Press release

Global Insurance Fraud Detection Market: Key Competitors, SWOT Analysis, Business opportunities, Trend Analysis.

The Insurance Fraud Detection Market Size Is Expected To Grow At A CAGR Of Approx. 25.8% From 2022 To 2032. The growth in the insurance fraud detection market can be attributed to the increasing number of people who are committing insurance fraud, which is driven by an increased number of cyber-attacks on companies. Insurance companies face significant challenges from the growing epidemic of insurance fraud, and these challenges are expected to continue to grow as the global insurance market continues to expand. This is due to factors such as policy abuse, underreporting of claims, using fake documents to claim, and other fraudulent activitiesRequest Free Sample Report or PDF Copy: https://report.evolvebi.com/index.php/sample/request?referer=parity&reportCode=013872

Key Players

The Insurance Fraud Detection market report gives detailed information about the company and its past performance. This will give you a clear picture of how strong an industry is, what kind of wealth is involved with it, and which fields are growing over time. Each and every element within a market report are updated regularly so that we can read the market better. The report also includes common risks associated with marketing in such a delicate industry as they present advice for future planning for business expansion accordingly.

The key players profiled in the report are:

• FICO (US)

• IBM (US)

• BAE Systems (UK)

• SAS Institute (US)

• Experian (Ireland)

• LexisNexis (US)

• iovation (US)

• FRISS (Netherlands)

• SAP (Germany)

• Fiserv (US)

• ACI Worldwide (US)

• Simility (US)

• Kount (US)

• Software AG (Germany)

• BRIDGEi2i Analytics Solutions (India)

• Perceptiviti (India)

Today's business environment is competitive and challenging, which means businesses need to be on top of new technologies and seek out market opportunities. Our recent research on the global Insurance Fraud Detection industry sheds light on the current state of the industry, including market size, key players, and SWOT analysis. The analysis serves as part of our qualitative assessment: we factored in findings from our own study to help readers decipher what they can do to embrace opportunity or prevent threats that may hinder the market moving forward.

COVID Impact

In terms of COVID 19 impact, the Insurance Fraud Detection market report also includes the following data points:

● COVID19 Impact on Insurance Fraud Detection market size

● End-User/Industry/Application Trend, and Preferences

● Government Policies/Regulatory Framework

● Key Players Strategy to Tackle Negative Impact/Post-COVID Strategies

● Opportunity in the Insurance Fraud Detection market

For Inquiry or Customization: https://report.evolvebi.com/index.php/sample/request?referer=parity&reportCode=013872

Scope of the Report:

Market Segment By Component with focus on market share, consumption trend, and growth rate of Insurance Fraud Detection Market:

• Solution

o Fraud Analytics

Predictive Analytics

Descriptive Analytics

Social Media Analytics

Big Data Analytics

o Authentication

Single-Factor Authentication

Multi-Factor Authentication

Risk-Based Authentication

o Governance, Risk, and Compliance

o Others

Services

o Professional Services

Consulting

Training and Education

Support and Maintenance

o Managed Services

Market Segment By Deployment Type with the focus on market share, consumption trend, and growth rate of Insurance Fraud Detection Market:

• On-premises

• Cloud

Market Segment By Organization Size with the focus on market share, consumption trend, and growth rate of Insurance Fraud Detection Market:

• Small and Medium-sized Enterprises (SMEs)

• Large Enterprises

For more information: https://report.evolvebi.com/index.php/sample/request?referer=parity&reportCode=013872

Key Region/ Countries Covered

● North America (US, Canada, Mexico)

● Europe (Germany, U.K., France, Italy, Russia, Rest of Europe)

● Asia-Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

● Middle East & Africa (Saudi Arabia, UAE, Egypt, South Africa, and Rest of MEA)

● Latin America (Mexico, Brazil, Argentina, Rest of Latin America

Asia Pacific is projected to grow at the highest Compound Annual Growth Rate (CAGR) during the forecast period.

Reasons to Buy this Report:

• Get detail analysis of the impact of market forces on your products & Services

• Competitive Intelligence providing the understanding about the ecosystem and its need

• Details analysis of Total Addressable Market (TAM) of your products

• Investment Pockets and New Business Opportunities

• Strategy Planning

• The Insurance Fraud Detection market report provides historical data and revenue forecasts for the different regions, which includes North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

Contact Us:

Evolve Business Intelligence

India

Contact: +1 773 644 5507 (US) / +441163182335 (UK)

Email: sales@evolvebi.com

Website: www.evolvebi.com

About EvolveBI

Evolve Business Intelligence is a market research, business intelligence, and advisory firm providing innovative solutions to challenging the pain points of a business. Our market research reports include data useful to micro, small, medium, and large-scale enterprises. We provide solutions ranging from mere data collection to business advisory.

Evolve Business Intelligence is built on account of technology advancement providing highly accurate data through our in-house AI-modelled data analysis and forecast tool - EvolveBI. This tool tracks real-time data including, quarter performance, annual performance, and recent developments from fortune's global 2000 companies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Insurance Fraud Detection Market: Key Competitors, SWOT Analysis, Business opportunities, Trend Analysis. here

News-ID: 2726106 • Views: …

More Releases from Evolve Business Intelligence

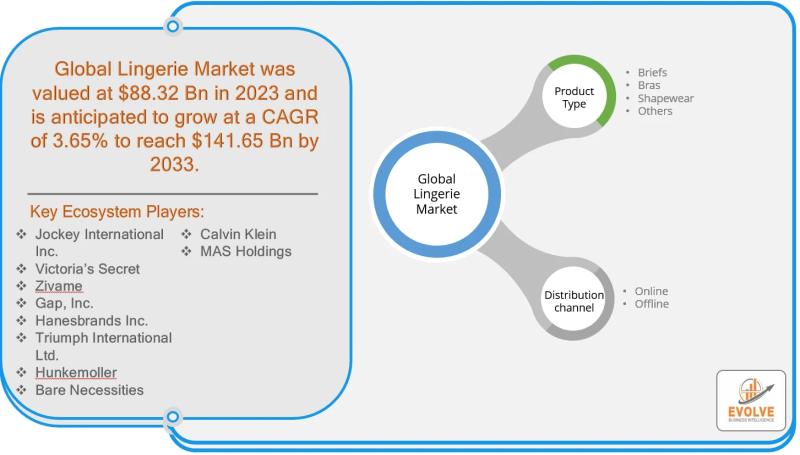

Lingerie Market Forecast to Reach USD 141.65 Billion by 2033

The global lingerie market is an expansive and dynamic industry, projected to reach a value of USD 141.65 billion by 2033, growing at a Compound Annual Growth Rate (CAGR) of 6.14% from 2023 to 2033. Within this market, the shapewear segment presents a significant opportunity for growth and innovation.

Driven by a growing emphasis on body positivity and inclusivity, consumers are increasingly seeking out products that offer comfort, style, and confidence.…

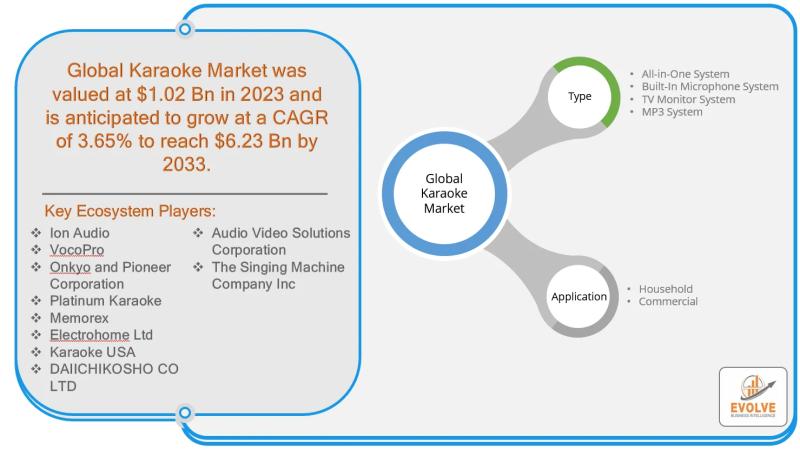

Karaoke Market Forecast to Reach USD 6.23 Billion by 2033

The global karaoke market is on a trajectory of significant growth, with projections from Evolve Business Intelligence indicating it will reach a valuation of USD 6.23 billion by 2033, expanding at a Compound Annual Growth Rate (CAGR) of 3.65% from 2023. This growth is driven by a combination of factors, including increasing disposable income, a strong cultural presence in regions like North America and Asia-Pacific, and an ever-evolving market that…

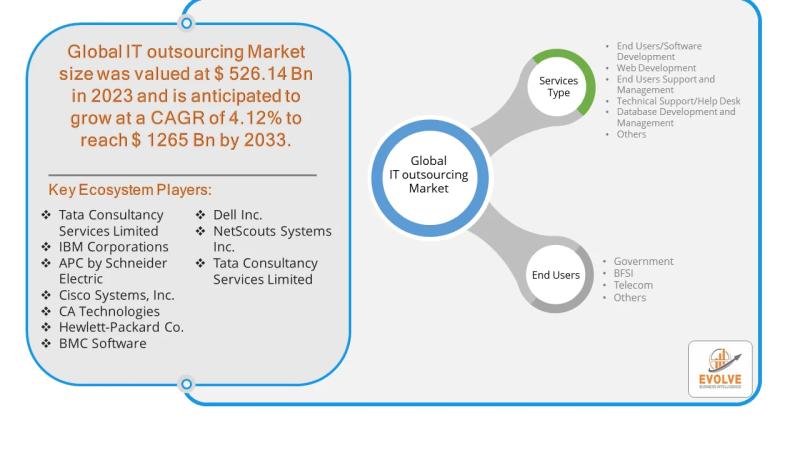

IT Outsourcing Market Forecast to Reach USD 1,265 Billion by 2033

The global IT outsourcing market is a significant and growing sector, driven by businesses seeking to cut costs, access specialized talent, and improve efficiency. Amid this growth, web development stands out as a high-opportunity area for several reasons. The demand for digital transformation, including the creation of new websites, e-commerce platforms, and web applications, is a constant for companies across all industries. This creates a continuous need for skilled developers,…

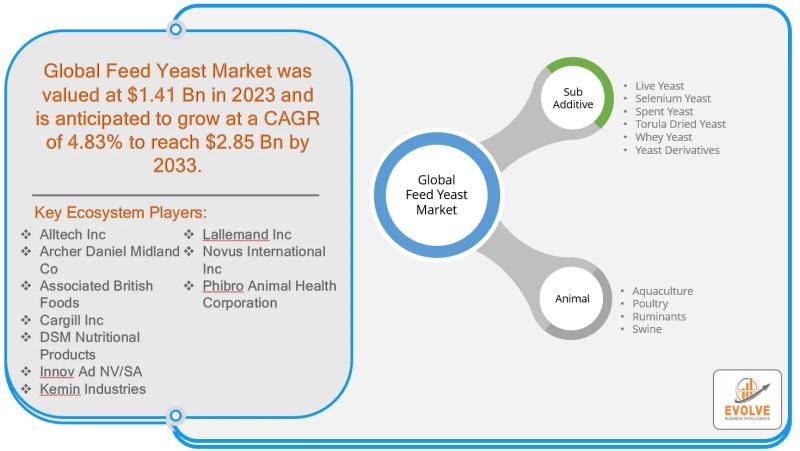

Feed Yeast Market Forecast to Reach USD 2.85 Billion by 2033

The Feed Yeast Market is experiencing significant growth, with a forecast to reach USD 2.85 Billion by 2033, a substantial increase from USD 1.41 Billion in 2023, at a Compound Annual Growth Rate (CAGR) of 4.83%. This expansion is largely fueled by the rising global demand for animal protein, which in turn drives the need for high-quality, nutritious feed additives like feed yeast. Yeast derivatives, as a key sub-additive, stand…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…