Press release

Neo And Challenger Bank Market size was valued at USD $45.0 Billion in 2021, growing at a CAGR of 48.56% from 2022 to 2032: Evolve Business Intelligence

The global Neo And Challenger Bank market size was valued at USD $45.0 Billion in 2021 growing at the CAGR of 48.56% from 2022 to 2032. Evolve Business Intelligence provides an in-dept research study that contains the ability to focus on the major market dynamics in several region across the globe. Moreover, a details assessment of the market is conducted by our analysts on various geographic including North America, Europe, Asia Pacific, Latin America, and Middle East & Africa to provide clients with opportunity to dominate the emerging markets. The Neo And Challenger Bank market study includes growth factors, restraining factors, challenges, and Opportunities which allows the businesses to assess the market capability of the industry. The report delivers market size from 2020 to 2032 with forecast period of 2022 to 2032. The report also contains revenue, production, sales consumption, pricing trends, and other factors which are essential for assessing any market.Request Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016055

Key Highlights:

• The global Neo And Challenger Bank market size was valued at USD $45.0 Billion in 2021 growing at the CAGR of 48.56% from 2022 to 2032.

• Europe dominated the market in 2021

• Asia Pacific is expected to grow at a highest CAFR from 2022 to 2032

Key Players

The Neo And Challenger Bank market report gives comprehensive information about the company and its past performance. The report also provides a detail market share analysis along with product benchmarking with key developments.

The key players profiled in the report are:

• Atom Bank plc

• Fidor Solutions AG

• Monzo Bank Limited

• Movencorp, Inc.

• Mybank

• Number26 GmbH

• Simple Finance Technology Corporation

• Tandem Bank

• UBank limited

• WeBank.

The Global Neo And Challenger Bank Logistic report also includes information on company profiles, product descriptions, revenue, market share data, and contact details for several regional, global, and local companies. Due to increased technological innovation, R&D, and M&A operations in the sector, the market is becoming more popular in particular niche sectors. Additionally, a large number of regional and local vendors in the Neo And Challenger Bank market provide specialised product offerings according to geographical regions in keeping with the global manufacturing footprint. Due to the reliability, quality, and technological modernity of the worldwide suppliers, it is difficult for the new market entrants to compete.

COVID Impact

In terms of COVID 19 impact, the Neo And Challenger Bank market report also includes the following data points:

● COVID19 Impact on Neo And Challenger Bank market size

● End-User/Industry/Application Trend, and Preferences

● Government Policies/Regulatory Framework

● Key Players Strategy to Tackle Negative Impact/Post-COVID Strategies

● Opportunity in the Neo And Challenger Bank market

Get a Free Sample Copy of This Report @ https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016055

Scope of the Report:

Market Segment By Service Type:

• Loans

• Mobile Banking

• Checking & saving accounts

• Payment & money transfer

• Others

Market Segment By End User:

• Business

• Personal

For more information: https://report.evolvebi.com/index.php/sample/request?referer=OpenPR&reportCode=016055

Key Region/ Countries Covered

● North America (US, Canada, Mexico)

● Europe (Germany, U.K., France, Italy, Russia, Rest of Europe)

● Asia-Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

● Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of MEA)

● Latin America (Mexico, Brazil, Argentina, Rest of Latin America)

Reasons to Buy this Report:

• Detail analysis of the impact of market drivers, restraints, and oppotunities

• Competitive Intelligence providing the understanding about the ecosystem

• Details analysis of Total Addressable Market (TAM) of your products

• Investment Pockets and New Business Opportunities

• Demand-supply gap analysis

• Strategy Planning

Contact Us:

Evolve Business Intelligence

India

Contact: +1 773 644 5507 (US) / +441163182335 (UK)

Email: sales@evolvebi.com

Website: www.evolvebi.com

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging the pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neo And Challenger Bank Market size was valued at USD $45.0 Billion in 2021, growing at a CAGR of 48.56% from 2022 to 2032: Evolve Business Intelligence here

News-ID: 2770330 • Views: …

More Releases from Evolve Business Intelligence

Physical Security Market Forecast to Reach USD 263.32 Billion by 2033

The global physical security market is undergoing a significant transformation, driven by a convergence of technological advancements and evolving security threats. Within this landscape, Video Surveillance as a Service (VSaaS) is emerging as a high-opportunity solution, poised to redefine how businesses and organizations protect their assets. This article explores the challenges facing the market and presents VSaaS as a pragmatic and effective solution, while also considering external factors like US…

Over-the-Top (OTT) Market Forecast to Reach USD 476.84 Billion by 2033

The Over-the-Top (OTT) market is a digital gold rush, bypassing traditional media distribution to deliver content directly to consumers via the internet. As per a recent analysis by Evolve Business Intelligence, this dynamic market is projected to reach a staggering USD 476.84 billion by 2033, with a robust compound annual growth rate (CAGR) of 16.74% from 2023. While smartphones and smart TVs currently dominate this landscape, a significant, often overlooked…

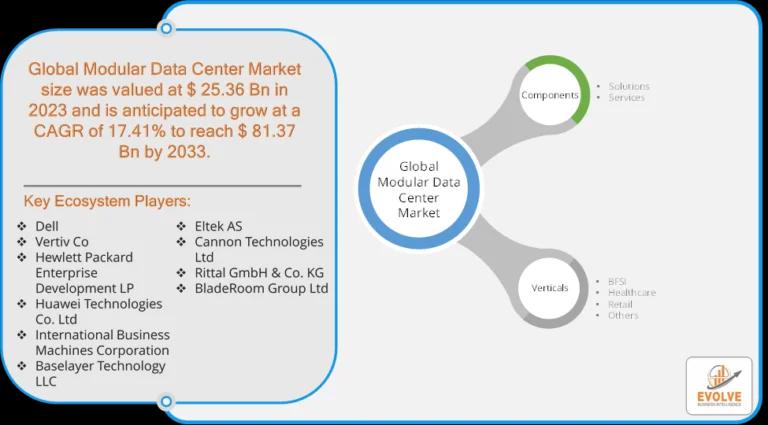

Modular Data Center Market Forecast to Reach USD 75.77 Billion by 2030

The global modular data center market, valued at an estimated $29.04 billion in 2024, is on a rapid growth trajectory, projected to reach $75.77 billion by 2030, with a compound annual growth rate (CAGR) of 17.4%. While this growth is fueled by major sectors like IT, telecom, and healthcare, the retail industry stands out as a high-opportunity niche poised to leverage modular data center solutions.

Download the full report now to…

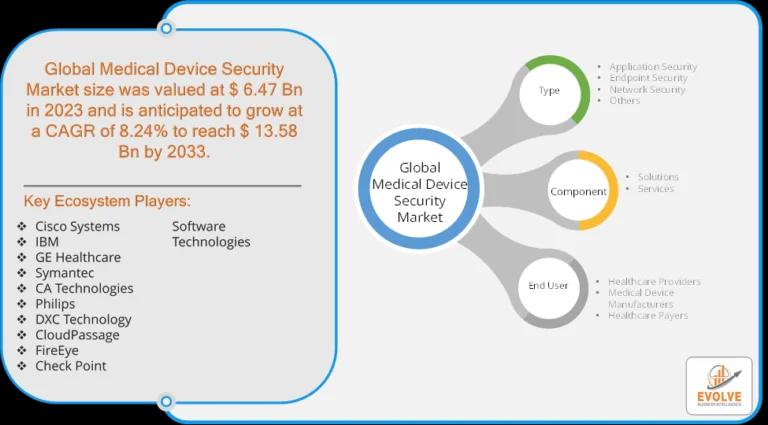

Medical Device Security Market Forecast to Reach USD 13.58 Billion by 2033

The medical device industry is undergoing a digital transformation, with an increasing number of devices connecting to the internet and healthcare networks. This evolution has created a significant market for medical device security, which is projected to grow from USD 6.47 billion in 2023 to USD 13.58 billion by 2033, at a robust Compound Annual Growth Rate (CAGR) of 8.24%. At the core of this growth lies a critical and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…