Press release

Ride Sharing Market Value $185.1 billion by 2026 at a CAGR of 16.6%

The global Ride Sharing Market is projected to grow at a CAGR of 16.6% during the forecast period, from an estimated USD 85.8 billion in 2021 to USD 185.1 billion by 2026. Increase in urbanization, internet and smartphone penetration and increase in cost of vehicle ownership are the major factors driving the growth of the Ride Sharing Market.Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=198699113

The ownership of a vehicle is cumulative of multiple factors such as finance, fuel, maintenance, registration/taxes, and maintenance & repair, along with depreciation. With each year, the cost of vehicle ownership increases. Though, according to American Automobile Association (AAA), depreciation contributes to ~43% of the ownership cost, the other costs, such as maintenance cost and fuel cost, contribute ~25% together. Fuel prices and maintenance costs have increased multifold in the past few years, and the same trend is estimated to continue without any decline. As cities are getting increasingly cramped with people and cars, owning an automobile has become more of a liability than an asset. According to AAA, the average cost to own and operate a new car increased by USD 279 in 2020, as compared with 2019, to reach USD 9,561.

As the millennial generation has little-to-no interest in owning a car, the rate of car ownership among people aged between 18 and 35 has declined over the years. Other reasons for the decline in car ownership are poor connectivity by public transportation in key cities and the increasing trend of online shopping, among others.

Though the trend of car ownership has grown during the pandemic, it is expected to return to the pre-pandemic trend after 2021. Hence, ride sharing service providers can capitalize on these demographics as the new tech-savvy generation constitutes one of the largest user bases of these services.

Request Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=198699113

The electric vehicle sharing market is projected to grow at the highest CAGR during the forecast period. This growth is attributed to the existing lower penetration of such vehicles in the ride-sharing fleets, favorable government policies, improving charging infrastructure, and growing awareness about CO2 emissions. In the initial stage, ride sharing with electric vehicles is estimated to be costly; however, in the future, as the awareness among people to use electric vehicles is growing, the market for ride sharing services by electric vehicles would ultimately enhance. The service providers can leverage this opportunity by providing a suitable sustainability model of ride sharing with electric vehicles, which could attract drivers and people to opt for the same. For instance, Uber has started paying extra dollars per trip to drivers who want to use electric cars.

Moreover, various developments in recent year as, in 2020, Uber announced a new partnership with Lithium Urban Technologies, that is among India's largest electric vehicle fleet operators. This partnership will deploy over 1,000 electric vehicles for Uber India's Rentals and Premier services in the upcoming years. Additionally, Uber launched it's Uber Green' service in London. With this, Uber users in central London can now request a zero-emission vehicle instead of wholly or partly fossil-fueled cars. In January 2021, Uber and in January 2021, expanded the Uber Green service in the USA after launching in 15 US cities in September. Such developments will bring more people toward using ride sharing with electric vehicles.

Key Market Players:

The report analyzes all major players in the Ride Sharing Market including Didi Chuxing (China), Uber Technologies, Inc (US), Gett (Israel), Lyft, Inc (US), and Grab (Singapore) are the major companies operating in the global Ride Sharing Market. These companies adopted new product development, and expansion strategies to gain traction in the Ride Sharing Market.

View Detail TOC @ https://www.marketsandmarkets.com/Market-Reports/mobility-on-demand-market-198699113.html

Company Name: MarketsandMarkets™ Research Private Ltd.

Contact Person: Mr. Aashish Mehra

Email: newsletter@marketsandmarkets.com

Phone: 18886006441

Address: 630 Dundee Road Suite 430

City: Northbrook

State: IL 60062

Country: United States

One stop solution for all Market Research & Consulting needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Ride Sharing Market Value $185.1 billion by 2026 at a CAGR of 16.6% here

News-ID: 2754235 • Views: …

More Releases from MarketsandMarkets™ INC.

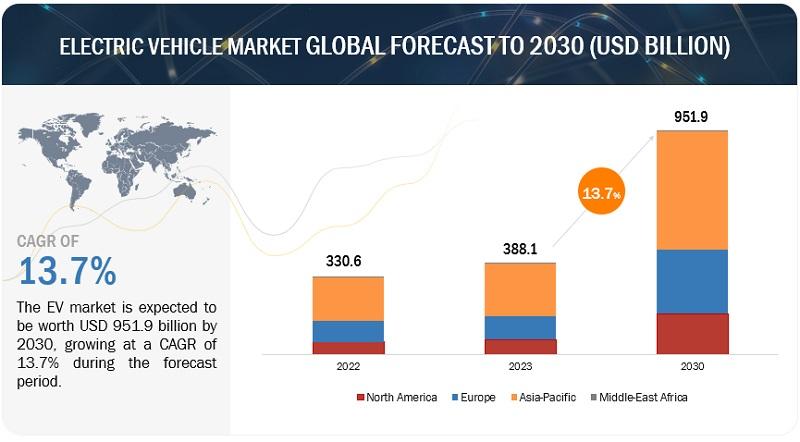

Electric Vehicle Market Size, Share, Trends & Analysis by 2030

The global EV market is projected to grow from USD 388.1 billion in 2023 to USD 951.9 billion by 2030, registering a CAGR of 13.7%. The electric vehicle (EV) market is currently experiencing a transformative phase of rapid growth and innovation. With increasing global concern over climate change and air pollution, coupled with advancements in technology and supportive government policies, the adoption of EVs has gained tremendous momentum. Consumers are…

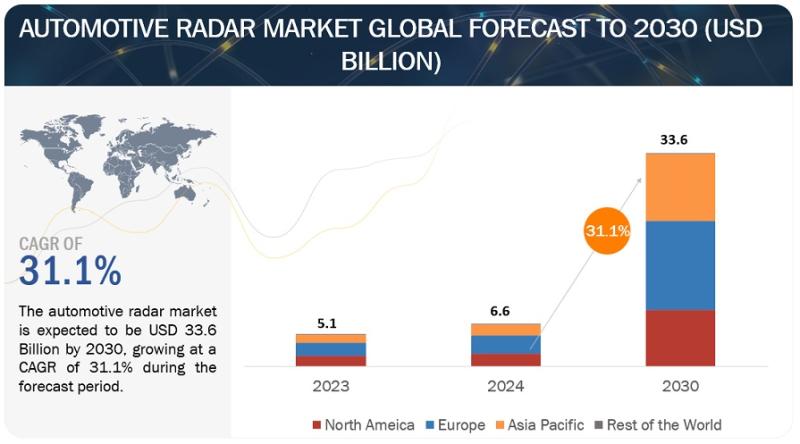

Automotive Radar Market Valued at $33.6 billion by 2030

The global automotive radar market is projected to grow from USD 6.6 billion in 2024 to USD 33.6 billion by 2030, registering a CAGR of 31.1%.

The automotive radar market is flourishing due to a confluence of factors. The primary driver is the surging demand for Advanced Driver-Assistance Systems (ADAS) and autonomous vehicles. These technologies heavily rely on radar for object detection and measurement, making it an essential component. Furthermore, stricter…

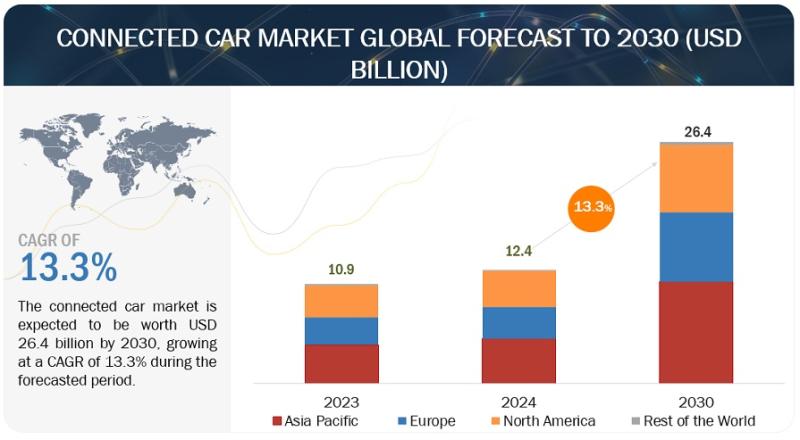

Connected Car Market Poised to Reach $26.4 billion by 2030

The globally connected car market is estimated to grow from USD 12.4 billion in 2024 to USD 26.4 billion by 2030, at a CAGR of 13.3%.

Government initiatives towards developing intelligent transportation networks and the growing trend of in-vehicle connectivity solutions are two factors influencing the growth of the worldwide connected car market. Also, the consumer demand for a safer, more convenient, and entertaining driving experience is a significant driver. This…

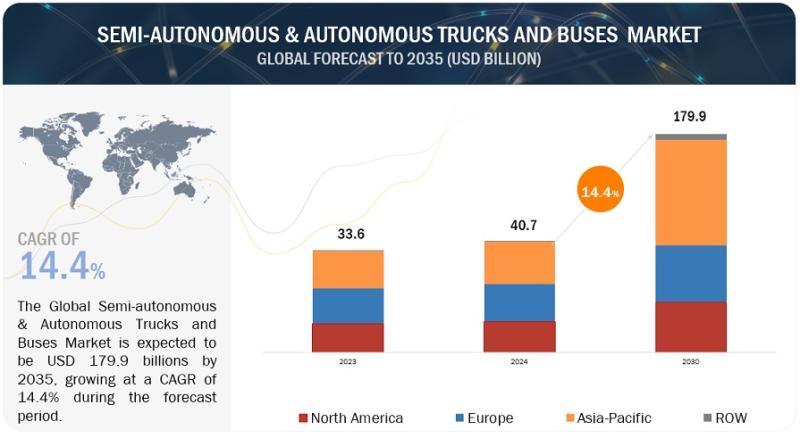

Semi-Autonomous & Autonomous Trucks and Buses Market worth $179.9 billion by 203 …

The Semi-autonomous & autonomous Trucks and Buses market size is projected to grow from USD 40.7 Billion in 2024 to USD 179.9 Billion by 2035, at a CAGR of 14.4%. The increasing demand for electric and autonomous vehicle and government regulation regarding safety is expected to increase the demand for Semi-autonomous & autonomous Trucks and Buses. Additionally, continuos innovation in advance driving technologies and components will boost the demand…

More Releases for Uber

Investigation for Long-Term Investors in Uber Technologies, Inc (NYSE: UBER) sha …

An investigation was announced concerning potential breaches of fiduciary duties by certain directors and officers of Uber Technologies, Inc.

Investors who are current long term investors in Uber Technologies, Inc (NYSE: UBER) shares, have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm for current long term investors in NYSE: UBER stocks follows a lawsuit filed against Uber…

Deadline on October 17th coming up in Lawsuit for Investors in Uber Technologies …

A deadline is coming up on October 17, 2022 in the lawsuit filed for certain investors of Uber Technologies, Inc (NYSE: UBER) over alleged securities laws violations by Uber Technologies, Inc.

Investors who purchased shares of Uber Technologies, Inc (NYSE: UBER) have certain options and there are strict and short deadlines running. Deadline: October 17, 2022. NYSE: UBER stockholders should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 -…

Lawsuit filed by an Investor in Uber Technologies, Inc (NYSE: UBER) against dire …

An investor in shares of Uber Technologies, Inc (NYSE: UBER) filed a lawsuit against certain directors of Uber Technologies, Inc over alleged breaches of fiduciary duties.

Investors who are current long term investors in Uber Technologies, Inc (NYSE: UBER) shares, have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

According to the complaint the plaintiff alleges that certain directors of Uber Technologies,…

Investigation announced for Investors in NYSE: UBER shares over potential Wrongd …

Certain directors of Uber Technologies, Inc are under investigation concerning potential breaches of fiduciary duties.

Investors who are current long term investors in Uber Technologies, Inc (NYSE: UBER) shares, have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm for current long term investors in NYSE: UBER stocks follows a lawsuit filed against Uber Technologies, Inc over alleged…

Investigation announced for Long-Term Investors in shares of Uber Technologies, …

An investigation was announced concerning potential breaches of fiduciary duties by certain directors and officers of Uber Technologies, Inc.

Investors who are current long term investors in Uber Technologies, Inc (NYSE: UBER) shares, have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm for current long term investors in NYSE: UBER stocks follows a lawsuit filed against Uber…

Investigation announced for Investors in Uber Technologies, Inc. (NYSE: UBER)

An investigation was announced on behalf of investors of Uber Technologies, Inc. (NYSE: UBER) shares over potential securities laws violations by Uber Technologies, Inc. in connection with certain financial statements.

Investors who purchased shares of Uber Technologies, Inc. (NYSE: UBER), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on possible claims on behalf of purchasers of…