Press release

Anti-Money Laundering Software Market Worth US$ 6,162.8 Million, Globally, by 2028 at 16.6% CAGR - Exclusive Report by The Insight Partners

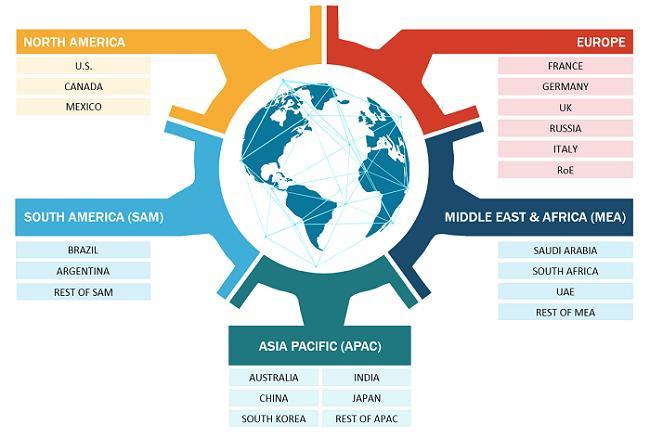

The Insight Partners Published latest research study on "Anti-Money Laundering Software Market Forecast to 2028 - COVID-19 Impact and Global Analysis By Component (Software and Services), Deployment (On Premise and Cloud based), Product (Transaction Monitoring, Compliance Management, Currency Transaction Reporting, and Customer Identity Management), End User (Healthcare, BFSI, Retail, IT and Telecom, Government, and Others) The anti-money laundering software market size is expected to grow from US$ 2,116.3 million in 2021 to US$ 6,162.8 million by 2028; The anti-money laundering software market size is estimated to grow at a CAGR of 16.6% from 2022 to 2028.Technological advancements are triggering the number of cyber-criminals. However, FinTech firms have the potential to help banks around the world to stay competitive in the global market. The use of more robust systems combined with advanced technologies in tracking digital currency, machine learning, and connecting data have opened up possibilities to combat money laundering. With increasing consumer adoption and subsequent transaction volumes in competitive FinTech firms in 2019, many firms shifted to automated anti-money laundering practices. The automated anti-money laundering systems provide a negligible number of false positives compared to those generated by traditional data and technology. This reduces the adverse effects of false positives, keeping the operational costs within the expected range.

Considering the growing connection between FinTech and AML solutions, in December 2020, the Association of Certified Anti-Money Laundering Specialists announced the launch of a new certification program for FinTech firms seeking to meet regulatory standards. The association also developed the Certified AML FinTech Compliance Associate program in collaboration with FINTRAIL. The program is built to increase the compliance toolkit of FinTech personnel working in financial crime prevention at the entry level. Thus, the increasing focus of FinTech on implementing AML solutions is propelling the anti-money laundering software market growth.

The Sample Pages Showcases Content Structure and Nature of Information Included in This Research Study Which Presents A Qualitative and Quantitative Analysis: https://www.theinsightpartners.com/sample/TIPRE00002921/?utm_source=OpenPR&utm_medium=10365

Impact of COVID-19 Pandemic on Anti-Money Laundering Software Market

The COVID-19 pandemic accelerated the development of digital technologies. Because of social restrictions worldwide, maximum people now rely on digital platforms to meet their everyday needs. Digital wallets, often known as eWallets, are becoming more popular. As a result of this transition, the likelihood of unlawful money transactions has grown. The FATF has cautioned banks about unlawful money transactions. As a result, demand for AML solutions has surged, and this factor has a significant impact on market growth. Owing to the widespread use of digital platforms, the amount of data on networks is growing, putting more strain on banks' and financial institutions' infrastructure security. Hackers continue to target banks irrespective of several measures taken by them. As a result, the demand for improved AML solutions is growing.

Cybercrimes, such as financial frauds, are rising as data on networks grows. Banks and financial institutions are now using data analytics techniques to improve their security procedures.

Rising Demand for Sophisticated Transaction Monitoring Solutions Drives Anti-Money Laundering Software Market Growth

Transaction monitoring is a crucial procedure and key control in AML and countering the financing of terrorism (AML/CFT) policies and procedures of financial institutions. The transaction monitoring solutions allow financial institutions to detect and evaluate whether transactions pose suspicion when considered against customers' respective profiles. Over the years, the financial regulators have intensified their focus on monitoring AML risk activities, including a thrust for the financial institutes to adopt a suitable transaction monitoring process. Furthermore, regulators expect firms to prove the capability and efficiency of their systems. This demand for a sophisticated transaction monitoring system is predominantly driven by the legislation, such as New York's Department of Financial Services part 504, and the general move toward the control being evaluated by their outcome quality.

The transaction monitoring software platforms allow the financial institutions to configure a range of monitoring scenarios, perform efficient data analysis, and filter out the genuine suspicious activities from the other false positives; thus, gaining significant traction in the market. This, in response, is accelerating the demand for AML enabled with sophisticated transaction monitoring solutions.

Component-Based Anti-Money Laundering Software Market Insights

The anti-money laundering software market analysis by component, the anti-money laundering software market is segmented into software and services segment. The software segment accounted a larger anti-money laundering software market share in 2021.

Deployment-Based Anti-Money Laundering Software Market Insights

The anti-money laundering software market analysis by deployment, the anti-money laundering software market is segmented into cloud based and on-premise. The on-premise segment accounted a larger anti-money laundering software market share in 2021. A cloud based anti-money laundering software is a web-based software as a service (SaaS) model utilizing enterprise cloud technology.

Product-Based Anti-Money Laundering Software Market Insights

On the basis of product, the anti-money laundering software market is categorized into transaction monitoring, compliance management, currency transaction reporting, and customer identity management. The transaction monitoring segment accounted for the largest share of the market in 2021.

End user-Based Anti-Money Laundering Software Market Insights

Based on end user, the anti-money laundering software market is segmented into healthcare, retail, BFSI, IT & telecom, government and others. The BFSI segment accounted for the largest share of the market in 2021. Rapid developments in financial information, technology and communication has enabled the money to move anywhere in the world with speed and ease.

Have A 15-Minute-Long Discussion with The Lead Research Analyst and Author of The Report in A Time Slot Decided by You. You Will Be Briefed About the Contents of The Report and Queries Regarding the Scope of The Document Will Be Addressed as Well: https://www.theinsightpartners.com/speak-to-analyst/TIPRE00002921/?utm_source=OpenPR&utm_medium=10365

Players operating in the anti-money laundering software market are mainly focused on the development of advanced and efficient products.

In January 2022, Oracle announced its partnership with Arachnys, to provide cloud-native CRI platform of Arachnys to get integrated with and enhance Oracle's Financial Services Financial Crime and Compliance Management (FCCM) solution suite.

In April 2021, successfully completed the acquisition of Exton Consulting, a French consulting firm involved in offering banking strategy support across Europe.

Anti-Money Laundering Software Market-CompanyProfiles

• ACI Worldwide

• SAS Institute

• Oracle Corporation

• BAE Systems

• Verafin Inc.

• Safe Banking Systems LLC

• Eastnets Holding Ltd.

• Ascent Technology Consulting

• Opentext Corporation

Immediate Delivery of Our Off-The-Shelf Reports and Latest Research Studies, Through Flexible and Convenient Payment Methods: https://www.theinsightpartners.com/buy/TIPRE00002921/?utm_source=OpenPR&utm_medium=10365

Contact Us:

If you have any queries about this report or if you would like further information, please contact us:

Contact Person: Sameer Joshi

E-mail: sales@theinsightpartners.com

Phone: +1-646-491-9876

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services. We specialize in industries such as Semiconductor and Electronics, Aerospace and Defense, Automotive and Transportation, Biotechnology, Healthcare IT, Manufacturing and Construction, Medical Device, Technology, Media and Telecommunications, Chemicals and Materials.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Software Market Worth US$ 6,162.8 Million, Globally, by 2028 at 16.6% CAGR - Exclusive Report by The Insight Partners here

News-ID: 2685862 • Views: …

More Releases from The Insight Partners

Green Building Materials Market Forecast 2031: Valued at US$ 791.93 Billion, Gro …

The Green Building Materials Market size is expected to reach US$ 791.93 billion by 2031. The market is anticipated to register a CAGR of 10.4% during 2025-2031.

Global Green Building Materials Market 2031 Report give our customers an exhaustive and top to bottom examination of Green Building Materials Market alongside its key factors, for example, market diagram and rundown, pieces of the pie, restrictions, drivers, local examination, players, serious elements, division,…

Text Analytics Market Growth Forecast: Valued at US$ 29.53 Billion by 2031

The Text Analytics Market is evolving rapidly, fueled by breakthroughs in artificial intelligence, natural language processing, and the exploding volume of unstructured data from social media, customer feedback, and enterprise communications. Businesses worldwide are turning to text analytics solutions to unlock hidden insights, enhance customer experiences, and drive data-informed strategies. As organizations navigate complex data landscapes, text analytics stands out as a critical tool for competitive advantage.

Download PDF: -https://www.theinsightpartners.com/sample/TIPTE100000198?utm_source=Openpr&utm_medium=10413

In today's…

Genome Editing Market: Trends, Opportunities, and Future Outlook

The genome editing market has emerged as one of the most dynamic and transformative sectors in biotechnology, driven by advancements in genetic engineering technologies and increasing applications across various fields. As of 2024, the market is witnessing significant growth, fueled by the rising demand for personalized medicine, agricultural innovations, and therapeutic solutions. This article explores the current trends, opportunities, and future outlook of the genome editing market.

Get the sample request…

Transdermal Drug Delivery System Market to Reach US$ 51,949.74 Million by 2030

The Transdermal Drug Delivery System Market is entering a new era of growth, driven by rising demand for non-invasive drug administration, patient-friendly therapies, and technological innovation. According to industry analysis, the market size is expected to grow from US$ 37,230.28 million in 2022 to US$ 51,949.74 million by 2030, recording a CAGR of 4.3% during 2022-2030. This trajectory highlights the increasing adoption of transdermal patches, gels, sprays, and other advanced…

More Releases for Laundering

Surge In Money Laundering Cases Drives Growth Of Anti-Money Laundering Software …

Use code ONLINE20 to get 20% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Anti-Money Laundering Software Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

The market size for anti-money laundering software has seen swift expansion in the past few years. Its growth is expected to rise from $2.85 billion in 2024 to $3.22 billion in 2025, with a…

Prominent Anti-Money Laundering Market Share Trend for 2025: SaaS Anti-Money Lau …

What industry-specific factors are fueling the growth of the anti-money laundering market?

The increasing emphasis on internet banking and digital transactions is anticipated to drive the anti-money laundering market's expansion in the future. Digital transactions involve money transfer from one payment account to another via a computer, mobile phone, or other digital device. Technologies aimed at preventing money laundering are employed to deter online fraud and mitigate risks associated with digital…

Leading Growth Driver in the Anti-Money Laundering Software Market in 2025: Surg …

Which drivers are expected to have the greatest impact on the over the anti-money laundering software market's growth?

The surge in incidents related to money laundering is anticipated to boost the anti-money laundering software industry. Money laundering typically involves transforming unlawfully obtained capital into lawful funds. The significant growth in money laundering incidents has facilitated the widespread use of anti-money laundering software programs to meet the regulatory demands of organizations seeking…

Anti-Money Laundering: Global Market Outlook

Summary:

Anti-money laundering (AML) comprises laws, policies, and regulations to safeguard financial frauds and illegal activity. Organizations must comply with these regulations even though compliance led financial institutions do have compliance departments and purchase software solutions. As times are changing, organizations are becoming more adaptive to the AML technologies and the end-user industry is reflecting various important trends shaping how they are being utilized. Increasing stringent regulations and compliance obligations for…

Rising Money Laundering Cases To Boost Anti-Money Laundering Market Growth

Factors such as the surging number of money laundering cases and mounting information technology (IT) expenditure will facilitate the anti-money laundering (AML) market growth during the forecast period (2021-2030). According to P&S Intelligence, the market generated a revenue of $2.4 billion revenue in 2020. Moreover, the surging volume of digital payments, rising technological advancements, and mounting internet traffic will also accelerate the market growth in the foreseeable future. Financial institutions…

Increasing Prevalence of Money Laundering Driving Anti-Money Laundering Market G …

The global anti-money laundering market reached a value of $3 billion in 2020 and it is predicted to exhibit huge expansion between 2021 and 2030 (forecast period). The market is being driven by the surging incidence of money laundering cases and the burgeoning demand for monitoring money laundering activities. Additionally, the soaring information technology (IT) expenditure in several countries is also pushing up the requirement for anti-money laundering (AML) solutions…