Press release

Automotive Usage Based Insurance Market Growing at 26% CAGR to be Worth USD 124.02 Billion by 2027: COVID-19 Impact and Global Analysis by The Insight Partners

The automotive insurance sector is catalyzing across the world due to recent developments. A number of auto insurers have been emerging in the automotive usage-based insurance market every year. They offer a wide variety of insurance policies such as pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD). The former calculates insurance premium depending on vehicle mileage and stipulated time. While the PHYD policy is entirely a function of driving pattern or behavior. It promotes lenient and smooth driving on the road. Thus, third-party traveling services and variety of auto insurances bolster the global automotive usage-based insurance market.According to The Insight Partners' research, the global automotive usage-based insurance market accounted for US$ 15,617.8 million in 2018 and is anticipated to hit US$ 105,118.8 million by 2027 to rise at an annual growth rate of 23.6% from 2019 to 2027. The significant adoption of mobility-as-a-service (MaaS) and a wide variety of insurance premiums are the potential factors stimulating the market expansion.

Sample PDF showcases the content structure and the nature of the information included in the report which presents a qualitative and quantitative analysis - https://www.theinsightpartners.com/sample/TIPAT100001345?utm_source=OpenPR&utm_medium=10051

According to policy type, the global automotive usage-based insurance market is split into pay-as-you-drive (PAYD) and pay-how-you-drive (PHYD). The latter occupied 73.3% market share in 2018, amassing US$ 11,449.5 million. It is forecasted to accrue US$ 73,694.4 million by 2027 to grow at 23.0% CAGR along the forecast period.

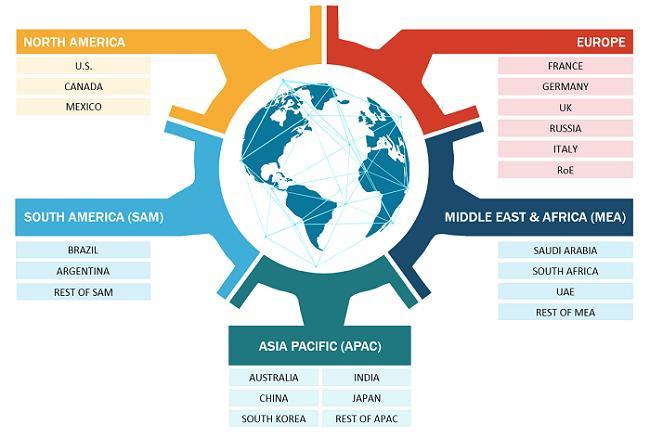

From the regional point of reference, it has been observed that North America captured 46.4% market share in 2018 with a revenue total of US$ 7,245.1 million. It is likely to reach US$ 44,454.7 million by 2027 to surge at 22.4% CAGR during the forecast period. The Asia Pacific market was evaluated at US$ 1,711.4 million in 2018 and is predicted to hit US$ 13,570.8 million by 2027.

Key players dominating the global automotive usage-based insurance market are Allstate Insurance Company; Allianz SE; Metromile, Inc.; Octo Telematics S.P.A.; Vodafone Automotive S.P.A.; Axa SA; Ingenie Services Limited; Liberty Mutual Insurance Company; Tomtom Telematics BV; Sierra Wireless, Inc; and Unipolsai Assicurazioni S.P.A., among others.

• In August 2017, Allstate Canada introduced a usage-based insurance program in Nova Scotia to expand its insurance business. The program offers reduced rates and special discounts to the drivers for safe rides.

Click here to avail lucrative discounts on our latest reports. We offer student, enterprise, and special periodic discounts to our clientele. Please fill the inquiry form below to know more - https://www.theinsightpartners.com/discount/TIPAT100001345?utm_source=OpenPR&utm_medium=10051

• In December 2017, Allianz SE extended the partnership with Marmalade, a special telematics provider. They jointly offer a smart digital customer interaction platform with enhanced user experience through app and portal.

• In September 2017, Metromile entered into a strategic partnership with JLT Re, a global reinsurance and brokerage company to pioneer reinsurance agreement and take necessary steps for future growth.

• In July 2018, Tokio Marine Holdings and Intact Financial Corp invested US$ 90 million in Metromile Inc to expand the business across different geographies and enhance the customer base.

A considerable chunk of travelers worldwide is no longer willing to own the vehicles to avoid messy traffic instances. This has led to the rise of other transit practices such as car-sharing and ride-hailing in both developed and developing economies. These practices are called mobility-as-a-service, as the customer avails the vehicle and driver from third-party service providers. This service makes substantial use of transportation infrastructure. Due to increasing traction of MaaS, the service providers are procuring more vehicles to expand the business. This surged the demand for telematics service providers (TSP) and auto insurers. The prominent MaaS providers are Uber, Lyft, Zipcar, Car2go, Beeline Singapore, Ubigo AB, and Smile Mobility, among others.

Contrastingly, the lack of telematics insurance awareness in emerging countries hinders the growth of global automotive usage-based insurance market.

Based on technology, the automotive usage-based insurance market sphere is divided into smartphones, black boxes, dongles, and others. The dongles segment led the market in 2018 with 36.6% share of the business. It generated US$ 5,723.7 million in 2018 and is estimated to garner US$ 33,254.9 million by 2027 to expand at 21.6% CAGR during 2019-2027. However, it is projected to lose its dominance to the black box segment by 2027. Though the black box market stood at the valuation of US$ 5,368.3 million in 2018; it is expected to reach US$ 34,613.2 million by 2027 with a stellar annual growth rate of 23.1% during the forecast period.

Immediate delivery of our off-the-shelf reports and prebooking of upcoming studies, through flexible and convenient payment methods - https://www.theinsightpartners.com/buy/TIPAT100001345?utm_source=OpenPR&utm_medium=10051

Email: sales@theinsightpartners.com

Phone : +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Usage Based Insurance Market Growing at 26% CAGR to be Worth USD 124.02 Billion by 2027: COVID-19 Impact and Global Analysis by The Insight Partners here

News-ID: 2740080 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for PHYD

Usage-Based Insurance Market Lucrative Growth, PAYD, PHYD & Distance-Based Insur …

DataM Intelligence has published a new research report on "Usage-Based Insurance Market Size 2025". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.

Additionally, the U.S. is projected to lead in…

Insurance Telematics Market to Reach $13.78 billion by 2030 |Pay-As-You-Drive (P …

According to the report published by Allied Market Research, the global insurance telematics market generated $2.37 billion in 2020, and is projected to reach $13.78 billion by 2030, witnessing a CAGR of 19.5% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

Download Free Sample Report (Get Detailed Analysis in PDF - 511 Pages):…

Usage-Based Insurance (UBI) Market by Policy Type [Pay-As-You-Drive Insurance (P …

UBI Market Size

The global usage-based insurance market size was valued at $28.7 billion in 2019, and is projected to reach $149.2 billion by 2027, growing at a CAGR of 25.1% from 2020 to 2027. Usage-based insurance is expected to grow rapidly in the coming years. Key drivers of the usage-based insurance market include the growing adoption of telematics technology in the automotive insurance space.

Download Free Sample: https://reports.valuates.com/request/sample/ALLI-Auto-0U87/Usage_Based_Insurance

Trends Influencing the Global…

APAC To Foster Global Usage Based Insurance Market Outlook Between 2019-2026

Global usage-based insurance (UBI) market is projected to witness heavy gains in the forecast timespan owing to the steady uptake of UBI platforms across the insurance sector. Through these platforms, insurance companies aim to align insurance premiums and accurately track driving patterns with estimated risks.

As per a research report by Global Market Insights, Inc., global usage-based insurance market is estimated to surpass $115 billion by 2026.

Increasing collaborations between solution providers…

Usage Based Insurance (UBI) Market Size, Share, Trends, Growth, Industry Forecas …

Usage Based Insurance (UBI) Market Size:

The global Usage-based Insurance market size is projected to reach USD 77.25 Billion by 2026, from USD 25.46 Billion in 2020, at a CAGR of 20.32% during 2020-2026.

Get Free Sample Report:

https://reports.valuates.com/request/sample/QYRE-Auto-23T2720/COVID_19_Impact_on_Global_Usage_Based_Insurance

USAGE-BASED INSURANCE MARKET SHARE

Based on the region, North America is expected to offer the maximum growth opportunities to vendors during the forecast period. The US is a key market for automotive usage-based insurance in North…

UBI Market Report 2026: AXA, Cambridge Mobile Telematics, Danlaw, Inc., Desjardi …

PHYD insurance package segment had accounted for more than 70% of global UBI market share on account of the rising popularity of the model among customers for the reduction of insurance premiums. Integration of various connected services like theft insurance and vehicle wellness programs along with PHYD packages shall support the growth of the market in the future and impact usage-based insurance trends.

Usage-based insurance (UBI) has been helping insurance…