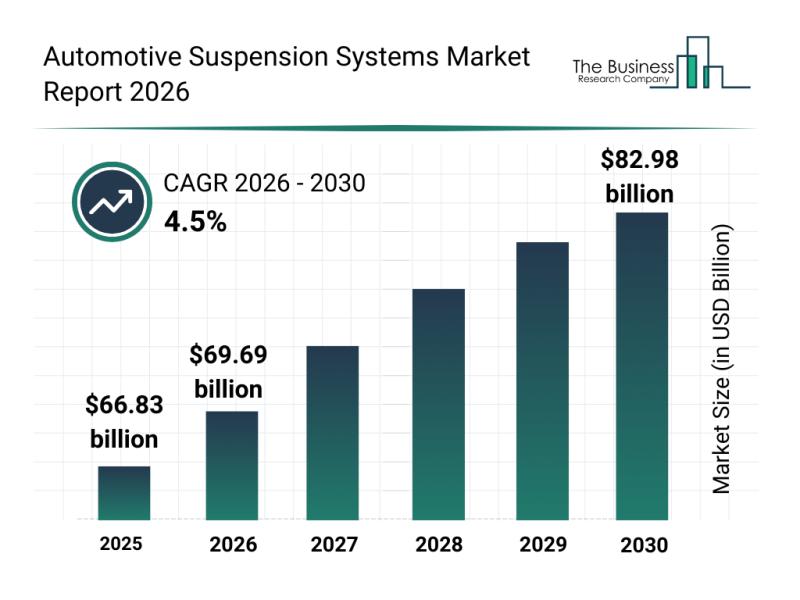

Global Trends Analysis: The Rapid Evolution of the Automotive Suspension Systems …

The automotive suspension systems market is positioned for consistent expansion over the coming years, driven by evolving vehicle technologies and growing demands for improved ride quality. As the automotive sector adapts to innovations such as electric and autonomous vehicles, suspension systems are becoming increasingly sophisticated to meet new performance and comfort expectations. Below is an overview of the market's future growth potential, key players, emerging trends, and segmentation.

Steady Market Growth…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…