Press release

Retirement | Importance of Mutual Fund at the End Era of Your Life

How Mutual funds are Beneficial at the End Era of Your Life i.e. in the Retirement Time Of Life?All employees look forward to retirement. However, it is the basic thing of life to plan for our future (i.e. our retirement Planning.) All people are engaged in their lifestyles no one can think about tomorrow, today is the time to think about tomorrow and invest in SIP.

Retirement is the golden time of life. Do not use it to carry anxiety while enjoying life's wonderful movement.

Don't let Retirement stop you from Your Financial Goals. Here's how to fix it!!! https://www.imperialfin.com/retirement-calculator/

Why Retirement Planning is Essential

Increase in Medical cost:

Medical costs rise with age, disrupting your monthly expenses during retirement. Get the Best Retirement Solution with Imperial Money Pvt. Ltd. for that.

No Pension:

The government has now suspended all pension plans. This is why you should invest in mutual funds. Get the best retirement solution and live your life to the fullest.

Inflation:

Inflation is the rate at which prices rise over a given time period. In today's world, there is a lot of inflation. To avoid facing inflation during your retirement years, invest in mutual funds that provide the best returns.

How Much Money Do You Need for Retirement?

Money will be required for retirement based on your lifestyle expenses. Assume Ramesh's age is 30, his monthly salary is Rs.30,000 and his monthly household expenses are Rs.25,000. He had only saved Rs.5, 000.

However, after 30 years, it will be time for him to retire, and he used all of his savings to cover his expenses. However, his savings are insufficient to cover his rising expenses, which include rising medical costs, inflation, and a lack of a pension plan.

Let's take the story of Ramesh and understand. How the planning of your retirement. It is the case that Ramesh was completely depressed because of this situation, and he was unable to enjoy his golden years or fulfill his dreams, among other things.

To ensure that no one faces this problem in their golden years, IMPERIAL MONEY offers the best retirement plan. Get a retirement plan from Imperial Money and start investing in mutual funds with a minimum of RS.1,000 or as much as you can afford, and enjoy your golden years.

How Much to Save for Investing:

Invest in mutual funds based on your financial capacity and income. However, according to today's life, a monthly investment of Rs.3768 for the next 20 years at a 15% annual return can yield Rs.50 lakes at the end of the 20th year. Your retirement may be made easier by doing this.

Systematic Investment Plan (SIP):

SIP is the best way to the creation of wealth. It is a simple strategy for accumulating wealth over a period of time by investing regularly at a fixed interval of time in mutual fund schemes, this is similar to the concept of recurring deposits scheme, but this being in equity comes tagged with relatively a higher risk and higher return than the recurring deposit.

Planning Your Retirement With Mutual Funds:

Planning your retirement with mutual funds, is One of the most important aspects of wealth creation is the return on investment. Mutual funds allow you to gain exposure to various asset classes and sub-classes, potentially resulting in higher returns in between 12% to 15%. Now a day's Mutual fund is the best performing asset class in the long run and has the potential to create wealth for investors over a long investment time.

What is after Retirement?

Planned all your savings like a pension and make sure those retirement savings should be yield you better than real estate rental income yield and even FD too.

Conclusion:

During our working days, retirement preparation should be one of our top financial goals. Many people forego their retirement plans in order to fund their children's higher education or marriage.

They are unaware that if they lose their financial freedom during retirement, they can wind up burdening their children. One of the investment options for retirement Solutions that also helps you achieve other financial objectives is using mutual funds.

Connect Now with Imperial Money and should go over how to use mutual funds for retirement Solutions.

Contact Us: 9595889988

Email Us: wecare@imperialfin.com

Follow Us: https://www.facebook.com/imperialfin/

Follow US: https://in.linkedin.com/company/imperialmoney

Join US: https://t.me/imperialfin

Our App: https://play.google.com/store/apps/details?id=com.iw.imperialmoney

Subscribe to YouTube Channel: https://www.youtube.com/c/IMPERIALMONEY

Imperial Money Pvt. Ltd.

302, Royal Vista, Opp. Dhantoli Garden Main Gate, Dhantoli, Nagpur - 440012

+91-9595889988

Committed to providing personalized wealth creation mutual funds, Imperial Money can amplify your riches! Quite literally.

We distribute the latest smart investment opportunities to get optimum returns on your capital. We are focuses on equipping the clients with proper knowledge of financial products and tools.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Retirement | Importance of Mutual Fund at the End Era of Your Life here

News-ID: 2671220 • Views: …

More Releases from Imperial Money Pvt. Ltd.

5 Investment Strategies to With Wealth Creation

Are anybody looking for wealth creation? If so, then come to the right place! In this blog post, will discuss five proven investment strategies that can help to reach financial goals.

Nagpur, Maharashtra, India., June 16, 2023 - /PressReleasePoint/ - Want to Take Wealth Creation to the Next Level? all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it…

5 Investment Strategies to Help You With Wealth Creation

Want to Take Your Wealth Creation to the Next Level?

We all want to build wealth, but it can be a daunting task. There are so many different investment options available, and it can be hard to know where to start. That's where this blog comes in. In this article, we will discuss five game-changing investment strategies that can help you transform your wealth creation journey.

Here are 5 Investment Strategies…

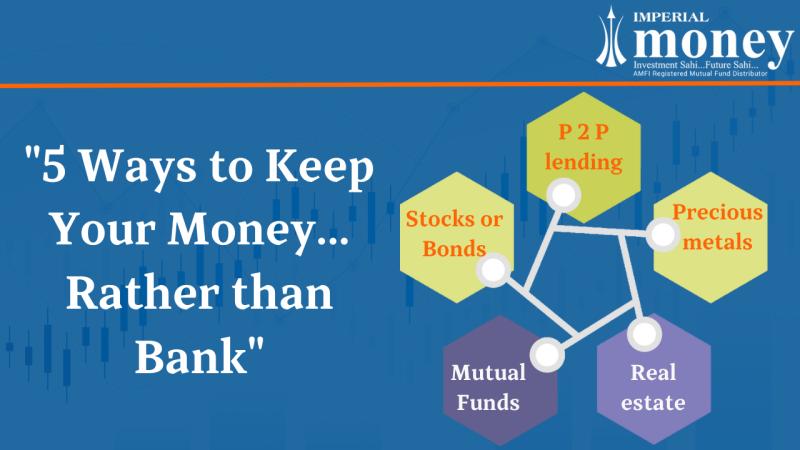

Top 5 Alternatives to Banks for Investing Your Money

Rather than a bank, here are the 5 best ways to keep your money

When it comes to storing your money, a bank account may seem like the most obvious option. However, there are many alternatives to banks to consider that may better suit your financial goals and preferences. In this blog, we'll explore some of the best alternatives to banks to keep your money besides a traditional bank.

Invest in…

More Releases for Retirement

Bayshore Retirement Solutions Offers Expanded Retirement Planning Framework for …

St Petersburg, FL - September 15, 2025 - Bayshore Retirement Solutions announced its expanded planning framework that brings together financial, tax, estate, Social Security, medical, and long-term care considerations. The company stated that the model is designed to address the increasing complexity of retirement planning faced by individuals and families across Florida.

Image: https://www.globalnewslines.com/uploads/2025/09/c72b1d4b2c28374c11869082c2904101.jpg

The announcement underscores the firm's emphasis on treating retirement as a multi-dimensional process rather than one driven solely…

Aleph Retirement Planners Shares Expert Strategies to Eliminate Debt Before Reti …

Almost 61% of Canadians said in a 2024 survey that they fear going broke during retirement. Some young adults also feel their savings will not be sufficient when they retire. These people don't have a proper retirement plan. However, these thoughts do not bother other Canadians with an appropriate financial plan. Which boat are you in? Planning is the only option to live a peaceful retired life. It gives you…

Lucas Wealth & Retirement Shares The Biggest Pitfalls of Retirement and How to R …

The company expands its services to Florida and the Carolinas to provide comprehensive strategies for retirees' financial, emotional, and mental well-being.

Houston, TX - Many retirees find themselves unprepared for the complexities of retirement, often facing financial uncertainty, emotional stress, and inadequate planning. Lucas Wealth & Retirement, a leading provider of comprehensive retirement planning services, is addressing these issues head-on while expanding its operations to Florida and the Carolinas. Known for…

Retirement Home Services Market Is Booming Worldwide | Erickson Living, Holiday …

AMA introduce new research on Global Retirement Home Services covering micro level of analysis by competitors and key business segments (2023-2028). The Global Retirement Home Services explores comprehensive study on various segments like opportunities, size, development, innovation, sales and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists both qualitative and quantitative detailing.

Ask Free Sample Report PDF @ https://www.advancemarketanalytics.com/sample-report/32334-global-retirement-home-services-market#utm_source=OpenPR/Tanuja

Some…

Retirement Home Services Market Is Booming Worldwide | Erickson Living, NHS, LHI …

The latest independent research document on Global Retirement Home Services examine investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore its potential to become a major business disrupter. The Retirement Home Services study eludes very useful reviews & strategic assessment including the generic market trends, emerging technologies, industry drivers, challenges, regulatory policies that propel the market growth, along with major players profile…

Beauty Point Retirement Resort

A luxury retirement village with the perfect combination of lifestyle and sense of security. Designed with the vision of providing an impeccable independent living environment, together with excellence in care, Beauty Point Resort prides itself on providing the highest level of services of any retirement home in Sydney. Call us on (02) 8708 4700 for more information on the perfect village for you, or your family member.

Beauty Point Retirement Resort

33…