Press release

Digital Banking Platform Market Size Report: Global Industry Share, Trends, Growth and Forecast 2022-2027

The latest research study "Digital Banking Platform Market: Global Industry, Growth, Trends, Share, Size, Opportunity and Forecast 2022-2027" by IMARC Group, finds that the global Digital Banking Platform Market size reached US$ 5.07 Billion in 2021. Looking forward, IMARC Group expects the market to reach a value of US$ 10.76 Billion by 2027 exhibiting a CAGR of 12.71% during 2022-2027.Covid-19 Impact:

We are regularly tracking the direct effect of COVID-19 on the market, along with the indirect influence of associated industries. These observations will be integrated into the report.

Digital banking platforms entail the financial services provided by banks solely via online mode. They rely on application programming interfaces (APIs), web-based services, and process automation to serve customers through online channels. Digital banking platforms involve the digitization of all traditional banking products and services, such as funds transfer, cash withdrawal, bill payments, opening deposit accounts, loan management, etc.

They also provide several features, including real-time transaction notifications, scheduling expenditures, obtaining bank statements, promoting cardless payments and account-to-account (A2A) payments, remotely monitoring personal finance management (PFM), etc. Digital banking platform services can be conveniently availed through mobile phones, laptops, and desktops and enable users to control everyday financial operations without hassle.

Download free sample brochure:https://www.imarcgroup.com/digital-banking-platform-market/requestsample

Global Digital Banking Platform Trends and Drivers:

The escalating shift from traditional to online banking solutions is primarily driving the digital banking platform market. Additionally, the expanding penetration of smartphones and internet coverage and the elevating requirement for enhanced transparency and flexibility in banking operations are acting as significant growth-inducing factors.

Besides this, the increasing utilization of Artificial Intelligence (AI) and machine learning (ML) by online banking platforms for detecting and preventing payment frauds, assessing risks, improving processes for anti-money laundering (AML) operations, and performing know-your-customer (KYC) regulatory checks is further augmenting the market growth.

Moreover, the growing demand for improved customer experiences and convenience and the widespread adoption of cloud-based solutions by banks and financial institutions for obtaining higher scalability are expected to propel the digital banking platform market over the forecasted period.

Click here to view detailed information with table of content: https://www.imarcgroup.com/digital-banking-platform-market

Report Segmentation:

The report has been segmented the market into following categories:

Breakup by Component:

· Solutions

· Services

Breakup by Type:

· Retail Banking

· Corporate Banking

Breakup by Deployment Mode:

· On-premises

· Cloud-based

Breakup by Banking Mode:

· Online Banking

· Mobile Banking

Breakup by Region:

• North America: (United States, Canada)

• Asia Pacific: (China, Japan,India, South Korea, Australia, Indonesia, Others)

• Europe: (Germany, France,United Kingdom, Italy, Spain, Russia, Others)

• Latin America: (Brazil, Mexico, Others)

• Middle East and Africa

The major players in the market are Appway AG (FNZ (UK) Ltd.), Fidelity Information Services (FIS), Finastra Limited, Fiserv Inc., Infosys Limited, nCino, NCR Corporation, Oracle Corporation, SAP SE, Sopra Steria, Tata Consultancy Services Limited, Temenos AG, The Bank of New York Mellon Corporation and Worldline.

Also, Read Latest Research Reports by IMARC Group:

Pediatric Medical Devices Market Size: https://www.imarcgroup.com/pediatric-medical-devices-market

Blockchain in Retail Market Size: https://www.imarcgroup.com/blockchain-in-retail-market

Fluid Power Equipment Market Size: https://www.imarcgroup.com/fluid-power-equipment-market

Contact Us:

IMARC Services Private Limited.

30 N Gould St Ste R

Sheridan, WY 82801 USA - Wyoming

Email: Sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

Americas:- +1 631 791 1145 | Africa and Europe :- +44-702-409-7331 | Asia: +91-120-433-0800, +91-120-433-0800

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market Size Report: Global Industry Share, Trends, Growth and Forecast 2022-2027 here

News-ID: 2713840 • Views: …

More Releases from IMARC Group

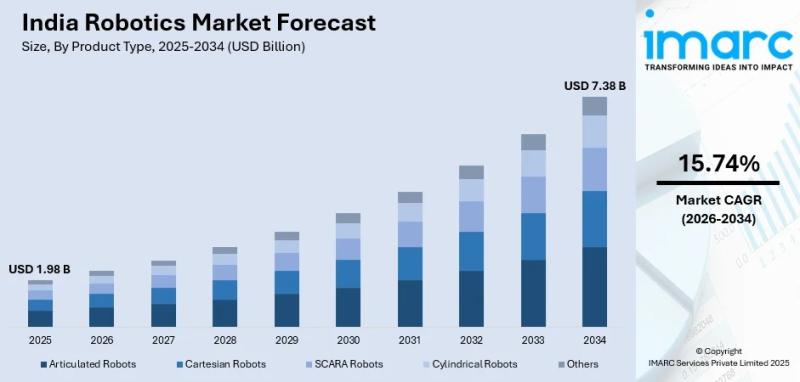

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

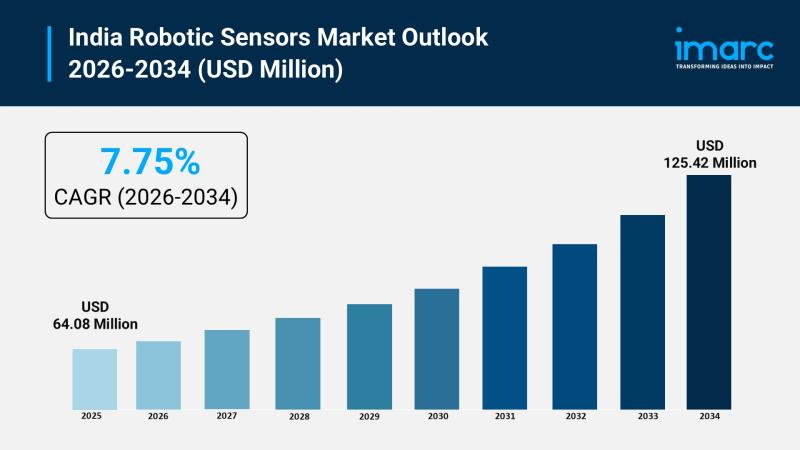

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

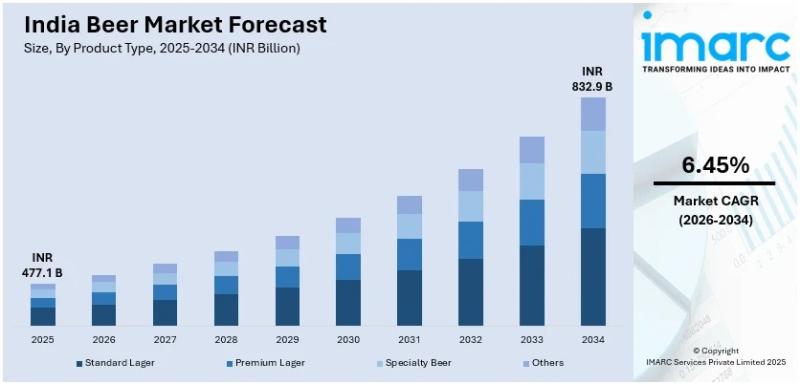

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

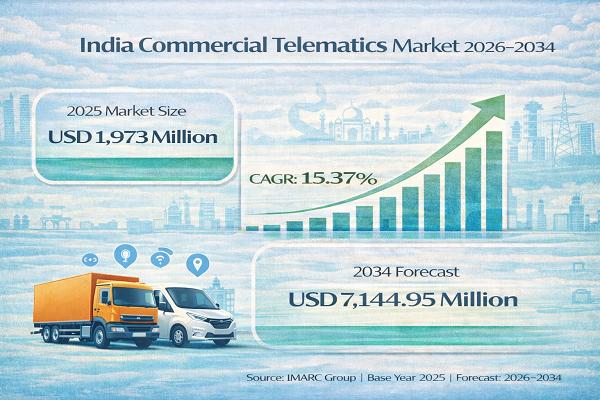

India Commercial Telematics Market Expected to Reach USD 7,144.95 Million by 203 …

India Commercial Telematics Market : Report Introduction

According to IMARC Group's report titled "India Commercial Telematics Market Size, Share, Trends and Forecast by Type, System Type, Provider Type, End Use Industry, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

Free Sample Download PDF (Exclusive Offer on Corporate Email): https://www.imarcgroup.com/india-commercial-telematics-market/requestsample

Commercial Telematics Market in India : Overview (2026-2034)

The India commercial telematics market…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…