Press release

Business Health Insurance Market To See Huge Growth By 2028| Aviva, AXA, Aviva

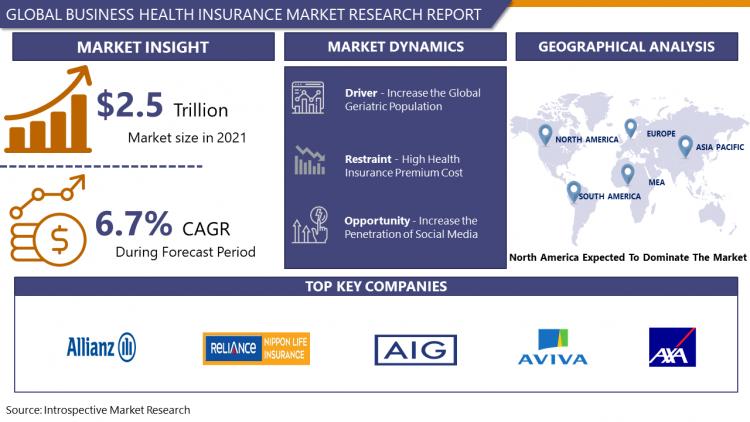

Market Overview:The global Business Health Insurance Market is anticipated to reach USD 3.9 Trillion by 2028, up from an anticipated USD 2.5 Trillion in 2021, with a CAGR of 6.7%.

Business health insurance is also known as group health insurance. It is a health insurance plan that employers provide to qualified employees and their families. The majority of larger businesses provide qualified employees with corporate health insurance that covers all medical costs. The insurance coverage quantity varies from firm to company. Hospital insurance costs for the treatment of any ailments, accidents, and other physical or mental disorders are all included in the health cost, and such charges are reimbursed by corporate health insurance in exchange for a monthly installment or payroll tax. Business health insurance offers various advantages to the business and employees, including tax advantages, help with employee retention, and coverage for pre-existing conditions starting on the first day.

Read Full Research Report:-

https://introspectivemarketresearch.com/reports/business-health-insurance-market/

Market dynamics:

Driver:

Rising the Global Geriatric Population

The geriatric population in the world is growing, which is a major factor that supports the growth of the business health insurance market. Chronic diseases are more common in people over 65. For instance, Statista reported that in 2021, Japan will have the biggest number of adults 65 and older. In 2021, there will be 22% of Germans and 29% of Japanese individuals over the age of 65. The prevalence of chronic diseases like cancer among the aging population is rising as a result. As a result, the majority of health insurance companies created insurance plans just for seniors, raising the government's worry over their health. These elements contribute to the market for business health insurance expanding throughout the forecasted year.

Opportunities:

Augmenting the Penetration of Social Media

The majority of individuals today are dependent on social media. Many people don't know enough about health insurance plans, but thanks to social media, people are more knowledgeable about health insurance plans for the treatment of any ailment, which presents a lucrative possibility for the commercial health insurance market. To give information on policies, the majority of health insurance companies release new mobile applications. So, buying a health insurance policy for the treatment of any illness or accident is simple for consumers.

Download Sample Report PDF (Including Full TOC, Table & Figures) @

https://introspectivemarketresearch.com/request/14869

Segmentation Analysis Of Business Health Insurance Market

By Service Providers, the private provider's sector is anticipated to dominate the market in terms of business health insurance market share. In developing countries, increase the number of private health insurance providers. Private health insurance policies are more flexible and offer more options to policyholders.

By Age group, the adult segment is expected to have maximum market growth in business health insurance. Most adults adopt the health insurance plan for treatment and hospitalization. The adult group is more aware of the health insurance plan.

By Network Providers, the PPOs segment is projected to have the highest market share in the business health insurance market. They give you more options when it comes to hospitals, doctors, and other advantages, which makes this network more appealing.

By Insurance Type, Medical Insurance is anticipated to have maximum market growth in business health insurance. Medical insurance contains a basic type of health insurance plan. It offers financial security to the people.

By Service Providers

• Public

• Private

By Age Group

• Adults

• Minors

• Senior Citizens

By Network Providers

• Exclusive Provider Organizations (EPOs)

• Preferred Provider Organizations (PPOs)

• Health Maintenance Organization (HMOs)

• Point of Services (POS)

By Insurance Type

• Hospitalization Insurance

• Medical Insurance

• Disease Insurance

• Income Protection Insurance

For More Information or Query or, Customization before Buying Visit@

https://introspectivemarketresearch.com/inquiry/14869

Regional Analysis Of Business Health Insurance Market

North America dominated the Business Health Insurance market. The presence of a large number of health and life insurance providers in the North American region. The growing prevalence of diseases and the rising number of elderly populations in this region support the growth of the market. The US is the dominant region in the business health insurance market. This is owing to the rising cost of medical services, and an increasing number of day-care procedures boosting the growth of the market. In addition, these people in this region are more aware of the health insurance plan, increasing the number of health sectors in this region also helps to rising the adoption of health insurance plans that propels the growth of the business health insurance market in the forecast year.

By Region

• North America (U.S., Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

• Asia-Pacific (China, India, Japan, Singapore, Australia, New Zealand, Rest of APAC)

• Middle East & Africa (Turkey, Saudi Arabia, Iran, UAE, Africa, Rest of MEA)

• South America (Brazil, Argentina, Rest of SA)

Top Key Players Covered In The Business Health Insurance Market:

• Allianz (Germany)

• AXA (France)

• Nippon Life Insurance (Japan)

• American Intl. Group (US)

• Aviva (UK)

• Assicurazioni Generali (Italy)

• Cardinal Health (US)

• State Farm Insurance (US)

• Dai-ichi Mutual Life Insurance (Japan

• Munich Re Group (Germany)

• Zurich Financial Services (Switzerland)

• Prudential (US)

• Asahi Mutual Life Insurance (Japan)

• Sumitomo Life Insurance (Japan)

• MetLife (US)

• Allstate (US)

• Aegon (Netherlands)

• Prudential Financial (US) and other major players.

Key Industry Development In The Business Health Insurance Market

In April 2021, Molina Healthcare Inc. and Cigna Corporation finalized a deal under which Molina Healthcare Inc. will buy Cigna's Texas Medicaid and Medicare-Medicaid Plan (MMP).

In April 2021, Anthem Inc. declared the acquisition of myNEXUS, Inc. The myNEXUS Inc. is a home-based nursing management organization that is engaged in providing clinical support services to about 1.7 million Medicare Advantage enrollees in the United States.

Objectives Of The Report

• To carefully analyze and forecast the size of the Business Health Insurance market by value and volume.

• To estimate the market shares of major segments of the Business Health Insurance

• To showcase the development of the Business Health Insurance market in different parts of the world.

• To analyze and study micro-markets in terms of their contributions to the Business Health Insurance market, their prospects, and individual growth trends.

• To offer precise and useful details about factors affecting the growth of the Business Health Insurance

• To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Business Health Insurance market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Buy the Latest Version of this Report @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=14869

Read Related Report: -

https://introspectivemarketresearch.com/reports/health-economics-and-outcomes-research-heor-services-market/

https://introspectivemarketresearch.com/reports/business-travel-insurance-market/

https://introspectivemarketresearch.com/reports/business-intelligence-in-healthcare-market/

https://www.openpr.com/news/2761947/micro-perforated-food-packaging-market-size-growth-factors

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

Email : sales@introspectivemarketresearch.com

LinkedIn | Twitter | Facebook

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assist our clients grow and have a successful impact on the market. Our team at IMR is ready to assist our clients flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, specialized in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Health Insurance Market To See Huge Growth By 2028| Aviva, AXA, Aviva here

News-ID: 2763300 • Views: …

More Releases from Introspective Market Research

Absorbed Glass Mat (AGM) Separator Batteries Market To Reach USD 38.55 Billion b …

Absorbed Glass Mat (AGM) Separator Batteries Market was valued at USD 23.81 Billion in 2023 and is expected to reach USD 38.55 Billion by the year 2032.

Absorbed Glass Mat (AGM) batteries are advanced lead-acid batteries designed for higher electrical output, making them ideal for start-stop vehicle systems and increasingly popular in electric vehicles. Unlike conventional batteries, AGM batteries are sealed, maintenance-free, non-spillable, and highly resistant to vibrations, with improved…

Automotive Fuel Injection Systems Market: Business Research Analysis By 2032

Automotive Fuel Injection Systems are crucial for optimizing engine performance, fuel efficiency, and reducing emissions in modern vehicles. These systems, which include fuel injectors, a fuel pump, a pressure regulator, and an ECU, precisely control fuel delivery either through Direct Fuel Injection or Port Fuel Injection. With growing demand for fuel-efficient, environmentally-friendly vehicles, advanced technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI) are driving market growth…

North America Coal to Liquid Market to Reach 3.02 Mn at CAGR 8.1% | DKRW Energy, …

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through…

India Green Hydrogen Market Next Big Thing | Adani Green Energy, JSW Energy, NTP …

IMR posted new studies guide on India Green Hydrogen Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the India Green Hydrogen marketplace became specifically driven with the aid of the growing R&D spending internationally.

India Green Hydrogen Market Size Was Valued at USD 2.51 Billion in 2023, and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…