Press release

Detailed Analysis of Doorstep Banking Services Market | Business Growth, Development Factors, Current and Future Trends till 2028 City Bank, Credit Suisse, HSBC, DBS Bank , Deutsche Bank

The latest release from WMR titled Doorstep Banking Services Market Research Report 2022-2028 (by Product Type, End-User / Application, and Regions / Countries) provides an in-depth assessment of the Doorstep Banking Services including key market trends, upcoming technologies, industry drivers, challenges, regulatory policies, key players company profiles, and strategies. Global Doorstep Banking Services Market study with 100+ market data Tables, Pie Chat, Graphs & Figures is now released BY WMR. The report presents a complete assessment of the Market covering future trends, current growth factors, attentive opinions, facts, and industry-validated market data forecast until 2028.A sample report can be viewed by visiting (Use Corporate eMail ID to Get Higher Priority) at: https://www.worldwidemarketreports.com/sample/747327

Global Doorstep Banking Services Market and Competitive Analysis

Know your current market situation! Not only an important element for new products but also for current products given the ever-changing market dynamics. The study allows marketers to stay in touch with current consumer trends and segments where they can face a rapid market share drop. Discover who you really compete against in the marketplace, with Market Share Analysis know market position, % Market Share and Segmented Revenue of Doorstep Banking Services Market.

Leading Players:

City Bank

Credit Suisse

HSBC

DBS Bank

Deutsche Bank

State Bank of India

HDFC Bank

ICICI Bank

Axis Bank

Bank of Baroda

IndusInd Bank

others

Market Segments by Type:

Primary

Secondary

Market Segments by Application:

Individual Banking

Business Banking

Loans

Get PDF Brochure by Clicking Here: https://www.worldwidemarketreports.com/sample/747327

Global Doorstep Banking Services Market Segmentations

The segmentation chapter allows readers to understand aspects of the Global Doorstep Banking Services Market such as products/services, available technologies, and applications. These chapters are written in a way that describes years of development and the process that will take place in the next few years. The research report also provides insightful information on new trends that are likely to define the progress of these segments over the next few years.

As the downstream consumption usually follows with developed and rapid economic growth areas, such as BRICS, the developed areas company prefers investing to underdevelopment regions these years.

Segmentation and Targeting

Essential demographic, geographic, psychographic, and behavioral information about business segments in the Doorstep Banking Services market is targeted to aid in determining the features company should encompass in order to fit into the business requirements. For the Consumer-based market - the study is also classified with Market Maker information in order to better understand who the clients are, their buying behavior, and patterns.

For the global version, a list of below countries by region can be added as part of customization at minimum cost:

North America (the United States, Canada & Mexico)

Asia-Pacific (Japan, China, India, Australia, etc)

Europe (Germany, UK, France, etc)

Central & South America (Brazil, Argentina, etc)

Middle East & Africa (United Arab Emirates, Saudi Arabia, South Africa, etc)

Get customization & Inquire About Discount: https://www.worldwidemarketreports.com/quiry/747327

Doorstep Banking Services Product/Service Development

Knowing how the product/services fit the needs of clients and what changes would require to make the product more attractive is the need of an hour. Useful approaches to focus group by utilizing User Testing and User Experience Research. Demand-side analysis always helps to correlate consumer preferences with innovation.

Marketing Communication and Sales Channel

Understanding marketing effectiveness on a continual basis help determine the potential of advertising and marketing communications and allow us to use best practices to utilize an untapped audience. In order to make marketers make effective strategies and identify why the target market is not giving attention, we ensure the Study is Segmented with appropriate marketing & sales channels to identify potential market size by Revenue and Volume*

Pricing and Forecast

Pricing/subscription always plays an important role in buying decisions; so we have analyzed pricing to determine how customers or businesses evaluate it not just in relation to other product offerings by competitors but also with immediate substitute products. In addition to future sales Separate Chapters on Cost Analysis, Labor*, production*, and Capacity are Covered.

(Note: * if Applicable)

How geography and sales fit together

This study is helpful to all operators who want to identify the exact size of their target audience at a specific geographic location. Doorstep Banking Services Market allows entrepreneurs to determine local markets for business expansion. This study answers the questions below:

☛ Where do the requirements come from?

☛ Where do non-potential customers reside?

☛ What is the buying behavior of customers in a specific region?

☛ What is the spending power of the customers in a particular region?

Purchase of Doorstep Banking Services Market Report at: https://www.worldwidemarketreports.com/buy/747327

Having our reviews and subscribing to our report will help you solve the subsequent issues:

✅ Uncertainty about the future: Our research and insights help our customers predict the upcoming revenue pockets and growth areas. This will guide customers to invest their resources.

✅ Understanding market sentiments: It is very important to have a fair understanding of market sentiment for your strategy. Our insights will help you see every single eye on market sentiment. We maintain this analysis by working with key opinion leaders on the value chain of each industry we track.

✅ Understanding the most reliable investment center: Our research evaluates investment centers in the market, taking into account future demand, profits, and returns. Clients can focus on the most prestigious investment centers through market research.

✅ Evaluating potential business partners: Our research and insights help our clients in identifying compatible business partners.

Contact Us:

Mr. Shah

Worldwide Market Reports,

Tel: U.S. +1-415-871-0703

U.K. +44-203-289-4040

Japan +81-50-5539-1737

Email: sales@worldwidemarketreports.com

Website: https://www.worldwidemarketreports.com/

About WMR

Worldwide Market Reports is your one-stop repository of detailed and in-depth market research reports compiled by an extensive list of publishers from across the globe. We offer reports across virtually all domains and an exhaustive list of sub-domains under the sun. The in-depth market analysis by some of the most vastly experienced analysts provides our diverse range of clients from across all industries with vital decision-making insights to plan and align their market strategies in line with current market trends.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Detailed Analysis of Doorstep Banking Services Market | Business Growth, Development Factors, Current and Future Trends till 2028 City Bank, Credit Suisse, HSBC, DBS Bank , Deutsche Bank here

News-ID: 2655838 • Views: …

More Releases from Worldwide Market Reports

Rising Trends of Brand Management Systems Market Future Prospects, Revenue Trend …

Worldwide Market Reports (WMR) has released a new, in-depth research study on the Brand Management Systems Market, projected to witness strong and sustained growth in the coming years. The report delivers a fact-based, strategic analysis of the global market landscape using a robust research framework that integrates market sizing, validated data modeling, and insights drawn from multiple authoritative sources.

This study is designed to support executive decision-making, strategic planning, and investment…

Smart Toilet Management System Market Outlook 2026-2033: Growth Trends, Opportun …

Worldwide Market Reports (WMR) has released a new, in-depth research study on the Smart Toilet Management System Market, projected to witness strong and sustained growth in the coming years. The report delivers a fact-based, strategic analysis of the global market landscape using a robust research framework that integrates market sizing, validated data modeling, and insights drawn from multiple authoritative sources.

This study is designed to support executive decision-making, strategic planning, and…

Business Process Outsourcing Solutions Market Expansion Strategies, Emerging Gro …

Worldwide Market Reports (WMR) has released a new, in-depth research study on the Business Process Outsourcing Solutions Market, projected to witness strong and sustained growth in the coming years. The report delivers a fact-based, strategic analysis of the global market landscape using a robust research framework that integrates market sizing, validated data modeling, and insights drawn from multiple authoritative sources.

This study is designed to support executive decision-making, strategic planning, and…

Future Scope of Online Trademark Registration Service Market Growth Drivers and …

Worldwide Market Reports (WMR) has released a new, in-depth research study on the Online Trademark Registration Service Market, projected to witness strong and sustained growth in the coming years. The report delivers a fact-based, strategic analysis of the global market landscape using a robust research framework that integrates market sizing, validated data modeling, and insights drawn from multiple authoritative sources.

This study is designed to support executive decision-making, strategic planning, and…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

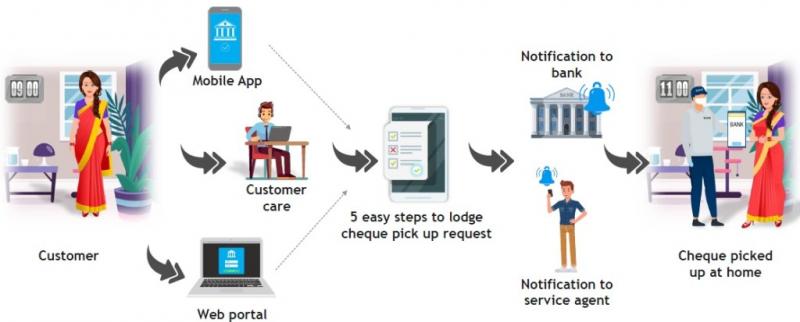

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…