Press release

Thailand Online Insurance market is currently in the growing stage where citizens are getting used to purchasing short insurance plans as they are much cheaper compared to long term plans: Ken Research: Ken Research

The pandemic (2019-20) led to a sharp incline of a double digit growth rate as it brought realization among Thais to buy new policies or port to insurers who offer better coverage and claim settlement.Impact of Digital: With increasing internet penetration rate and wide awareness of e-commerce, online platforms are making sure of smooth, intuitive, and time-saving customer experience which is achieved by incorporating fast and efficient ways of purchasing insurance online via verification of insurance company's credibility by checking their incurred claim ratio, customer reviews; instant insurance issuance; minimal paperwork and lower insurance premium and more.

COVID- 19: The Pandemic is the major driver of the growth in Thailand's Online Insurance Market which has spurred Health Insurance in the country as people were inclined toward family health security especially in emergencies and uncertain circumstances. It led to a sharp incline of a double digit growth rate as it brought realization among Thais to buy new policies or port to insurers who offer better coverage and claim settlement.

For More Detail @ https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/thailand-online-insurance-market-outlook-to-2027/596005-93.html

Government Initiatives: The digital revolution in the country is driving the overall market growth with policies like "Insurance Development Plan 4.0" in establishing a stable and sustainable insurance system that facilitates a healthy competition in the digital economy through the adoption of new innovations and technologies where the public, the private and the people will have an easy access to the insurance as a risk management tool for the citizens' well-being. Compulsory Motor Insurance by the government agencies have also increased the insurance growth in the country.

Challenges in the Market: The market is challenged integrating new technology into existing systems, lack of speed to deliver new services into the market, high it run time cost before migrating to digitally enhanced systems, lack of it expertise, analyzing a large volume of customer data, cyber threats and more. However, these challenges can be managed with providing efficient customer-oriented service and leverage technology to forecast and optimize outputs. To embrace full digital transformation, insurance companies must overcome different barriers to modernize their operations from integrating new technology to tackling with cyber threats.

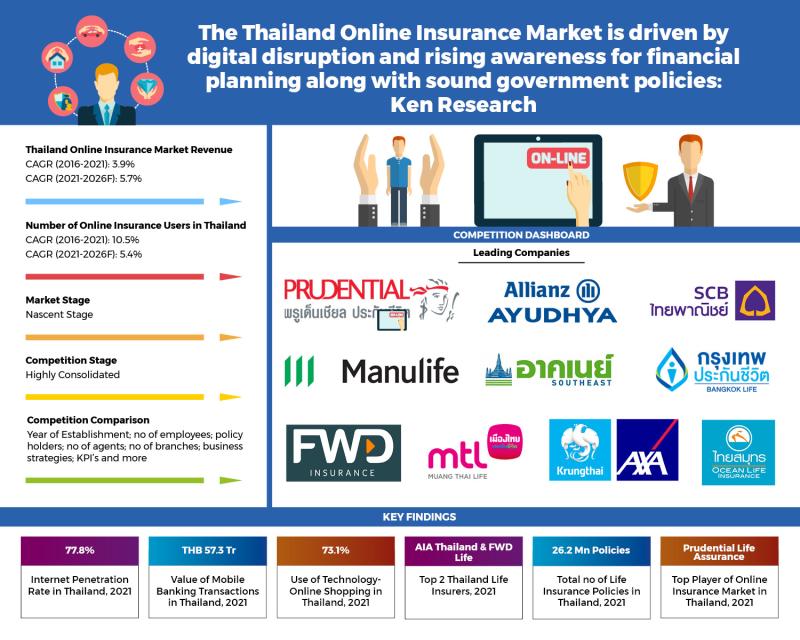

Analysts at Ken Research in their latest publication "Thailand Online Insurance Market Outlook to 2026F- Driven by digital disruption and rising awareness for financial planning along with sound government policies" by Ken Research observed that with the online insurance industry being at the nascent stage, the marketplace offers wide opportunities at affordable premiums as multiple players enter the market. The market is expected to grow @5.7% CAGR (2021-2026F) owing to the increase in smart phone penetration rate and increased consumer spending on different life and non-life insurance due to growing penetration of internet and smart phones and increasing safety measures for emergencies are driving the market in Thailand.

Request for Free Sample Report @ https://www.kenresearch.com/sample-report.php?Frmdetails=NTk2MDA1

Key Segments Covered in the report

Thailand Online Insurance Market

By Product Type

Life Insurance

Non-Life Insurance

By Non-Life Insurance

Health Insurance

Motor Insurance

Property insurance

Others

By Region

Bangkok

Songkhla

Lamphun

Others

By Income

Less than 40k

More than 40k

By Mode of Distribution

Agents

Aggregators

Company Website

Key Target Audience

Insurance Industry

Online Insurance Companies

Policy Consultants

Life and Non-Life Insurers

Government Agencies

Private Insurance Agents

Insurance Brokers

Market Research and Consulting Firms

Time Period Captured in the Report:

Historical Period: 2016-2021

Base year: 2021

Forecast Period: 2022F-2026F

Companies Covered:

Prudential Life Assurance

Muang Thai Life Assurance

Bangkok Life Assurance

South East Life Insurance

Ocean Life Insurance

FWD Life Insurance

Allianz Ayudhya Assurance

SCB Insurance

Manulife Insurance

Krungthai AXA Life Insurance

Key Topics Covered in the Report

Executive Summary of Thailand Online Insurance Market

Thailand Country Overview

Thailand Insurance Sector Overview

Thailand Online Insurance Market Genesis and Overview

Major Challenges in Thailand Online Insurance Market

Comprehensive Analysis on Thailand Online Insurance Market (Market Size, 2016-2026F; Market Shares; Future Trends)

Industrial Analysis of Thailand Online Insurance Market

Government and Private Initiatives for Thailand Online Insurance Market

Technologies Shaping Thailand Online Insurance Market

Competitive Landscape in Thailand Online Insurance Market

Analyst Recommendations

Related Reports:

https://www.kenresearch.com/banking-financial-services-and-insurance/insurance/uae-online-insurance-industry-outlook-to-2024/335274-93.html

https://www.kenresearch.com/banking-financial-services-and-insurance/loans-and-advances/indonesia-online-loan-aggregator-industry-outlook/347119-93.html

Follow Us

https://www.linkedin.com/company/ken-research/

https://www.instagram.com/kenresearch/

https://www.facebook.com/kenresearch

https://twitter.com/KenResearch

https://www.youtube.com/c/KenResearchKen

Contact Us:-

Ken Research

Ankur Gupta, Head Marketing & Communications

support@kenresearch.com

+91-9015378249

Ken Research Pvt. Ltd.,

Unit 14, Tower B3, Spaze I Tech Business Park, Sohna Road, sector 49 Gurgaon, Haryana - 122001, India

Ken Research is a research based management consulting company. We provide strategic consultancy to aid clients on critical business perspective: strategy, marketing, organization, operations and technology transformation, advanced analytics, corporate finance, mergers & acquisitions and sustainability across all industries and geographies. We provide business intelligence and operational advisory across 300+ verticals underscoring disruptive technologies, emerging business models with precedent analysis and success case studies. Some of top consulting companies and Market leaders seek our intelligence to identify new revenue streams, customer/ vendor paradigm and pain points and due diligence on competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Thailand Online Insurance market is currently in the growing stage where citizens are getting used to purchasing short insurance plans as they are much cheaper compared to long term plans: Ken Research: Ken Research here

News-ID: 2766473 • Views: …

More Releases from Ken Research Pvt .Ltd

Ken Research Stated Saudi Arabia's Food and Beverage Market to Reached USD 23.5 …

Comprehensive market analysis maps consumption evolution, investment opportunities, and strategic imperatives for industry leaders in the Kingdom's rapidly transforming F&B ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Food and Beverage Market," revealing that the current market size is valued at USD 23.5 billion, based on a five-year historical analysis. The detailed study outlines how the market is poised to expand,…

Saudi Arabia Facility Management Services Market Surpasses USD 26 Billion Milest …

Comprehensive market analysis maps sustained infrastructure expansion, outsourcing momentum, and strategic imperatives for operators and investors in the Kingdom's rapidly professionalizing facility management ecosystem.

Delhi, India - September 16, 2025 - Ken Research released its strategic market analysis titled "Saudi Arabia Facility Management Services Market," revealing that the current market size is valued at USD 26 Billion, based on a five-year historical analysis. The detailed study outlines how the market is…

Ken Research Stated Chile Sports Equipment and Fitness Retail Market to Reached …

Comprehensive market analysis maps growth trajectory, consumer demand shifts, and strategic imperatives for retailers and brands operating in Chile's rapidly evolving sports and fitness ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Chile Sports Equipment and Fitness Retail Market," revealing that the current market size is valued at USD 1.2 Billion, based on a five-year historical analysis. The detailed study outlines how the…

Saudi Arabia Life Insurance Market - Ken Research Stated the Sector Valued at ~U …

Comprehensive market analysis maps strong growth trajectory, investment opportunities, and strategic imperatives for insurers operating in the Kingdom's rapidly evolving life insurance ecosystem.

Delhi, India - February 16, 2026 - Ken Research released its strategic market analysis titled "Saudi Arabia Life Insurance Market Outlook to 2030," revealing that the current market size is valued at USD 8 billion, based on a five-year historical analysis. The detailed study outlines how the market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…