Press release

(2022-2031) Insurance Fraud Detection Global Market Analysis And Forecast| Technologies, Demand, Growth, Research And Development

The global insurance fraud detection market size is expected to grow from $4.24 billion in 2021 to $5.19 billion in 2022 at a compound annual growth rate (CAGR) of 22.6%. The insurance fraud market size is expected to grow to $12.01 billion in 2026 at a CAGR of 23.3%.The Business Research Company offers the Insurance Fraud Detection Global Market Report 2022 in its research report store. It is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by region and by country. It also compares the market's historic and forecast growth, and highlights important trends and strategies that players in the market can adopt.

Request FREE SAMPLE COPY of this research study:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6399&type=smp

The insurance fraud detection market consists of sales of insurance fraud detection services by entities (organizations, sole traders, and partnerships) that help in the identification and prevention of fraudulent activities related to money or insurance. Numerous software-based solutions are used to analyze historic patterns and incidents to predict future occurrences. Insurance fraud detection is generally used by organizations for fraud analytics, authentication, governance, risk, and compliance to safeguard databases and identify vulnerabilities.

Some key insurance fraud detection market players are ACI Worldwide Inc., BAE Systems, BRIDGEi2i Analytics Solutions Pvt. Ltd., Datawalk Inc., DXC Technology Co., Experian PLC, Fair Isaac Corp., Fiserv Inc., FRISS, IBM Corp., Iovation Inc., Kount Inc., LexisNexis, Oracle Corp., Scorto Inc., TransUnion LLC, Wipro Ltd., CI Worldwide Inc., Equifax Inc, and Perceptiviti.

The countries covered in the global insurance fraud detection market are Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, Mexico, Netherlands, New Zealand, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Turkey, UAE, UK, USA, Venezuela, Vietnam.

The regions covered in the global insurance fraud detection market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Insurance fraud detection Market Segmentation:

1) By Deployment Type:

On-Premises

Cloud

2) By Component:

Solution

Services

3) By Organization Size:

Small and Medium-Sized Enterprises (SMEs)

Large Enterprises

See more on the report at https://www.thebusinessresearchcompany.com/report/insurance-fraud-detection-global-market-report

The Report's Table Of Contents includes

1. Executive Summary

2. Insurance Fraud Detection Market Characteristics

3. Insurance Fraud Detection Market Trends And Strategies

4. Impact Of COVID-19 On Insurance Fraud Detection

5. Insurance Fraud Detection Market Size And Growth

…….

27. Insurance Fraud Detection Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Insurance Fraud Detection Market

29. Insurance Fraud Detection Market Future Outlook and Potential Analysis

30. Appendix

This report covers the trends and market dynamics of the insurance fraud detection market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Directly purchase the report here:

https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6399

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our:

TBRC Blog: http://blog.tbrc.info/

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

About Us:

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. It has published over 3000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release (2022-2031) Insurance Fraud Detection Global Market Analysis And Forecast| Technologies, Demand, Growth, Research And Development here

News-ID: 2726278 • Views: …

More Releases from The Business research company

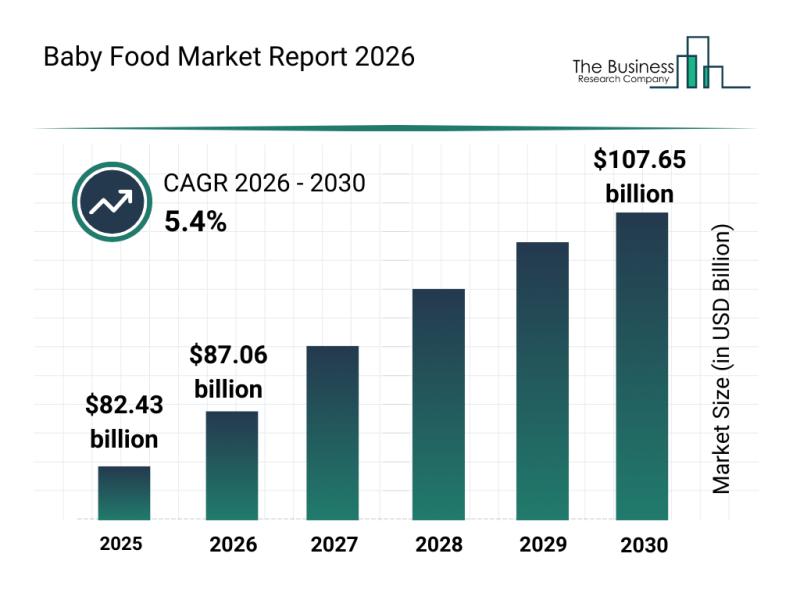

Future Perspective: Key Trends Shaping the Baby Food Market Until 2030

The baby food market is on track for substantial expansion over the coming years, driven by evolving consumer preferences and increasing awareness of infant nutrition. As parents seek healthier, more convenient, and safer options for their children, this sector is poised to witness significant growth and innovation. Let's explore how the market size is expected to develop, the main players involved, emerging trends, and the key segments shaping the industry's…

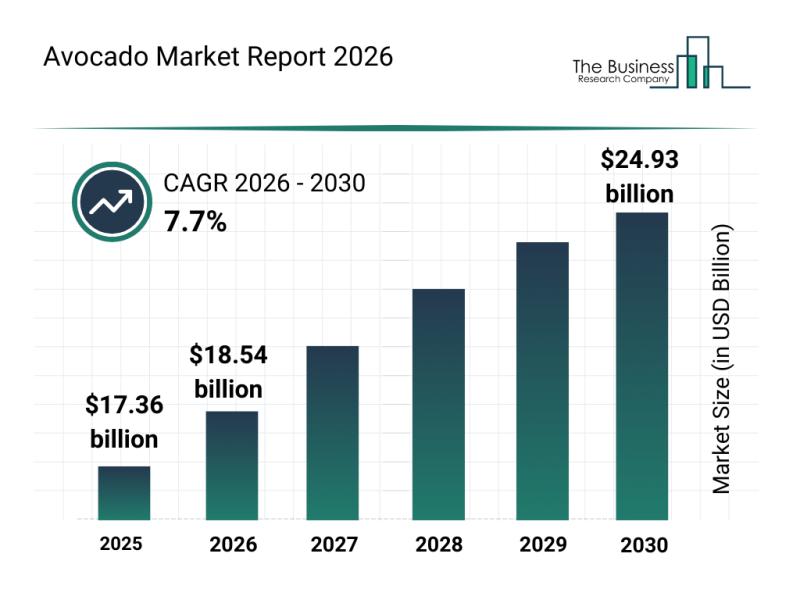

Segmentation, Major Trends, and Competitive Analysis of the Avocado Market

The avocado market is poised for impressive growth over the coming years, driven by shifting consumer preferences and advancements in agricultural technology. As the popularity of plant-based diets and organic produce continues to rise, the industry is set to expand significantly. Let's explore the market's size forecast, key players, emerging trends, and segmentation for a thorough understanding of this vibrant sector.

Projected Expansion and Market Size of the Avocado Market by…

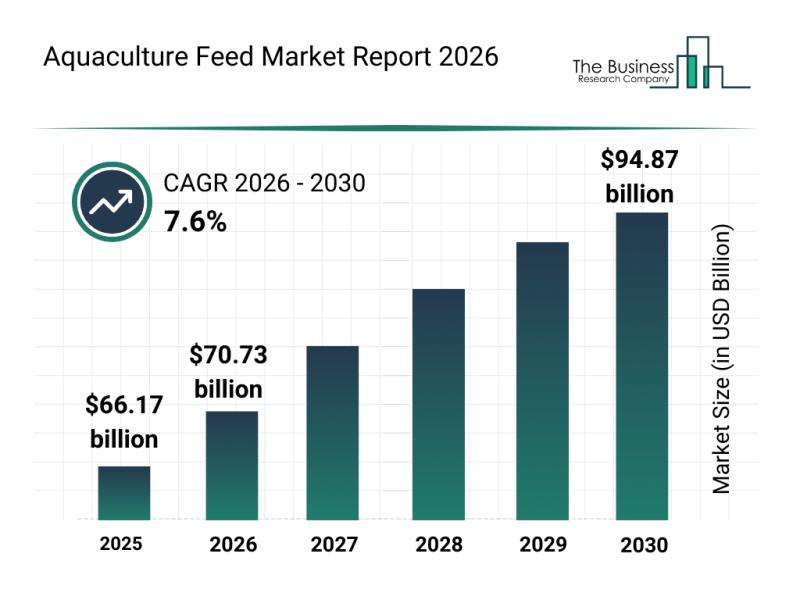

Competitive Analysis: Leading Companies and New Entrants in the Aquaculture Feed …

The aquaculture feed sector is poised for significant expansion in the coming years as it responds to evolving industry demands and sustainability goals. With advancements in feed formulations and growing investments in nutrition research, this market is set to experience remarkable growth by 2030. Below, we explore the market size projections, key players, trends shaping the industry, and detailed market segmentation.

Projected Growth and Market Size of the Aquaculture Feed Industry…

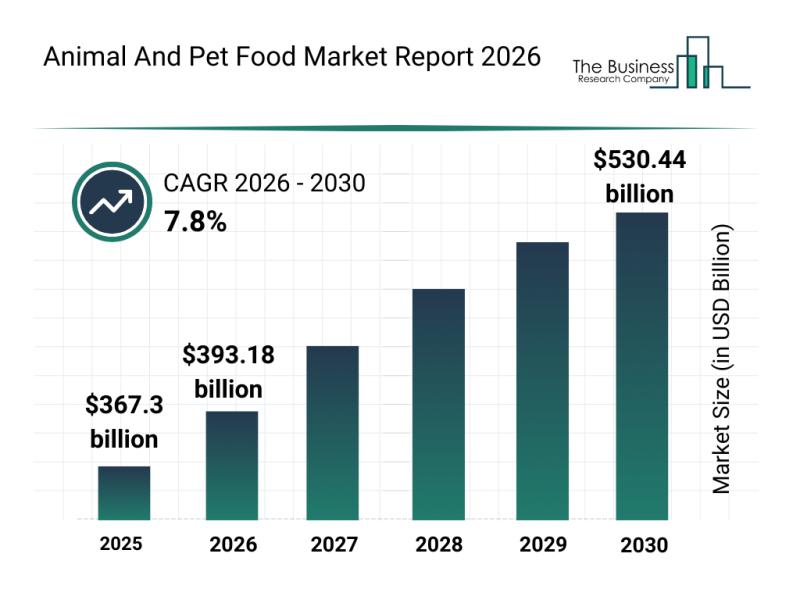

Future Perspectives: Key Trends Shaping the Animal and Pet Food Market Until 203 …

The animal and pet food market is on a trajectory of significant expansion, driven by evolving consumer preferences and advancements in nutrition science. As pet owners become more conscious of health and sustainability, the market is adapting with innovative products and ingredients. Below, we explore the market size, leading companies, emerging trends, and key segments shaping this vibrant industry.

Projected Market Size and Growth of the Animal and Pet Food Market…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…