Press release

Global Online Trading Platform Market Growth Prospects, Future Industry Landscape 2031 | Charles Schwab Corporation, Ally Financial Inc., TD Ameritrade, Fidelity Investments

The global online trading platform market size is expected to grow from $9.6 billion in 2021 to $10.21 billion in 2022 at a compound annual growth rate (CAGR) of 6.4%. The global online trading platforms market size is expected to grow to $13.13 billion in 2026 at a CAGR of 6.5%.The Business Research Company offers the Online Trading Platform Global Market Report 2022 in its research report store. It is the most comprehensive report available on this market and will help gain a truly global perspective as it covers 60 geographies. The regional and country breakdowns section gives an analysis of the market in each geography and the size of the market by region and by country. It also compares the market's historic and forecast growth, and highlights important trends and strategies that players in the market can adopt.

Request FREE SAMPLE COPY of this research study:

https://www.thebusinessresearchcompany.com/sample.aspx?id=6106&type=smp

The online trading platform market consists of the sale of online trading platforms services by entities (organizations, sole traders, and partnerships) that are used for trading and investing online. An online trading platform is a software or website that allows investors and traders to position trades through financial intermediaries and track accounts with a combination of robust features and low fees digitally.

Some key online trading platform market are Charles Schwab Corporation, Ally Financial Inc., TD Ameritrade, Fidelity Investments, E-Trade Financial Corporation, AAX, ErisX, Huobi Group, Interactive Brokers, MarketAxess, Merril Edge, Plus500, Tradestation, Bitstamp, EToro, BitPay, Eruption, Octagon Strategy Limited, Blockstream, Bitfinex, Tradeweb, DigiFinex, Templum, Unchained Capital, Cezex, and SIMEX.

The countries covered in the global Online Trading Platform market are Argentina, Australia, Austria, Belgium, Brazil, Canada, Chile, China, Colombia, Czech Republic, Denmark, Egypt, Finland, France, Germany, Hong Kong, India, Indonesia, Ireland, Israel, Italy, Japan, Malaysia, Mexico, Netherlands, New Zealand, Nigeria, Norway, Peru, Philippines, Poland, Portugal, Romania, Russia, Saudi Arabia, Singapore, South Africa, South Korea, Spain, Sweden, Switzerland, Thailand, Turkey, UAE, UK, USA, Venezuela, Vietnam.

The regions covered in the global Online Trading Platform market are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Online Trading Platform Market Segmentation:

1) By Product Type

Commissions

Transaction Fees

Other Related Service Fees

2) By Component

Solution

Services

See more on the report at https://www.thebusinessresearchcompany.com/report/online-trading-platform-global-market-report

The Report's Table Of Contents includes

1. Executive Summary

2. Online Trading Platform Market Characteristics

3. Online Trading Platform Market Trends And Strategies

4. Impact Of COVID-19 On Online Trading Platform

5. Online Trading Platform Market Size And Growth

....

27. Online Trading Platform Market Competitive Landscape And Company Profiles

28. Key Mergers And Acquisitions In The Online Trading Platform Market

29. Online Trading Platform Market Future Outlook and Potential Analysis

30. Appendix

This report covers the trends and market dynamics of the Online Trading Platform market in major countries - Australia, Brazil, China, France, Germany, India, Indonesia, Japan, Russia, South Korea, UK, and USA. The report also includes consumer surveys and various future opportunities for the market.

Directly purchase the report here: https://www.thebusinessresearchcompany.com/purchaseoptions.aspx?id=6106

Contact Information:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 8897263534

Americas: +1 315 623 0293

Email: info@tbrc.info

Check out our blog: http://blog.tbrc.info/

And follow us on:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

About Us:

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that excels in company, market, and consumer research. It has published over 3000 industry reports, covering over 2500 market segments and 60 geographies. The reports draw on 150,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders. The reports are updated with a detailed analysis of the impact of COVID-19 on various markets.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Global Online Trading Platform Market Growth Prospects, Future Industry Landscape 2031 | Charles Schwab Corporation, Ally Financial Inc., TD Ameritrade, Fidelity Investments here

News-ID: 2718556 • Views: …

More Releases from The Business research company

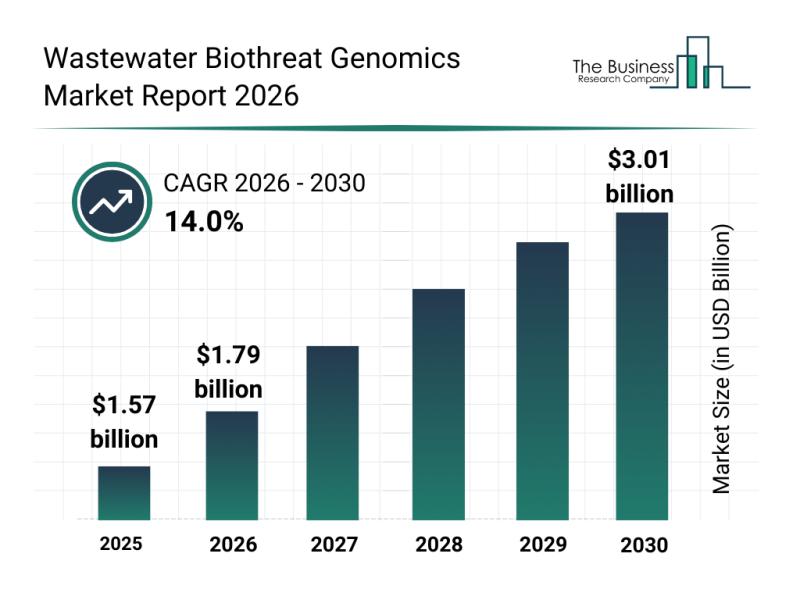

Emerging Growth Factors Driving Rapid Expansion in the Wastewater Biothreat Geno …

The field of wastewater biothreat genomics is emerging as a vital area within public health and environmental safety, driven by advances in technology and growing concerns over biological threats. This sector is set to experience remarkable growth as it plays an increasingly important role in early detection and monitoring of pathogens through wastewater analysis. Let's explore the market size, leading players, key growth drivers, current trends, and primary market segments…

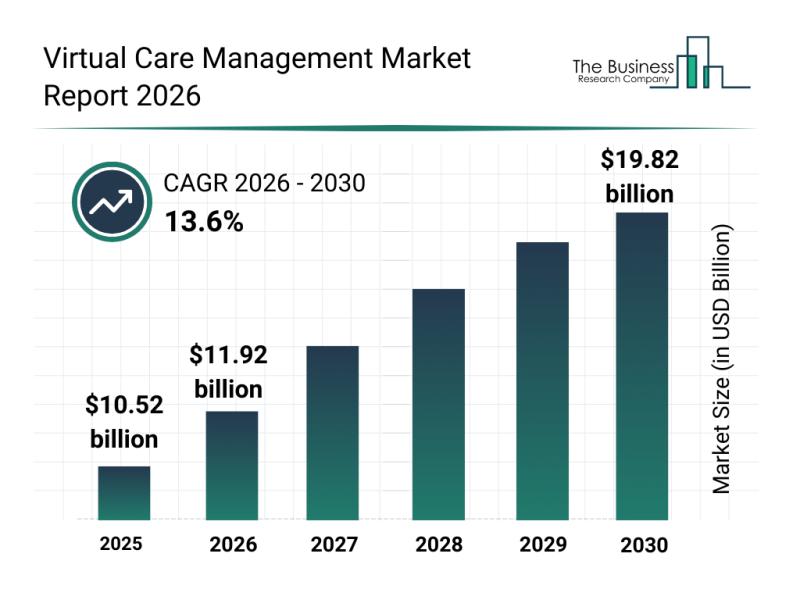

Segment Evaluation and Major Growth Areas in the Virtual Care Management Market

The virtual care management sector is rapidly evolving, driven by technological advancements and changing healthcare delivery models. This market is gaining momentum as healthcare providers and payers increasingly adopt digital tools to improve patient outcomes and operational efficiency. Let's explore the current market size, key players, emerging trends, and future potential within this dynamic industry.

Virtual Care Management Market Size and Growth Prospects Through 2030

The virtual care management market…

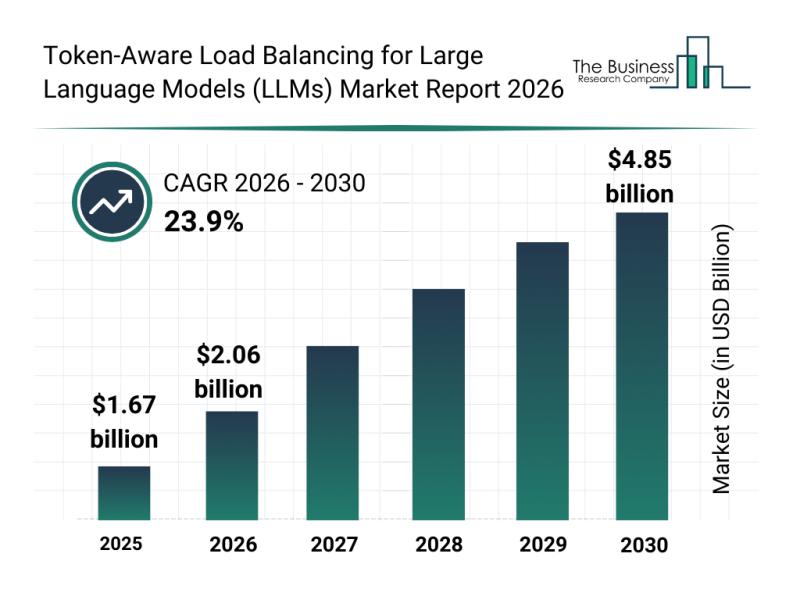

Key Strategic Developments and Emerging Changes Shaping the Token-Aware Load Bal …

The token-aware load balancing market for large language models (LLMs) is set for remarkable expansion as demand for efficient AI infrastructure continues to increase. This emerging sector is gaining attention due to its ability to optimize AI workloads and reduce latency, making it an essential component in the growing landscape of large-scale AI applications and services. Below, we explore the current market size, key players, major trends, and detailed segmentation…

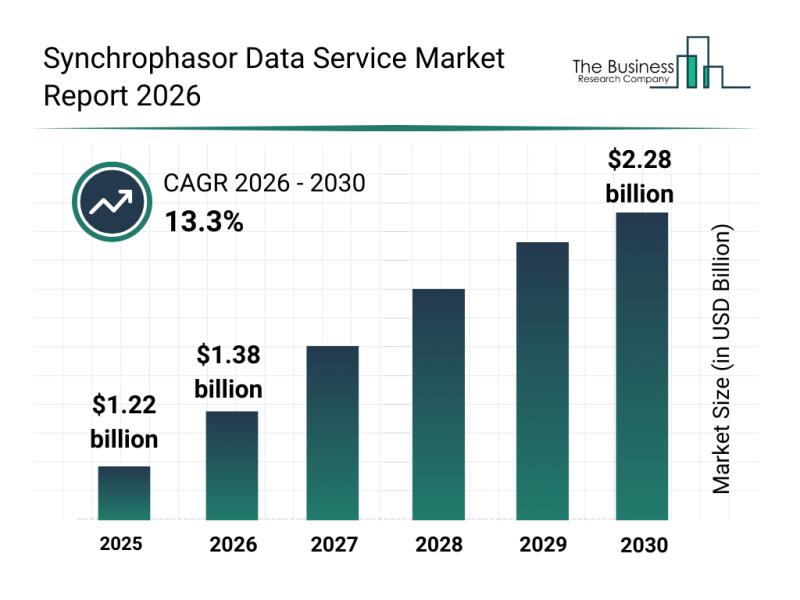

Emerging Sub-Segments Transforming the Synchrophasor Data Service Market Landsca …

The synchrophasor data service sector is poised for significant expansion as the demand for advanced grid management and real-time monitoring solutions continues to grow. With increasing integration of renewable energy and the need for enhanced grid visibility, this market is attracting considerable attention from industry players and investors alike. Let's explore the market's expected growth, key companies, emerging trends, and segment classifications to understand its evolving landscape.

Forecasted Market Value Growth…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…