Press release

Eastern Europe Core Banking Market Revenue, Key Findings and Forecast 2020-2025

The latest research report on the Eastern Europe Core Banking Market by MarkNtel Advisors drafts an extensively detailed analysis of the different trends, drivers, restraints, challenges, and opportunities for the stakeholders to make informed decisions in the future. The report is to benefit the leaders by using the integrated market report using the advantageous information, including the impact of Covid-19. While the pandemic affected the world drastically and has brought along various changes in market conditions, the rapidly changing dynamics of the market in the historic, current, and future times are evaluated in the report.The study is also a combination of analysis of the market statistics, growth, growing competition analysis, investment opportunities, prominent players, industry facts, statistical figures, revenues, sales & profit, and gross margins of the Eastern Europe Core Banking Market. Nonetheless, the business strategies, market shares, top lucrative regions, upsurging product/service demand, & recent developments are also incorporated in the market report by the research analysts of MarkNtel Advisors.

Request Sample Report of Eastern Europe Core Banking Market: - https://www.marknteladvisors.com/query/request-sample/eastern-europe-core-banking-market.html

What Information does this report contain?

Composition of the Research Report on the Eastern Europe Core Banking Market

• The analysis of the previous year generated in the historic years of 2015-18, the existing scenario, trends, & ongoing statistics of the market in the base year 2020, & estimation of the prospect of the market during the forecast period of 2020-25

• The analysis on the development, rise & falls, new entrants, mergers & acquisitions, among other facts across different segmentations & regions/countries, are also comprehensively covered in the market.

• The expert analysis of the key trends in the industry, innovation & technological developments, along with factors restraining & challenging the market expansion, is also integrated into the report using tools like SWOT (Strength, Weakness, Opportunity, &Threat), PESTEL (Political, Economic, Social, Technological, Environmental, & Legal), and Porter's Fiver Forces Model.

Competitive Landscape in the Eastern Europe Core Banking Market: -

The research report by MarkNtel Advisors drafts unbiased & straightforward analysis of different parameters of the leading players in the complete company profiling, covering the following:

• Business Strategy

• Company Overview

• Financial Performance

• Key Product/Service Offerings

• Performance Indicators

• Porter's Five Forces Model

• Risk Analysis

• Recent Developments

• Regional Presence

• SWOT Analysis

The most prominent players in the Eastern Europe Core Banking Market are: -

• FIS

• DXC Technology

• TAS group

• Finastra

• Sopra

• Temenos

• Oracle

• Asseco

• Diasoft

• Avaloq

• Others

For in-depth competitive analysis Visit: - https://www.marknteladvisors.com/research-library/eastern-europe-core-banking-market.html

Segmentation Analysis:

The research report on the Eastern Europe Core Banking Market by MarkNtel Advisors depicts that the industry is highly fragmented and has multiple bifurcations. The reports demonstrate detailed researched information on each segment across different geographical locations to provide precise & accurate data on the actual size & volume. The prominent segmentation of the Eastern Europe Core Banking Market is done in the following way:

Based on, By Component

- Service

-- Managed Service

-- Professional Service

- Software

Based on, By Deployment

- On-Premise

- Cloud

Based on, By Type

- Retail

- Private

- Corporate

- Universal

- Wholesale

- Others

Based on, By Bank Asset Size

- Tier 1- Upto USD10 billion

- Tier 2- USD10-30 billion

- Tier 3- USD30-100 billion

- Tier 4- USD100-250 billion

- Tier 5- USD250 and above

Alongside that, on the geographical front, the Eastern Europe Core Banking Market expands across the following regions/countries:

• Hungary

• Romania

• Poland

• Czech Republic

• Serbia

• Bulgaria

• Others

Scope of the Eastern Europe Core Banking Market Report:

• The research report offers a comprehensive insight into defining, describing, and forecasting the dynamics of the Eastern Europe Core Banking Market across different segmentations & regions.

• The study drafts a complete computation of the key strategies, developments, trends, profits, and other schemes of the leading players.

• Additionally, the report showcases the effects of the Covid-19 pandemic on the Eastern Europe Core Banking Market and the leading players & stakeholders involved, witnessing the fluctuations amidst the crisis.

• The researchers at the MarkNtel Advisors are using exhaustive tools for the computation & study of the external environmental effects of the market.

• The core aim of the report is also to deliver the stakeholder insights on the opportunities & provide crucial details about the competitive landscape for the forecast years.

Request for Report Customization: - https://www.marknteladvisors.com/query/request-customization/eastern-europe-core-banking-market.html

Read our Latest Blog

• How is CRISPR changing the landscape of Cancer Treatment?:- https://newscluster24.com/how-is-crispr-changing-the-landscape-of-cancer-treatment/

• What does the Future Hold for Gastroesophageal Cancer?:- https://newscollectiononlines.blogspot.com/2022/08/what-does-future-hold-for.html

• What's Latest in Non-Hodgkin Lymphoma Diagnosis & Treatment?:- https://newscluster24.com/whats-latest-in-non-hodgkin-lymphoma-diagnosis-treatment/

Contact Us:

MarkNtel Advisors

Email: sales@marknteladvisors.com

Call - +1 604 1900 2671

Website: www.marknteladvisors.com

MarkNtel Advisors is a leading research, consulting, and data analytics firm that provides a wide range of strategic reports on diverse industry verticals to a substantial and varied client base that includes multinational corporations, financial institutions, governments, and individuals.

We specialize in niche industries and emerging geographies to support our clients in the formulation of strategies viz. Go to Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, trend analysis, etc. in around 15 industry verticals to enable our clients in identifying attractive investment opportunities and maximizing ROI through an early mover advantage.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Eastern Europe Core Banking Market Revenue, Key Findings and Forecast 2020-2025 here

News-ID: 2716390 • Views: …

More Releases from MarkNtel Advisors LLP

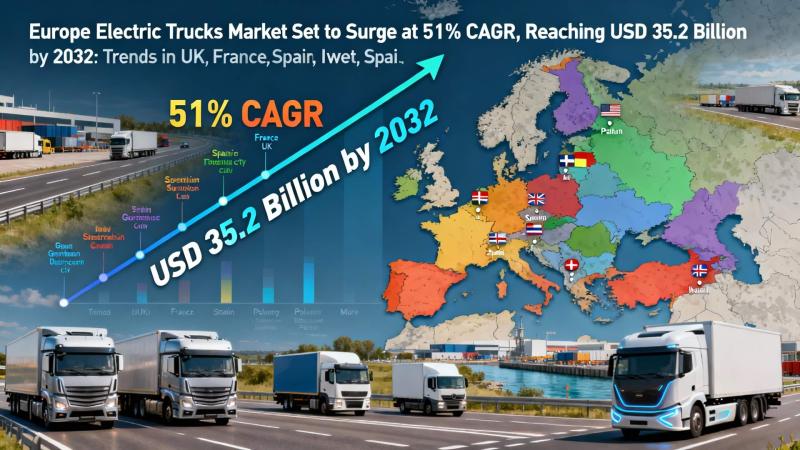

Europe Electric Trucks Market Set to Surge at 51% CAGR, Reaching USD 35.2 Billio …

Latest Research Report of European Electric Trucks Market Size and CAGR

According to MarkNtel Advisors latest market research report data, the Europe Electric Trucks Market is projected to grow from USD 1.96 billion in 2025 to USD 35.2 billion by 2032, registering a remarkable CAGR of 51.07%. Growth is primarily driven by stringent EU emission standards, expansion of high-capacity charging networks, and fleet electrification by major OEMs like Volvo Trucks and…

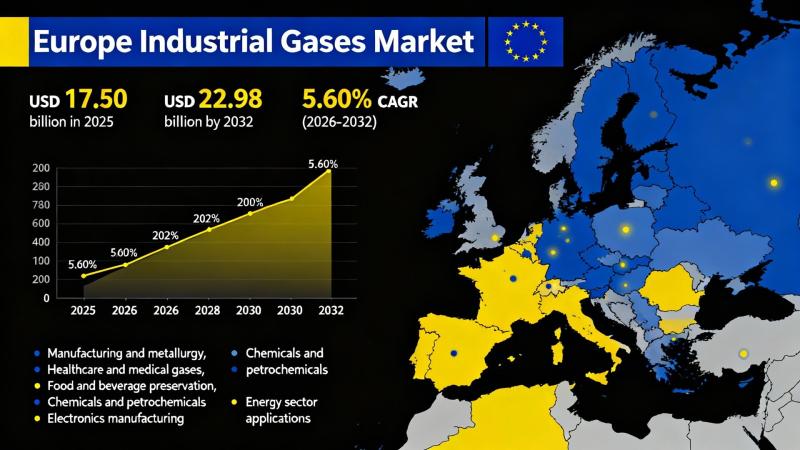

Europe Industrial Gases Market Expected to Reach Nearly $22.98 Billion by 2032: …

Europe Industrial Gases Market: Trends, Insights, and Future Outlook

The Europe Industrial Gases Market is seeing robust growth, driven by increasing demand across key sectors such as petrochemicals, healthcare, and steelmaking. Innovations in hydrogen production and carbon capture technologies are prominent factors influencing market dynamics. A shift towards renewable and low-carbon sources presents significant opportunities amid growing environmental regulations. Additionally, the rise in energy costs is reshaping the landscape for industrial…

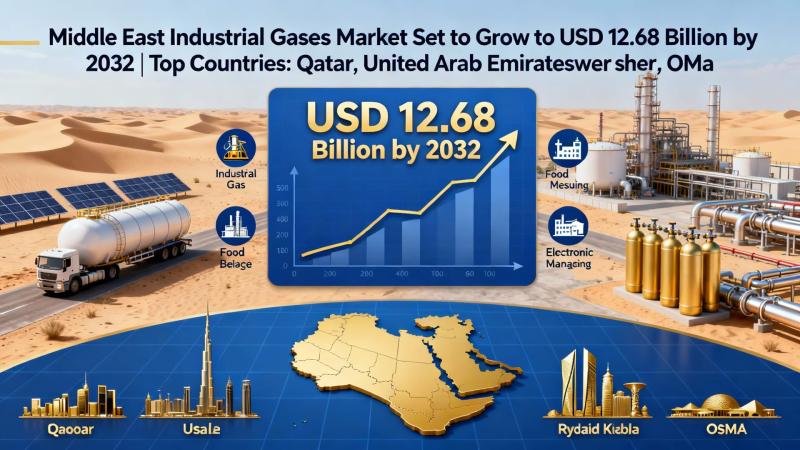

Middle East Industrial Gases Market Set to Grow to USD 12.68 Billion by 2032 | T …

The Middle East Industrial Gases Market is forecasted to expand from USD 10.06 billion in 2025 to USD 12.68 billion by 2032, reflecting a compound annual growth rate (CAGR) of 4.72% during the period of 2026 to 2032. The primary drivers fueling this growth are the increasing demand for hydrogen and the robust expansion of the petrochemical industry, which necessitates high-purity gases for various applications such as chemical synthesis and…

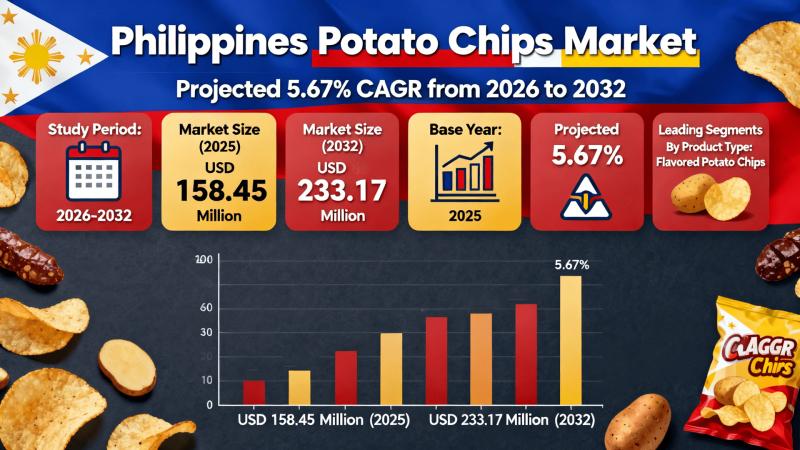

Potato Chips Market in Philippines Set to Grow to USD 233.17 Million by 2032 as …

The Philippines Potato Chips Market is entering a significant growth phase, projected to expand from USD 158.45 million in 2025 to USD 233.17 million by 2032, with a robust compound annual growth rate (CAGR) of 5.67%. Key growth drivers include government initiatives aimed at bolstering local potato production and the rising popularity of flavored varieties among consumers.

Philippines Potato Chips Market Growth Outlook:

As snack food preferences evolve, the Philippines Potato Chips…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…