Press release

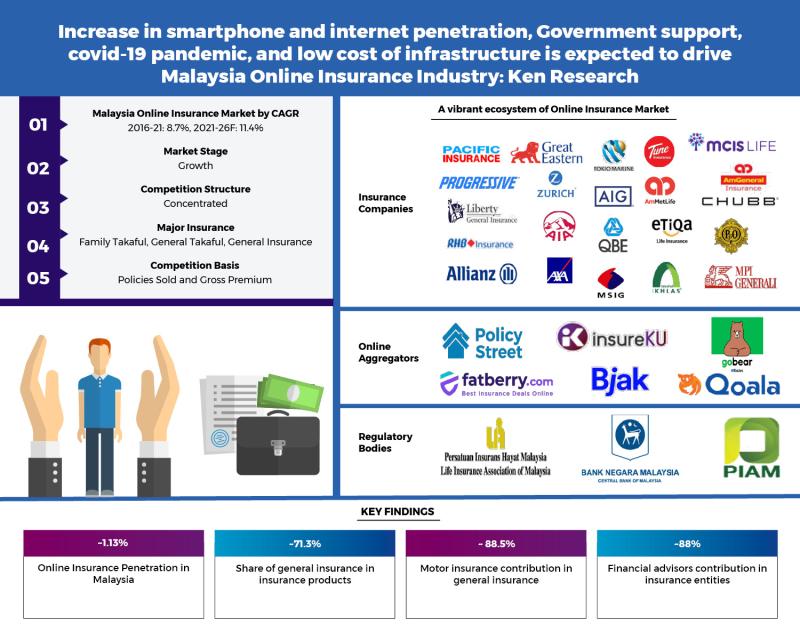

Increase in smartphone and internet penetration, Government support, covid-19 pandemic, and low cost of infrastructure is expected to drive Malaysia Online Insurance Industry: Ken Research

Malaysia Online Insurance Industry Overview:Increasing Internet and Smartphone penetration, low infrastructural cost and covid-19 pandemic have collectively influenced the demand of Online Insurance users in the country. Players in Insurance industry are aiming to provide online services to cater the untapped and under exploited market.

Medical inflation is increasing at more than 10% since 2015, leading to increasing demand for health insurance providers. Covid-19 also plunged the demand and penetration in the health insurance segment with double digit CAGR seen from 2019 to 2020, the highest increase in over the past 5 years. Malaysia's life insurance industry underwent digitization because of the COVID-19 epidemic. The restrictive measures imposed in Malaysia provided an opportunity for insurers to switch to a digital mode of operations.

Motor Vehicle registration is growing at a constant rate, with more than 50 products launched in the market in 2019. This has increased the need for motor vehicle insurance providers in Malaysia.

Travel Insurance constitutes very high proportion in the online insurance segment, with Most of the travel insurance are sold online along with the travel packages or bookings. Online travel agencies tie up with companies to provide insurance for their users. Huge investment are made in insurtech companies with technological advancement in the form of automation and personalization, dominated the insurance landscape.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/malaysia-online-insurance-market-outlook-to-2026/596048-93.html

Increasing mobile penetration gave high upside potential to the online insurance market with Malaysia having 89% internet users in 2020, and growing at a CAGR of 5% since 2016 showing opportunity for business to divest in online insurance segment. Multiple marketing and business strategies are implemented involving cutting insurance time from 14 days to 1 hour, thus reducing waiting time for the buyers.

The report titled "Malaysia Online Insurance Market Outlook to 2026F: Driven by a growth in demand for insurance at greater convenience and lesser cost in the country" by Ken Research suggested that the Malaysia Online Insurance market is expected to grow significantly owing to increasing government support and covid-19 pandemic. Covid-19 drive the growth of Insurance Industry with the increase in online users and people's preference towards avoiding physical contact and substantial increase in the health demand for the users. Instead of a one-size fits-all approach, insurer's offers personalized or customized insurance products through the digital insurance process, in order to satisfy the needs of all types of clients. Online sales of insurance has removed the intermediary between the firm and the policyholder. This cuts down cost for both the insured as well as the insurer. The convenience and ease of use offered due to shifting of the industry online makes it a preferred choice for people looking to purchase insurance currently. The experience of being able to purchase insurance from the comfort of one's own home drives them towards online insurance.

Key Segments Covered in Malaysia Online Insurance Industry

Malaysia Online Insurance Market

By Product type of Insurance basis Gross Premium

Life Insurance

Family Takaful

General Takaful

General Insurance

By Product type of General Insurance basis Gross Premium

Motor Insuranc

Medical & Health

Employer's liability

Personal accident

By Type of Entity basis Gross Premium

Captive Players

Aggregator Players

Financial Advisors

By Region basis Gross Premium

Penang

Johar

Klang Valley & Selangor

Request For Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDQ4

Key Target Audience

Insurance players

Online Insurance Captive players

Online Insurance Aggregators players

Insurance Technology provider

Insurance users

New Entrant in Online Insurance space

Associated or affiliated Banks with Insurance entities

Regulatory Bodies for Insurance entities

Time Period Captured in the Report:

Historical Period: 2016-2021

Forecast Period: 2022-2026

Emerging Companies in Malaysia Online Insurance Sector

Companies Covered:

Online Insurane Aggregators

Policy Street

Bjak

Qoala

Online Insurance Captive Players

Liberty Insurance

Axa Affin Insurance

eTiQa Insurance

AIA Malaysia

Takaful Ikhlas

Tune Insurance

Zurich Insurance

Chubb Insurance

Allanz Malaysia Berhad

FWD Takaful

Key Topics Covered in the Report

Overview of Malaysia Online Insurance Industry

Startups in Malaysia Online Insurance Sector

Country Overview of Malaysia Online Insurance Industry

Malaysia Online Insurance Market Overview and Genesis

Malaysia Online Insurance Market Segmentations

Industry Analysis of Malaysia Online Insurance Market

Snapshot on Online Aggregators in Malaysia

Competition Analysis of Malaysia Online Insurance Market

Outlook and Future Projections for Malaysia Online Insurance Market

Research Methodology

Related Reports

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-online-loan-aggregator-industry-outlook/347119-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/uae-online-insurance-industry-outlook-to-2024/335274-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/india-web-insurance-aggregator-industry/308537-93.html

Follow Us

https://www.linkedin.com/company/ken-research/

https://www.instagram.com/kenresearch/

https://www.facebook.com/kenresearch

https://twitter.com/KenResearch

https://www.youtube.com/c/KenResearchKen

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Increase in smartphone and internet penetration, Government support, covid-19 pandemic, and low cost of infrastructure is expected to drive Malaysia Online Insurance Industry: Ken Research here

News-ID: 2774879 • Views: …

More Releases from Ken Research Pvt .Ltd

Indonesia Industrial Air Filtration Market Surpasses USD 1.1 Billion Milestone - …

Comprehensive market analysis maps compliance-led growth trajectory, industrial expansion hotspots, technology evolution, and strategic imperatives for stakeholders across Indonesia's rapidly industrializing manufacturing ecosystem.

Delhi, India - February 12, 2026 - Ken Research released its strategic market analysis titled "Indonesia Industrial Air Filtration Market Outlook to 2030," revealing that the current market size is valued at USD 1.1 billion, based on a five-year historical analysis. The detailed study outlines how the market…

Ken Research Stated Nigeria Solar Home Systems and Pay-Go Energy Market to Reach …

Comprehensive market analysis maps exponential growth trajectory, investment opportunities, and strategic imperatives for industry leaders in Nigeria's rapidly evolving off-grid energy ecosystem.

Delhi, India - October 2025 - Ken Research released its strategic market analysis titled "Nigeria Solar Home Systems and Pay-Go Energy Market," revealing that the current market size is valued at USD 1.1 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised…

Ken Research Stated Philippines' Death Care Market to Reached USD 1.0 Billion

Comprehensive market analysis maps evolving consumer preferences, regulatory shifts, and expansion opportunities shaping the country's organized death care ecosystem.

Delhi, India - February 11, 2026 - Ken Research released its strategic market analysis titled "Philippines Death Care Market", revealing that the current market size is valued at USD 1.0 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand, driven by rising urbanization,…

Philippines Curtain Wall Market Surpasses USD 1.3 billion Milestone - Latest Ins …

Comprehensive market analysis maps strong construction-led growth trajectory, competitive dynamics, and strategic imperatives for façade system manufacturers, developers, EPC firms, and investors across the country's evolving commercial and residential skyline.

Delhi, India - February 11, 2026 - Ken Research released its strategic market analysis titled "Philippines Curtain Wall Market Outlook to 2032," revealing that the current market size is valued at USD 1.3 billion, based on a five-year historical analysis. The…

More Releases for Insuranc

Burial Insurance Market Hits New High | Major Giants nited of Omaha, Fidelity Li …

HTF MI recently introduced Global Burial Insurance Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Gerber Life, Mutual of Omaha, Colonial Penn, Globe Life, AARP, Foresters Financial, MetLife,…

Empowering Growth: Kidnap for Ransom and Ransom Insuranc Market 2024 and Industr …

Kidnap for Ransom and Ransom Insuranc Market Overview

Kidnap for ransom and ransom insurance is evolving in response to the escalating threat of kidnapping and extortion in high-risk regions around the world. Kidnap for ransom insurance provides financial protection to individuals, families, and businesses against the financial consequences of ransom demands, extortion, and related expenses such as crisis management and legal fees. With geopolitical instability, organized crime, and terrorism posing significant…

Takaful Insurance Market : Top 10 Players are ABU DHABI NATIONAL TAKAFUL CO., AL …

Global Takaful Insurance Market Size, Share, and Industry Forecast, 2021-2030 . The global takaful insurance market study evaluates the market reach, revenue potential, and industry growth while keeping track of the current regional trends. All information in the takaful insurance market is gathered from trustworthy sources and is meticulously examined and validated by industry professionals. According to research report by Allied Market Research, the global takaful insurance market was valued…

Personal Accident and Health Insurance Market to See Huge Growth by 2025 | Allia …

A new research document is added in HTF MI database of 200 pages, titled as 'Global Personal Accident and Health Insurance Market Size study with COVID-19 impact, by Type (Personal Accident Insurance, Health Insurance), by Application (Direct Marketing, Bancassurance, Agencies, E-commerce, Brokers) and Regional Forecasts 2020-2026' with detailed analysis, Competitive landscape, forecast and strategies. The study covers geographic analysis that includes regions like North America, South America, Europe, Asia-Pacific…

Demographic Trends in Insurance Market Report- Detailed Analysis Report with Lea …

The research reports on Demographic Trends in Insurance Market report gives detailed overview of factors that affect global business scope. Demographic Trends in Insurance Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. Demographic Trends in Insurance Market report contains emerging players analyze data including competitive situations, sales, revenue and…

Accident Insurance Industry in US Forecast to 2019-2025 Profiling Allianz, AXA, …

The Global Accident Insurance Industry Research Report includes companies engaged in manufacturing, capacity, production, price, cost, revenue and contact information.

The report provides key statistics on the market status of the Accident Insurance manufacturers and is a valuable source of guidance and direction for companies and individuals interested in the industry.

Get Free Sample Copy of Accident Insurance market 2019-25 at: https://www.inforgrowth.com/samplerequest/r/949749/global-accident-insurance-market-size-status-a

Complete report on Accident Insurance market spreads across 106 pages…