Press release

Global Travel Insurance Market - Analysis By Growth, Revenue, Latest Investment, Key Players, Regional Development And Forecast 2031

The global travel insurance market size is expected to grow from $16.05 billion in 2021 to $18.81 billion in 2022 at a compound annual growth rate (CAGR) of 17.2%. The global travel insurance market size is expected to grow to $32.61 billion in 2026 at a CAGR of 14.7%.The Business Research Company offers the Travel Insurance Global Market Report 2022 in its research report store. It is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by region and by country. It also compares the market's historic and forecast growth, and highlights important trends and strategies that players in the market can adopt.

Request FREE SAMPLE COPY of this research study:

https://www.thebusinessresearchcompany.com/sample.aspx?id=7098&type=smp

The travel insurance market consists of sales of travel insurance by entities (organizations, sole traders, and partnerships), which is a type of insurance that covers different risks while traveling. It covers medical expenses, flight cancellations, lost luggage, and other losses that a traveler can incur while traveling. This is largely due to the fact that having these risks covered ensures an additional layer of protection against financial loss.

Some key travel insurance market players are Allianz SE, American Express Company, American International Group Inc., Assicurazioni Generali S.P.A, Atlas Travel Insurance, Aviva plc, Axa S.A., Bajaj Finserv Limited, Berkshire Hathaway Specialty Insurance Company, Chubb Limited, Generali Group, Insure & Go Insurance Services Limited, MAPFRE, Prudential Financial Inc., Saga Plc, Seven Corners Inc., Crum & Forster, Travelex Insurance Services Inc., USI Affinity Inc., Zurich Insurance, and Arch Capital Group Ltd.

The countries covered in the global travel insurance market are Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, Mexico, Netherlands, New Zealand, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Turkey, UAE, UK, USA, Venezuela, Vietnam.

The regions covered in the global travel insurance market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Travel Insurance Market Segmentation:

By Type

1. Domestic

2. International

By Insurance Cover

1. Single-Trip Travel Insurance

2. Annual Multi-Trip Travel Insurance

3. Long-Stay Travel Insurance

By Coverage

1. Medical Expenses

2. Trip Cancellation

3. Trip Delay

4. Property Damage

By End- User

1. Senior Citizens

2. Corporate Travelers

3. Family Travelers

4. Education Travelers

By Distribution Channel

1. Insurance Intermediaries,

2. Insurance Companies

3. Banks

4. Insurance Brokers

See more on the report at https://www.thebusinessresearchcompany.com/report/travel-insurance-global-market-report

The Report's Table Of Contents includes

1. Executive Summary

2. Travel Insurance Market Characteristics

3. Travel Insurance Market Trends And Strategies

4. Impact Of COVID-19 On Travel Insurance

5. Travel Insurance Market Size And Growth

....

26. Africa Travel Insurance Market

27. Travel Insurance Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Travel Insurance Market

29. Travel Insurance Market Future Outlook and Potential Analysis

30. Appendix

This report covers the trends and market dynamics of the travel insurance market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Directly purchase the report here: https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=7098

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our:

TBRC Blog: http://blog.tbrc.info/

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

About Us:

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. It has published over 3000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Travel Insurance Market - Analysis By Growth, Revenue, Latest Investment, Key Players, Regional Development And Forecast 2031 here

News-ID: 2758644 • Views: …

More Releases from The Business research company

Analysis of Key Market Segments Driving the Pet Supplements Industry

The pet supplements industry is witnessing significant momentum as pet owners increasingly prioritize the health and well-being of their animals. This growing interest is driving innovations and expanding market opportunities, with several key players and trends shaping the sector's future. The following discussion explores the market size projections, major companies, evolving trends, and segmentation within this dynamic industry.

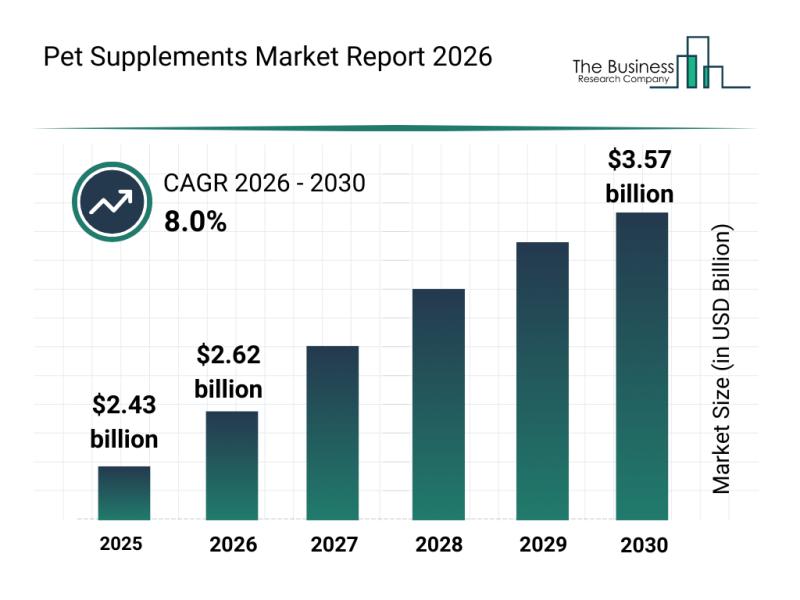

Projected Market Size and Growth Outlook for the Pet Supplements Industry

The…

Market Trend Analysis: The Impact of Recent Innovations on the Pet Food Market

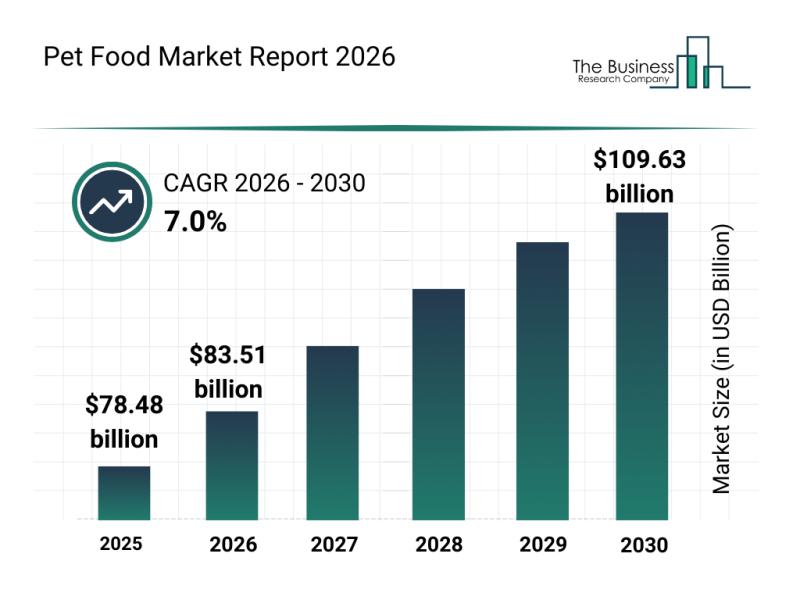

The pet food market is rapidly evolving, driven by shifting consumer preferences and advancements in pet nutrition. As more pet owners become conscious of health and wellness for their animals, the market is set to experience significant growth and innovation in the coming years. Let's explore the current market size, key players, emerging trends, and the main segments shaping this dynamic industry.

Projected Market Valuation and Growth Trajectory of the Pet…

Trends in Growth, Segment Analysis, and Competitor Approaches Influencing the Pe …

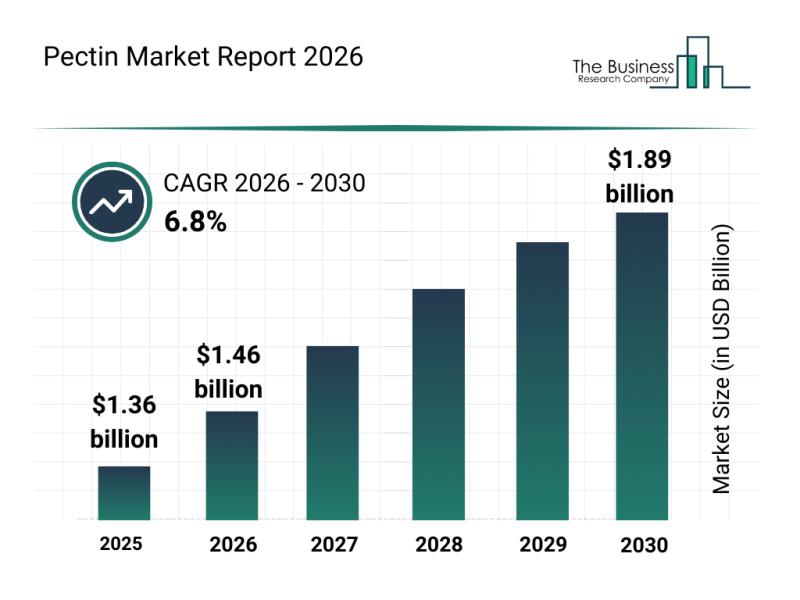

The pectin market is positioned for significant expansion over the next several years as demand for natural additives and clean-label ingredients continues to rise. With growing interest in healthier food options and broader pharmaceutical uses, this sector is set to evolve with innovative products and expanding applications. Here's a detailed look at the market's size, key players, emerging trends, and driving segments.

Forecasted Expansion and Market Size of the Pectin Industry…

Analysis of Key Market Segments Influencing the Palm Oil Market

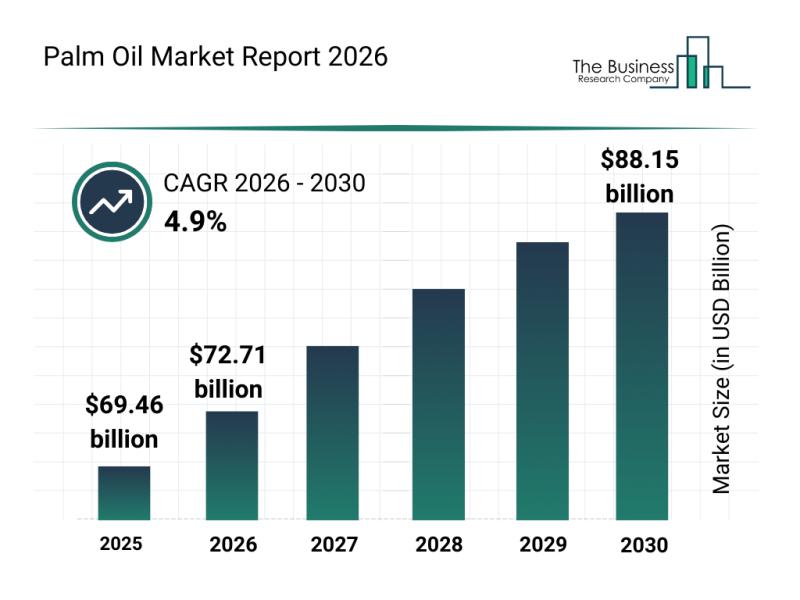

The palm oil industry is on track for consistent growth over the coming years, driven by multiple evolving factors. This sector is adapting to shifting demands and technological advancements, positioning itself for significant expansion by 2030. Let's explore the projected market size, key players, segmentation, and recent developments shaping the industry's future.

Forecasted Growth and Market Size of the Palm Oil Market by 2030

The palm oil market is projected…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…