Press release

Home Insurance Market to Reach Value of USD 277.25 Billion With CAGR 8.3% by the year 2028, Report by Introspective Market Research

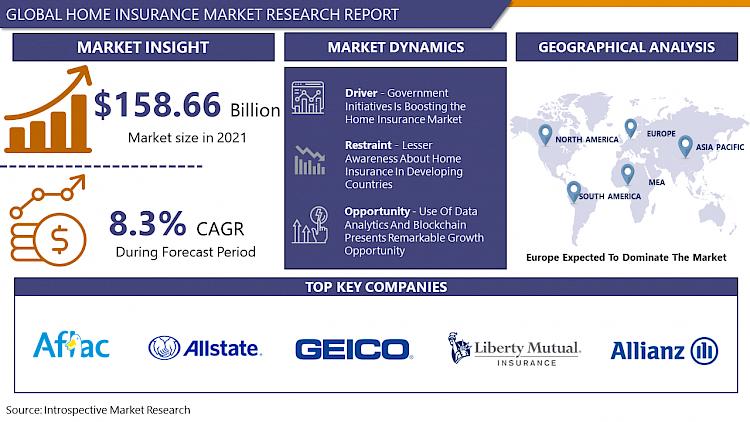

Market Overview:Home Insurance Market was valued at USD 158.66 Billion in 2021 and is expected to reach USD 277.25 Billion by the year 2028, at a CAGR of 8.3%.

Home insurance, commonly referred to as homeowner's insurance, is a type of property insurance that protects a person's house and personal goods against risks and losses. Each policy's level of home insurance coverage is different, but the majority of them cover dangers like fire, thunderstorms, and burglary. General property and casualty insurance are one of the many insurance products offered by the majority of insurance firms. The house insurance market is anticipated to experience consistent growth throughout the course of the forecast period.

Read Full Research Report: - https://introspectivemarketresearch.com/reports/home-insurance-market/

Market Dynamics:

Driver:

The global market for home insurance is anticipated to be driven by the rising demand for insurance services connected to property and casualty. The need for property insurance has increased, which is assisting the expansion of the house insurance market. Environmental and catastrophic occurrences like avalanches, earthquakes, floods, forest fires, hurricanes, lightning, tornadoes, tsunamis, and volcanic eruptions are on the rise internationally. Additionally, the Global Facility for Disaster Reduction and Recovery (GFDRR) and the World Bank Group's Finance, Competitiveness, and Innovation Global Practice jointly launched the "Disaster Risk Financing and Insurance (DRFI) Program" in to put comprehensive financial protection strategies into action. These kinds of initiatives are anticipated to increase the accessibility of home insurance services and raise awareness of its significance.

Opportunities:

It is anticipated that the adoption of technology like predictive analytics would open up new prospects in the home insurance sector. Property insurers should have access to the historical data required to more properly estimate risk thanks to the use of predictive analytics techniques. Additionally, it is simpler to contextualize policies and monitor risk in real-time thanks to the Internet of Things (IoT) use in smart devices and increased access to their data. These elements should create a lot of new prospects for this sector.

Acquire PDF Sample Report + All Related thorough TOC, Graphs and Tables of Global Medical Crutches Market Now:

https://introspectivemarketresearch.com/request/14857

Market Segmentation

Personal Property Insurance To Dominance Market

Personal property Home insurance has dominated the industry and is expected to continue to do so in the next five years, owing to the additional risks provided by vendors in insurance policies such as jewelry and furs, stamp or coin collections, art and antiques, music instruments, weapons, and so on.

By Type

• Comprehensive Coverage

• Dwelling Coverage

• Content Coverage

• Other Optional Coverages

By End Users

• Tenants

• Landlords

Up-To Avail 20% Discount on various license types on immediate purchase (Use corporate email ID). Get Higher Priority-

https://introspectivemarketresearch.com/discount/14857

Regional Outlook of Home Insurance Market

Purchasing household insurance policies online has increased in popularity in the United Kingdom, and it is now the most popular option for policy seekers. According to industry reports, online channels currently account for more than 40% of all revenue. To thrive in the current Home insurance market, providers must have a strong online presence. Visiting a price comparison website is the most popular pre-purchase practice, stressing the value of price to consumers. As a result, both premium rates and the coverage offered must be highly competitive.

By Regional Outlook

• North America (U.S., Canada, Mexico)

• Europe (Germany, U.K., France, Italy, Russia, Spain, Rest of Europe)

• Asia-Pacific (China, India, Japan, Southeast Asia, Rest of APAC)

• Middle East & Africa (GCC Countries, South Africa, Rest of MEA)

• South America (Brazil, Argentina, Rest of South America)

For More Information or Query or, Customization before Buying Visit

https://introspectivemarketresearch.com/inquiry/14857

Key benefits of the report

• This study presents the analytical depiction of the global Home insurance industry along with the current trends and future estimations to determine the imminent investment pockets.

• The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the Home insurance market share.

• The current market is quantitatively analyzed from 2022 to 2028 to highlight the Home insurance market growth scenario.

• Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

• The report provides a detailed Home insurance market analysis based on the present and future competitive intensity of the market.

Buy the Latest Version of this Report @

https://introspectivemarketresearch.com/checkout/?user=1&_sid=14857

Read Related Report: -

https://www.openpr.com/news/2762017/private-healthcare-market-global-industry-analysis-size

https://www.openpr.com/news/2761403/medical-crutches-market-to-reach-value-of-usd-7-03-billion-by

https://introspectivemarketresearch.com/reports/logistics-insurance-market/

https://introspectivemarketresearch.com/reports/solar-home-system-market/

https://introspectivemarketresearch.com/reports/smart-home-camera-robot-market/

https://introspectivemarketresearch.com/reports/home-appliances-market/

Contact us:

Introspective Market Research

3001 S King Drive,

Chicago, Illinois

60616 USA

Ph no: +1-773-382-1047

About us:

Introspective Market Research (introspectivemarketresearch.com) is a visionary research consulting firm dedicated to assisting our clients to grow and have a successful impact on the market. Our team at IMR is ready to assist our clients to flourish their business by offering strategies to gain success and monopoly in their respective fields. We are a global market research company, that specializes in using big data and advanced analytics to show the bigger picture of the market trends. We help our clients to think differently and build better tomorrow for all of us. We are a technology-driven research company, we analyze extremely large sets of data to discover deeper insights and provide conclusive consulting. We not only provide intelligence solutions, but we help our clients in how they can achieve their goals.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Home Insurance Market to Reach Value of USD 277.25 Billion With CAGR 8.3% by the year 2028, Report by Introspective Market Research here

News-ID: 2763188 • Views: …

More Releases from Introspective Market Research

Absorbed Glass Mat (AGM) Separator Batteries Market To Reach USD 38.55 Billion b …

Absorbed Glass Mat (AGM) Separator Batteries Market was valued at USD 23.81 Billion in 2023 and is expected to reach USD 38.55 Billion by the year 2032.

Absorbed Glass Mat (AGM) batteries are advanced lead-acid batteries designed for higher electrical output, making them ideal for start-stop vehicle systems and increasingly popular in electric vehicles. Unlike conventional batteries, AGM batteries are sealed, maintenance-free, non-spillable, and highly resistant to vibrations, with improved…

Automotive Fuel Injection Systems Market: Business Research Analysis By 2032

Automotive Fuel Injection Systems are crucial for optimizing engine performance, fuel efficiency, and reducing emissions in modern vehicles. These systems, which include fuel injectors, a fuel pump, a pressure regulator, and an ECU, precisely control fuel delivery either through Direct Fuel Injection or Port Fuel Injection. With growing demand for fuel-efficient, environmentally-friendly vehicles, advanced technologies like Gasoline Direct Injection (GDI) and Common Rail Diesel Injection (CRDI) are driving market growth…

North America Coal to Liquid Market to Reach 3.02 Mn at CAGR 8.1% | DKRW Energy, …

North America Coal to Liquid Market Size Was Valued at USD 1.50 Billion in 2023, and is Projected to Reach USD 3.02 Billion by 2032, Growing at a CAGR of 8.1% From 2024-2032.

The North America Coal to Liquid (CTL) market is a niche but evolving segment within the broader energy and fuel industry. CTL technology involves converting coal into liquid hydrocarbons, such as diesel, gasoline, and other petroleum products, through…

India Green Hydrogen Market Next Big Thing | Adani Green Energy, JSW Energy, NTP …

IMR posted new studies guide on India Green Hydrogen Market Insights with self-defined Tables and charts in presentable format. In the Study you may locate new evolving Trends, Drivers, Restraints, Opportunities generated via targeting market related stakeholders. The boom of the India Green Hydrogen marketplace became specifically driven with the aid of the growing R&D spending internationally.

India Green Hydrogen Market Size Was Valued at USD 2.51 Billion in 2023, and…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…