Press release

Fraud Detection and Prevention Market Growth Rate Research Report and Future Plans 2026

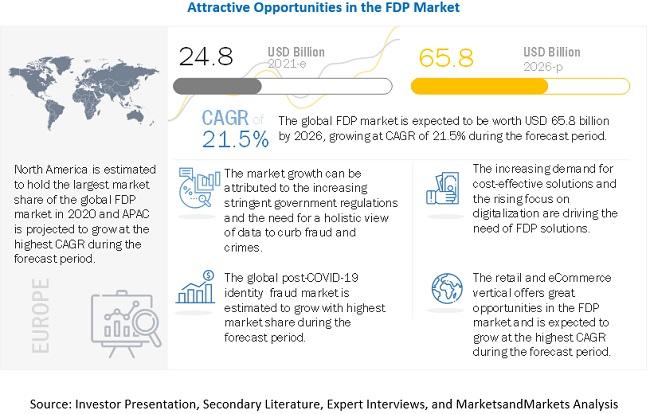

Fraud Detection and Prevention Market expected to grow from USD 24.8 billion in 2021 to USD 65.8 billion by 2026 at a CAGR of 21.5%. Increasing adoption of IoT and digital solutions, increasing revenue losses due to frauds, and growing adoption of analytics for fraud detection across industries are some of the key factors that are driving the market growth. However, rising cases of complex frauds instances such as digital that require highly professional expertise is one of the factors that is hindering the market growth.Browse 493 market data Tables and 46 Figures spread through 381 Pages and in-depth TOC on "Fraud Detection and Prevention Market by Solution (Fraud Analytics, Authentication, and GRC), Service (Managed and Professional), Vertical (BFSI, Retail and eCommerce, and Travel and Transportation), Deployment Mode and Region - Global Forecast to 2026"

Get Sample Of Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1312

By solution type, fraud analytics segment to hold the largest market size during the forecast period

Based on solutions, the FDP market is segmented into fraud analytics, authentication, and GRC solutions. According to the Consumer Sentinel Network maintained by FTC, 3.2 million identity thefts and fraud reports were received in 2019, out of which 1.7 million were fraud cases. The increasing cases of frauds force financial companies to advance their security infrastructure by deploying FDP solutions such as fraud analytics. Fraud analytics is the core of all FDP solutions. Several vendors offer traditional rule-based fraud analytics models, whereas some prefer AI- and ML-based techniques. Fraud analytics solutions proactively detect frauds and help meet compliance needs.

By deployment mode, cloud deployment to grow at a higher CAGR during the forecast period

The cloud deployment mode involves storing applications and software on remote servers, providing access through the internet. According to Flexera, enterprises are set to spend around 15-16% of their revenue for cloud hosting services by 2020. Another study by Cisco stated that "53% of organizations host at least 50% of their infrastructure on the cloud." Cloud-based solutions are increasing their market share continuously as both large and small banks currently have the required infrastructure and resources to deploy solutions on the cloud. Other than BFSI, retail and eCommerce, healthcare, and travel verticals are also adopting cloud-based FDP solutions to combat frauds efficiently.

North America to hold the largest market size during the forecast period

North America, a technologically advanced region, tops the world in terms of the presence of cybersecurity vendors. The US is a highly regulated country with stringent laws and offers multiple opportunities for FDP providers to cater to a wide range of customers across industries. Major FDP solution vendors, such as BAE systems, FICO, LexisNexis, TransUnion, are headquartered in North America.

Americans have adopted the online trends and applications and have a high usage rate. For example, according to the American Association of Bankers' data, 7 out of 10 Americans rely on online mobile applications to make online payments. The volume of cybercrime attacks on financial institutions and the need for a unified platform to prevent risk, especially with the onset of COVID-19, are persuading enterprises in the US and Canada to adopt FDP solutions.

View detailed Table of Content here - https://www.marketsandmarkets.com/Market-Reports/fraud-detection-prevention-market-1312.html

Key Players

Major vendors in the global FDP market include BAE Systems (UK), Nice Actimize(US), FICO (US), LexisNexis(US), TransUnion(US), Kount (US), Software AG(Germany), RSA Security(US), Fiserv(US), FIS (US), ACI Worldwide(US), Experian(Ireland), SecuroNix (US), Accertify (US), Feedzai (US), CaseWare (Canada), FRISS(Netherland), MaxMind (US), Gurucul (US), DataVisor (US), PayPal (US), Visa (US), SAS institute (US), SAP SE (Germany), Microsoft Corporation (US), F5, Inc (US), Ingenico (France), AWS (US), PerimeterX (US), OneSpan (US), Signifyd (US), Cleafy (Italy) and Pondera Solutions (US).

Contact:

Mr. Aashish Mehra

MarketsandMarkets™ INC.

630 Dundee Road

Suite 430

Northbrook, IL 60062

USA: 1-888-600-6441

Email: sales@marketsandmarkets.com

About MarketsandMarkets™

MarketsandMarkets™ provides quantified B2B research on 30,000 high growth niche opportunities/threats which will impact 70% to 80% of worldwide companies' revenues. Currently servicing 7500 customers worldwide including 80% of global Fortune 1000 companies as clients. Almost 75,000 top officers across eight industries worldwide approach MarketsandMarkets™ for their painpoints around revenues decisions.

Our 850 fulltime analyst and SMEs at MarketsandMarkets™ are tracking global high growth markets following the "Growth Engagement Model - GEM". The GEM aims at proactive collaboration with the clients to identify new opportunities, identify most important customers, write "Attack, avoid and defend" strategies, identify sources of incremental revenues for both the company and its competitors. MarketsandMarkets™ now coming up with 1,500 MicroQuadrants (Positioning top players across leaders, emerging companies, innovators, strategic players) annually in high growth emerging segments. MarketsandMarkets™ is determined to benefit more than 10,000 companies this year for their revenue planning and help them take their innovations/disruptions early to the market by providing them research ahead of the curve.

MarketsandMarkets's flagship competitive intelligence and market research platform, "Knowledge Store" connects over 200,000 markets and entire value chains for deeper understanding of the unmet insights along with market sizing and forecasts of niche markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market Growth Rate Research Report and Future Plans 2026 here

News-ID: 2775795 • Views: …

More Releases from Markets and Markets

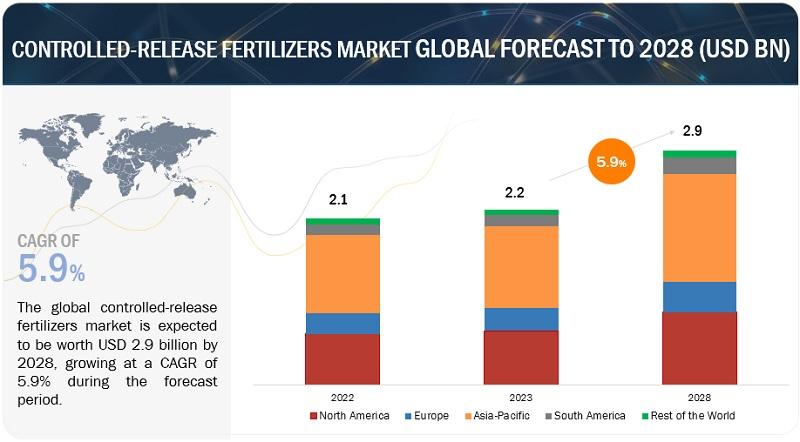

Controlled-release Fertilizers Market Latest Trends, Demands, Overview and Analy …

The controlled-release fertilizers market is experiencing notable growth, estimated at USD 2.2 billion in 2023 and projected to reach USD 2.9 billion by 2028. This reflects a compound annual growth rate (CAGR) of 5.9% during the forecast period. The demand for controlled-release fertilizers is increasing due to their benefits in enhancing nutrient efficiency, reducing environmental impact, and supporting sustainable agricultural practices.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=136099624

These fertilizers are prized for their ability…

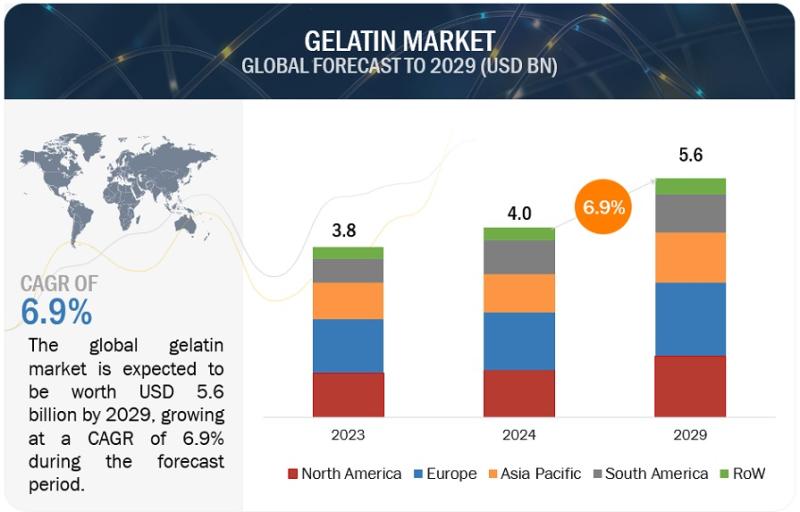

Gelatin Market is Projected to Reach $5.6 billion by 2029, at a CAGR of 6.9% fro …

According to a research report titled "Gelatin Market by Source (Animal, Plants), By Applications (Food & Beverages, Pharmaceuticals, Health & Nutrition, Cosmetics, Personal Care, Animal Feed), Type (Type A, Type B), Function (Thickener, Stabilizer, Gelling Agent) - Global Forecast to 2029," published by MarketsandMarkets, the gelatin market is poised for significant growth. The market, valued at USD 4.0 billion in 2024, is projected to reach USD 5.6 billion by 2029,…

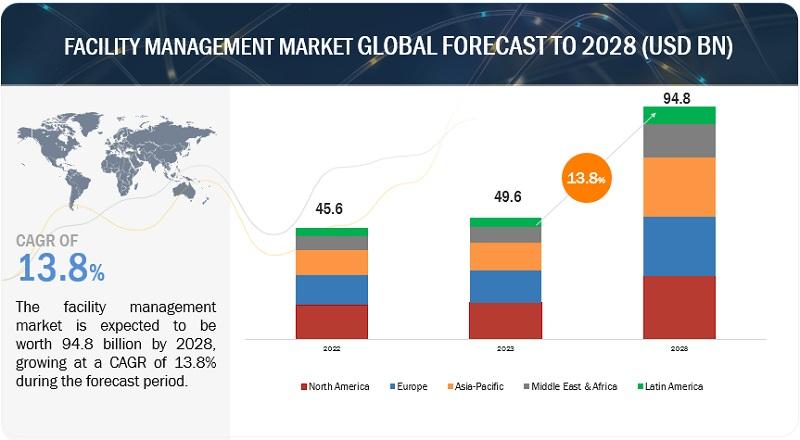

Facility Management Market Status, Revenue, Growth Rate, Services and Solutions

According to a research report "Facility Management Market by Offering (Solutions (IWMS, BIM, Facility Operations & Security Management) and Services), Vertical (BFSI, Retail, Construction & Real Estate, Healthcare & Life sciences) and Region - Global Forecast to 2028" published by MarketsandMarkets, the facility management market is estimated at USD 49.6 billion in 2023 to USD 94.8 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 13.8%.

Download PDF Brochure:…

Endpoint Security Market Size, Revenue, Growth Rate Analysis and Forecast 2024

According to a research report "Endpoint Security Market by Solution (Endpoint Protection Platform and Endpoint Detection and Response), Service, Deployment Mode, Organization Size, Vertical (Healthcare, Retail and eCommerce, and Government), and Region - Global Forecast to 2024", published by MarketsandMarkets, the global endpoint security market size is expected to grow from USD 12.8 billion in 2019 to USD 18.4 billion by 2024, at a Compound Annual Growth Rate (CAGR) of…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…