Press release

InsurTech Market 2021 Size to Reach Revenues by Top Key Companies | Zhongan Insurance, Tractable, Trov, Inc.

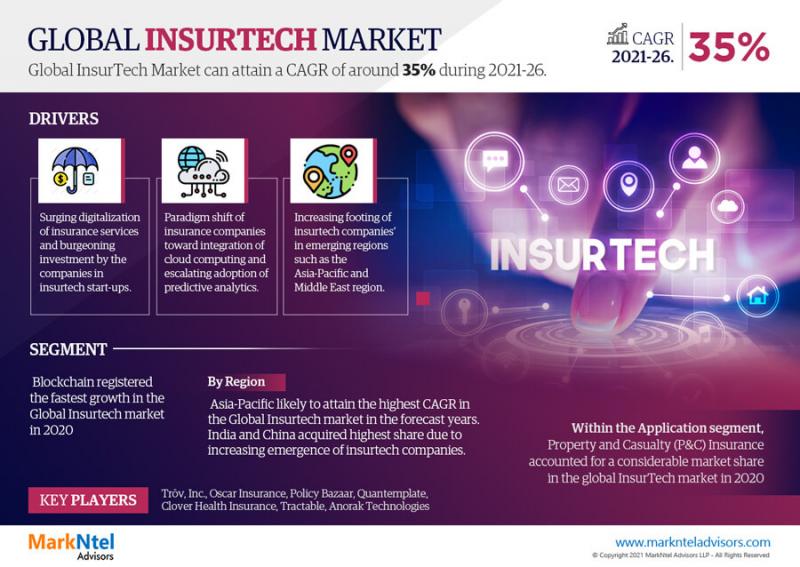

The research report offered by MarkNtel Advisors brings detail-driven, unbiased, and accurate research on the InsurTech Market, covering aspects associated with the changing interface of the market over the years. The analysis covers data from the historic years 2016-19 and the base year 2020, put together in a way to bring out estimations for the forecast period 2021-26.This study is relentless & integrates an extensive & detail-driven examination of the industry, portraying elements like drivers, restraints, opportunities, challenges, key trends, & recent developments, among others. These parameters are associated with their influence on the market growth, preparing the stakeholders to get an idea of what to expect in the future.

Key Driver: Rapid Digitalization to Transform Business Models in the Insurance Sector

The rapidly changing business models, constant technological advancements in services & solutions, & increasing support from the governments of different countries promoting digital transformation in the insurance industry are propelling the demand for InsurTech solutions substantially & globally.

Request Sample Report of InsurTech Market: - https://www.marknteladvisors.com/query/request-sample/global-insurtech-market.html

Segmentation Analysis

This section reveals the key parameters influencing the market expansion in diverse segments across locations. The researchers bring together an analysis covering aspects like the overall size & volume of products/services, their demands, and the fluctuations in the industry. In addition, this section also incorporates information allowing the stakeholders to procure knowledge on the demand, sales, production, & distribution mapping & their potential growth in the coming years.

Based on, By Technology

- Block chain

- Cloud Computing

- Internet of Things (IoT)

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Drones

Based on, By Deployment Mode

- On-Premise

- Cloud

Based on, By Application

- Life and Accident Insurance

- Health and Medical Insurance

- P&C Insurance

- Commercial Insurance

- Insurance Administration and Risk Consulting

- Annuities

Read full Report Description with Table of Content and Figure: - https://www.marknteladvisors.com/research-library/global-insurtech-market.html

Geographically, the InsurTech Market scales across the following regions/countries:

• North America

• South America

• Europe

• Middle East & Africa

• Asia-Pacific

Competitive Analysis

With exhaustive research & complete company profiling by the researchers, the competitive landscape in the InsurTech Market report is a compilation of the changing interface, sustainability tactics, and strategies adopted by the prominent players for sustainability & higher yields in the industry. These aspects are grounded on the following parameters:

• Investments & Developments

• Overview of the company & business strategy

• Product/Service portfolio expansion

• The geographical presence of players

• Trends & recent developments

• Performance indicators

The prominent companies profiled in the InsurTech Market report are listed below:

• Trov, Inc.

• Oscar Insurance

• Policy Bazaar

• Quantemplate

• Insurance

• Tractable

• Anorak Technologies

• Majesco

• Cytora Ltd.

• Zhongan Insurance

Speak to Analyst for more details: - https://www.marknteladvisors.com/query/talk-to-our-consultant/global-insurtech-market.html

Top Reasons to Invest in the InsurTech Market Report

• The InsurTech Market research report furnishes unbiased & accurate perspicuity into the changing interface of the industry. It solely aims to help the stakeholders to develop business strategies after understanding the key trends influencing the market.

• This analysis talks about the potential market growth in the future & the competitive scenario for strategic investments. Here, the stakeholders are enlightened with greater efficiency in organizing the sales & marketing efforts by closely studying the opportunities presented in the research.

• Using this compilation of accurate analysis of the competitive landscape in the study, the stakeholders can also identify a strong upcoming competition & devise their strategies to get ahead of the competitors in the future.

Have a look on our latest press release on InsurTech Market: - https://www.marknteladvisors.com/press-release/global-insurtech-market-growth

Read our Latest Blog

• Here's why the Future of Baby Food Manufacturers is Opportunistic: - https://www.tradove.com/blog/Here%2525252525E2%252525252580%252525252599s-why-the-Future-of-Baby-Food-Manufacturers-is-Opportunistic.html

• Digital Pathology: Transforming the Healthcare Education: - https://www.marknteladvisors.com/blogs/digital-pathology-transforming-healthcare-education.html

• The Stronger than Ever Demand for Basmati Rice in Europe: - https://newscluster24.com/the-stronger-than-ever-demand-for-basmati-rice-in-europe/

• How InsurTech is Transforming the Insurance Sector?: - https://www.marknteladvisors.com/blogs/how-insurtech-transforming-insurance-sector.html

• Why is Latin America a Crucial Market for Pet Food Makers?: - https://newscollectiononlines.blogspot.com/2022/09/why-is-latin-america-crucial-market-for.html

Contact Us:

MarkNtel Advisors

Email: sales@marknteladvisors.com

Call - +1 604 1900 2671

Website: www.marknteladvisors.com

MarkNtel Advisors is a leading research, consulting, and data analytics firm that provides a wide range of strategic reports on diverse industry verticals to a substantial and varied client base that includes multinational corporations, financial institutions, governments, and individuals.

We specialize in niche industries and emerging geographies to support our clients in the formulation of strategies viz. Go to Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, trend analysis, etc. in around 15 industry verticals to enable our clients in identifying attractive investment opportunities and maximizing ROI through an early mover advantage.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release InsurTech Market 2021 Size to Reach Revenues by Top Key Companies | Zhongan Insurance, Tractable, Trov, Inc. here

News-ID: 2724001 • Views: …

More Releases from MarkNtel Advisors LLP

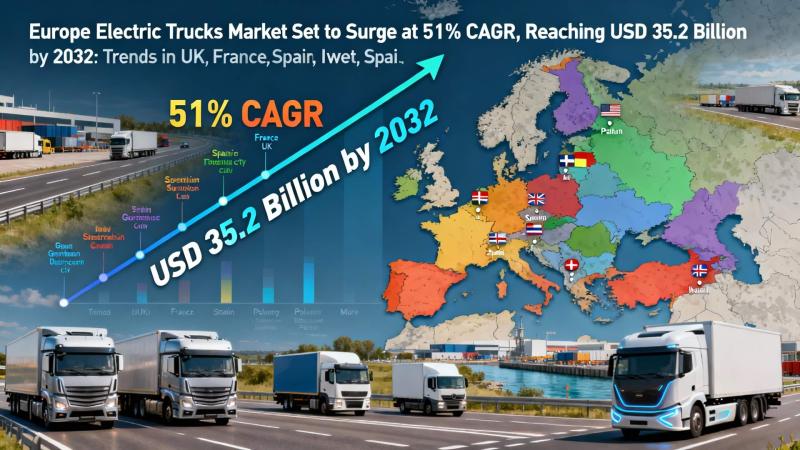

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

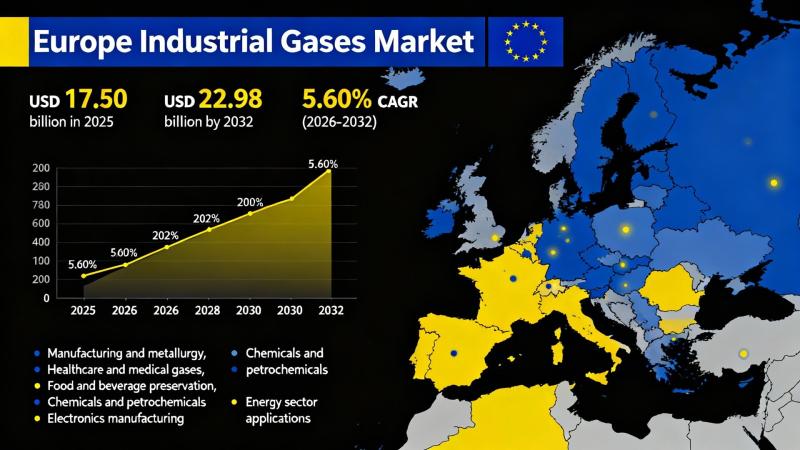

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

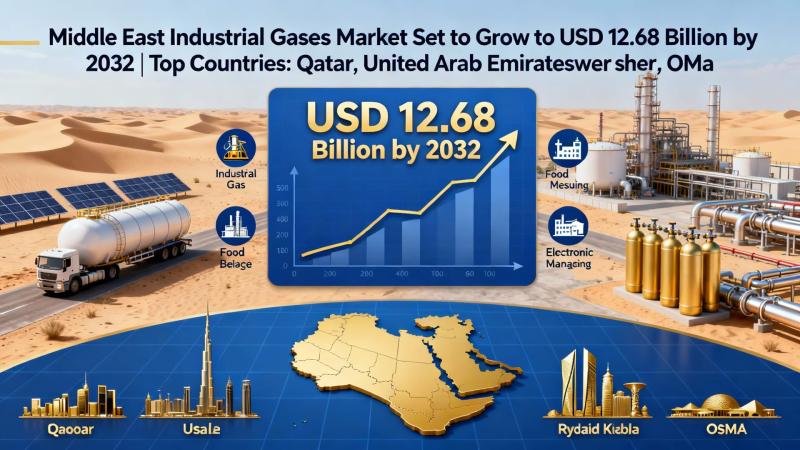

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

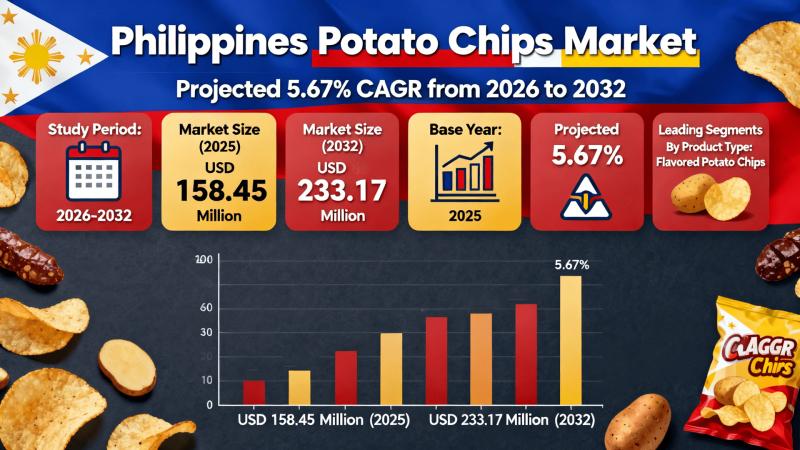

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for InsurTech

Insurtech Accelerators Market Hits New High | Major Giants Plug and Play, Startu …

HTF MI just released the Global Insurtech Accelerators Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2033. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Insurtech Accelerators Market are: Plug and Play,…

Insurtech Market: A Comprehensive Overview

The global insurtech market was valued at approximately USD 10.3 billion in 2024 and is projected to reach around USD 152.9 billion by 2033, growing at a compound annual growth rate (CAGR) of about 31.5% from 2025 to 2033.

Insurtech Market Overview

The global Insurtech market is undergoing explosive growth, fueled by the insurance industry's rapid digitization and rising customer demand for seamless, personalized digital experiences. Advanced technologies like artificial intelligence (AI),…

Top Trends Transforming the InsurTech (Insurance Technology) Market Landscape in …

"Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the InsurTech (Insurance Technology) Industry Market Size Be by 2025?

The volume of the insurtech (insurance technology) market has expanded significantly in the past few years. The market, currently valued at $19.23 billion in 2024, is projected to reach $25.95 billion in 2025, demonstrating a compound annual…

Emerging Trends Influencing The Growth Of The Insurtech Market: Innovative AI-Po …

The Insurtech Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Insurtech Market Size Expected to Be by 2034?

In recent times, the insurtech market has seen substantial expansion. The projected growth indicates an increase from $17.08 billion in 2024 to $22.08 billion…

Top Factor Driving Insurtech Market Growth in 2025: Rising Tide Of Insurance Cla …

How Are the key drivers contributing to the expansion of the insurtech market?

The expected surge in insurance claims is projected to directly contribute to the expanded growth of the insurtech market. Insurtech plays a critical role in claim management, risk assessment, contract processing, and policy underwriting. The increase in hospitalizations during the COVID-19 pandemic has resulted in a steep rise in insurance claims. An illustrative example of this could be…

Insurtech, Market Dynamics, Global Opportunities, Forecast 2024

The Business Research Company recently released a comprehensive report on the Global Insurtech Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…