Press release

The market for insurance technology will be worth US$165.4 billion by 2022-2032

The insurtech market is forecasted to reach a net worth of US$ 165.4 Bn in 2032 from a mere market value of US$ 12.5 Bn in 2021. It is predicted to with an impressive CAGR of 25.9% during the forecast period.The growth of general awareness among common people about the benefits of insurance policies has created a huge demand for general insurance policies provided by several companies across the globe. Insurance companies have also increased their market presence by the application of digital insurtech or insurance technology infrastructure with the changing economic scenario.

Over the years of service and development of commercial insurance, insurtech companies have intensified in terms of offering customized policies to the customers. Adoption of such technology for collecting and analyzing customer data for insurtech life insurance companies has further boosted the business attraction of the global insurtech market.

The emergence of a number of small and regional players operating in various categories such as insurtech car insurance or home insurance insurtech companies have fragmented the market, making it highly competitive.

Most of the key players are strengthening their market by establishing partnerships and collaborations with the banking and financial institutions for introducing new specific commercial insurance insurtech solutions.

Get Sample of the Report @

https://www.futuremarketinsights.com/reports/sample/rep-gb-14559

"Rapid digitization of all major service sectors of economy has also shifted the business model of insurance providing companies across the globe. Addition of professional and consulting services to the potential customers over online platforms have necessitated the integration of insurance technology solutions further propelling the growth of global insurtech market."

According to the market survey report of the EIS group for Insurance companies, almost 59% of the companies were found to have increased their spending on establishing digital infrastructure. This includes a record proliferation of P&C insurtech companies in the global market.

Key Takeaways

• As per the market analysis report, the absolute growth of the global insurtech market size in terms of value is predicted to be around US$ 148.8 Bn over the forecast years 2022 to 2032.

• As the concept of insurtech insurance companies is expanding to new areas of service, the solution segment is growing at a faster rate than the service segment. The CAGR predicted for the solution segment is nearly 25.8% for the coming decade.

• On the basis of various technologies adopted by life insurance tech companies, cloud computing has emerged to be the most attractive segment in the present market. The estimated growth of this segment over the forecast years is nearly 25.2%.

• US market holds the dominant position in the global market for having the highest amount of insurtech capital, valued at about US$ 6 Bn in the year 2022. It is also the top-performing country with a CAGR of 25.6% that is predicted to reach the net worth of the regional insurtech market up to US$ 58.6 Bn by the end of this forecast period.

Inquire Before Buying Research Report@

https://www.futuremarketinsights.com/ask-question/rep-gb-14559

Competitive Landscape

The major players operating in the global insurtech market include Damco Group, DXC Technology Company, Majesco, Oscar Insurance, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, and Zhongan Insurance, among others.

• One of the top insurance companies in the USA named, Universal Fire & Casualty Insurance Company, announced to accept cryptocurrency payments for premiums, starting a new business model for home insurance insurtech companies in the US market. Integration of such advanced digital facilities and blockchain technologies is expected to further boost the global insurtech market.

• An automobile insurance company named Metromile also announced in December 2021 to accept cryptocurrency from its customers to pay their premiums and claim payments. This new development is anticipated to give way to some new opportunities in the domain of insurtech car insurance services in the coming days.

Key Segments

By Offering

Solution

Service

By Deployment Model

On-premise

Cloud

By Technology

Artificial Intelligence

Cloud Computing

Blockchain

Big Data & Business Analytics

IoT

Others

By End User

Life & Health Insurance

Property and Casualty (P&C) Insurance

By Application

Product Development & Underwriting

Sales & Marketing

Policy Admin Collection & Disbursement

Claims Management

Request Customization of the report @

https://www.futuremarketinsights.com/customization-available/rep-gb-14559

Explore FMI's Extensive Coverage on Technology Domain

Virtual Private Cloud Market: https://www.futuremarketinsights.com/reports/virtual-private-cloud-market

Leadership Development Program Market: https://www.futuremarketinsights.com/reports/leadership-development-program-market

5G Chipset Market: https://www.futuremarketinsights.com/reports/5g-chipset-market

Future Market Insights Inc.

Christiana Corporate, 200 Continental Drive,

Suite 401, Newark, Delaware - 19713, USA

T: +1-845-579-5705

For Sales Enquiries: sales@futuremarketinsights.com

Browse latest Market Reports: https://www.futuremarketinsights.com/reports

Future Market Insights (ESOMAR certified market research organization and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel and End Use over the next 10-years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release The market for insurance technology will be worth US$165.4 billion by 2022-2032 here

News-ID: 2716935 • Views: …

More Releases from Future Market Insights

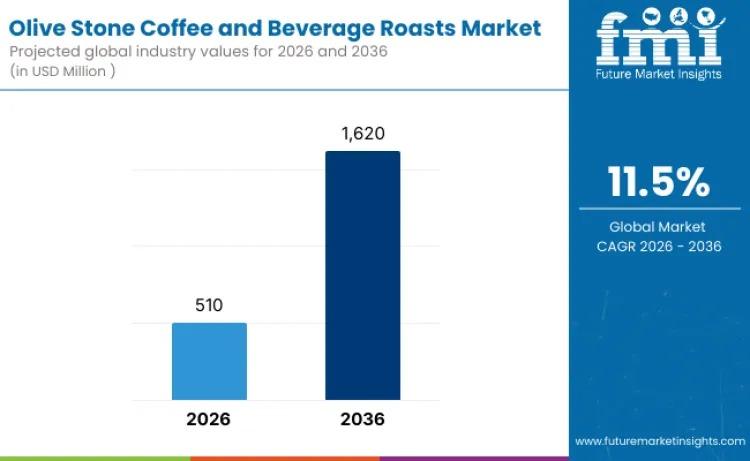

Global Olive Stone Coffee and Beverage Roasts Market to Reach USD 1,620 Million …

The global olive stone coffee and beverage roasts market is entering a high-growth decade, fueled by sustainability innovation and evolving specialty coffee culture. Valued at USD 510 million in 2026, the market is projected to reach USD 1,620 million by 2036, expanding at a compelling CAGR of 11.5%.

As consumers increasingly seek beverages that combine sustainability, functionality, and distinctive taste, olive stone-based roasting solutions are transitioning from niche experimentation to structured…

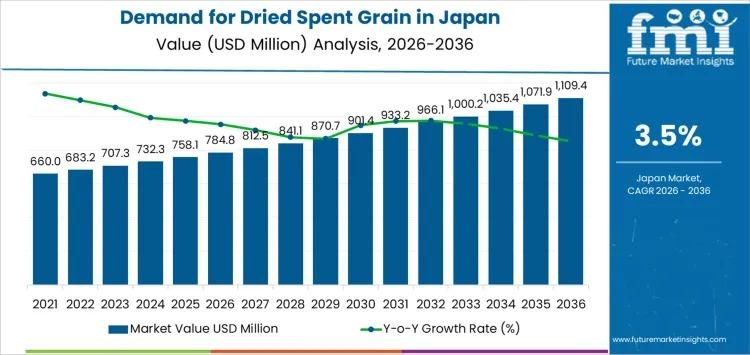

Japan Dried Spent Grain Market to Surpass USD 1.1 Billion by 2036 as Feed Optimi …

Japan's dried spent grain market is entering a decade of steady, value-driven expansion, supported by structured feed demand, brewery byproduct utilization, and rising integration of fiber-rich ingredients into food manufacturing. Industry estimates place the market at USD 784.8 million in 2026, with projections indicating growth to USD 1,109.4 million by 2036, reflecting a CAGR of 3.5%.

Between 2020 and 2026, demand increased from USD 637.5 million to USD 784.8 million, shaped…

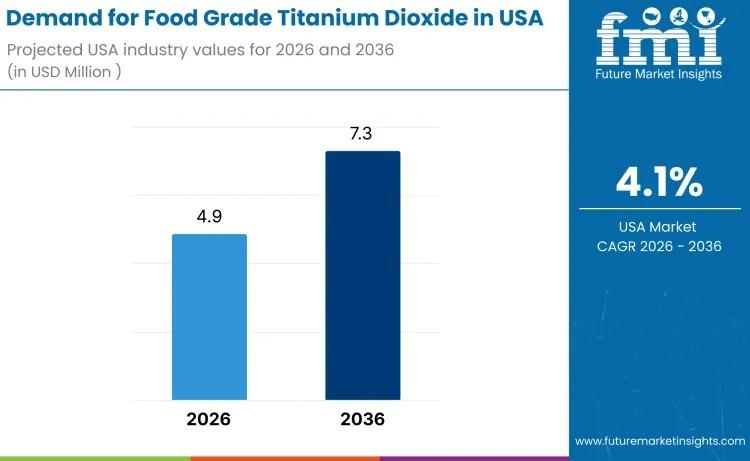

USA Food Grade Titanium Dioxide Market to Reach USD 7.3 Million by 2036 Amid Ste …

The demand for food grade titanium dioxide in the USA is valued at USD 4.9 million in 2026 and is projected to reach USD 7.3 million by 2036, expanding at a CAGR of 4.1%. Growth remains moderate yet stable, supported by continued use of titanium dioxide as a whitening and opacifying agent across confectionery coatings, bakery decorations, sauces, dairy analogues, and processed food matrices.

Despite heightened regulatory scrutiny and evolving clean-label…

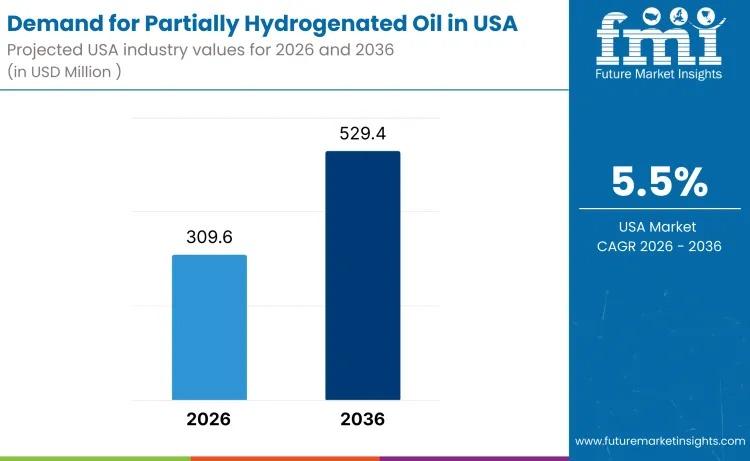

USA Partially Hydrogenated Oil Market to Reach USD 529.4 Million by 2036 Amid Me …

The demand for partially hydrogenated oil in the USA is projected to rise from USD 309.6 million in 2026 to USD 529.4 million by 2036, expanding at a steady CAGR of 5.5%. While edible applications remain tightly regulated, demand persists across specialty industrial and permitted food-related segments where oxidative stability, viscosity control, and texture performance remain critical.

Despite regulatory constraints on trans fats in conventional food manufacturing, PHOs continue to serve…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…